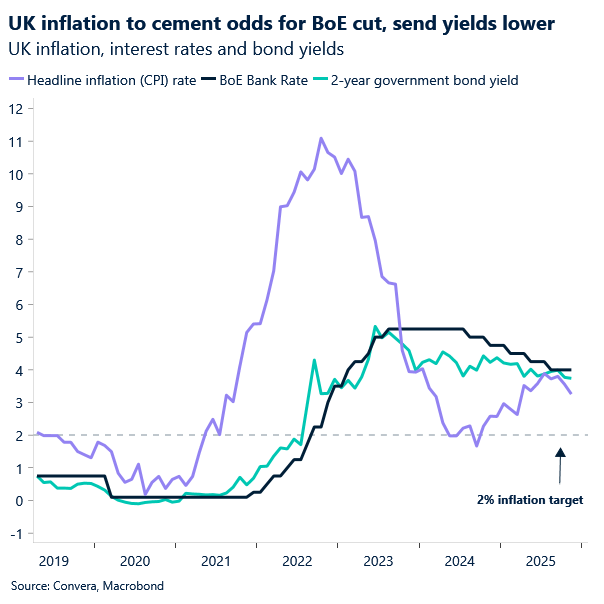

UK inflation adds to BoE easing bets

UK inflation fell to its lowest level in eight months, undershooting expectations and reinforcing the case for a Bank of England (BoE) rate cut on Thursday. The pound is reeling, pulling back sharply from 2-month highs yesterday and trading closer to $1.33 versus the USD once again.

Headline CPI eased to 3.2% versus a 3.5% forecast, down from 3.6% previously, while services inflation slipped to 4.4%. The softer readings strengthen the argument for a 25bp reduction, which would bring Bank Rate to 3.75% and likely push 2‑year gilt yields below that threshold. Traders are now pricing in around 68 basis points of easing by the end of 2026, from 58 on Tuesday. Sterling has already weakened, dropping 0.8% against the USD this morning. The rate‑ and yield‑driven bearish narrative for GBP remains intact as markets look ahead to 2026.

Sterling briefly recovered on Tuesday, helped by stronger than expected UK PMI data and disappointing US data. The UK’s composite PMI jumped to 52.1 in December’s flash estimate, up from 51.2 the previous month. It was one of the strongest readings this year and driven by an accelerating services sector and the strongest increase in factory output in 15 months. The survey may alleviate some concerns at the BoE that the economy has lost considerable momentum since a strong first half of the year.

However, with the unemployment rate rising to an almost 5-year high, wage growth cooling and inflation decelerating faster than expected, we wouldn’t be surprised to see a dovish tilt in the BoE vote split on Thursday, which doesn’t bode well for the pound.

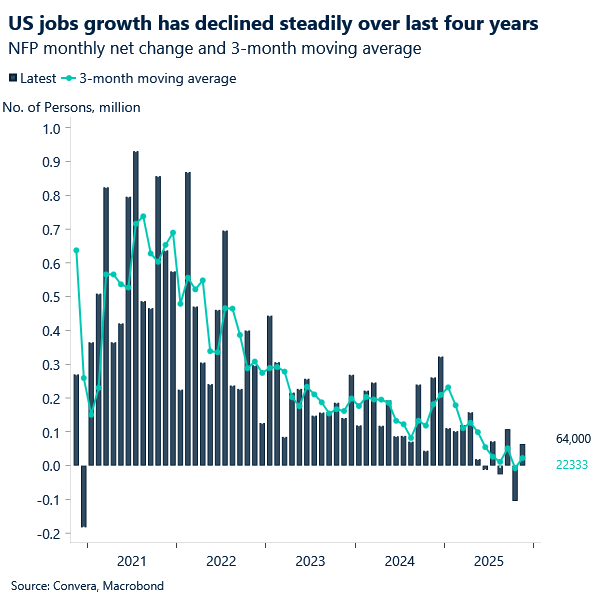

US jobs slowdown continues

The US dollar index is hovering near its lowest level since early October, dragged down by the slide in front-end Treasury yields following the US jobs data yesterday.

