Powell peril sends USD lower

Markets experienced significant volatility overnight after various reports suggested Trump was close to firing Fed Chair Powell. Within the hour, Trump denied the reports, stating he was not firing Powell “unless there is fraud for renovation”.

While Powell’s future remains uncertain, Trump’s comments caused partial market reversal – USD remains weaker and the US treasury curve retains a slight bear steepening bias, though US equities recovered from lows. S&P500 and Nasdaq ended +0.3% and 0.25% gains respectively.

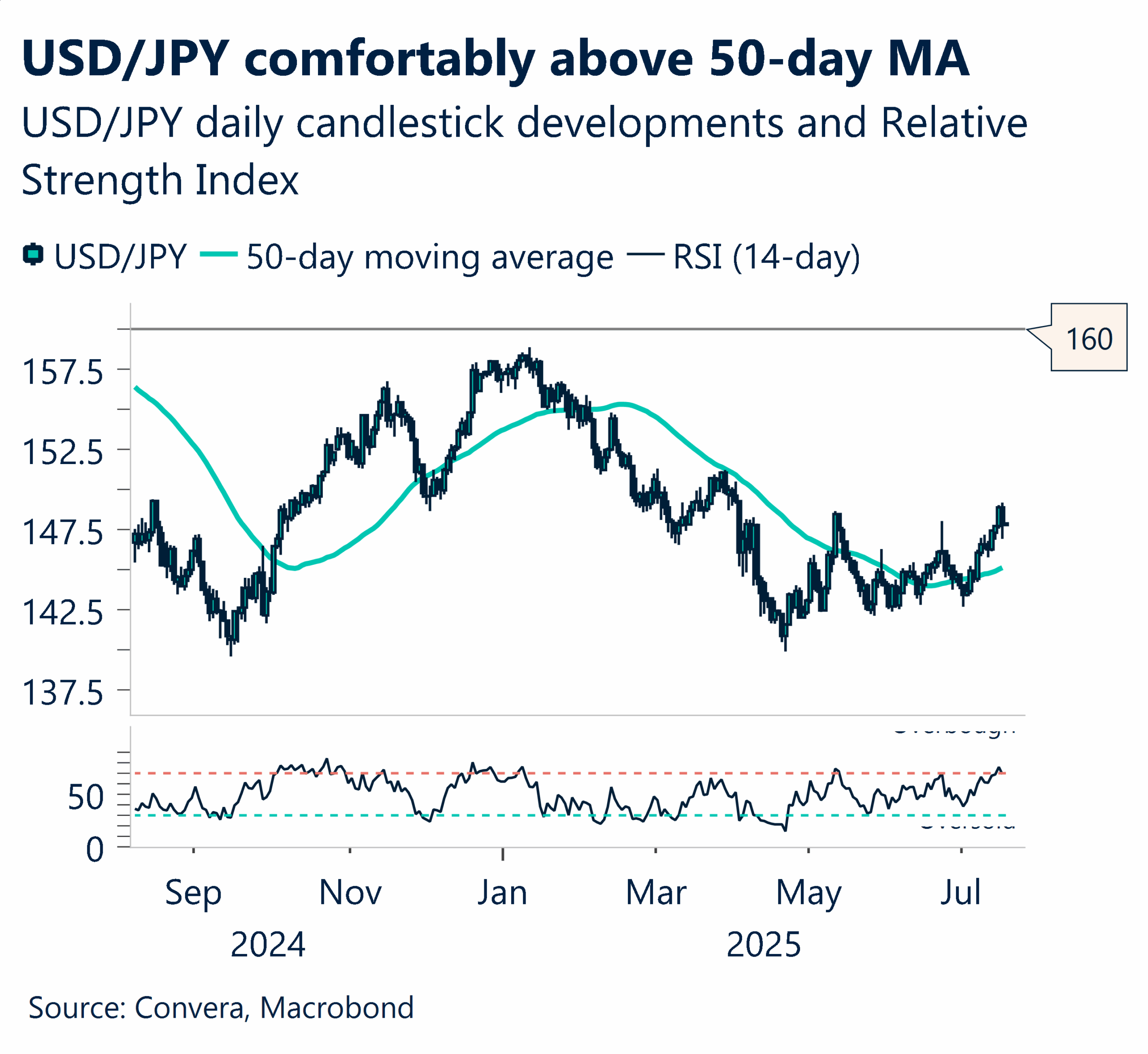

The JPY followed US rates moves, but with election risks potentially driving USD/JPY higher towards 150.

The IDR remains supported by the latest 19% US/ID tariff deal, viewed as net dovish with growth risks more visible than trade balance deterioration risks. Further rate cuts expected in September and November.

