GBP: Balancing fiscal strains and data signals

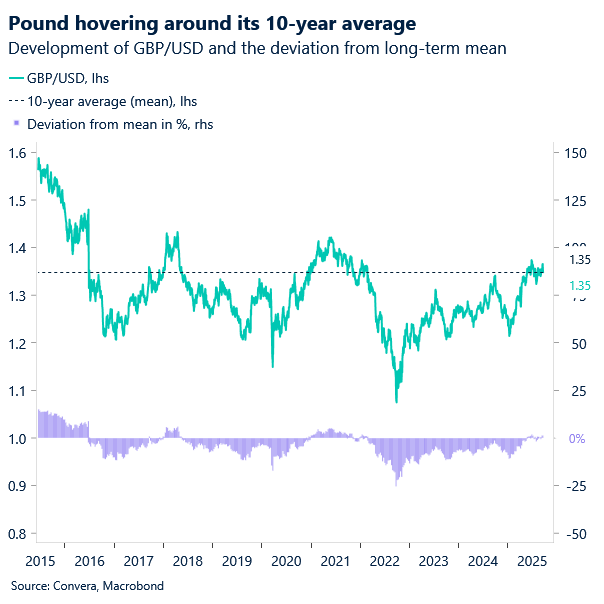

The pound continues to hover around $1.35 against the US dollar- close to its 10‑year average – while slipping toward an eight‑week low near €1.14 versus the euro. Traders are focused on today’s flash PMI releases, which provide one of the earliest snapshots of business activity and are critical for gauging growth momentum.

Given the UK’s services‑heavy economy, even modest shifts in the services PMI can influence inflation expectations and the Bank of England’s (BoE) policy stance. A weaker‑than‑expected print would reinforce stagflation concerns and weigh further on sterling, while stronger data could deliver a short‑term lift in the absence of other domestic catalysts before November’s Autumn Budget.

Sterling has already been pressured by disappointing borrowing figures and mounting fiscal concerns of late. The gilt market has become the latest focal point of bearish sentiment, with volatility most acute at the long end of the curve. Yields on 30‑year gilts climbed to their highest levels since the late 1990s earlier this month, reflecting investor unease over the government’s ability to rein in debt and a decline in demand from traditional buyers such as pension funds. In response, the BoE last week slowed the pace of quantitative tightening, cutting its annual target from £100bn to £70bn and skewing sales toward shorter maturities. The government has also reduced issuance of long‑dated bonds, acknowledging the vulnerability of that segment.

Despite these headwinds, there are reasons for cautious optimism. Recent UK data have shown signs of stabilization, underlying fundamentals appear firmer than market sentiment suggests, and speculative positioning remains heavily skewed against sterling. This means the threshold for a sterling‑positive outcome from the Autumn Budget is not especially high – provided the government delivers a credible fiscal plan. However, with the Budget delayed until 26 November, uncertainty will linger, leaving the pound exposed to bouts of volatility in the weeks ahead.

USD: Unconventional views

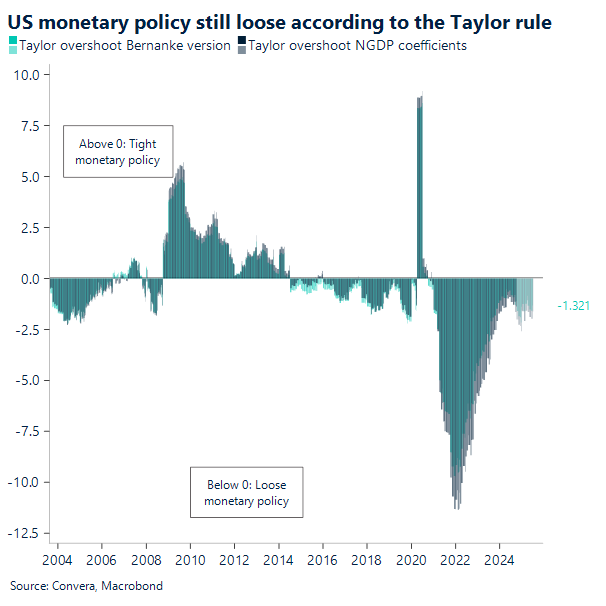

Stephen Miran’s recent dissent from the Federal Reserve’s (Fed) rate decision has cast a spotlight on his economic philosophy and has stirred more than internal debate. He’s making a case that the Fed’s current stance is too tight, and he’s not shy about the scale of adjustment he thinks is needed: a full two percentage point cut in the federal funds rate. His argument leans on a reworked version of the Taylor rule, but the real distinction lies in what he’s choosing to emphasize. Miran sees immigration, trade shifts, and fiscal expansion as structural forces that have quietly lowered the neutral rate of interest, factors he believes the Fed is underestimating.

