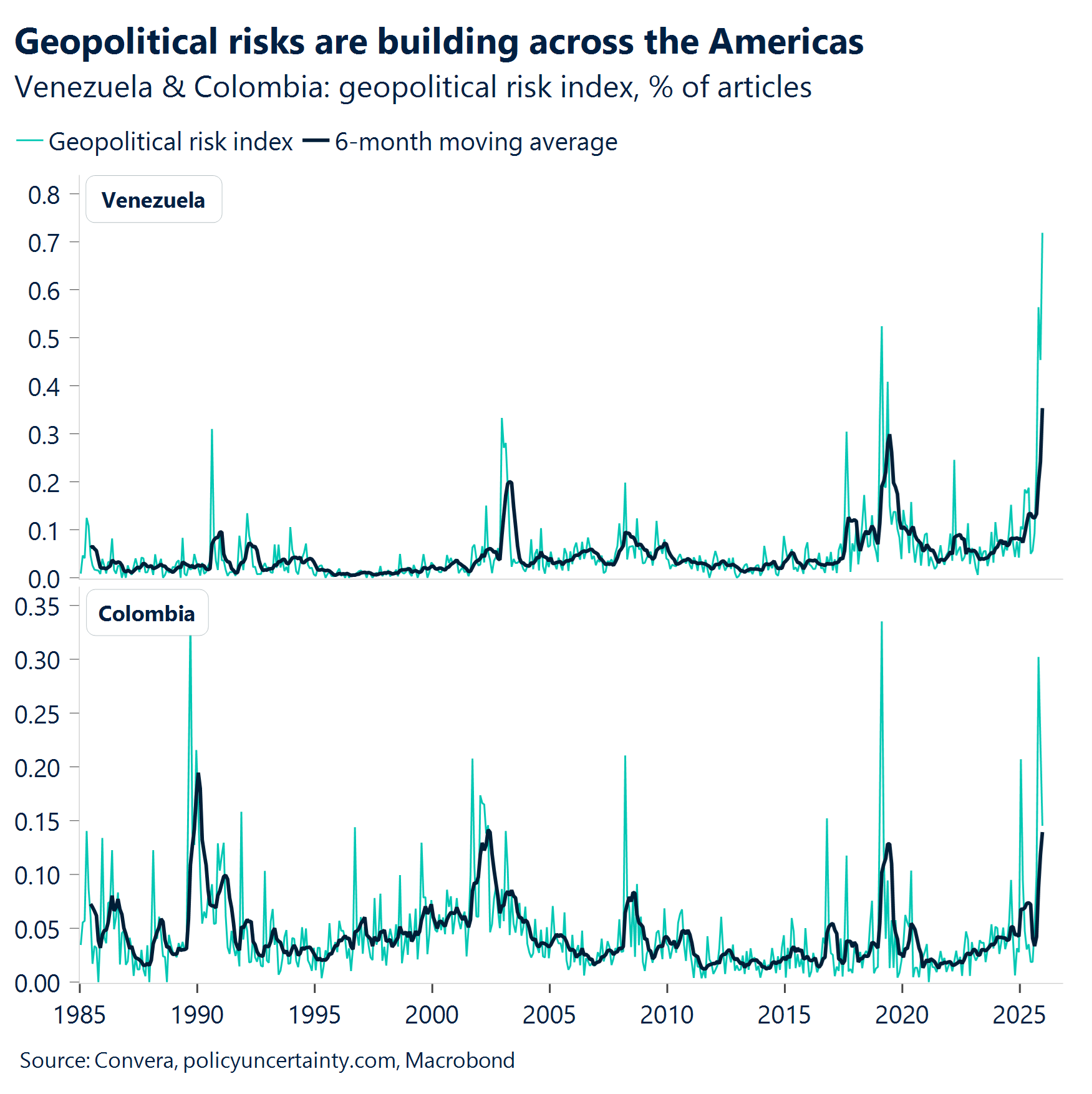

- Nicolás caged. Any hope of a quiet start to the year evaporated as President Trump authorised a major US military operation in Venezuela and revealed that Nicolás Maduro had been captured.

- Hemispheric dominance. This marked a bold debut for Trump’s so‑called “Donroe Doctrine,” a modern revival of then-President James Monroe’s 19th-century policy creating US dominance in the Americas.

- New regime. On the global stage, this is a massive gamble that could redefine international norms for the rest of the decade. By acting so unilaterally in its “near abroad,” the US may be inadvertently handing a roadmap to its rivals.

