USD: Dollar creeps higher as month-end looms

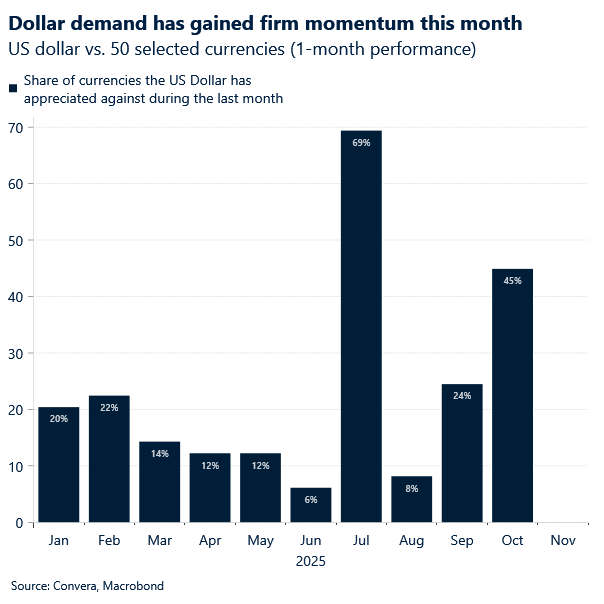

The US dollar index is set to log its second monthly gain of 2025, buoyed by resilient economic data, cautious optimism around trade negotiations, and a hawkish-leaning Federal Reserve (Fed). Options traders have crept back in with fresh bets on further dollar strength, though positioning remains far from ghoulishly aggressive. Whether the dollar’s rebound has legs may hinge on how month-end flows haunt the tape today. Portfolio rebalancing, benchmark tracking, and liquidity shifts often collide at month-end — a volatile brew that can distort short-term trends and amplify price swings.

The dollar’s recent strength also reflects a broader improvement in risk sentiment, helped in part by the Trump-Xi trade truce, which offered a temporary reprieve from geopolitical tensions and reinforced flows into US assets. It would also be a mistake to pin the dollar’s rise solely on the Fed’s path, as evidenced by the delayed spike in the buck. Through Asia and Europe sessions, the greenback was eerily flat — even drifting lower — until a brief bump followed the Bank of Japan’s rate hold and dovish remarks from Governor Kazuo Ueda. The real rally didn’t materialize until New York desks stirred on Thursday, coinciding with a spike in Treasury yields after Meta’s surprise $25 billion bond offering.

Technically, the US dollar index still faces long-term headwinds, with its 200-day moving average sloping downward. But it has convincingly reclaimed its 21-day moving average this month and now eyes a potential test of the 100 threshold. A close above would signal the rally has real bite. Support around 96 has held firm all year, aligning with a long-term ascending trendline that’s been quietly creeping higher since 2010.

In short, the dollar’s recent strength is built on solid fundamentals and tactical momentum — though longer-term risks still lurk in the background.

GBP: Sterling spooked by rate cut fears and fiscal fog

The pound is on track for its worst week since early January against the US dollar, haunted by growing expectations that the Bank of England (BoE) will resume cutting interest rates before year-end — stripping away one of sterling’s last remaining supports.

Markets now assign more than a 60% chance to a 25-basis-point cut by December, up from just 20% a month ago. Two cuts are fully priced by mid-2026. The pressure is coming from where rates are expected to go: six-month implied rates for the pound have plunged around 4.5% this quarter — one of the steepest drops in the G10 — suggesting investors see the BoE easing faster than most of its peers. By contrast, implied rates for Norway and Sweden have risen, underscoring the pound’s loss of relative-yield appeal.

Falling gilt yields may offer some relief to the government’s borrowing costs, but they’ve also drained sterling’s draw. The BoE’s expected pivot toward easier policy stands in stark contrast to a still-cautious Fed and an ECB remains on hold. Sterling continues to move in eerie lockstep with rate differentials, now trading near its lowest since May against the dollar and close to a two-year low versus the euro.

Adding to the gloom, fears around next month’s budget are casting a long shadow. Investors expect tax hikes and spending cuts to plug a widening fiscal gap, deepening the slowdown already visible in consumer and housing data. News of a 2p income tax rise followed Prime Minister Sir Keir Starmer’s refusal to repeat Labour’s manifesto pledge not to raise income tax, National Insurance, or VAT — a move that may prove politically costly, but fiscally unavoidable.

For a government unwilling to trim the welfare budget, a hefty tax increase was always the only credible path to keep bond market spirits calm. But for sterling, the witches’ brew of rate cut bets, fiscal tightening, and soft data is proving hard to stomach.

EUR: Lagarde holds, Germany folds

It was a busy day for the eurozone yesterday, though the market showed little reaction to the underlying euro-centric drivers. The ECB left interest rates unchanged, as broadly expected, while data pointed to overall strong GDP growth in Q3 for the eurozone. Notable outperformers included France (despite ongoing political turmoil), the Netherlands, and the eurozone aggregate, all of which overshot expectations. The outlier dragging down the mood was Germany – still the eurozone’s growth laggard. The country narrowly avoided a technical recession, with Q3 GDP growth flat, following a slightly upwardly revised Q2 contraction of -0.2% (from -0.3%). Germany remains a textbook case of an economy struggling to translate stimulus promises into tangible performance.

