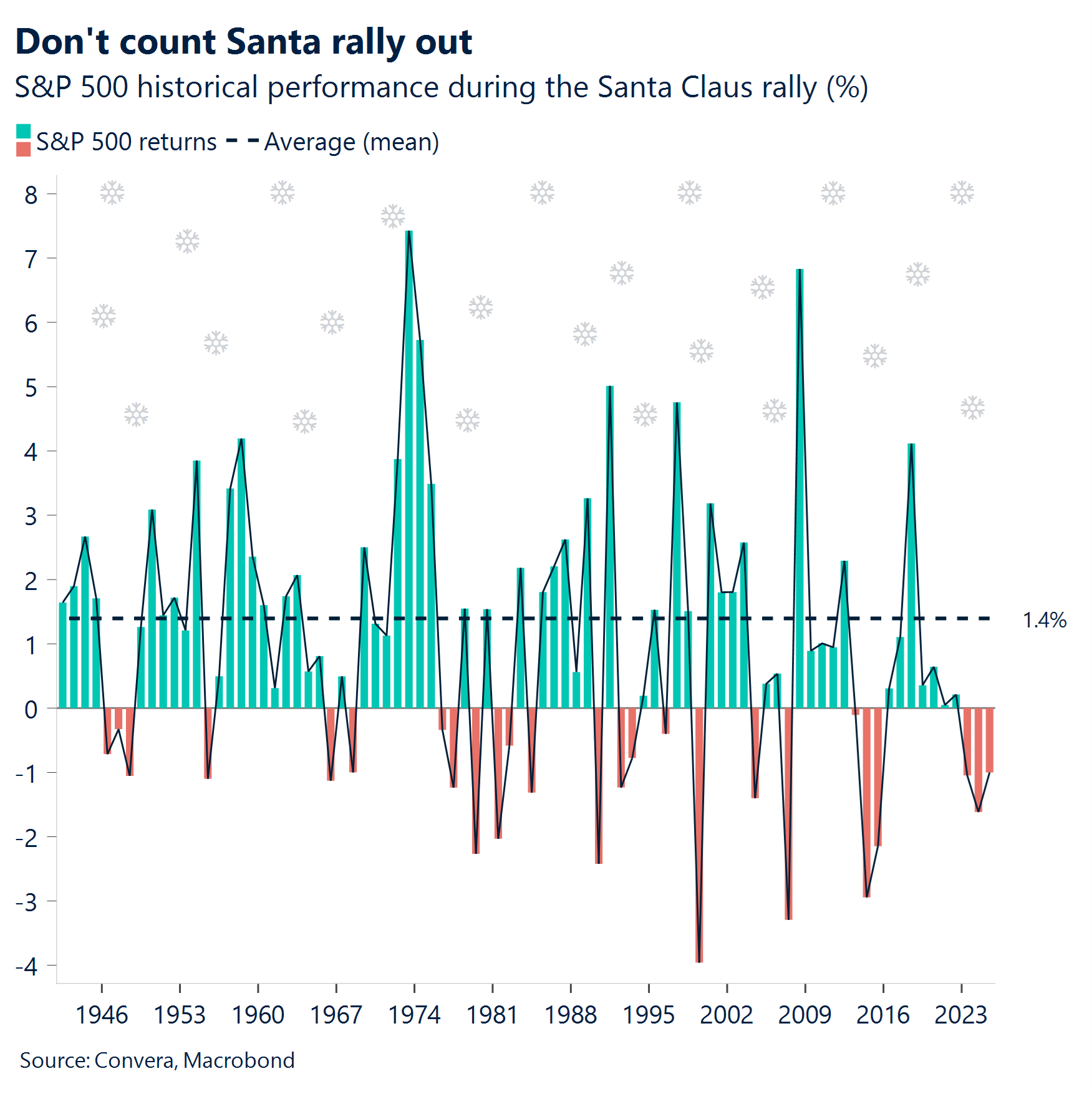

- A frosty CPI present. US inflation unexpectedly dropped to 2.7% in November, far below the 3.1% consensus, while core CPI slowed to 2.6%, its lowest reading since 2021. The softer print bolsters the Fed‑dovish case for further cuts and keeps hopes alive for a belated Santa‑Claus rally as the year draws to a close.

- Payrolls add a bow. US jobs data also supports this view as US nonfarm payrolls rose 64k in November, modestly above consensus, but October’s sharp downward revision left the three-month average at just 22k.