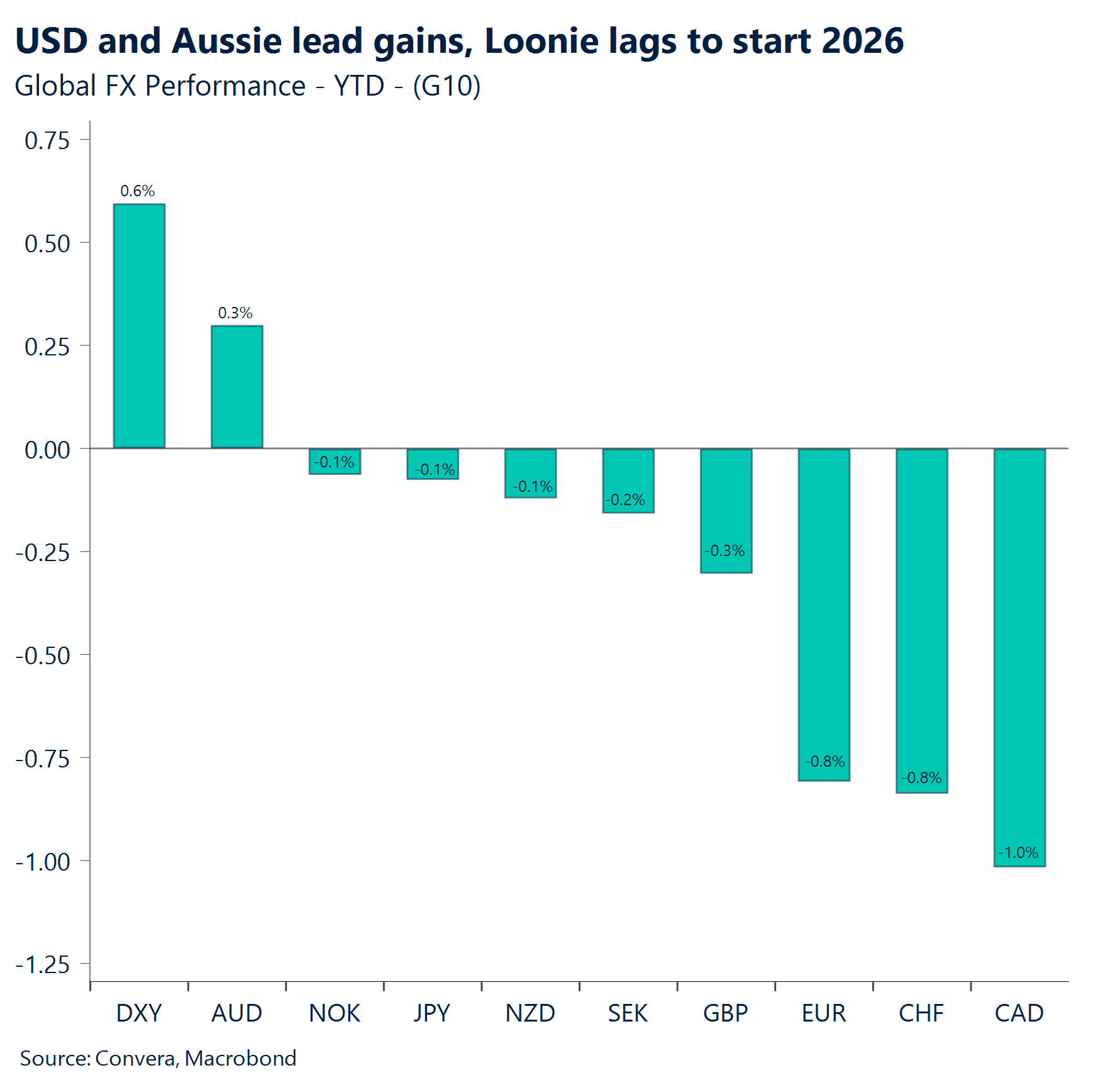

- Keeping calm. Cross‑asset volatility gauges remain subdued, allowing US equity indices to notch their strongest start to a year in several cycles. Oil prices continue to swing as traders balance near‑term supply risks against longer‑horizon production dynamics. In FX, the US dollar leads the majors, while the CAD sits firmly at the bottom of the pack.

- Mixed macro signals. US labour indicators softened. Non-farm payrolls rose 50k, less than forecast. The previous month’s numbers were also revised lower. The unemployment rate fell to 4.4%, lower than estimated too. But the ISM services surge to a 14‑month high — with activity, employment and new orders all expanding — suggests underlying momentum remains firm in the US economy.

