USD: Shutdown risk and data watch

George Vessey

The US dollar is on the backfoot this morning as investors weighed the growing risk of a government shutdown and braced for a pivotal week of economic data. With the fiscal year ending Tuesday and no funding bill yet approved, parts of the federal government could shutter by Wednesday. President Donald Trump is expected to meet with congressional leaders in a last-minute effort to avoid disruption, but uncertainty continues to pressure the dollar.

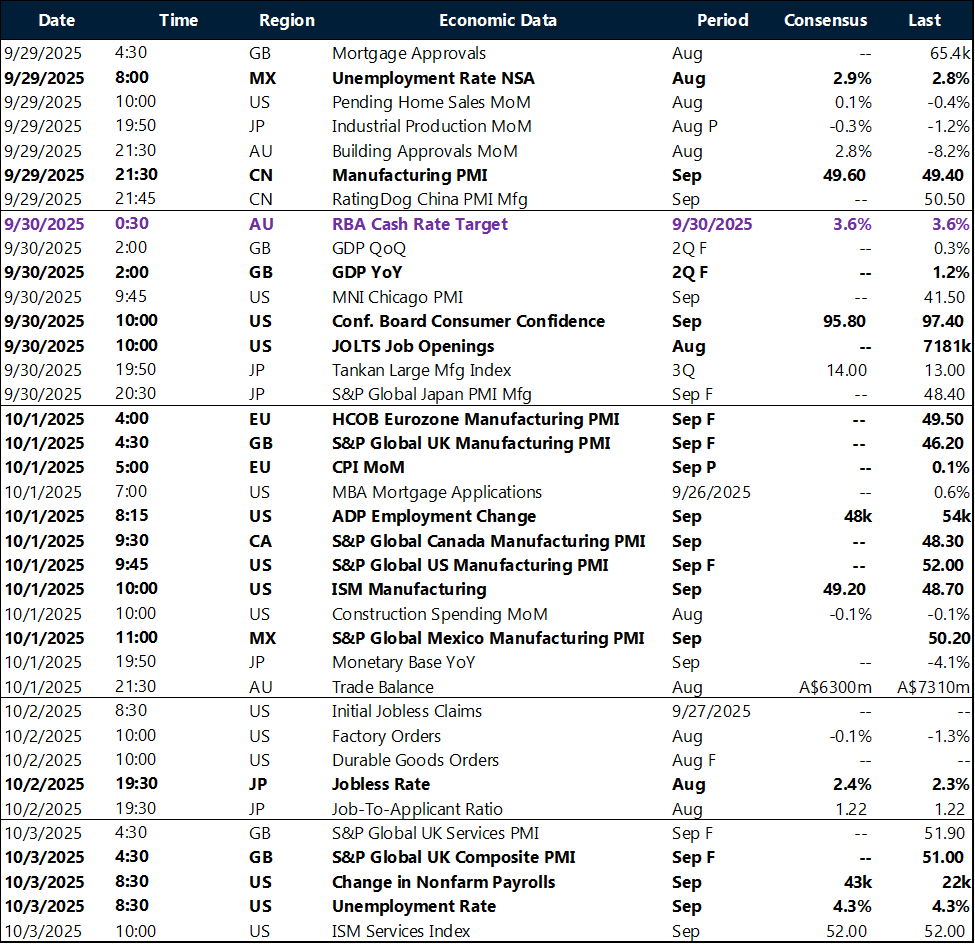

Markets are also laser-focused on September’s employment figures, including nonfarm payrolls, job openings, and private sector hiring, alongside the ISM manufacturing PMI this week. These indicators will shape expectations for future Fed policy, especially after last week’s stronger-than-anticipated data tempered hopes for aggressive rate cuts, which gave the dollar a strong cushion. Traders have scaled back their forecasts, now pricing in roughly 40 basis points of easing by year-end – a shift that has added volatility to USD positioning.

