Soft jobs data fuels Fed cut bets

George Vessey

Signs of a weakening U.S. labour market have accelerated expectations for Fed easing, driving the dollar lower and pulling short-end yields down. August’s non-farm payrolls showed just 22,000 new jobs – well below forecasts – and revised June figures revealed net job losses for the first time since 2020. The market reaction was swift: traders are now pricing a small possibility of a 50bps rate cut at the September FOMC meeting.

The dollar’s vulnerability to labour market disappointments is playing out in full too. Friday’s data triggered a sharp dovish repricing, with 1y1y forward swap rates dropping to 2.81% – a clear signal that investors are recalibrating the Fed’s terminal rate outlook.

But the story doesn’t end there. This week brings U.S. PPI (Wednesday) and CPI (Thursday) – the final major data points before the Fed’s decision. If inflation prints come in soft, it could reinforce the case for aggressive easing and deepen dollar downside. On the other hand, any upside surprise, particularly in core CPI, might temper rate cut bets and offer the dollar a temporary reprieve.

Still, the broader market psychology has shifted. Following Fed Chair Powell’s pivot at Jackson Hole, the question is no longer if the Fed will ease, but how fast. That shift opens the door to renewed dollar weakness, especially as lower rates reduce hedging costs and potentially revive passive USD hedging flows – a theme that briefly dominated earlier this year.

Together, softer data, dovish repricing, and structural flow dynamics are laying the groundwork for the next leg lower in the dollar heading into year-end.

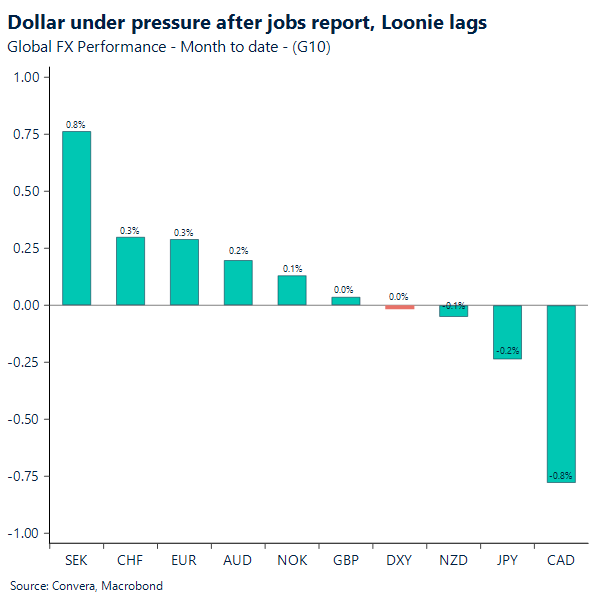

Tariff-sensitive sectors bleed jobs, CAD lags all G10

Kevin Ford

According to Statistics Canada, the nation’s job market is showing clear signs of significant weakness, having posted back-to-back monthly job losses. In August, employment fell by 65,500, with the majority of losses in part-time work, pushing the unemployment rate up to 7.1%, its highest level since May 2016, outside the pandemic. This downturn is widespread across provinces, with Ontario, British Columbia, and Alberta hit hardest. A notable and concerning trend is the particular vulnerability of tariff-sensitive sectors. Since February, industries such as manufacturing and transportation and warehousing have been the most susceptible to job loss, with manufacturing specifically seeing a decline of 19,000 jobs in August.

This employment data, coupled with a disappointing U.S. nonfarm payroll report that added only 22,000 jobs, has weighed heavily on the Canadian dollar. Following both reports that came in below market expectations, the Loonie has been lagging all G10 counterparts, losing 0.8% for the week. The increasing odds of a rate cut by the Bank of Canada, now at 73% for its next meeting, further pressures the currency. This divergence in FX performance, where the Canadian dollar is underperforming its peers, is a trend that may continue to characterize the market into 2026, as the economic headwinds facing Canada appear to be gaining momentum.

This week, Canada has no major macro releases, while markets remain focused on U.S. CPI and PPI data and their impact on the odds of a larger Fed rate cut next week.

EUR/USD above 1.17 – Will it hold up?