- Eurozone inflation at 2%. A move below the 2% target later in the year, driven by such factors as a stronger euro, lower energy prices, and easing wage growth, would strengthen the case for further ECB easing in 2026.

Global Macro

2026 opens loud

Donroe Doctrine. Following the sudden ousting of Nicolas Maduro in Venezuela, the “Donroe Doctrine” has emerged as the definitive driver of global markets to start the year. The US continues to pivot away from hands-off globalization toward a more localized, militaristic approach to economic security. While markets remain relatively quiet in the short term, the geopolitical landscape has reshuffled following the administration’s high-stakes campaign to ensure the Western Hemisphere remains an uncontested American stronghold.

US labor market hits 5-year low. The December NFP missed expectations at 50,000, capping 2025 as the weakest year for US job growth since 2020. With only 584,000 jobs added annually and significant downward revisions, the three-month average has officially entered contraction.

Geopolitics aside. US private-sector payrolls and job openings both fell short of expectations, signaling cooling labor demand, yet low layoff and rising quit rates maintain a “low-hire, low-fire” market dynamic. Conversely, the ISM services index surged to a 14-month high, driven by strong expansion in new orders and business activity. While shrinking backlogs offered some relief, persistent price pressures suggest the Fed may remain patient with rate cuts. Simultaneously, the US trade deficit saw a historic contraction, dropping to its lowest level since 2009, but a deeper look shows the figure is an anomaly that’s likely to reverse.

Eurozone. Eurozone inflation eased to 2% in December from 2.1% in November, driven primarily by lower energy prices. Meanwhile, sticky services inflation, which slipped to 3.4% from 3.5%, was largely the result of easing wage growth. The data is unlikely to prompt much reaction among ECB members for now, especially after the upward revisions to inflation forecasts in the December staff projections.

Week ahead

Markets poised for the CPI print

US CPI sets the tone for the Fed. The US CPI report is due, offering crucial detail to help shape the Fed’s path ahead. It will complement the labour‑market picture and help interpret the much‑debated November print at 2.7%, which was distorted by shutdown‑related technical issues.

UK GDP as the first domestic checkpoint. Monthly GDP figures for the UK are due. The release gives markets something domestic to chew on, but the real test comes the following week with labour‑market, inflation and PMI data. These will provide the first meaningful read‑across for the Bank of England’s February decision and determine whether policymakers feel compelled to deliver another cut.

Germany 2025 growth under the microscope. Germany’s 2025 GDP growth print is released. With well‑known challenges weighing on industrial competitiveness, the figure will serve as a key summary of the economy’s performance and how it stands relative to 2026, when spending plans are expected to ramp up following fiscal‑stimulus commitments.

Soft momentum, few signs of lift. We will monitor industrial production for the euro area following the recent weaker‑than‑expected Economic Sentiment Indicator, which slipped from 97.1 to 96.7 in December. It is not a large move, but it reflects an economy showing modest growth without meaningful signs of a pickup. Industrial sentiment improved somewhat as new orders came in a little better, although still below October levels.

