USD: Cautious Powell collides with growth resilience

The US dollar index firmed after Fed Chair Jerome Powell struck a cautious tone on further easing, stressing that the rate‑cut path remains uncertain as policymakers balance inflation risks against a softening labor market. Meanwhile, new Fed Governor Stephen Miran, who favored a deeper 50 bp cut last week, warned that underestimating policy tightness could endanger jobs without bolder action.

On the macro front, US PMIs undershot expectations but only modestly. The composite index slipped from 54.6 to 53.6 (vs. 54 expected), with both employment (51.7) and new orders (53.1) still comfortably above 50. Input costs rose while output prices eased, hinting at margin pressure, but the data were not weak enough to shift expectations or market prices materially. In fact, following Powell’s comments, markets are no longer fully pricing in two more rate cuts from the Fed by year-end, hence the dollar’s rebound.

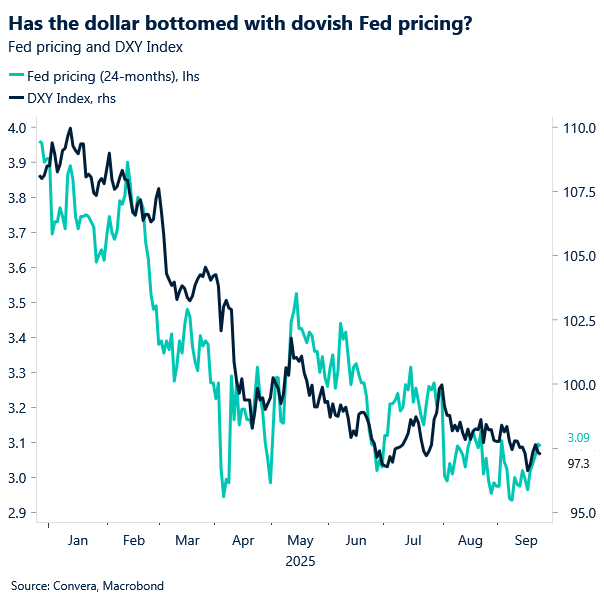

Indeed, it could be argued that the dollar narrative is shifting from a “rate‑cut casualty” to a relative growth story, echoing dynamics from President Trump’s first term. After a historic H2 decline for the USD, the latest slide was largely a terminal‑rate repricing, with expectations consolidating near 3%. However, although growth has slowed from post‑pandemic peaks, tariff volatility has eased, financial conditions remain loose, and fiscal support is building via the “One Big Beautiful Bill.” This could result in better US growth outcomes in 2026 versus this year.

If this is the case, the dollar could be nearing a bottom, with risks tilting to the upside as growth resilience challenges the market’s downbeat view. If the recovery mirrors Trump’s first term, dollar strength could extend, though it’s reasonable to expect the US currency to become increasingly sensitive to macroeconomic developments and Fed expectations. Moreover, in the very near term lower funding costs could weigh on the buck through hedging activity – especially as seasonal headwinds build into year-end too.

EUR: EUR/USD floats on Fed uncertainty

EUR/USD treaded water yesterday, hovering just south of the $1.18 level. We maintain a moderate bias for $1.18 to settle as new medium-term support, but that would require a more unified signal from the Fed on its willingness to ease. For now, the overall tone remains hawkish – despite the usual doves (see Waller). In the short term, while a breach of $1.18 is possible, the euro may struggle to hold firmly above it.

On the data front, PMIs painted a mixed picture. September’s provisional manufacturing reading came in at 49.5, undershooting forecasts of 50.7. However, strength in services more than offset the weakness, lifting the composite print to 51.2 from 51.0. While the data keeps the euro supported for now, it underscores a fragile outlook for the bloc’s manufacturing sector – particularly vulnerable in a tariff-heavy global environment that continues to pressure export-driven economies like the EU.

The key risk event for the euro this week is U.S. PCE (Friday). A below-consensus print may allow the euro to explore the $1.18 zone, albeit briefly, given the Fed’s reiterated cautious and fractured stance this week.

GBP: PMI miss reinforces sterling’s fragile backdrop

September’s S&P Global PMI signalled a sharp slowdown in UK private‑sector activity, undershooting expectations. Services output expanded at a slower pace, while manufacturing recorded its steepest contraction since April. As a result, the composite PMI slipped from a one‑year high to a four‑month low.

Sterling initially extended losses, falling to an eight‑week low versus the euro, before staging a modest afternoon rebound. GBP/USD, meanwhile, held above the $1.35 handle — a level it has traded above only 20% of the time over the past decade. The currency pair continues to flirt with this key level this morning.