August’s PCE inflation data offered few surprises, though modest gains in both income and spending hinted at resilient consumer demand. Inflation ticked up slightly, but not enough to suggest a tariff-driven surge is imminent. Combined with upward revisions to second-quarter consumption, the data paints a picture of an economy still humming, complicating the case for deeper rate cuts. Equity markets responded with cautious optimism, while bond yields held steady, reflecting a wait-and-see stance.

The Fed’s recent rate cut – the first of the year – was driven by concerns over labour market softening. Yet with inflation hovering near 3%, well above the Fed’s 2% target, the decision underscores the delicate balancing act policymakers face. Most officials anticipate price pressures will ease by early next year, but they remain vigilant. Any unexpected spike in inflation could force a reversal in policy, potentially lifting rates and strengthening the dollar.

For now, the trajectory of the USD hinges on upcoming data. A disappointing jobs report or signs of cooling consumer prices could reignite dovish momentum and weigh further on the dollar. Conversely, any upside surprises may reinforce the Fed’s cautious stance and offer support to the currency. Either way, the stakes are high – and the dollar is caught in the crossfire.

CAD: Ending Q3 on a high

Kevin Ford

The Canadian dollar’s performance following the back-to-back policy decisions by North American central banks has aligned with Scenario A presented, here.

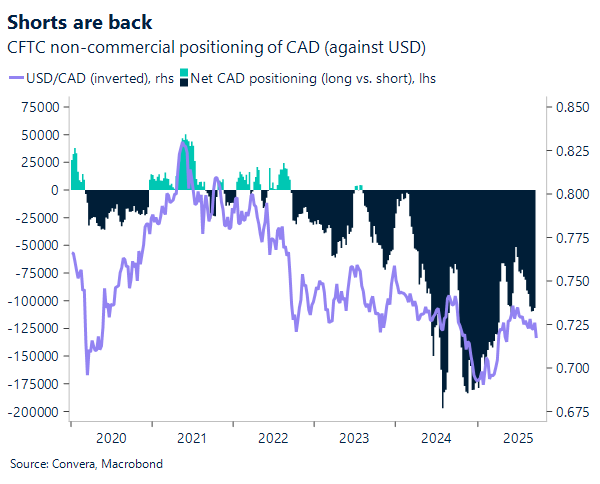

The USD/CAD is closing the month near its highest levels for both September and the third quarter. Last Friday’s GDP report for July came in slightly better than expected, easing pressure on the Loonie. However, net short positioning has re-emerged, and a widening U.S.-Canada yield differential has also helped pushed the USD/CAD closer to its 200-day simple moving average (SMA) at 1.40.

September has provided little support for the Canadian dollar. Recent data has reinforced expectations of a stagnant economy, aligning with the Bank of Canada’s (BoC) view that downside risks have increased. Last week’s dual policy announcements from the Fed and the BoC further exposed the Canadian dollar to U.S. dollar strength. The divergence in positioning and central bank tone, with a more dovish BoC and a more hawkish Fed, combined with hawkish ‘Fedspeak’ last week, helped drive USD/CAD to a high of 1.395.

Although the pair is technically overbought in the short term, and we could expect USD easing off the momentum ahead of this Friday’s payrolls data, only a significant downside surprise in macro data from the U.S. could prevent the USD/CAD from breaking back above 1.40. U.S. macro data has surprised to the upside lately, offering little relief for the Loonie.

While this week’s Canadian manufacturing PMI will be closely watched, the spotlight remains on Friday’s U.S. payrolls report, which could reinforce the dollar’s recent momentum, as we enter Q4 2025.