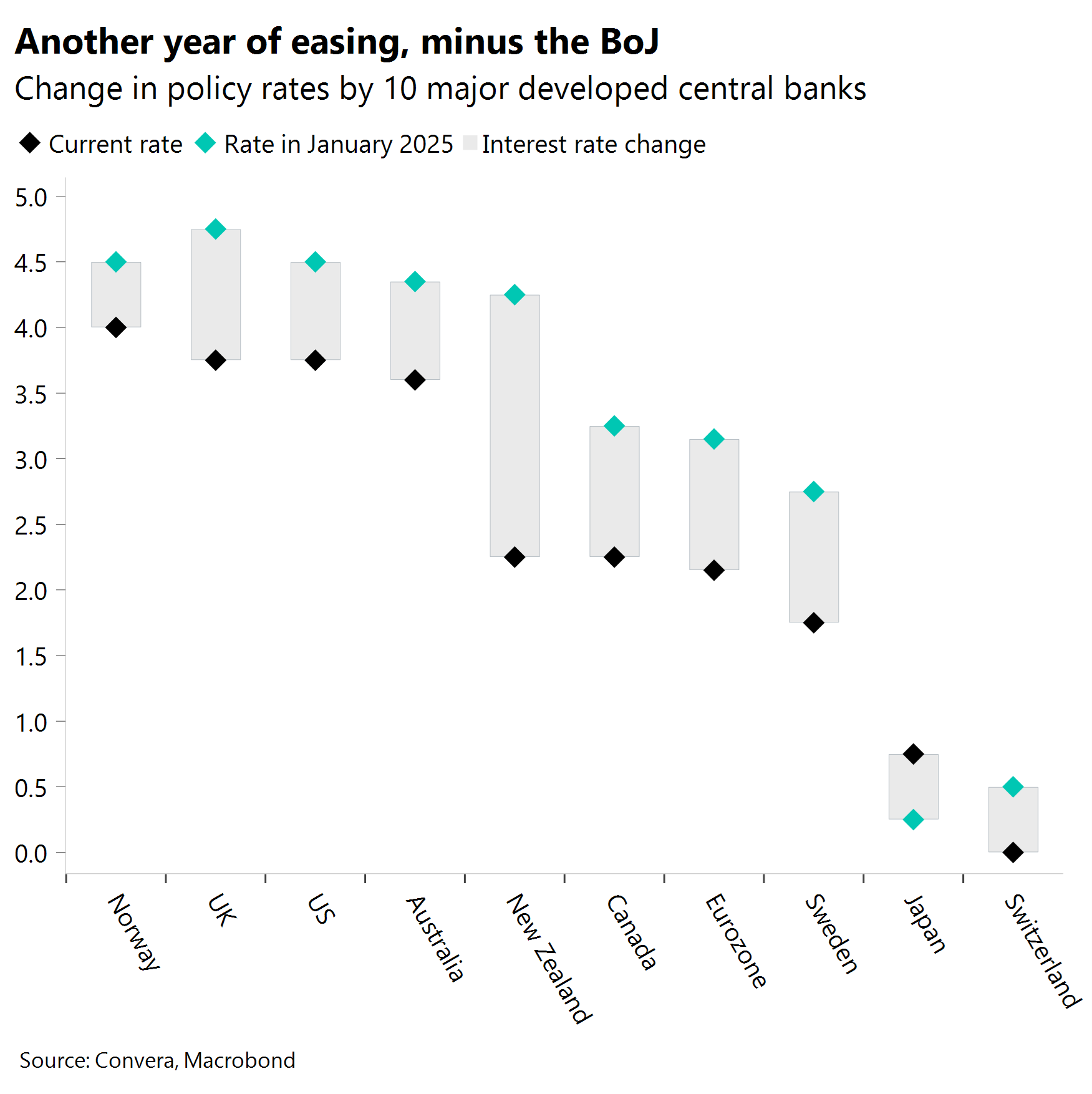

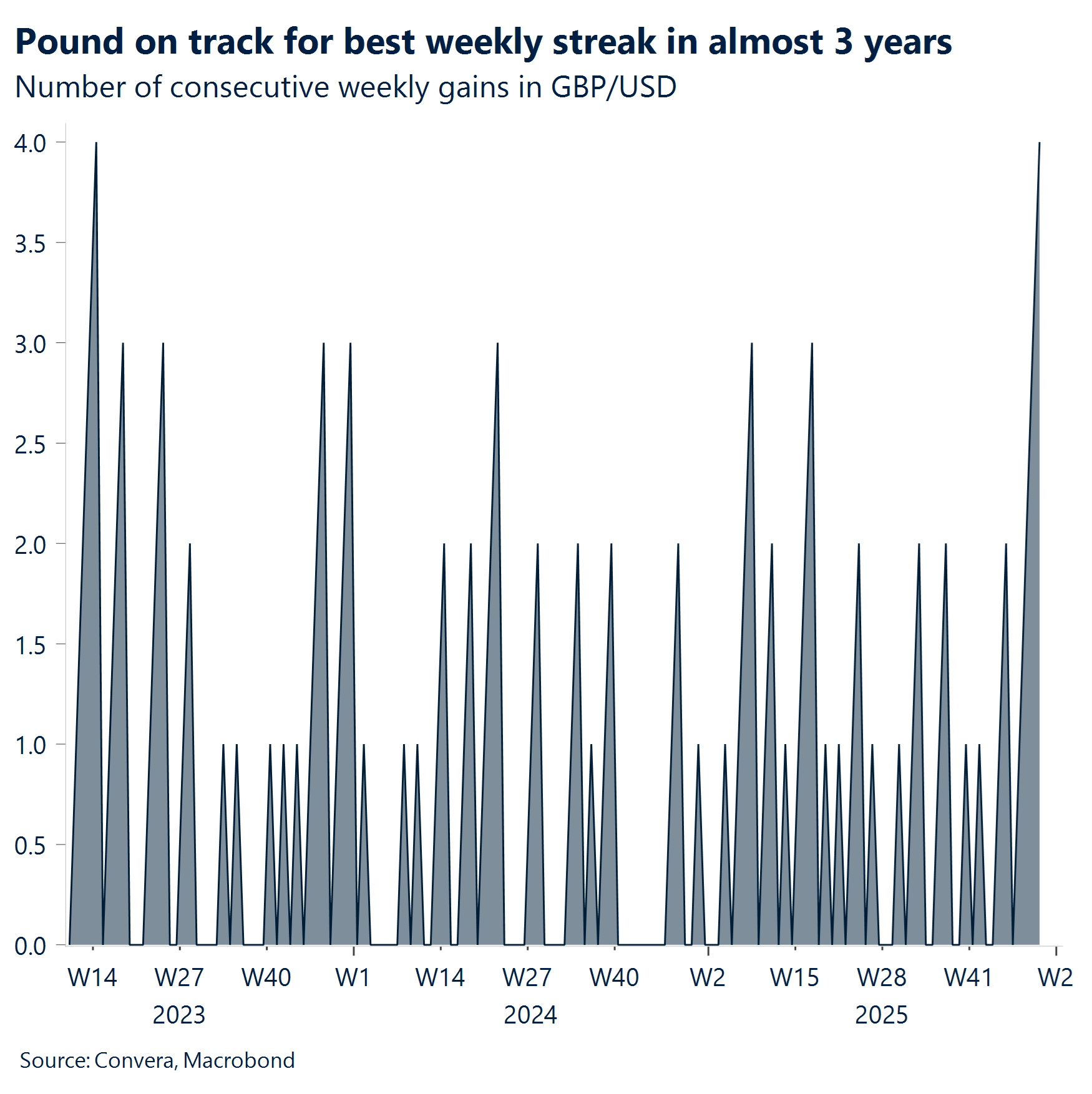

- BoE’s festive trim. The Bank of England (BoE) cut rates as expected, but the tight 5-4 vote split saw GBP/USD spike briefly back above $1.34 and GBP/EUR above €1.14. UK data this week supports a more dovish policy path though. Expect two more cuts in 2026, keeping sterling’s gains limited.

- Silent night at the ECB. The European Central Bank (ECB) left its benchmark rate unchanged at 2% for the fourth consecutive meeting, reiterating its “data-dependent, meeting-by-meeting” guidance.

- BoJ rings bell, yen doesn’t jingle. The Japanese yen weakened after the Bank of Japan (BoJ) raised interest rates by 25 bps to 0.75% in a unanimous decision. The move pushed official rates to their highest level since 1995. The BoJ signaled further, gradual hikes were likely.

- Crude moves. Oil-sensitive FX fell after big losses in the crude oil markets, with WTI crude falling to the lowest level since 2021. The move weighed on the commodity currencies, like AUD, NOK and CAD.

