USD: Dollar cruises on tepid waters

The current resilience of the S&P 500 is undeniable. In just eight trading days this month, the index has notched four record-closing highs. This strong performance is fueled by a highly optimistic “soft landing” narrative and, of course, the continued strength of big tech. The markets are betting high that the economy can slow just enough to warrant Fed rate cuts without tipping into a recession, a perfect scenario that carries significant risk if underlying economic signals prove contradictory.

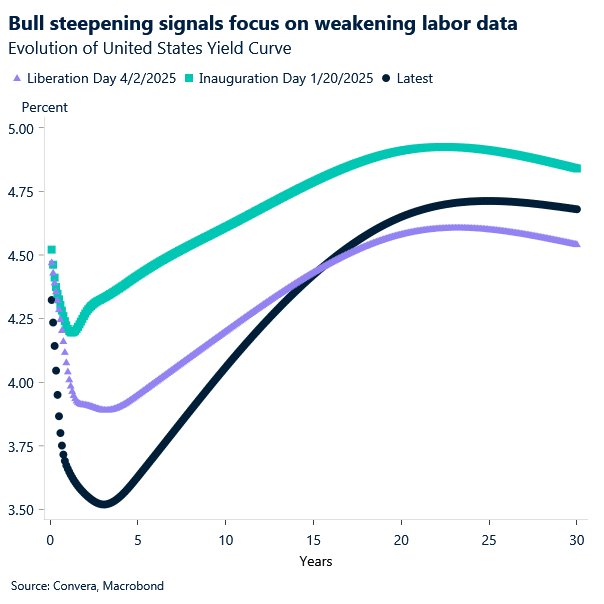

While stock investors are optimistic, the fixed-income market has been in a clear re-pricing mode. Since mid-July, we’ve seen a noticeable drop in 10-year and 30-year Treasury yields. This more dovish scenario, catalyzed by a weaker labor market, has the “bond vigilantes” repricing their expectations and pushing the 10-year yield closer to 4.0%. This downward pressure on long-term yields is a classic sign that bond investors are growing nervous about the economic slowdown. For example, the 30-10 Year Treasury Yield Spread is currently 0.64%, higher than its long-term average of 0.49%.

This week’s Fed meeting is key, with the market widely expecting a rate cut, a move largely priced in. This expectation is fueled by recent weak labor market data, which many believe will push the Fed to ease monetary policy at least three times this year. However, the market might be getting ahead of itself. A key risk remains sticky inflation, particularly as the full impact of tariffs becomes more evident in upcoming reports. While companies have initially absorbed these costs, the “pass-through” to consumers is slow and uncertain. If inflationary forces from not only tariffs but also services rebound, it could force the Fed to cut and then pause, a scenario that would undermine the foundation of the current stock market rally. Stagflation remains the major macro risk for markets, and while data isn’t pointing there yet, it’s a concern on the horizon.

The anticipation of rate cuts has weakened the US dollar, but we’ve recently seen a curious stability in the currency. Since August 1st, the dollar has retreated 2.7% and its movements have been contained between the 97 to 99 level. Since the market has largely factored in the Fed’s next steps, a lack of an economic surprise could prolong this period of tepid moves. On the other hand, this low volatility in the FX market could signal that only a significant “tail risk”, like a severe drop in hiring or a sudden inflationary spike, is needed to cause a major move. Although both scenarios are unlikely at the moment, and markets have noticed the cracks in the labor market, the US dollar could be primed for an upside move if the fragile equilibrium breaks and the soft-landing narrative collapses, assuming the flight-to-safety correlation holds.

The upcoming Fed meeting will be particularly interesting. With Miran stepping in and the unresolved situation surrounding Lisa Cook, the press conference will be more consequential. Questions for Chair Powell are likely to be wide-ranging, touching on his Jackson Hole speech, the board’s composition, inflation pass-through, the dual mandate, and labor weakness. This packed agenda should provide an informative session on the medium-term economic outlook. Meanwhile, markets might continue to ride their risk-on wave, focusing on the major theme of Fed easing to support the economy.