EUR: Euro’s edge wears thin

Antonio Ruggiero

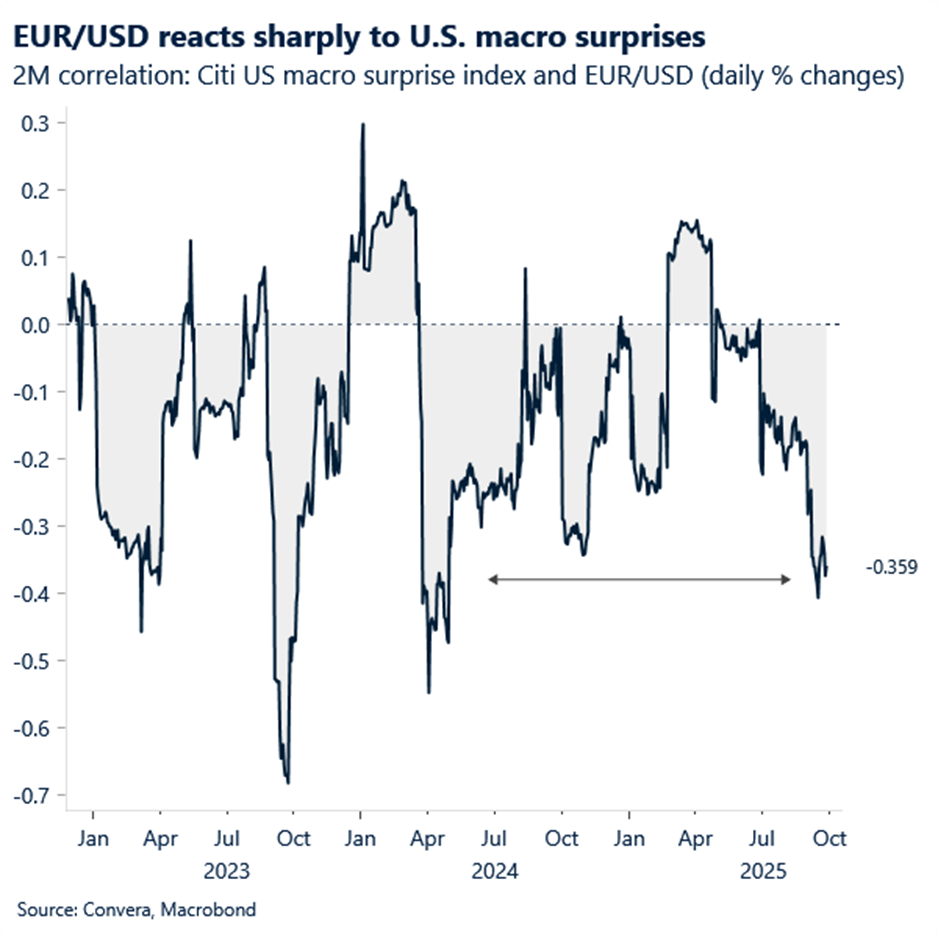

EUR/USD closed the week just above 1.17 at 1.1703, down 0.4%, as a string of upward revisions to U.S. macro data – most recently August’s stronger-than-expected personal spending – hint that the U.S. economy may be regaining momentum. The pair, however, began the week on a more positive note, buoyed by renewed concerns over a potential U.S. government shutdown due to the failure to agree on a short-term spending bill – potentially putting a hold on the one factor that could meaningfully drag EUR/USD lower today: US official economic releases.

The pair hasn’t reacted this sharply to U.S. data surprises in years. Assuming a resolution to the funding bill impasse, if the current trend persists – especially with this week’s labour market report in focus – the pair could break below $1.1650, then $1.16. Beyond that, technical support is sparse until $1.14, a level briefly tested in late July before rebounding.

Still, for this pullback to evolve into a broader correction, we’ll need more convincing evidence of a sustained U.S. rebound. The euro’s rally began with USD-negative tariff headlines, then shifted toward fundamentals, morphing into a “bad data validates tariff fears” narrative that justified dollar selling. But if this narrative culminates in an economy that’s not just stabilizing – but outperforming – then the euro’s fuel evaporates, setting the stage for a deeper decline. That said, given these dynamics, the decline can be as sharp as precarious, meaning that a constant streak of upside surprises are warranted to win untrustful investors back.

On the domestic front, EU confidence indicators are due today, alongside CPI releases from key eurozone members and the broader bloc later in the week. While inflation is worth watching – especially after last week’s ECB upward revisions to 1-year and 3-year inflation forecasts – these prints are not expected to have significant traction in FX markets.

DXY shows stronger upbeat momentum

Table: Currency trends, trading ranges and technical indicator

Key global risk events

Calendar: September 29 – October 3

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.