FX Views

No Fed cut on the horizon just yet

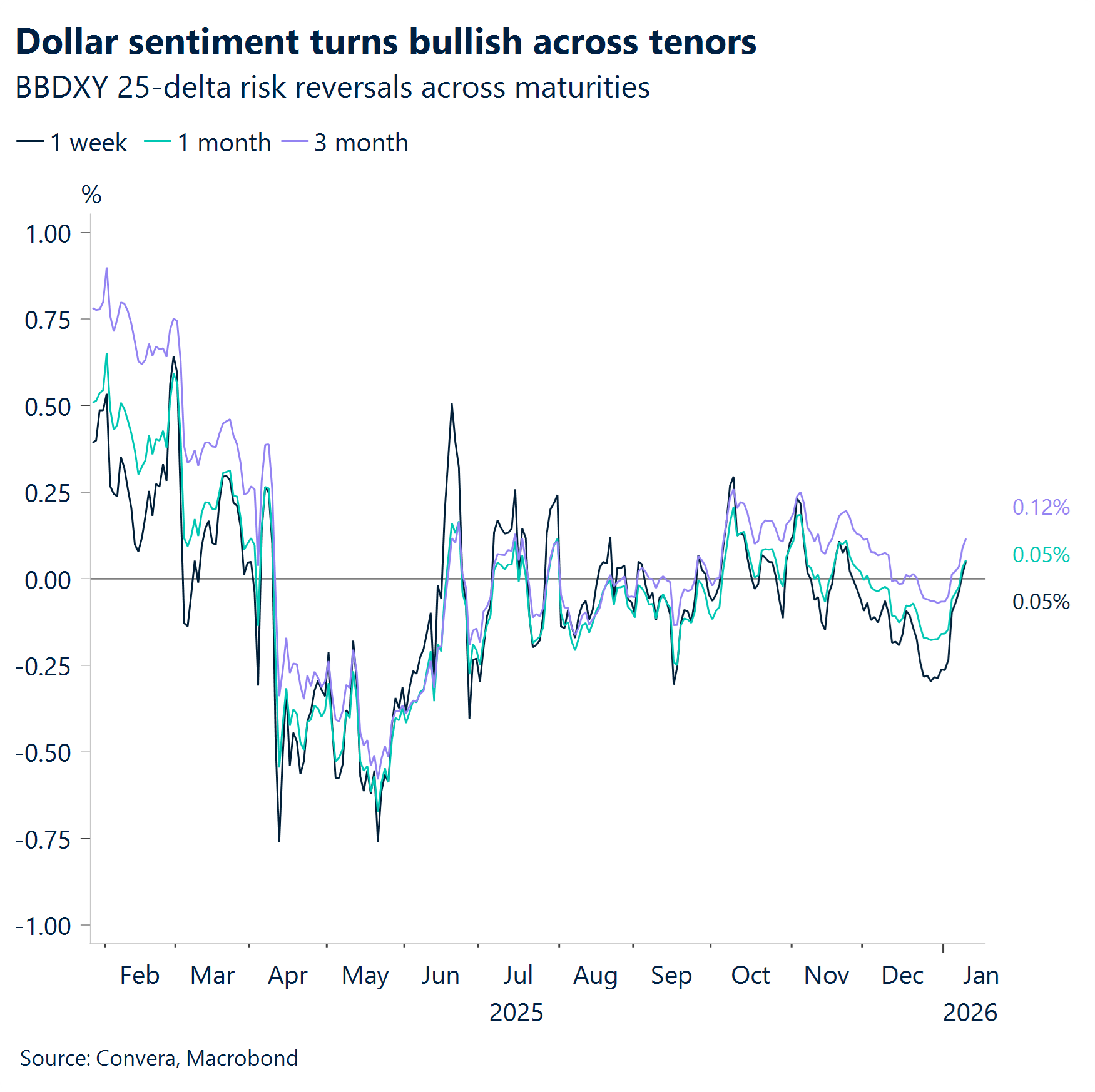

USD Dollar holds the upper hand The dollar absorbed some cautious optimism through the week on mixed macro signals. Markets interpreted the overall data picture as broadly positive, allowing yields to drift higher and the dollar to follow. While the week leaves both hawks and doves with data to chew on, the picture does not point to any urgency to cut rates at the January meeting. That should keep the dollar’s ascent from the December lows at 97.749 intact, with next week’s inflation report acting as the next key catalyst. With the data flow now coming through more smoothly, without major shutdown‑related hiccups, investors can finally begin to form more concrete expectations, which tends to instill firmer direction in the dollar’s price action. The greenback also benefited from a mix of safe haven demand tied to geopolitical escalations, including the capture of Maduro and renewed threats to seize Greenland, as well as heightened perceptions of US market dominance linked to efforts to secure additional oil supplies. From here, however, these factors are likely to exert only limited influence unless further US intervention occurs in the near term.

EUR Euro softens; dollar sets the tone. Eurozone inflation dropped to 2% from 2.1% in December. Market bets on an ECB hike this year were wiped out, as the release renewed concerns about disinflationary pressures across the bloc, driven by such factors as a stronger euro, easing wage growth, and lower energy costs. But it was the US leg that did most of the heavy lifting in moving EUR/USD, with a slate of mixed labour‑market data killing any urgency for the Fed to resume cutting at the January meeting. The pair is on track to close lower for a fourth consecutive day, down 0.6% week-to-date. Having breached the 100‑ and 50‑day moving averages, the next key levels are 1.1625 and 1.16, as bearish momentum may extend following next week’s US CPI report.