The UK domestic backdrop has turned notably more bearish compared with the first half of 2025, with soft data and fiscal concerns back in focus. This leaves sterling bulls increasingly reliant on continued dollar weakness into year‑end. That said, G10 FX is once again being driven by relative rate differentials. The correlation between UK‑US two‑year yields and GBP/USD, which had briefly broken down after April 2 amid structural flows, has re‑asserted itself. The spread recently widened to 46 bps – a two-year high, helping the pound hold onto its 8% gains year-to-date.

Still, fiscal risks remain a key vulnerability. Market sentiment can shift quickly to view debt dynamics as outweighing any hawkish repricing of Bank of England policy. Options markets echo this caution: sterling risk reversals versus the euro show the most negative skew into year‑end since April, highlighting persistent demand for downside protection.

Dollar extends rebound

Table: Currency trends, trading ranges and technical indicators

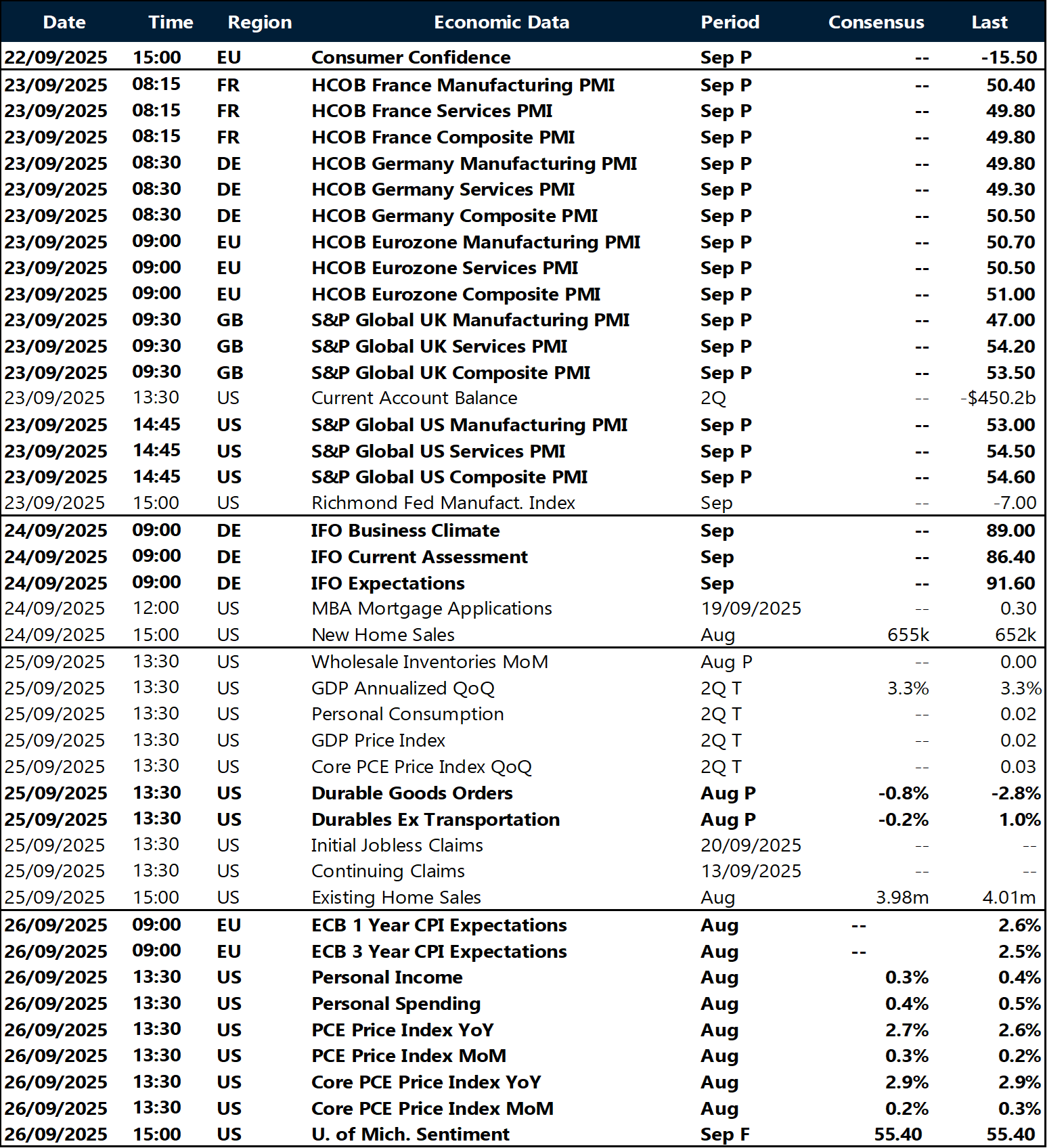

Key global risk events

Calendar: September 22-26

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.