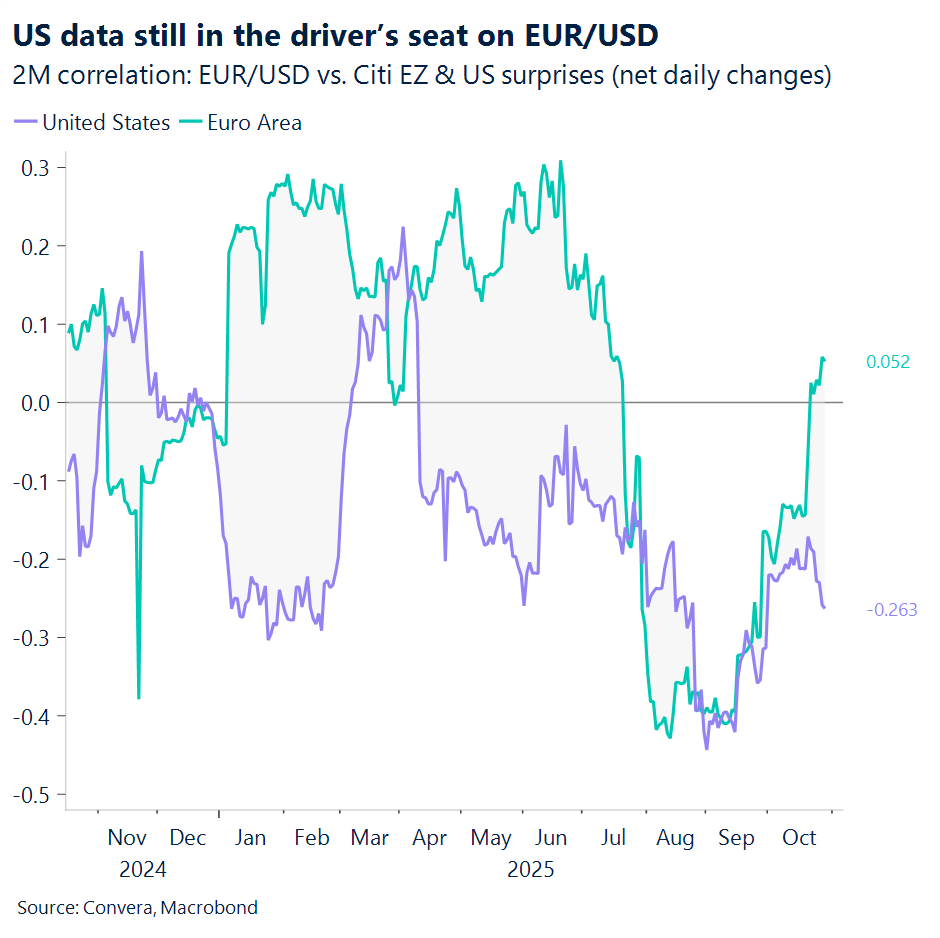

Meanwhile, European Commission sentiment surveys also surprised to the upside, reinforcing a general sense of cautious optimism despite lingering uncertainty. The euro’s reaction was muted, later slipping below 1.16 as USD-positive headlines from Wednesday and yesterday fueled fresh buying – New York desks picking up the baton ahead of the open and well into. Not that euro-centric policy or macro has moved the needle for the euro much anyway.

Onto the policy meeting, Lagarde reiterated the ECB’s comfort with current rate levels – having left rates unchanged for the third consecutive meeting yesterday. The decision was widely anticipated, and the market reaction predictably subdued. The tone emphasized a meeting-by-meeting approach, avoiding any pre-commitment to a defined rate path. Lagarde noted that the inflation outlook remains broadly unchanged, with both upside and downside risks still in play amid persistent global uncertainty.

The persistence EUR/USD showed in testing 1.16 underscored how the Fed’s recently re-affirmed cautious stance presents a double-edged sword for the euro: it confirms a still-steady and broadly resilient US economy – supportive of the dollar for sentiment – while the cautious tone keeps doves at bay and any upside zipped. We struggle to see fresh catalysts for the euro to push higher from here, unless US macro takes a distinctly softer turn through alternative data releases.

Sterling bleeds as cuts loom

Table: Currency trends, trading ranges and technical indicators

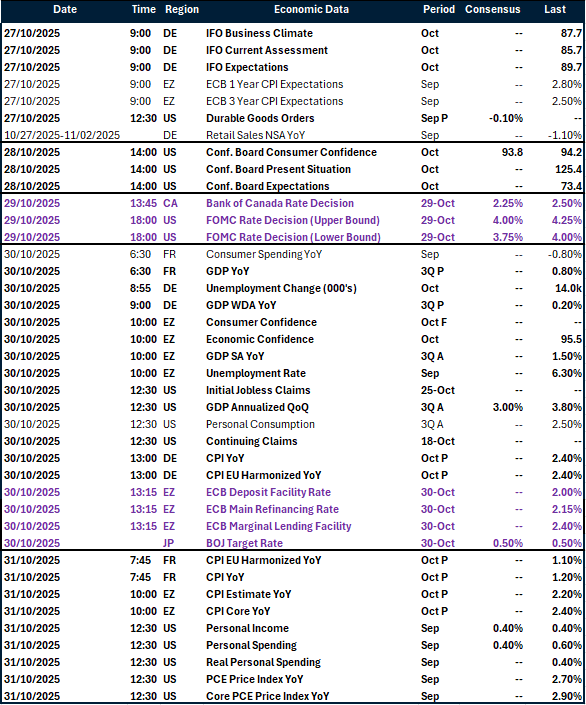

Key global risk events

Calendar: October 27-31

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.