La seule chose qui est certaine sur les marchés des changes est l’incertitude. Les tensions géopolitiques, les conditions économiques et les événements imprévus tels que le climat ou les catastrophes de santé publique constituent un état constant de mouvement. Et cela signifie la volatilité des marchés financiers.

Lorsque le risque de change est élevé, les entreprises doivent être conscientes de leur exposition et élaborer, mettre en œuvre et gérer un plan clair et approfondi pour traverser cette période difficile. Les programmes de couverture efficaces ne devraient plus être un luxe; ils sont une nécessité dans un contexte d’incertitude accrue.

Pourquoi avez-vous besoin d’un programme de couverture?

Les devises mondiales fluctuent constamment, et toute organisation qui effectue des transactions transfrontalières, accepte des paiements en devises ou détient des actifs financiers à l’étranger devrait envisager de mettre en œuvre une stratégie de couverture des changes.

Des changements défavorables dans les conditions mondiales peuvent entraîner des pertes soudaines qui pourraient nuire aux objectifs de croissance d’une organisation et mettre des années à s’en remettre. Un bon programme de couverture peut protéger une organisation contre ces changements en réduisant les risques liés aux fluctuations des marchés et des devises à l’aide de divers instruments financiers, mais il doit être bien fait, car il y a aussi des risques liés à la négociation d’instruments financiers.

Trois composantes d’une bonne stratégie de couverture

Bien que les programmes de couverture de change soient essentiels en période de forte volatilité, ils ne sont pas une solution simple. La couverture de change exige une solide compréhension des concepts financiers complexes et comporte des inconvénients potentiels, lorsqu’elle n’est pas réfléchie.

Mis à part les produits financiers, un bon programme de couverture comprendra trois éléments clés.

1. Des objectifs solides et un plan d’action clair

Les organisations doivent s’assurer d’avoir défini clairement leurs objectifs et de suivre un plan discipliné qui tient compte à la fois de leurs besoins futurs et de leurs objectifs immédiats. Voici quelques questions à garder à l’esprit:

- Qu’espérez-vous obtenir grâce à votre programme de couverture ?

- Quels sont les besoins de votre entreprise?

- Quelles sont vos expositions sous-jacentes au FX ?

- Avez-vous une solide compréhension de la santé financière de votre entreprise? A quoi ressemblent les flux de trésorerie ?

Quels que soient vos objectifs, un plan clair à long terme basé sur des données vous aidera à garder le cap.

« Avant tout, élaborez un plan », explique David Renta, responsable mondial de la couverture chez Convera. « Trop souvent dans le passé, j’ai vu des entreprises qui ont eu du mal à obtenir des données sur leurs expositions sous-jacentes, et quand elles élaborent un plan, elles ne peuvent pas s’y tenir. »

Pour éviter cela, Renta conseille de s’associer à des experts, qui peuvent aider à comprendre ces expositions et développer un programme de couverture, ensemble. « Ensuite, une fois que vous […] aurez établi cela, assurez-vous de vous donner suffisamment de flexibilité pour ne pas rater d’occasions, mais aussi de respecter le plan. »

2. Une bonne compréhension du risque

La couverture est conçue pour protéger une organisation contre les risques financiers, mais aucune stratégie n’est infaillible.

Certains programmes de couverture peuvent entraîner des coûts administratifs et d’automatisation élevés. Certaines stratégies, en particulier celles qui dépendent fortement de la spéculation, exposeront intrinsèquement une organisation à plus de risques, y compris le risque d’un événement indésirable.

Une solide stratégie de gestion des risques peut aider à compenser les pertes potentielles. En s’appuyant sur leurs propres ressources et sur des partenaires compétents, les dirigeants d’entreprise devraient examiner leur tolérance au risque et aller de l’avant en étant conscients de ce qu’ils assument.

« Quand une entreprise prévoit essentiellement des transactions avec lesquelles elle a des expositions sous-jacentes et que quelque chose change fondamentalement par rapport à ces hypothèses sous-jacentes », explique Renta, « cela signifie qu’une entreprise doit trouver un partenaire financier capable à la fois de comprendre les facteurs sous-jacents expliquant pourquoi ces changements ont lieu et d’utiliser des stratégies qui […] se marient en fait avec ce à quoi ressemblent leurs expositions sous-jacentes, après la perturbation. »

3. Examen régulier

La couverture est conçue pour aider les organisations à mieux faire face aux fluctuations des taux de change. À mesure que la conjoncture mondiale évolue, les stratégies de couverture devraient être revues et adaptées pour garantir l’adhésion aux objectifs à long et à court terme et l’évolution des besoins opérationnels.