Antonio Ruggiero

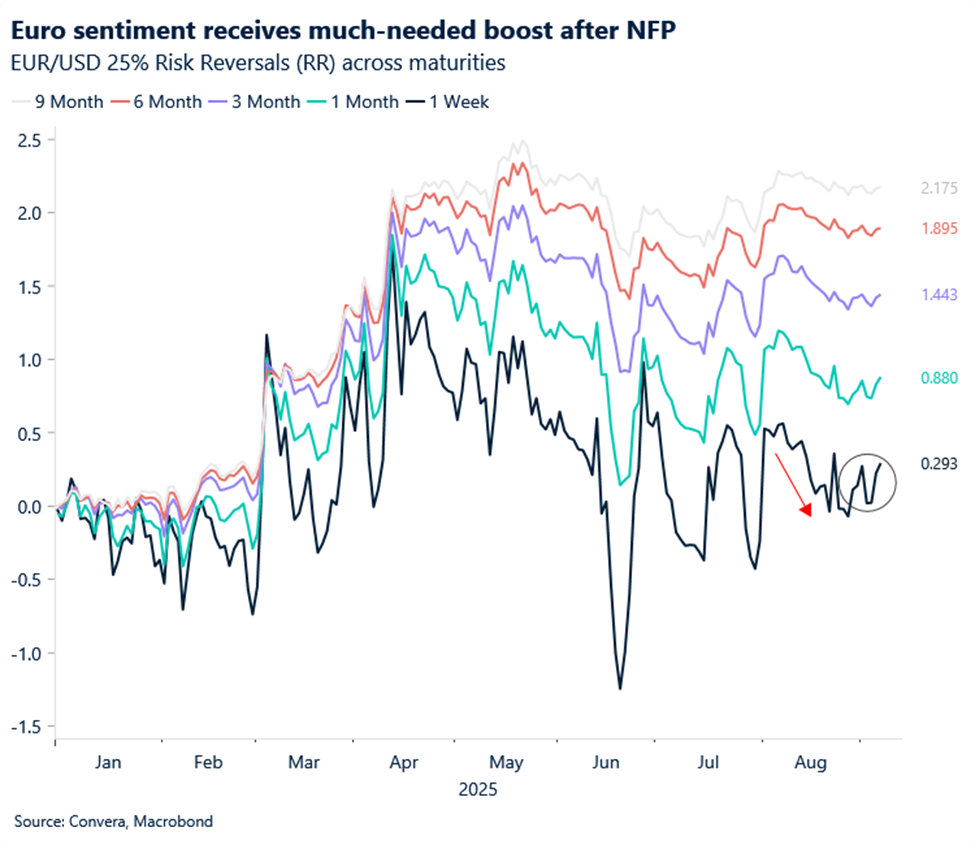

EUR/USD broke decisively above the 1.16–1.17 range following last week’s NFP release, closing higher and signaling potential consolidation above 1.17. With limited scope for dovish surprises from the ECB this week and a more dovish Fed, the setup resembles July’s rally toward the YTD high of 1.1829.

That said, a few cautionary notes are worth highlighting. First, EUR/USD risk reversals across maturities – measuring investors’ relative willingness to hedge against euro appreciation versus depreciation – indicate waning interest in protecting against euro upside over the summer. Political uncertainty in France and a poorly negotiated EU-US trade deal likely contributed to this sentiment. Post-NFP, we’ve seen a modest uptick, but further data is needed to gauge the strength of investor conviction in euro topside potential amid renewed dollar bearishness as we enter the fall.