Global Macro

Doves, hawks and doubt

US data digest. November payrolls rose by 64,000, modestly above economists’ forecasts but following October’s sharp 105,000 drop, driven by a 157,000 fall in government employment — the delayed impact of federal workforce reductions. The unemployment rate ticked up unexpectedly to 4.6%, its highest since September 2021, highlighting labour‑market fragility and lending support to the Fed’s recent rate cut. Moreover, US headline inflation came in at 2.7% – well below the 3.1% forecast and core at 2.6% – the slowest since 2021. Thus, traders remain positioned for two additional Fed cuts in 2026, keeping pressure on the dollar.

BoE’s not-so-dovish cut. As expected, the Bank of England cut rates by 25bps to 3.75%, with the vote split at 5–4. We had warned that the bigger risk was not the cut itself, but that a narrow split would disappoint doves and leave scope for sterling to strengthen. After this week’s softer labour and inflation data, some had anticipated a more dovish vote split — so the resilience of the hawkish contingent caught markets off guard. With pessimism already embedded in GBP, stretched short positioning and sterling’s still‑attractive carry profile, the setup was ripe for a contrarian move, and the post‑decision rally in the pound and gilt yields reflected that dynamic.

ECB hold. The European Central Bank left its benchmark rate unchanged at 2% for the fourth consecutive meeting, in line with expectations. It still reiterated its guidance that further moves would follow a “data-dependent and meeting-by-meeting approach”. More notable were the staff projections: Eurozone GDP growth for 2025 was revised up to 1.4% (from 1.2%), while the 2026 forecast rose to 1.2%. Inflation is now seen at 1.9% in 2026, edging closer to the ECB’s 2% target.

Global macro

PMIs lose momentum

The most up-to-date reading of global economy – the purchasing managers’ indexes (PMIs) – were released this week with mainly disappointing results. Italy and the UK were the rare bright spots.

Most notably, the US is showing signs of a slowdown, with manufacturing PMI falling from 52.2 to 51.8, while services PMI dropped from 54.1 to 52.9. Both figures remain above the 50 line that signals economic growth. The cooling will concern the Federal Reserve and makes rate cuts more likely. This could weigh on the US dollar.

In the commodity-sensitive space, both Australia and China have seen a weakening in economic activity in recent months, although China’s December numbers will not be released until later this month.

In Europe, an improvement in activity has been reflected in the euro’s recent strength, with Italy the standout and Germany lagging. France has seen a rapid improvement, but from a low base, and has only just moved above the critical 50 boom-bust line.

The UK beat forecasts in both services and manufacturing this week, with manufacturing climbing from 50.2 in November to 51.2 in December. The services sector rose from 51.3 to 52.1. If only the English cricket team could produce such a recovery!