Dollar slips as Fed signals longer pause

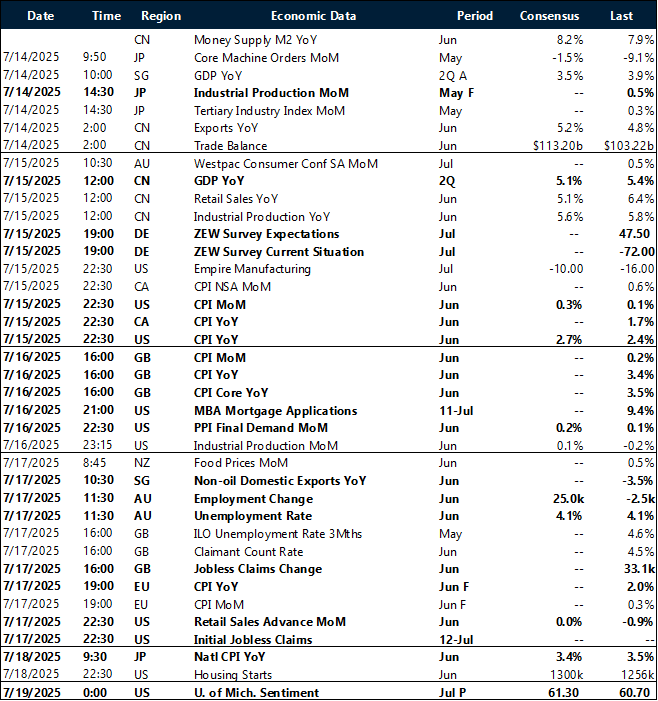

Dallas Fed President Lorie Logan says the central bank may need to hold interest rates steady a bit longer to fully tame inflation. She warns against relying too heavily on short-term improvements, even as inflation and job market data hint at progress. Based on the latest US CPI report, Logan expects the Fed’s preferred inflation gauge to rise in June.

USD/JPY slipped in response to shifting US rate expectations. The pair fell below the former 200-day moving average of 148.14, now acting as resistance. The next key support is seen near the 21-day moving average at 146.19, where dollar buyers may look to take advantage.

Kiwi drifts lower as markets digest flat US PPI

US producer prices in June came in flat, undershooting forecasts. According to the Bureau of Labor Statistics, both headline and core PPI showed no change from the previous month, missing expectations for a 0.2% rise. Annual inflation slowed to 2.3%, below the projected 2.5%.

Service prices dipped 0.1%, while goods rose 0.3%. Notably, traveler accommodation costs dropped 4.1%, making up more than half of the decline in final demand services.

In New Zealand, the central bank left its key rate at 3% last week and signaled a wait-and-see approach on inflation and other data before considering any cuts.

NZD/USD price action is negative, slipping below 21-day EMA of 0.6003 and 50-day EMA of 0.5983.

The next key support is near the 200-day moving average at 0.5908.

Antipodeans edged slightly higher

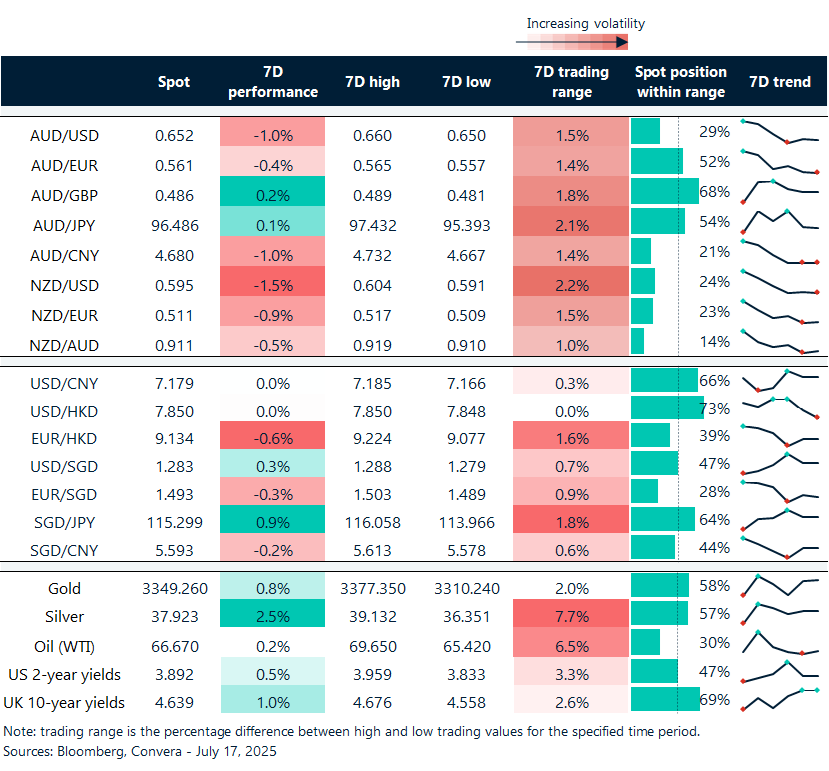

Table: seven-day rolling currency trends and trading ranges

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.