That view puts him at odds with most of his colleagues. St. Louis Fed President Alberto Musalem supported the recent rate cut as a precaution against labor market softening, but he’s already signaling reluctance to go further. Atlanta Fed President Raphael Bostic is even more reserved, penciling in just one cut for all of 2025. With only two meetings left this year, that suggests he sees little urgency to move again.

Overall, Miran’s analysis critics argue that he may be overestimating or oversimplifying the complexities of monetary policy. His claims that recent policies have had specific, large numerical impacts, such as a sharp decline in the neutral rate due to immigration, might be seen by some as speculative and lacking broad empirical support. Furthermore, his assertion that tariffs do not cause inflation but instead boost national saving runs counter to the views of mainstream economists. This oversimplification risks leading to a flawed conclusion about the ideal policy stance and could potentially underestimate the risk of renewed inflation.

We know Miran is the architect of the so-called Mar-a-Lago Accord, a framework that calls for lower yields and a weaker dollar to help rebalance global trade through higher protectionism. An unconventional idea, that after 8 months of the new U.S. administration’s economic agenda (a.k.a Trumponomics) look less theoretical. The dollar’s poor performance, coupled with an increase in the global effective tariff rate, along with a drop in yields, has unfolded with timing that makes parallels to the Plaza Accord of 1985 hard to ignore. As this week marks the 40th anniversary of the agreement that reshaped global currency markets, a de facto Mar-a-Lago Accord seems to have taken shape in 2025. With rates drifting lower and the dollar having lost ground against major currencies, the engineered competitiveness is evident. However, whether this will ultimately translate into a narrower trade deficit with little impact on inflation remains an open question.

His speech at the Economic Club of New York felt like positioning, where he reiterated his unconventional economic views. With the Fed Chair in play next year, Miran’s public profile is rising fast, and whether his ideas gain traction inside the Fed remains to be seen. But he’s clearly not content to remain a footnote in the minutes.

EUR: Euro anchored by diverging central bank tones

EUR/USD edged higher yesterday by approximately 0.5%, continuing to consolidate, with buying interest building around 1.0730. The bias remains bullish, though a cautious Federal Reserve is unlikely to fuel significant upside. This week, both the euro and the dollar remain highly sensitive to commentary from central bank officials. Although the two institutions have embarked on clearly divergent policy paths, the recent nature of this shift has made investors more attentive to any change in tone or signs of consolidation, as they seek greater clarity on the emerging consensus.

The overall message from the Fed has been one of caution and restraint, with a clear emphasis on avoiding premature or excessive rate cuts. However, the remarks were not unanimous. Dove-leaning officials – such as Governor Stephen I. Miran – commented on the restrictive nature of current Fed policy, warning that it may threaten the employment mandate. The takeaway was, once again, a cautiously dovish Fed.

Meanwhile, from the ECB, Governing Council member Joachim Nagel played down concerns that euro appreciation could damage export competitiveness, which offered support for the currency.

On the data front, eurozone consumer sentiment improved in September, rising to -14.9 and beating expectations of -15.3. Keep an eye on PMI releases later today, though we don’t expect them to move the euro significantly, as the currency continues to respond more to developments in the US narrative. On that note, both Powell and Bowman are scheduled to deliver speeches today.

