US weekly jobless claims have surged to their highest level in almost four years, a clear sign of a cooling labor market. This shift away from tight employment is causing markets to focus on an economic slowdown rather than persistent inflation. As a result, traders have fully priced in three interest rate cuts by the end of the year, anticipating a less aggressive Federal Reserve as it responds to weakening economic conditions.

CAD: Government action against rising debt

While household net worth increased for the seventh consecutive quarter, rising to $17.9 trillion, the latest data from Statistics Canada also reveals a concerning trend in household debt. According to the release, the debt-to-income ratio climbed for the third straight quarter to 174.9%, meaning Canadians now hold approximately $1.75 in credit market debt for every dollar of disposable income. This upward movement, along with the first increase in the debt service ratio in over a year, suggests that while the overall economic picture may appear stable, individual households are facing increasing financial strain.

Prime Minister Mark Carney’s recent announcements are a direct response to this need for long-term economic stimulus and stability. To “turbocharge” the economy and counter a potential trade war with the United States, his government has unveiled the first wave of major national projects. These initiatives, which will be fast-tracked through the new Major Projects Office, include a liquefied natural gas (LNG) expansion in British Columbia, the construction of a small modular reactor at Ontario’s Darlington nuclear facility, a port expansion in Quebec, and the development of two critical mineral mines. By focusing on these nation-building projects, the government aims to add over C$60 billion to the economy and create thousands of jobs, aiming to strengthen the long-term foundations of the Canadian economy and helping to address the underlying issues of a weak economy, as evidenced by the household debt statistics.

Despite these worrying indicators and announcements from the government, the data has had no significant impact on the broader markets or the Canadian Dollar.

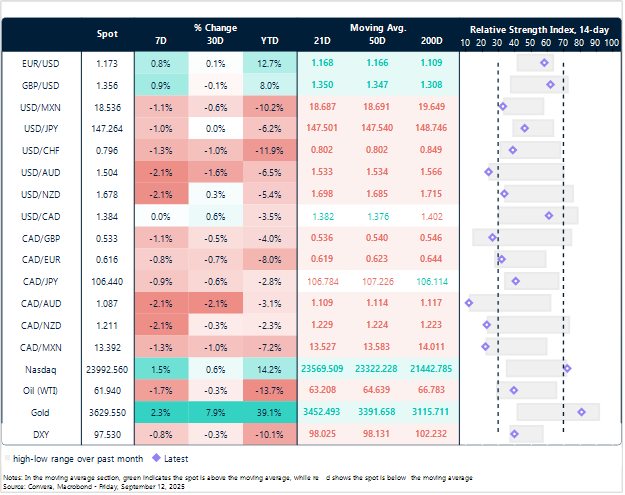

In FX, no signs of volatility, much less in the Canadian dollar. With few catalysts and a recent weak jobs report, the Canadian dollar has shown little volatility, though it has remained vulnerable to U.S. dollar upticks ahead of yesterday’s inflation data. After falling as low as 1.378 this week, recent upward pressure has lifted it above 1.384, putting it back above its 20, 40, and 60-day moving averages. Since August, the CAD has underperformed all G10 currencies, which have benefited from renewed U.S. dollar weakness. The USD/CAD has traded within a range of 1.37 to 1.39 over the last two months, while its weakness is more pronounced against majors, particularly the Euro.

EUR: ECB optimism lifts the euro

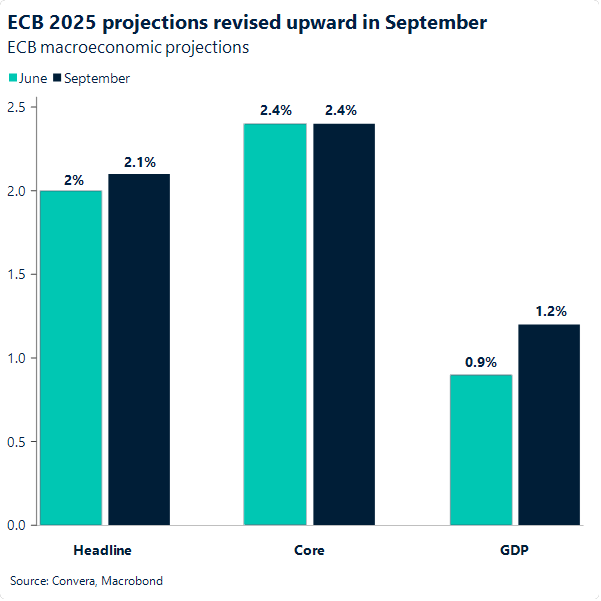

There was more optimism in Lagarde’s remarks at the ECB policy meeting press conference than many had expected. While holding rates steady came as no surprise, what stood out was her firm stance on reduced trade uncertainty, which she linked to a more balanced outlook for growth and inflation. Growth and inflation projections for 2025 were revised upward compared to the June forecast.