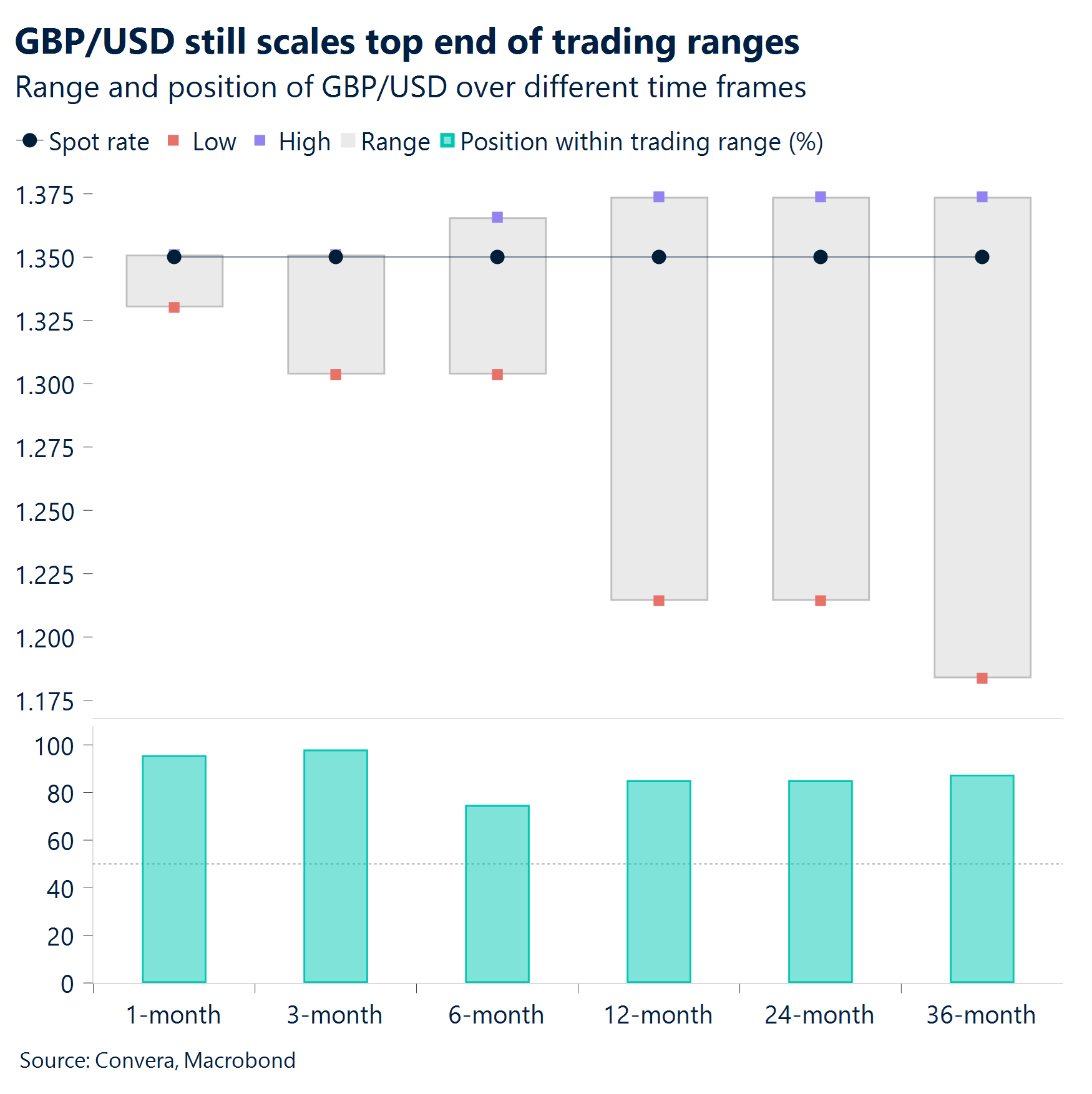

GBP Short-lived shine. Sterling pulled back from over 3-month highs versus the US dollar (1.3568) and euro (1.1568) as cooling global risk appetite lifted safe‑haven demand. That dynamic left the pound firmer against higher‑beta peers like the Scandis and Antipodeans. With no UK‑specific catalysts of late, sterling was largely trading off the global backdrop. Hence, with the dollar firming, GBP/USD slipped back below its 21‑day moving average for the first time since late November — a signal that the Q4 rebound from $1.30 to $1.35 may be running out of steam. The 100‑ and 200‑day moving averages in the upper $1.33s should offer solid layers of support though and may slow any further downside in the near term. As for GBP/EUR, we had flagged the rally looked stretched: the 200‑day moving average remains a clear resistance line, and the failure to break higher leaves the cross vulnerable to renewed downside risks. With a busy run of UK data ahead, the domestic narrative might play a bigger role in shaping sterling’s path as markets refine expectations around the Bank of England’s policy trajectory.