FX Views

Buck up now, buckle later

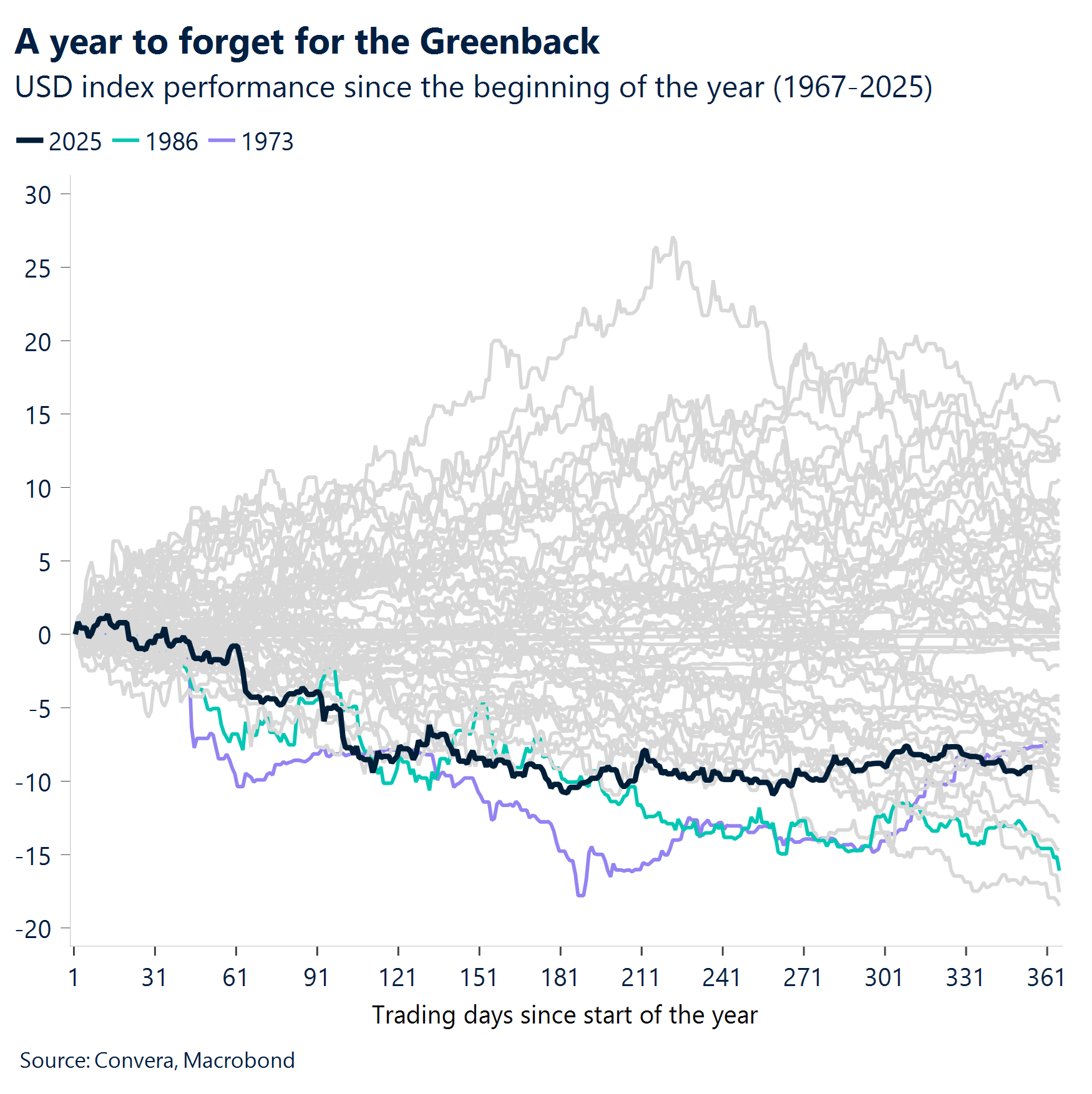

USD A year to forget. The dollar is proving surprisingly resilient of late despite a raft of dovish US data this week. The latest payrolls showing November’s 64k rise was modestly above expectations, but a sharp downward revision to October dragged the three‑month average to just 22k, reinforcing the sense of a labour market losing momentum. The very soft November CPI report didn’t move the dial too much, with markets seemingly treating the numbers as a little too good to be true. That skepticism kept the dollar and short-term rates contained. Even so, the data keeps Fed‑cut expectations for 2026 intact, with markets pricing a 25bp cut by April and another by September. Sure, the dollar index is up on the week, but it is still down 0.8% month‑to‑date and on track for its worst year (-9%) in more than two decades. Expected Fed dovishness next year remains central to a bearish dollar view, but conviction still needs validation from incoming data — especially the labour market, where any renewed strength could challenge the easing path and dollar’s demise.

EUR Brief lift before the drift. The euro hit its strongest level since late September this week, briefly spiking above $1.18 against the US dollar, but as the week winds down EUR/USD is slipping back toward the lower end of recent ranges. Thursday’s ECB meeting didn’t shift the dial, yet the updated forecasts still leave room for a slow grind higher, especially with rate differentials favouring the common currency too. A move back above $1.18 before year‑end looks increasingly plausible as a result. That said, net‑long EUR positioning has remained stubbornly elevated since the spring, and this does leave the currency vulnerable to a sharper correction should sentiment turn against the euro for any reason.

GBP Relief rally, fragile foundations. After all the doom and gloom surrounding the UK budget, sterling has quietly put in an impressive run — rising every week since against the US dollar and heading for its best streak in almost three years. The dollar leg is doing most of the heavy lifting, but the pound has also gained around 1% versus the euro over the same period, underscoring a broader resilience rather than a one‑off move. However, UK data disappointments remain hard to ignore. PMIs offered some welcome relief, but inflation is fading faster than the BoE anticipated, private‑sector wage growth has slipped below 4% for the first time since 2020, and unemployment is now at a near five‑year high. If growth stays sluggish and inflation edges closer to target in early 2026, the pressure for additional BoE cuts will only build — leaving GBP increasingly exposed. This week’s tight MPC vote split to cut Bank Rate delivered a brief sterling relief rally, but the underlying fundamentals still look fragile as we head into the new year.

