USD: Too early to call it a turning point

Ahead of the US NFP report, markets were positioned to confirm the cooling of the US labor market, however they were met with an upside surprise. January payrolls rose by 130,000 and the unemployment rate slipped to 4.3%, both better than consensus expectations heading into the release, with forecasters clustered roughly around 55,000–80,000 for job gains and 4.4% on the jobless rate.

That pop, however, sits atop a softer underlying trend revealed by the Bureau of Labor Statistics’ annual benchmark revision. With the January report, BLS revised March 2025 total nonfarm employment down by 898,000 on a seasonally adjusted basis (–0.6%) and by 862,000 not seasonally adjusted, recasting 2025 as a year that added just 181,000 jobs in total, about 15,000 per month. It was the weakest hiring year since 2020, and the weakest outside recession since 2003.

The anatomy of job creation underscores that fragility. Employment has shown little net change since April 2025, and the gains we do have are unusually concentrated: health care and social assistance continue to shoulder most of the growth. In January alone, health care added roughly 82,000 jobs and social assistance 42,000, while many other industries were little changed. That concentration means the broader economy would likely be treading water without the medical complex’s steady expansion.

Into 2026, cyclical and structural forces point in different directions. Fiscal tailwinds from the “One Big Beautiful Bill” (OBBB) should deliver a front‑loaded boost, via extended TCJA provisions, full expensing and targeted tax relief, even as analysts debate the long‑run costs and the bill’s impact on the debt trajectory and term premium. At the same time, easier financial conditions and an AI‑driven capex super‑cycle, variously estimated at $500–$700 billion across the hyperscalers this year, are channeling investment into data centers, chips and power, with potential productivity spillovers that markets may still be underpricing.

These supports should help the greenback find its footing after a weak 2025. However, they are being offset by rising US risk premia and policy uncertainty, which can keep long‑end yields stickier and valuations more fragile even when growth steadies. The currency lens reflects that tension: despite rates backing up on the strong jobs print, the dollar index (DXY) remained unchanged, with narrative pressure from “de‑dollarization” debates and reports that Chinese regulators have encouraged banks to limit or trim US Treasury exposure, alongside data showing China’s Treasury holdings at a 17‑year low. The result is a greenback struggling to find a durable footing even as the domestic data surprise.

In short, January’s upside surprise forces investors to respect the possibility that labor demand is stabilizing from very weak 2025 momentum, but the broader picture hasn’t morphed into a clean reacceleration. The benchmark revisions confirm a thinner foundation, the sector mix remains narrow, and the macro balance of fiscal thrust versus risk premia and currency headwinds keeps the path for policy, yields and the dollar unusually path‑dependent.

EUR: Dollar’s fragile supports

The muted reaction in EUR/USD to the stronger‑than‑expected US jobs report yesterday was no surprise. We had noted that despite last week’s weaker ADP and JOLTS data, the hawkish baseline set by the Fed at the January policy meeting was likely to dominate, effectively widening the window for dovish surprises. Instead, the data aligned with the Fed’s stance, leaving little directional impetus. While the recent dominance of sentiment over rate differentials may have contributed to a more subdued macro‑driven bearish move, we think the nature of that macro force – specifically the details in the jobs report – also played a role in keeping the reaction in the pair relatively muted.

Yesterday’s NFP print showed concentrated gains in a few sectors (such as private education and healthcare) while others saw no growth. The backdrop suggests a less uniform labour‑market picture, consistent with other indicators – see, for example, the recent JOLTS and Challenger reports pointing to a sharp drop in job vacancies. This unevenness therefore fails to convey a more organic and cohesive picture of labour‑market health, and may make it harder for the FOMC to shift more unanimously toward the hawkish side.

On the inflation front, tariffs have mechanically lifted prices for months, keeping hawks in check, but their impact is expected to dissipate in the months ahead. And then Warsh’s reputation for past hawkishness, which also added to tempered easing expectations. These factors offer limited substance for a more durable hawkish shift, yet they keep markets positioned in deceptively hawkish territory. Overall, therefore, the backdrop may point to a numbed sensitivity in the dollar’s reactions to upbeat releases, while exerting more pronounced bearish pressure in the months ahead as these supports erode and a more dovishly compatible macro backdrop emerges.

EUR/USD remains comfortable at the top of the 1.18 handle after briefly dipping to 1.1833 on the initial knee‑jerk reaction to the jobs release. The bullish structure remains intact, with the pair holding well above key moving averages. We doubt this week’s inflation report – likely to show easing price pressures – will challenge that structure, and an end above 1.19 remains a favourable target by week’s end.

GBP: Disappointing UK GDP figures

GBP/USD dropped from $1.37 towards $1.36 in the minutes following yesterday’s solid US labour market data. We warned that sizeable dollar moves seen late last week and into Monday, raised the risk of a counter‑move, especially given the downside‑miss bias heading into the release. The unexpected strength in the monthly data caught investors off guard, sparking a rally in both the dollar and the Treasury curve.

This morning’s UK data dump hasn’t helped the pound — though it hasn’t hurt it much either. Quarter‑on‑quarter growth came in at 0.1% versus the 0.2% expected, with services flat, production a touch firmer and construction weak. On an annual basis, output rose 1.0%, below the 1.2% forecast. December’s monthly GDP met expectations at 0.1%.

The data is a further blow to PM Starmer, who has come under intense pressure to resign. Polymarket continues to show a 70% probability of him stepping down by June 30, and concerns about a less‑centrist Labour successor introduce a meaningful layer of political risk for GBP, given the potential fiscal implications.

GBP/USD is clinging onto its 21‑day moving average for now, which is still sloping higher — a sign that underlying trend support hasn’t fully given way. GBP/EUR is also holding above its 100‑day moving average — a level we view as key to preserving the upside bias that’s been in place since November.

The principal focus for traders now shifts to next week’s January CPI release. It will be the single most important input into the Bank of England’s (BoE) March policy decision. Overnight indexed swaps are already pricing more than a 70% chance of a March cut following the dovish BoE hold last week. Any material repricing won’t happen until the inflation print and that’s why the two‑year gilt yield — now around its lowest since August — is unlikely to gather any real momentum until those CPI figures are in hand.

Market snapshot

Table: Currency trends, trading ranges & technical indicators

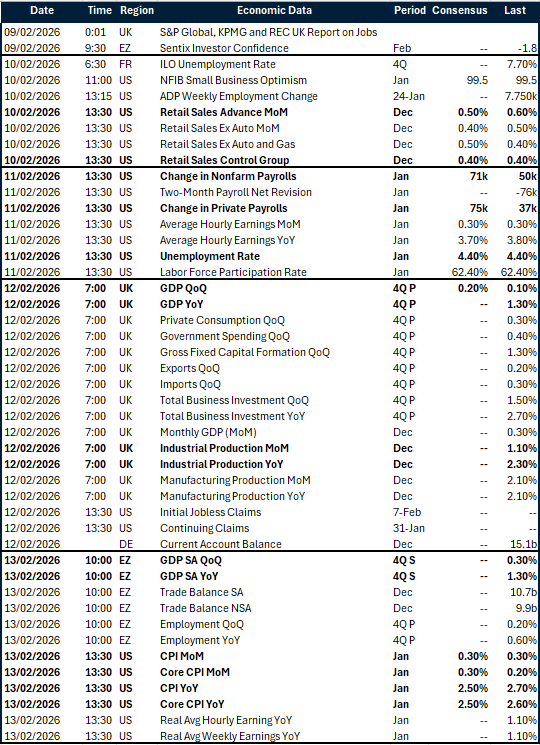

Key global risk events

Calendar: February 9-13

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.