CHF Francly unusual. The Swiss franc has been a laggard this week, slipping nearly 1% against the dollar and 0.3% versus the euro. This is an unusual move given rising geopolitical tensions, especially with gold volatile and the yen no longer offering the refuge it once did. The timing has fuelled speculation that the Swiss National Bank may have been quietly leaning against franc strength, consistent with its long‑standing discomfort with an overvalued currency. Confirmation will come soon when traders see whether the SNB expanded its balance sheet in December. This week’s uptick in Swiss inflation argues against expecting sustained franc weakness and while the SNB may smooth excessive appreciation, it is not trying to reverse the broader trend — leaving the franc well supported over the medium term. Topside resistance is thus seen at 0.8060 and 0.933 for USD/CHF and EUR/CHF respectively.

CNH Yuan holds firm as inflation ticks up. China’s consumer prices rose 0.8% year-on-year in December, matching forecasts and up from 0.7% previously. It marks the fourth straight monthly improvement and the strongest reading since March 2023. Elsewhere, producer prices remained in decline for the 39th month, down 1.9% year-on-year. That was a smaller drop than the 2% expected and an improvement from November’s 2.2% fall. USDCNH has been firm last week. The next key resistance for USDCNH lies at 50-day EMA of 7.0442 followed by 100-day EMA of 7.0841. USD buyers may look to take advantage, as RSI is in oversold territory. Market participants will keep an eye on upcoming exports, imports, trade balance and new loans.