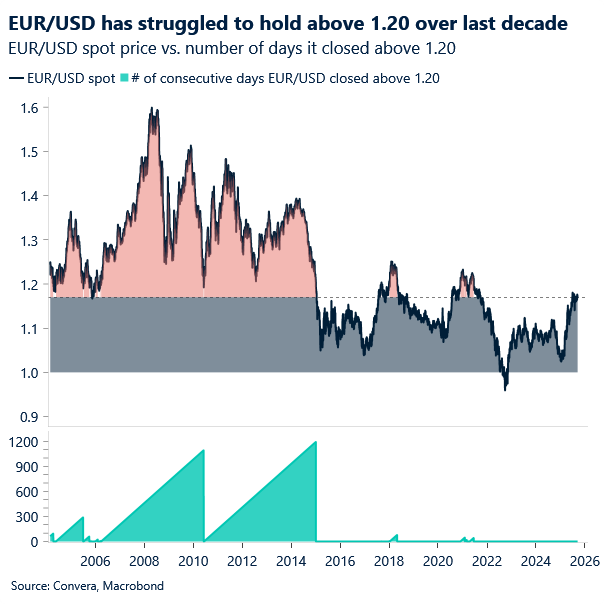

EUR: The path to $1.20

Will EUR/USD climb to $1.20, or are markets leaning too hard on the Fed narrative? Much of that upside hinges on a continued negative US narrative. With U.S. growth momentum fading and the Fed expected to ease, while the ECB appears near the end of its own cutting cycle, the bullish euro-dollar view remains in play – but it’s largely driven by U.S. dynamics and arguably already reflected in pricing. Euro strength could get a boost if fiscal stimulus starts showing through in the data, though trade tensions – particularly around tariffs – pose downside risks.

Since “liberation day,” the euro has served as the primary vehicle for expressing dollar pessimism, with the pair rising over 10%. Still, the eurozone isn’t without its own vulnerabilities. France’s political turbulence resurfaced last week, culminating in Fitch’s downgrade of its sovereign rating. However, following Bayrou’s failed confidence vote and Macron’s appointment of a centrist prime minister, markets received what was seen as the most constructive outcome. That’s helped contain any sustained widening in the French-German bond spread, supporting the euro. Meanwhile, the ECB held rates steady as expected last week, and President Lagarde reiterated that policy remains appropriately positioned, with little urgency for further cuts. This slightly hawkish tone helped re-anchor EUR/USD to relative rate differentials.

Looking ahead, although EUR/USD’s direction will largely be driven by US developments in our view, eurozone-specific risks may increasingly limit the euro’s upside potential as well. The region’s deteriorating terms of trade could become more problematic over time. Near-term focus will thus be on this week’s trade balance and industrial output data, as well as final inflation figures for August, and the ZEW sentiment surveys – key forward-looking indicators for both Germany and the broader euro area, and important signals for euro performance.

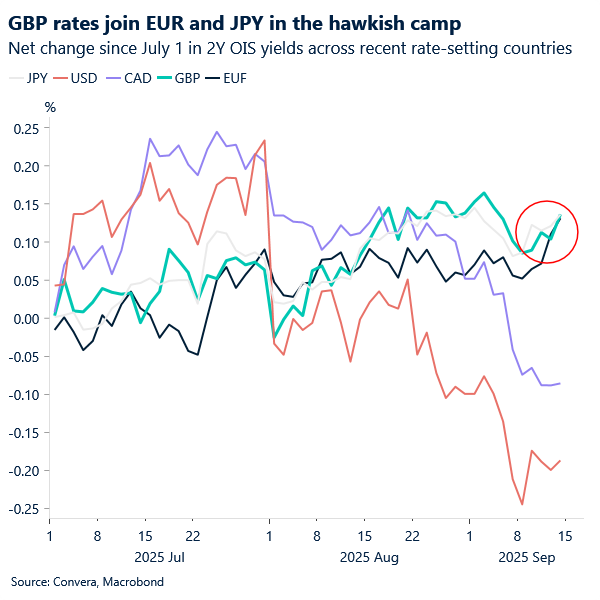

GBP: Hawkish hold, fragile ground

Sterling remains a currency propped up by one key pillar: the Bank of England’s hawkish stance. Recent macro data – including disappointing industrial production and sluggish GDP growth – have reinforced concerns about the UK’s underlying economic fragility. Fiscal risks are also mounting, with the autumn budget approaching and speculation building around potential tax hikes. Yet, in the short term, GBP/USD continues to find support, driven by the divergence in rate expectations between the Fed and the BoE. While the Fed is widely expected to cut rates this week, the BoE is seen holding steady, with sticky inflation still a central concern and its easing pace limited to one cut per quarter.

This week’s UK jobs report (Tuesday) and CPI release (Wednesday) are unlikely to move the needle for a cut this month, but will be instructive in shaping future policy direction, helping to solidify market expectations for a November cut – a timeline that aligns with the Bank’s current easing tempo.

Against the euro, sterling held up for most of last week, but momentum faded following softer UK data, with GBP/EUR closing just ~0.2% higher. Still, unless the BoE surprises with a dovish tone, elevated front-end UK rates continue to make the pound an expensive short versus the euro.

For now, sterling’s resilience is anchored to the BoE’s hawkish posture. But with structural headwinds intensifying – from weak growth to fiscal uncertainty and the higher likelihood of a Q4 rate cut – the balance of risks remains tilted to the downside.

