USD: Dollar caution persists

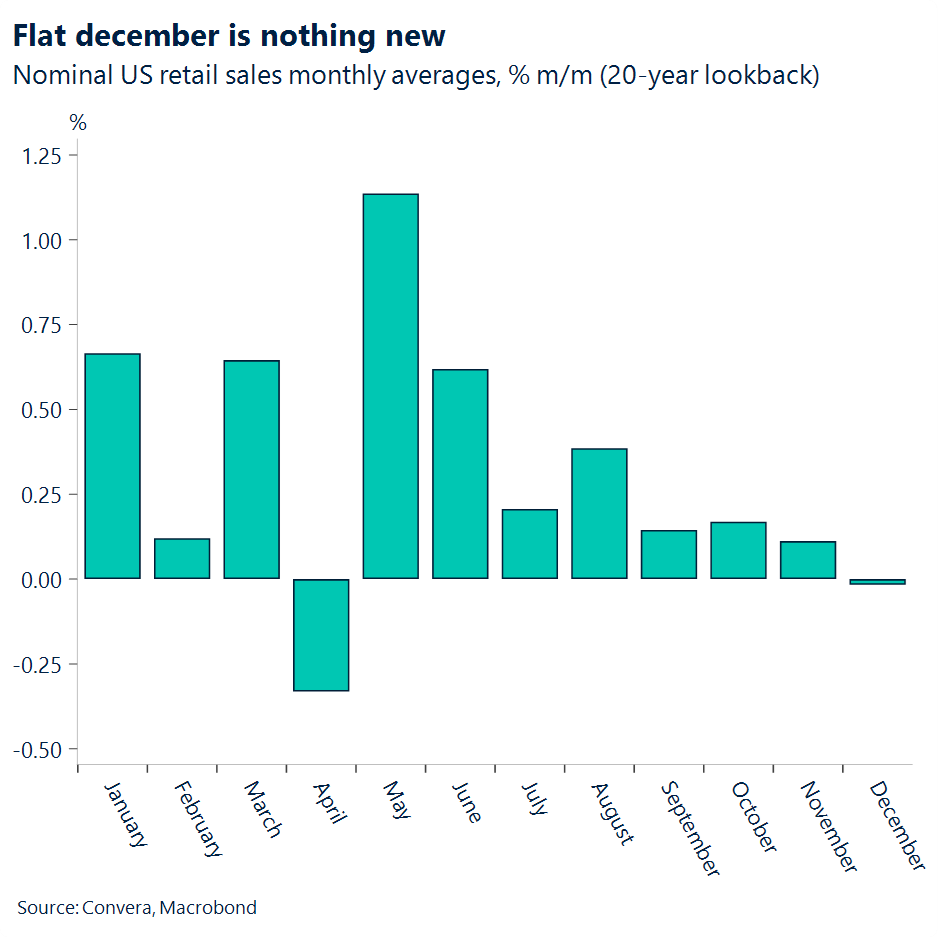

December’s retail sales landed flat on the month, with most aggregates unchanged and the less‑volatile control group slightly lower. The outcome points to softer consumer spending as the year closed. Coming off a 0.6% gain in November, there is some base effect at play, and the figures are not adjusted for inflation, meaning Christmas discounts mechanically pull the headline lower. The fact that December retail sales have been broadly flat on average over the past 20 years helps temper concerns. The dollar reaction was broadly muted.

What stood out instead was the below‑forecast quarterly Employment Cost Index, which eased in Q4 to 0.7% q/q (0.8% in Q3) – a four-year low. This print is more likely to catch the FOMC’s attention, since lower employment costs typically translate into lower prices from firms. But all eyes are on today’s jobs report. Last week’s weaker labour market releases (ADP and JOLTS) may tempt some to argue that risks are more skewed to the upside should the outcome come in orderly or above estimates. Still, the hawkish baseline set by the Federal Reserve at the January meeting is still likely to dominate. We therefore believe the dollar remains more sensitive to downside risks.