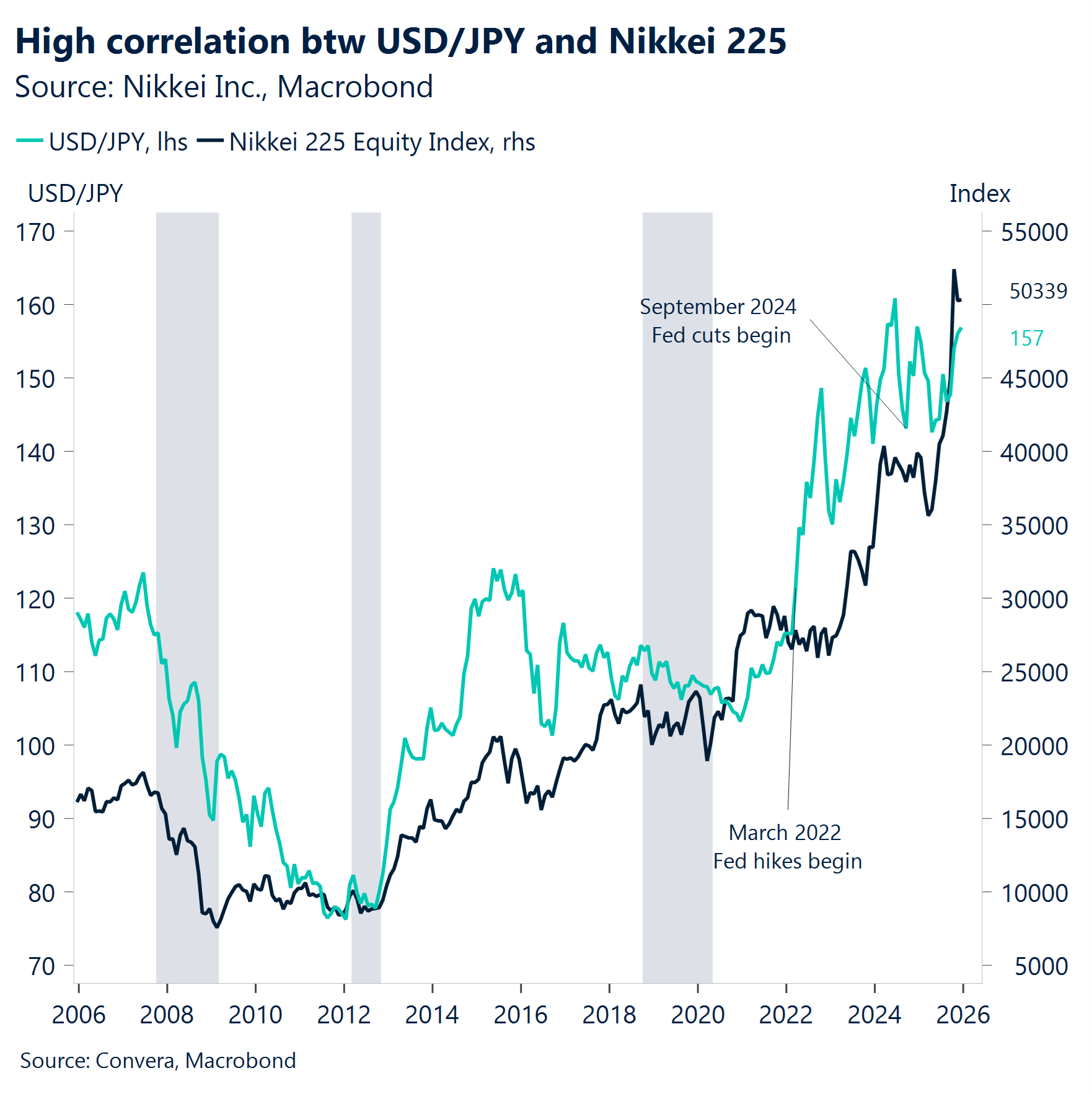

JPY Yen slips as BoJ holds outlook. The Bank of Japan kept its economic outlook unchanged across all nine regions in its latest quarterly report, noting moderate recovery despite some areas of weakness. Branch managers also reported that many businesses expect to raise wages in the coming fiscal year, at a pace similar to the current one. Despite the wage outlook, the yen slipped 0.6% last week, with the USDJPY holding firm above 155. The next key support lies at 21-day EMA of 156.42, followed by 50-day EMA of 155.33. Chart shows the high correlation between Nikkei 225 and USD/JPY. Market participants will keep an eye on upcoming adjusted current account, PPI and bank lending.

CAD A weak start. The USD/CAD pair has retreated to start the year, hitting 1.3860 and effectively reclaiming its 200-day Simple Moving Average (SMA) at 1.3849. This move has fundamentally shifted the chart’s vibe, as markets scramble to price in the geopolitical earthquake in Venezuela. With Washington’s plan to market Venezuelan crude “indefinitely,” the “Venezuela discount” is hitting the Canadian Dollar hard. Traders are quickly realizing that the US control of these proceeds creates a massive narrative shift that favors the Greenback over the Loonie. The pair is now trading above both its 50-day and 200-day SMAs, and with the RSI pushing slowly into overbought territory, the momentum is clearly with the bulls. If we see any pullbacks toward the 1.3780–1.3800 zone, expect dip-buyers to step in aggressively. On the topside, the 1.3860 level is the immediate pivot, with the big psychological target at 1.3900 looming large. While intraday models show some minor friction around 1.3790, the broader trend is looking much more constructive for the USD. After the job reports in US and Canada, the Loonie still remains under pressure, trading above 1.385.

AUD Aussie dollar dips as services slow. Australia’s services sector grew at its weakest pace in seven months, easing to 51.1 from 52.8 but staying above the neutral 50 mark. Even with the softer headline, new business and export demand picked up, while hiring accelerated and helped clear backlogs. Rising costs added pressure, with input and output prices climbing and fueling inflation concerns. The composite PMI slipped to 51.0 from 52.6, the slowest growth since May, yet demand and jobs suggest cautious momentum heading into early 2026. On the charts, AUDUSD trades within an ascending channel. The 14‑day RSI has pulled back, avoiding overbought territory. Next key support for AUDUSD is at 21-day EMA of 0.6677 and 50-day EMA of 0.6627. Markets will focus next on building approvals for fresh signals.