US non‑farm payrolls rose 64k in November, modestly above consensus, but October’s sharp downward revision left the three‑month average at just 22k. The unemployment rate climbed unexpectedly to 4.6%, the highest since 2021, underscoring labour‑market fragility and validating the Fed’s recent rate cut. This backdrop keeps traders positioned for two further cuts in 2026, reinforcing downside risks for the dollar.

Retail sales provided a brighter note, with October’s control group up 0.8%, signalling household demand remains resilient. Yet with jobs data softening and consumption holding up, the next inflation release will be pivotal in shaping Fed expectations — and near‑term USD direction.

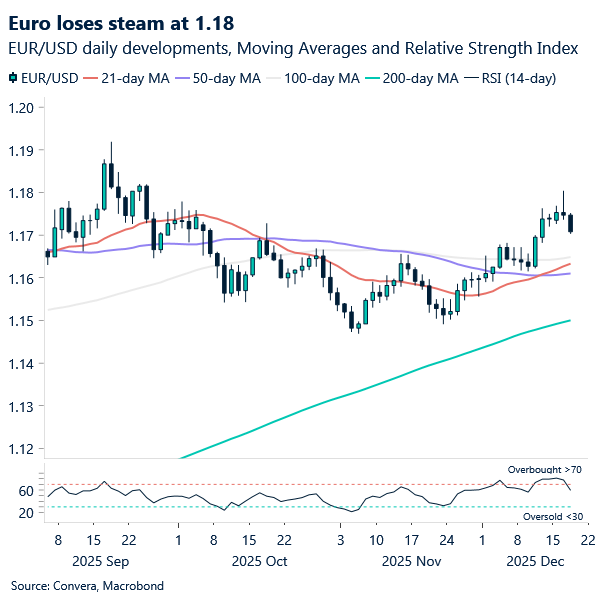

Euro pulls back from $1.18 peak

The euro briefly touched $1.18 yesterday — its highest level versus the dollar since late September — before retreating as renewed USD demand followed a heavy data slate. While the European Central Bank (ECB) is expected to hold rates steady at 2% on Thursday, growing acceptance that the easing cycle is complete suggests downside for EUR/USD may be limited.

Across the Atlantic, November’s US jobs report showed resilience but signs of slowing, tempering dollar strength. In Europe, the composite PMI slipped to 51.9, dragged lower by Germany’s industrial weakness, though France surprised with its strongest factory growth in over three years. Meanwhile, Germany’s ZEW expectations index jumped to 45.8, the highest since July, hinting at improving sentiment despite near‑term softness.

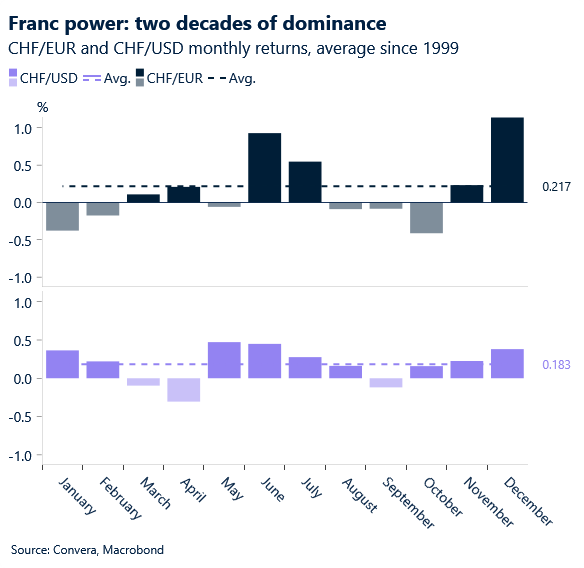

Swiss franc eases despite SECO upgrade

The Swiss franc has eased moderately in the early part of this week despite an economic upgrade from the Swiss government’s SECO forecasts.

The Swiss “Federal Government Expert Group on Business Cycles” raised its 2026 GDP forecast from 0.9% to 1.1%, supported mainly by a reduction in US tariffs. Tariffs were cut by the US from 39% to 15%.