« Ce qu’il faut retenir, c’est que lorsque vous travaillez à l’international, vous devez vous associer à quelqu’un qui comprend la dynamique du marché et qui peut vous offrir la flexibilité nécessaire pour vous assurer que vos couvertures et vos expositions sous-jacentes sont mesurées », explique Renta.

Comment développer et gérer une stratégie de couverture

Lors de l’élaboration, de la mise en œuvre et de la gestion d’une stratégie de couverture, les organisations devraient tenir compte de leurs objectifs à court terme parallèlement à leurs besoins opérationnels à long terme.

Les stratégies de couverture impliquent généralement quelques pièces mobiles clés.

Tenir compte du cycle de vie de couverture

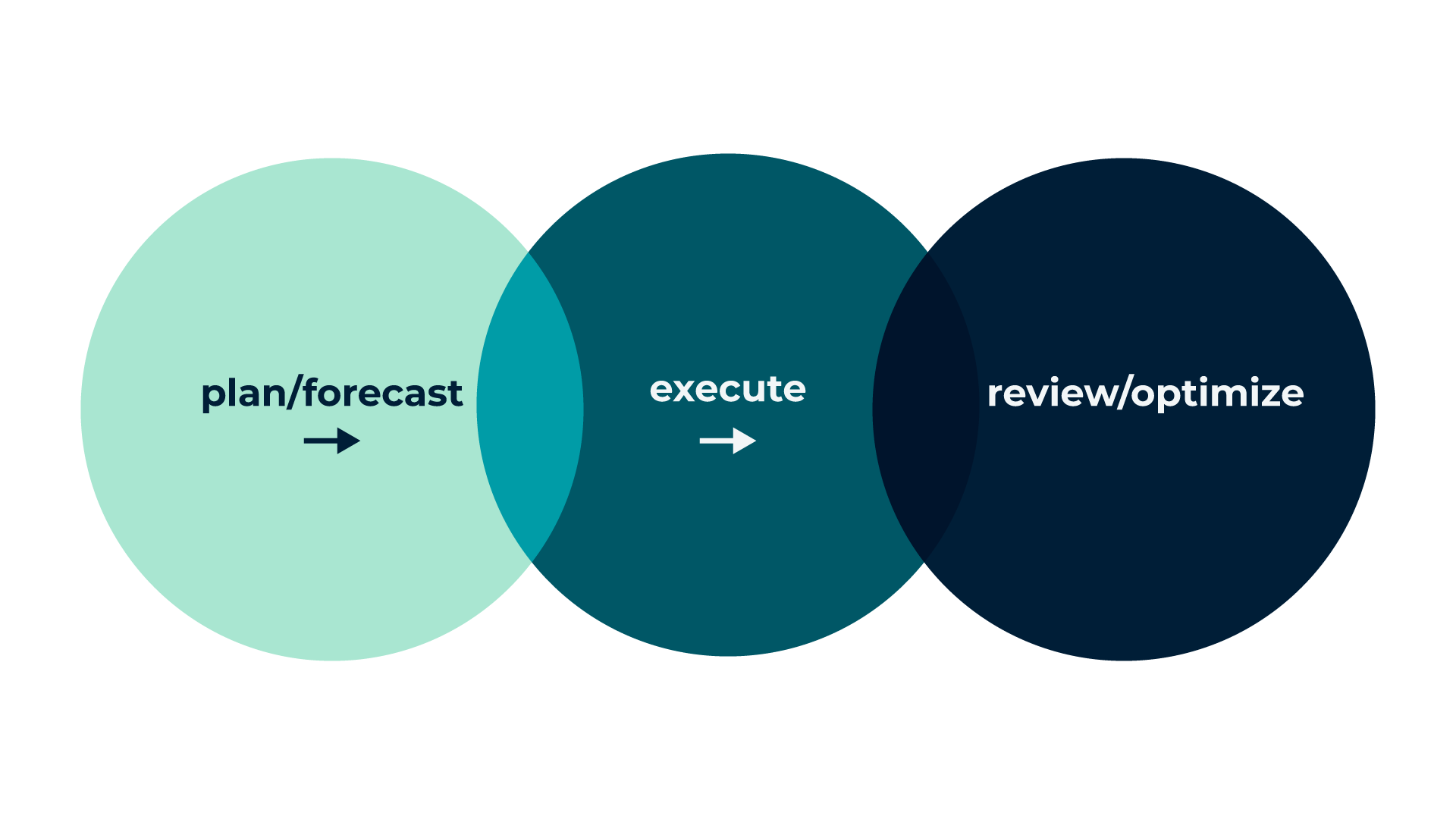

Le cycle de vie de la couverture FX comporte différentes étapes, de la planification à l’exécution en passant par l’examen.