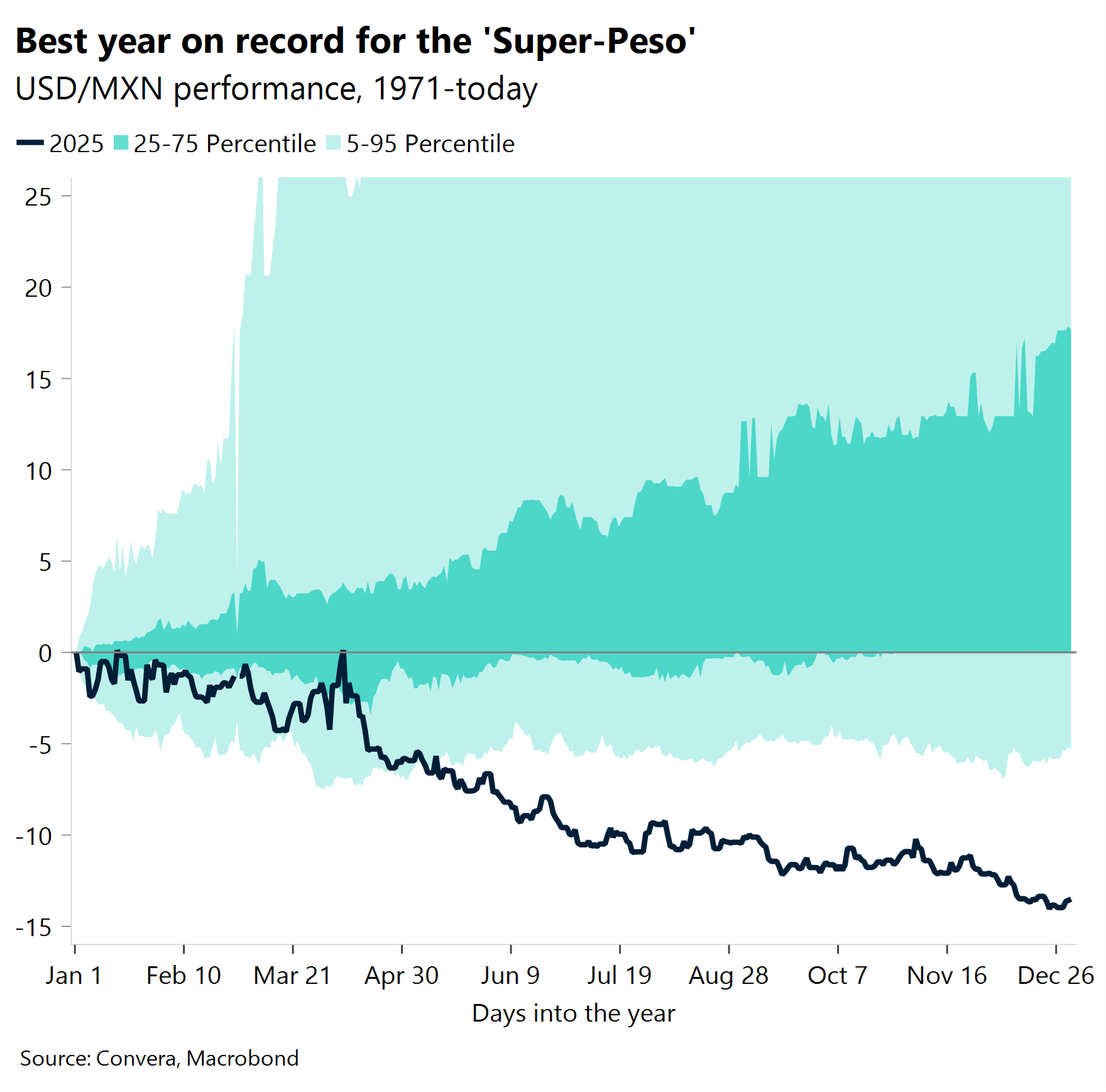

MXN Carry + credibility sustain Peso’s gains. 2025 was a banner year for the “super peso,” which finished near 18 per USD after a 14% appreciation—its strongest annual gain since Mexico adopted a free-floating regime in the 1990s. This rally was fueled by domestic resilience against U.S. trade noise, the peso’s high carry appeal, and a softening U.S. dollar as markets priced in a gentler Federal Reserve path. By December 2025, Banxico calibrated its stance with a 25 bp cut to 7.00% in a split 4–1 vote, signaling a shift toward data-dependent guidance rather than an open-ended easing cycle, especially with core inflation still stubbornly above 4%. Consequently, local yields remain attractive compared to developed markets, suggesting that as long as global risk appetite holds, the peso’s gains are unlikely to evaporate early in 2026.

Looking ahead to 2026, the base case suggests a short policy pause while Banxico assesses inflation dynamics, followed by gradual cuts if headline inflation continues toward its 3% target by the third quarter. Key swing factors include persistent core services inflation, potential tariff-related shocks, and the pace of the Fed’s own easing, all of which will dictate the rate differentials that nudge USD/MXN around the 18 handle. Through a Behavioral Equilibrium Exchange Rate (BEER) lens, the peso’s fair value is currently supported by real rate differentials and terms of trade; however, this cushion is expected to narrow as both central banks ease. With the Real Effective Exchange Rate (REER) already elevated at approximately 131 as of late 2025, there is limited room for further outperformance. Unless domestic disinflation significantly outpaces trading partners or nearshoring inflows surge, investors should expect two-way, range-bound price action until policy signals break decisively.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.