This clarity reinvigorated the hawkish tone: markets further priced out expectations of another rate cut this year, increasingly convinced that the easing cycle has ended. Adding to that conviction were remarks such as “the deflationary trend is over” and confirmation that the decision to hold rates was “unanimous.”

The euro saw a meaningful rebound, cementing itself more firmly in the 1.17 territory – a level the pair had struggled to hold throughout the week. This meeting solidifies the euro leg of the rate differential (vs. the U.S.), reducing the likelihood of further euro upside based solely on ECB policy (unless a hike unexpectedly comes into play, which seems unlikely for now). Instead, it’s the USD leg that still holds sway. Despite most dovish expectations already priced in, it retains the potential to drive EUR/USD higher.

For this week, given the lack of fresh catalysts, the pair is likely to end in the lower end of the 1.17–1.18 range – up a mere 0.1% against the dollar week-to-date.

GBP: UK economy flatlines in July

Sterling remains well-supported this week, underpinned by its high-yielding status thanks to hawkish tilt in Bank of England (BoE) expectations. Elevated front-end rates have helped the pound outperform major peers, particularly in a backdrop of resilient risk appetite. Gains have been most pronounced against safe-haven currencies like JPY, CHF, EUR, and USD.

However, as previously flagged, rising long-end gilt yields – driven by fiscal sustainability concerns and sticky inflation – pose a structural headwind, especially in risk-off conditions. The bullish technical setup had us eyeing a potential retest of the $1.36 August high, but conviction remains low in the absence of fresh catalysts.

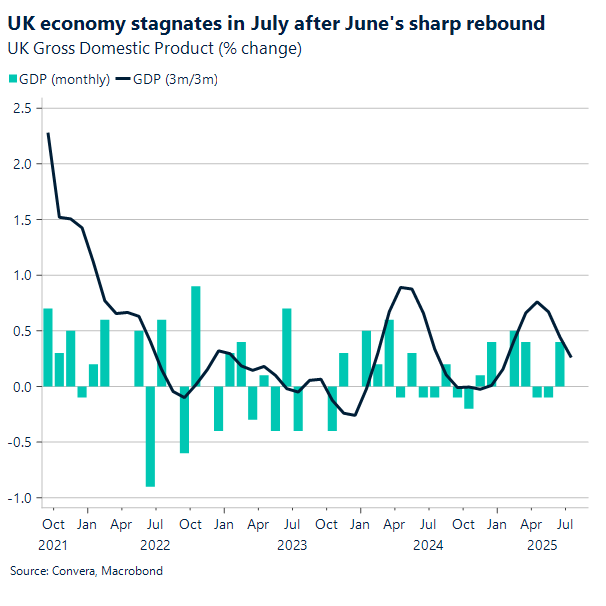

Fundamentally, the pound still faces challenges. UK growth is stalling, and inflation remains a drag. This morning’s data confirmed zero monthly GDP growth in July, matching expectations and following a 0.4% rebound in June. While H1 2025 saw relatively strong expansion – 0.7% in Q1 and 0.3% in Q2 – boosted by government spending and pre-tariff export flows, momentum is fading. The second half is likely to underwhelm as U.S. tariffs bite and labour market conditions soften.

Looking ahead, sterling faces key domestic tests. The BoE is expected to hold rates at 4.00% next Thursday, in line with consensus. But the labour market and inflation reports – both due ahead of the meeting – could heavily influence the tone of forward guidance. The vote split will also be closely watched, given its surprise impact last time.

The Mexican Peso hits a new 2025 high

Table: Currency trends, trading ranges and technical indicators

Key global risk events

Calendar: September 8-12

All times are in EST.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.