Traditionnellement, une stratégie de couverture FX commence par une phase de planification. C’est le moment de calculer une valeur de risque et de savoir si cette valeur peut changer en fonction des conditions extérieures (comme un bouleversement politique ou économique).

Une fois que tout est planifié et que les risques sont gérés, il est temps de passer à l’étape suivante. Avec une stratégie bien pensée et des objectifs clairs, l’exécution des métiers est censée être l’étape la plus facile.

Examiner ce qui a bien fonctionné et optimiser pour les ratés potentiels est la phase finale, avant que le cycle de vie de couverture FX se répète.

Identifier les vulnérabilités spécifiques

Il peut s’agir d’expositions transactionnelles (flux de trésorerie), d’expositions à la conversion par l’intermédiaire d’éléments du bilan comme le solde de trésorerie étranger, les stocks, les prêts à taux fixe ou les obligations, les capitaux propres nets dans des filiales étrangères, les engagements fermes et l’exposition nette à vos investissements, qui sont tous liés à un actif sous-jacent.

En fonction de l’équilibre des avoirs commerciaux et des investissements particuliers, les organisations devraient être en mesure d’identifier leurs vulnérabilités d’ensemble ainsi que les points de contact individuels qui nécessitent de l’attention.

Ensuite, la complexité de la réglementation et le manque de cohérence entre les différents marchés posent des défis importants, une tâche encore plus difficile sans un partenaire compétent.

« Il s’agit d’une [entreprise] complexe qui nécessite un examen d’horizon et une véritable armée de personnes pour s’assurer que vous avez une expertise appropriée en la matière afin de vous assurer que vous faites ce que vous êtes censé faire en ce qui concerne chacun des régimes réglementaires où vous exercez vos activités », explique Renta.

Tenir compte des principaux intervenants et des besoins de communication

Les programmes de couverture peuvent avoir une incidence sur divers intervenants d’une organisation, y compris les services comptables, les équipes juridiques, le personnel technique, les équipes de planification financière et plus encore.

Il est essentiel de s’assurer que toutes les parties prenantes comprennent les objectifs et les attentes du programme de couverture des changes et reçoivent une communication cohérente et claire au fur et à mesure de son évolution pour assurer le succès d’un programme de couverture, en particulier lorsqu’elles utilisent des outils financiers complexes comme les options et les contrats à terme.

Peser les coûts

La couverture peut entraîner des coûts importants, allant de frais administratifs supplémentaires à une croissance du portefeuille plus faible que prévu à long terme.

Une organisation devrait tenir compte des coûts et des risques parallèlement aux avantages potentiels d’un programme de couverture.

La clé intemporelle d’une stratégie de couverture FX réussie

Comme toute décision financière importante, le fait qu’une organisation décide ou non de mettre en œuvre une stratégie de couverture pour se protéger contre le risque de change et la façon de mettre en œuvre ce programme se résumeront à un ensemble complexe de considérations fondées sur ses objectifs, ses besoins et sa tolérance au risque.

Une solide conscience du risque, des objectifs clairement définis et un plan bien pensé sont les premières étapes pour bâtir un programme de couverture qui peut maintenir la santé financière d’une organisation en période d’incertitude et offrir une protection essentielle du portefeuille.

Les partenaires, comme Convera, peuvent aider à développer, mettre en œuvre et gérer un programme de couverture efficace. En commençant par une évaluation de la pertinence, les experts en couverture de Convera tiennent compte des connaissances et de l’expérience financières, des conditions financières, de la tolérance au risque et des buts et objectifs de chaque client. Convera vous aide ensuite à adapter un portefeuille de couverture en fonction de ce que vous cherchez à réaliser et de ce qui vous convient vraiment en fonction de votre expérience des marchés financiers et de l’endroit où vous espérez vous rendre.

Vous voulez plus d’informations sur les sujets qui façonnent l’avenir des paiements transfrontaliers? Suivez Converge, avec de nouveaux épisodes tous les mercredis.

De plus, inscrivez-vous au Daily Market Update pour recevoir les dernières nouvelles sur les devises et les analyses FX de nos experts directement dans votre boîte de réception.