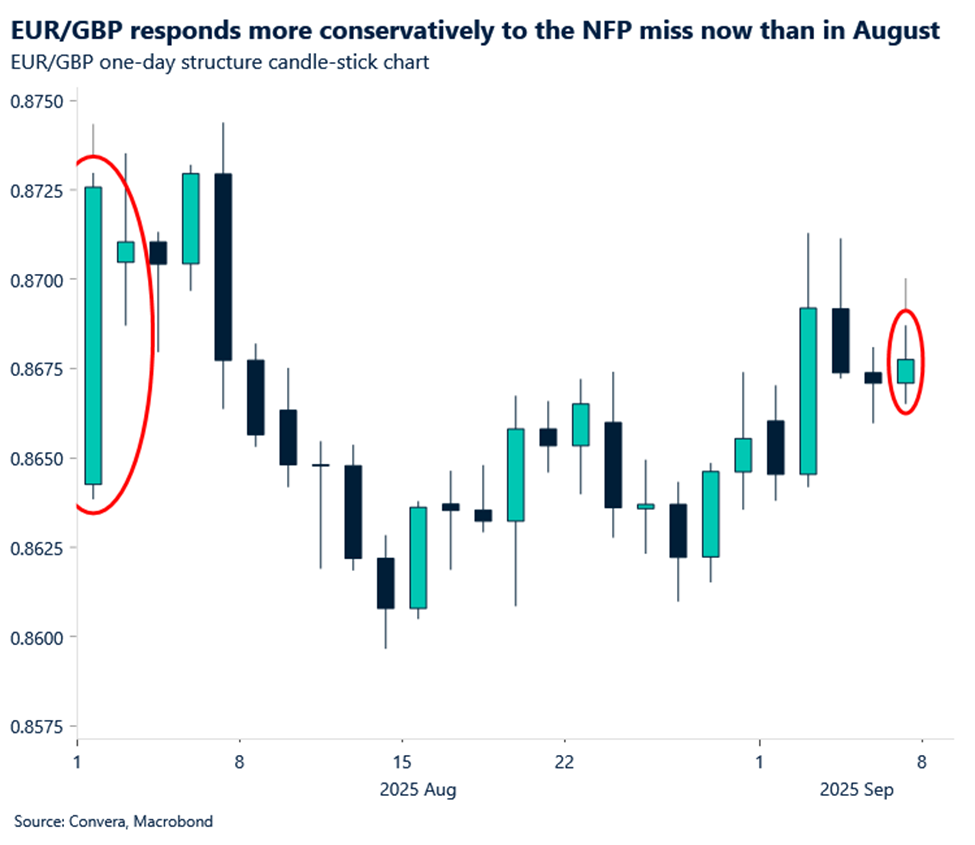

Second, looking at EUR/GBP, the pair surged nearly 1% after August’s weak NFP but remained flat last Friday, which may suggest waning euro enthusiasm as the go-to currency when it comes to running away from dollar exposure. Meanwhile, EUR/CHF fell 0.4%, pointing to relatively stronger Swiss franc demand. This may signal a gradual decoupling between dollar weakness and euro-as-safe-haven flows, as investors appear to be diversifying rather than concentrating demand solely on the euro.

Cable climbs, but caution lingers

George Vessey

As flagged last week, short-term implied volatility in GBP/USD spiked once it captured the U.S. jobs report window – and the downside surprise did the job, propelling the pair sharply to test $1.3550 resistance. While some of that move unwound into the Friday close at $1.35, it marked the biggest daily gain in two weeks and capped off a positive week overall, having traded as low as $1.3333 amid UK fiscal jitters.

The question now is whether there’s momentum for further upside. $1.36 – August’s high – remains a key resistance level. Technically, GBP/USD is back above its major daily and weekly moving averages, and momentum indicators like relative strength index are sitting in neutral territory across both timeframes, leaving room for directional extension.

Fundamentally, the UK backdrop remains fragile. Stagflation risks and fiscal uncertainty continue to weigh, but for now, this is a dollar-driven story. Even a hotter-than-expected U.S. inflation print this week may struggle to shift Fed rate expectations meaningfully – keeping the focus on broader risk sentiment and positioning.

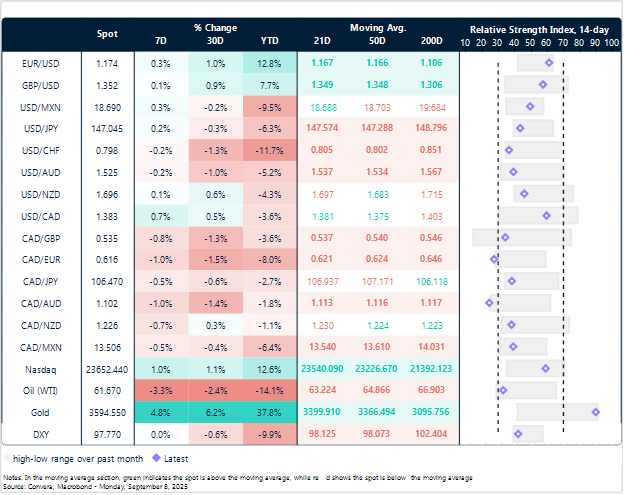

Euro breaks above 1.17, Pound above 1.35

Table: Currency trends, trading ranges and technical indicators

Key global risk events

Calendar: September 8-12

All times are in EST.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.