CHF Swiss franc eases despite SECO upgrade. The Swiss franc was moderately higher after an economic upgrade from the Swiss government’s SECO forecasts. The Swiss “Federal Government Expert Group on Business Cycles” raised its 2026 GDP forecast from 0.9% to 1.1%, supported mainly by a reduction in US tariffs. Tariffs were cut by the US from 39% to 15%. The USD/CHF still sees support at 0.7925. The zone above 0.7900 has been a major support area for the pair over the past three months.

CNH Yuan reaches for new highs. The Chinese yuan strengthened further despite softer results from key monthly indicators, including industrial production, retail sales, and fixed asset investment. Annual retail sales growth slowed sharply to 1.3% in November, down from 2.9% in October, while industrial production eased from 4.9% to 4.8% over the same period. The yuan has recently been firmer, with USD/CNH at an 18-month low. The move has been partly driven by USD weakness, with the yuan’s gains less pronounced against the euro and British pound.

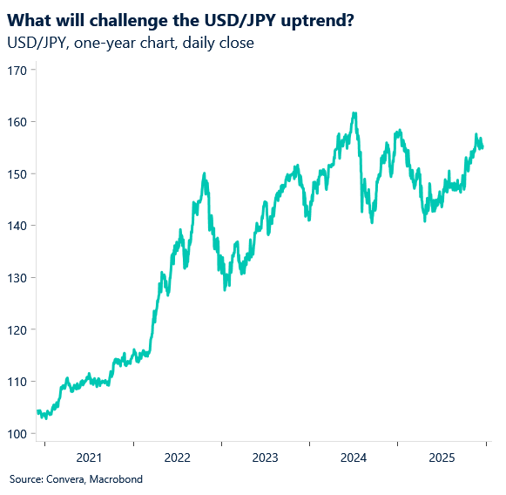

JPY Yen lower even after BoJ hike. The Japanese yen was mostly lower after the Bank of Japan raised interest rates to the highest level since 1995. The BoJ lifted rates by 25bps to 0.75% in a unanimous decision. The JPY eased even as the Bank of Japan signalled further hikes are likely with the central bank saying: “[It’s] highly likely that the mechanism in which both wages and prices rise moderately will be maintained.” However, markets expect any further moves will take some time – the first full 25bps hike isn’t priced in until September 2026. The USD/JY gained with the pair back near 2025 highs. In other markets, the GBP/JPY returned to near 17-year highs while the EUR/JPY climbed back to all-time highs. The CAD/JPY neared 18-month highs.

CAD Easing inflation hampers loonie’s gains. USD/CAD paused at three-month lows after a weaker-than-expected inflation reading raised questions about the Bank of Canada’s hawkish stance. Headline annual inflation in November was steady at 2.2% — versus forecasts for a rise to 2.3% — while the trimmed core reading fell more than expected, from 3.0% to 2.8%. The CAD has strengthened over the past three weeks, supported by a robust jobs report, improving GDP, and a shift in tone from the Bank of Canada (BoC). Last week, BoC Governor Tiff Macklem said: “The Canadian economy was healthier than we previously thought before we were hit by the US trade conflict.” Markets reacted to the remarks, with pricing shifting from an easing bias to a tightening bias. However, only 20 bps of tightening is priced in over the next 12 months – less than a full 25 bps hike.

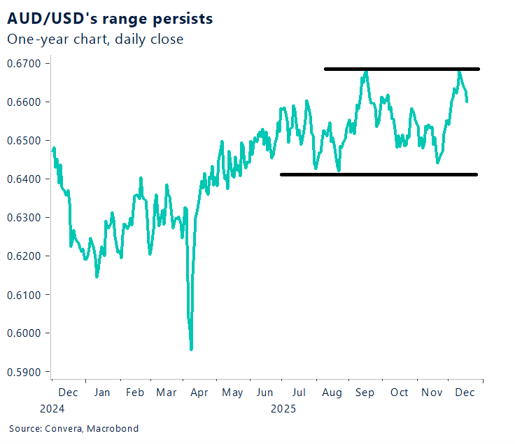

AUD Break higher remains possible. The AUD/USD has been mostly lower as global equity markets fell over the week – most notably the US’s tech-focused Nasdaq fell to four-week lows. In FX, the economically sensitive Aussie was among the biggest losers, down 0.4% to two-week lows. The Aussie has been stuck in 0.6400 to 0.6700 range for over six months – an incredible length of time. RBA caution on inflation and greater chance for Federal Reserve rate cuts mean a break higher over the Australian summer holidays remains possible.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.