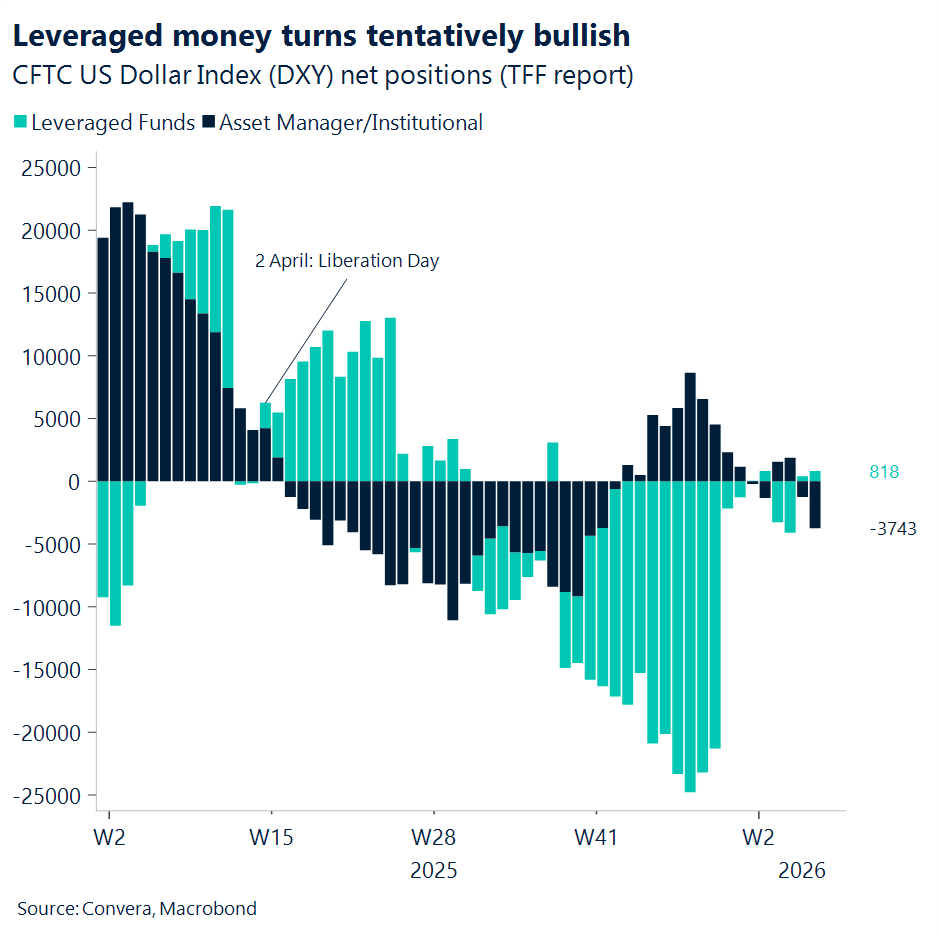

Investors appear more hopeful about the US macro story reasserting its dominance in driving the dollar’s price action compared with the period immediately after Liberation Day, when the selloff was both sharp and more durable. CFTC data as of Tuesday, 3 February, supports that view. Leveraged funds, the cohort that trades more tactically and speculatively, turned heavily bearish when the initial policy turmoil under Trump sent the dollar into freefall. We read this as a tactical stance, with funds clinging to the US macro story as the trigger for a rebound.

A few weeks on, we now see funds back in net bullish positioning on the Dollar Index (DXY). The net positive is still small, suggesting caution as macro data begins to flow again post‑shutdown. The incoming releases are likely to inject greater conviction into funds’ directional bias or challenge it outright. In the meantime, the DXY remains on the softer side, almost 1% lower week‑to‑date. Part of that reflects an upbeat JPY story (USD/JPY is 2.6% lower week‑to‑date), but the broader driver is still a lingering weakened sentiment toward the buck.

EUR: Sentiment favours euro, US data eyed

A good portion of recent FX moves has been driven more by sentiment than hard data. The ongoing diversification away from US assets has helped the euro, which remains one of the most liquid alternatives in the G10 space, though the benefit hasn’t matched the scale seen back in 2025. Even so, policy uncertainty in the US continues to act as a headwind for the dollar, allowing EUR/USD to trade above our fair‑value estimate near $1.18.