The franc fell from a one-month high against the US dollar, with USD/CHF rebounding from support at 0.7925. The zone above 0.7900 has been a major support area for the pair over the past three months.

The Swiss franc also eased from two-week highs versus the British pound and the euro.

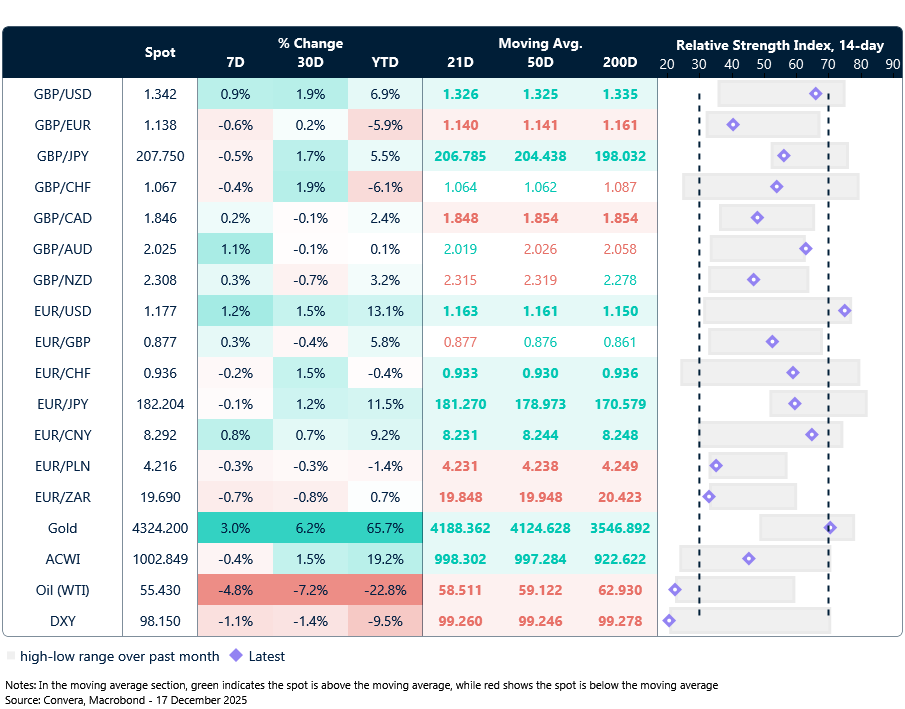

Market snapshot

Table: Currency trends, trading ranges and technical indicators

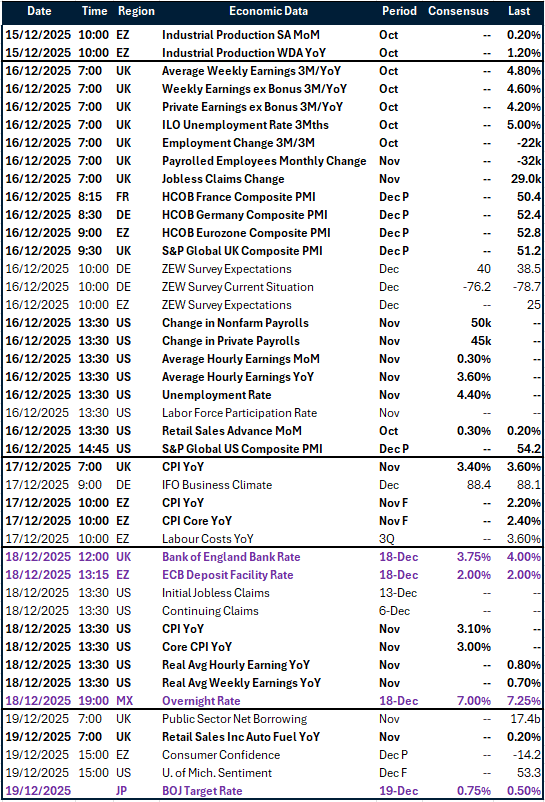

Key global risk events

Calendar: December 15-19

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.