CAD: Key week ahead for the Loonie

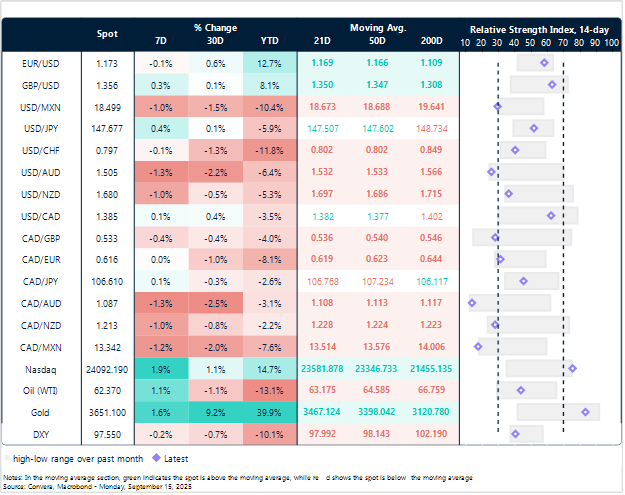

In FX, no signs of volatility, much less in the Canadian dollar. The Canadian dollar has shown little volatility, though it has remained vulnerable to U.S. dollar upticks ahead of yesterday’s inflation data. After falling as low as 1.378 last week, recent upward pressure has lifted it above 1.384, putting it back above its 20, 40, and 60-day moving averages. Since August, the CAD has underperformed all G10 currencies, which have benefited from renewed U.S. dollar weakness. The USD/CAD has traded within a range of 1.37 to 1.39 over the last two months, while its weakness is more pronounced against majors, particularly the Euro

The Loonie could be exposed this week, if the upcoming BoC decision and press conference are perceived as more dovish than the Federal Reserve’s decision. Before that, Canadian CPI inflation data will provide a clearer picture of how much flexibility BoC Governor Tiff Macklem has to set a monetary policy path that aligns with recent weak macro data

Mexican Peso hits a new 2025 high

Table: Currency trends, trading ranges and technical indicators

Key global risk events

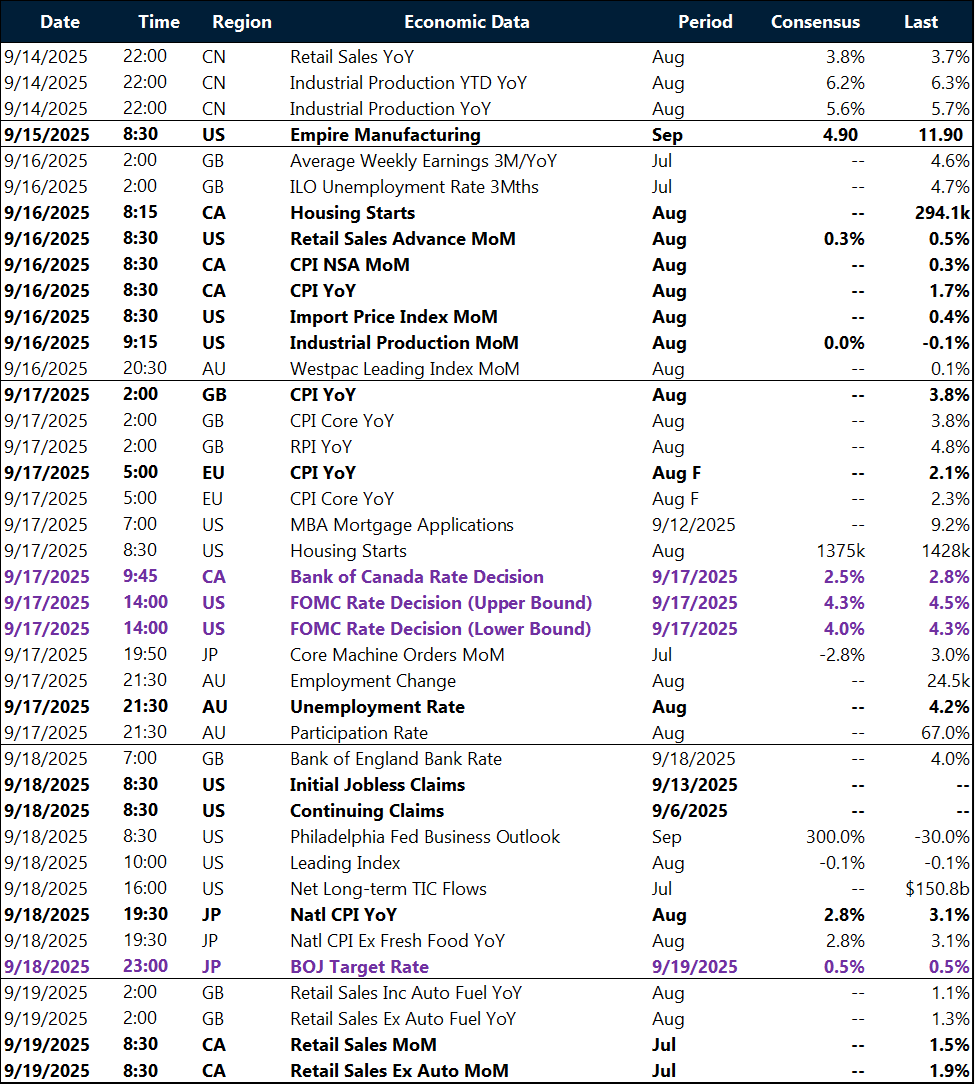

Calendar: September 15-19

All times are in EST.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.