That said, fundamentals may soon start reinforcing the sentiment‑led flow. US labour indicators softened last week and retail sales disappointed yesterday, prompting a dovish shift in Fed expectations. With the key US jobs report looming, the market is increasingly sensitive to any sign of slowing momentum — especially if it nudges the Fed toward a more accommodative stance into mid‑year.

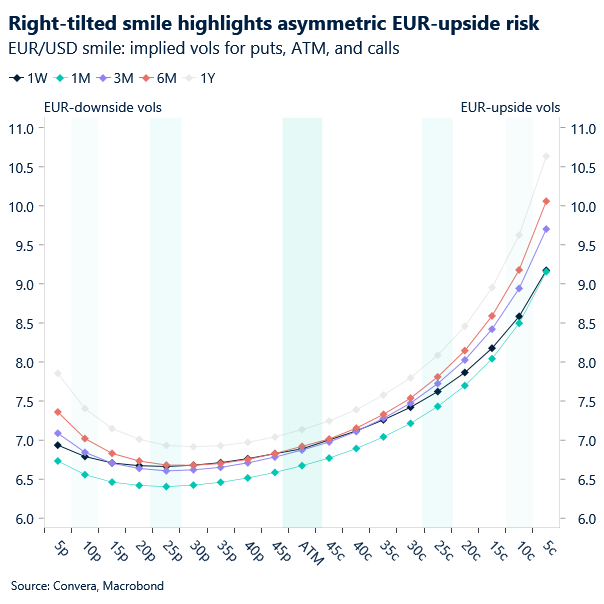

Plus, the options market is signalling greater concern about EUR/USD continuing to rally than about it selling off. The EUR/USD options curve is showing a clear tilt to the right, meaning implied volatility is higher for EUR calls than for EUR puts. In plain terms, it means the market is paying more to protect against the euro going up than the euro going down. Traders are willing to spend more on options that would benefit from a stronger euro, especially on more extreme upside moves. That doesn’t mean the euro will necessarily rally though, it just shows where demand for protection is concentrated right now.

GBP: Pound under pressure, but GBP/USD plays its own game

As previously reported this week, UK political uncertainty, coupled with a dovish shift in Bank of England (BoE) expectations have been a drag on sterling sentiment. GBP is lower across the board, with the heaviest losses against JPY and NOK — though both currencies have their own supportive drivers. Interestingly, GBP/USD has been moving higher though, reinforcing the idea that this pair is trading more as a dollar story than a reflection of UK‑specific risk. In that sense, GBP/EUR remains the cleaner barometer of domestic political pressure, while GBP/USD is being driven primarily by shifts in US sentiment.

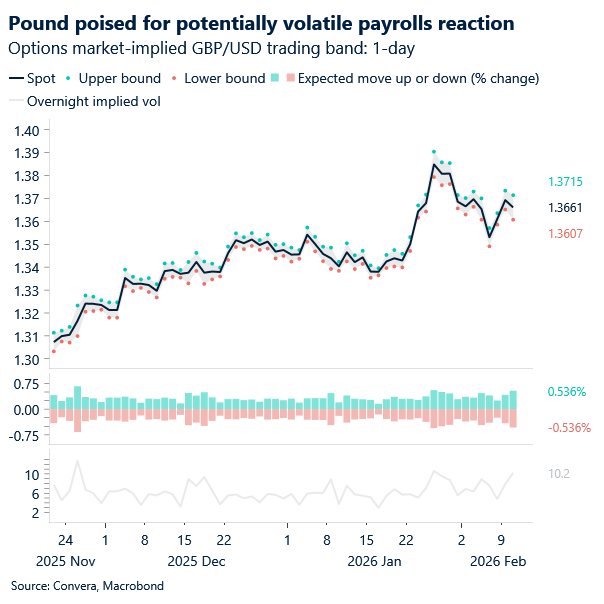

That makes today’s US jobs report pivotal. A softer payrolls print would likely see markets price a faster or deeper Fed easing cycle, putting renewed pressure on the dollar and offering further support to GBP/USD. But after the sizeable dollar moves seen late last week and into Monday, the risk of a counter‑move shouldn’t be dismissed.