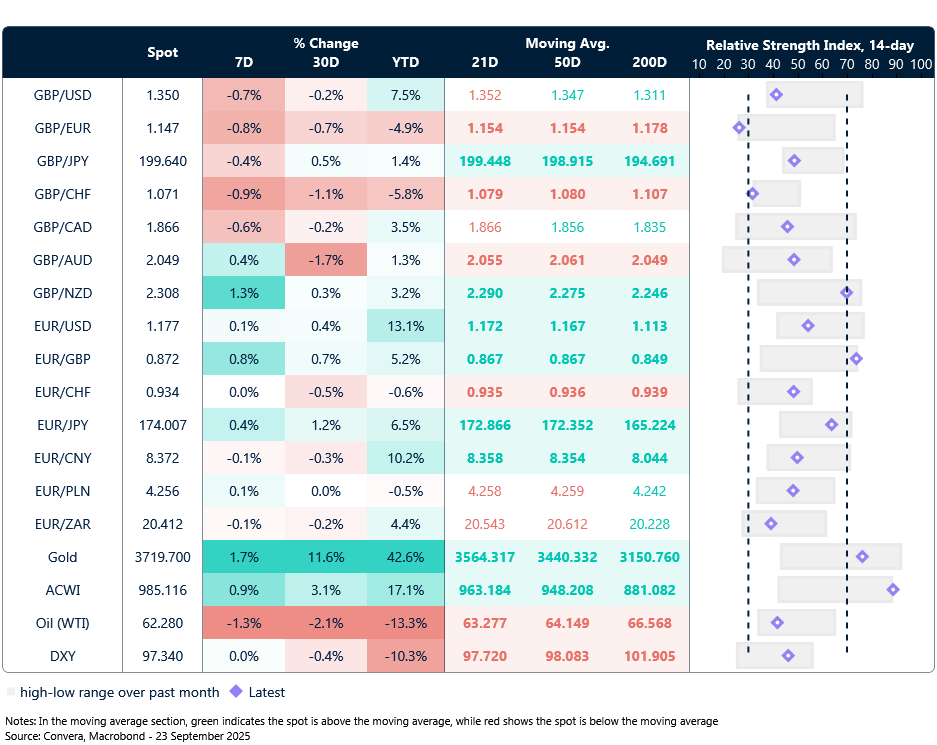

Sterling looking oversold versus euro

Table: Currency trends, trading ranges and technical indicators

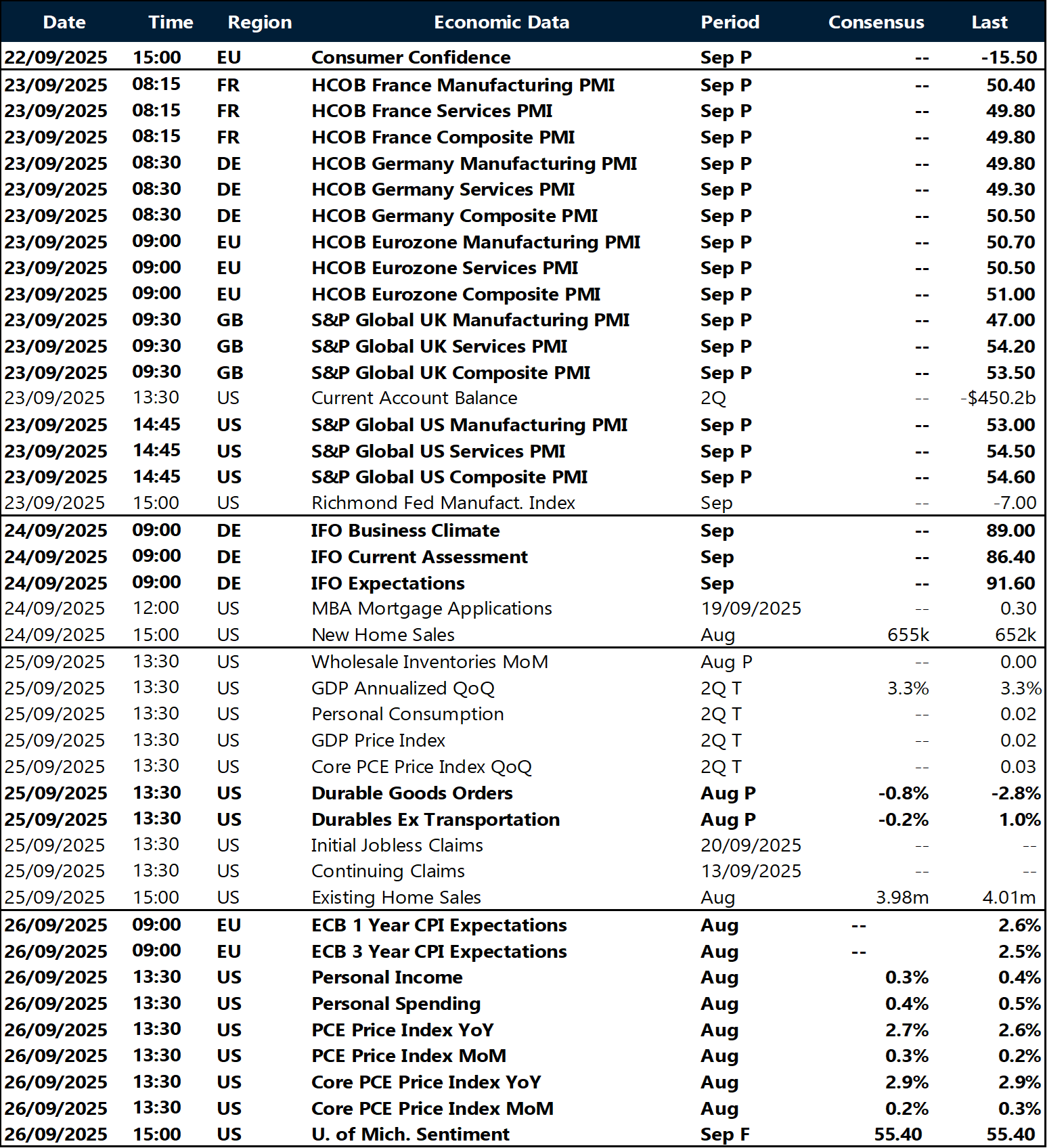

Key global risk events

Calendar: September 22-26

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.