Options markets underline the sense of anticipation. Overnight implied volatility has jumped to one of the highest levels in recent months, pointing to expectations of a larger‑than‑usual move — a little over a 0.5% swing in either direction. The skew in the options curve also shows investors paying more to hedge against GBP weakness than strength. That doesn’t guarantee such a move will occur, but it does highlight how traders are positioning ahead of the data. In short, markets are braced for a sharp reaction, with a slight bias toward guarding against GBP softness.

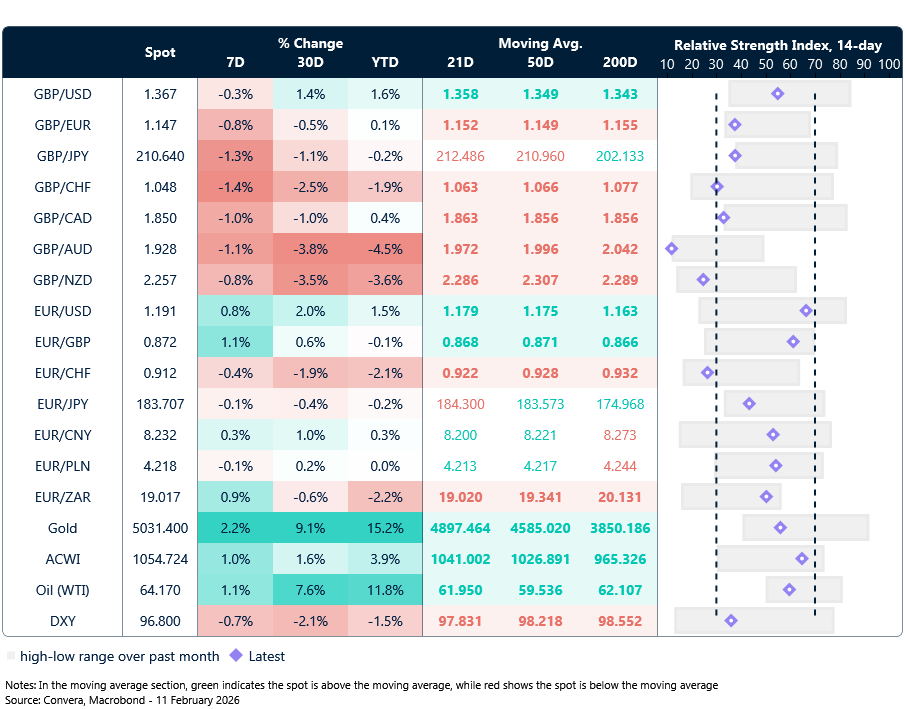

Market snapshot

Table: Currency trends, trading ranges & technical indicators

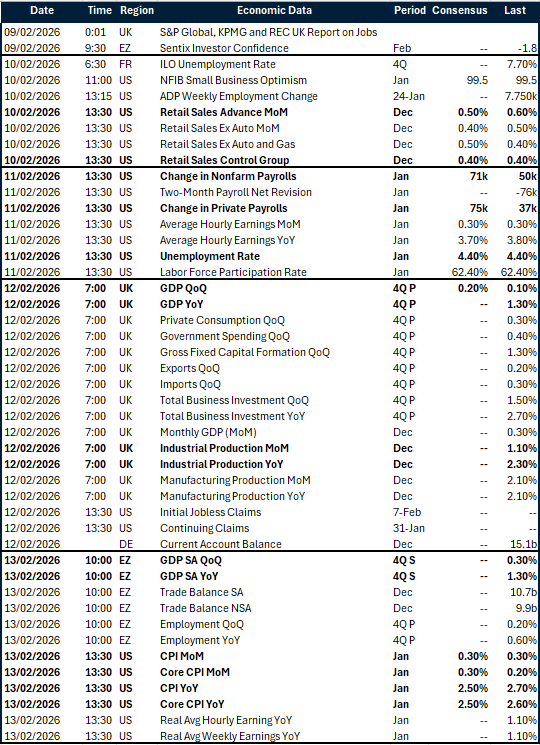

Key global risk events

Calendar: February 9-13

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.