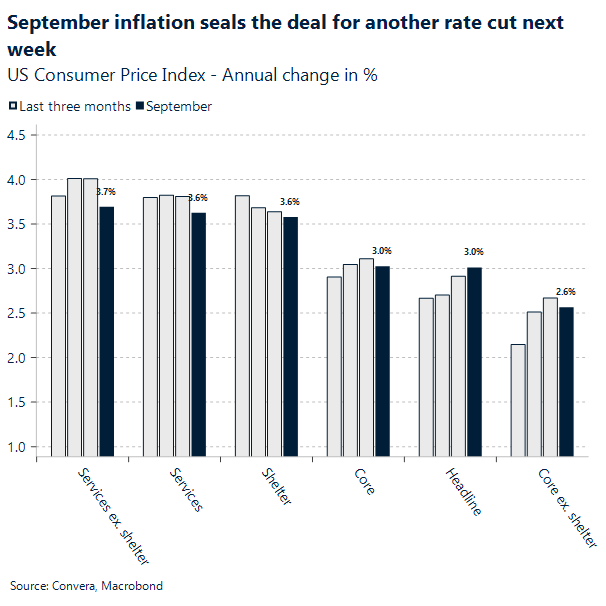

US: CPI came in slightly lower than expected

The market is clearly taking note of this latest inflation data, which almost certainly points to another rate cut from the Fed next week. Both the headline and core 12-month CPI changes came in slightly below forecasts at 3.0%, a reading only seven out of 76 economists in the Bloomberg survey had predicted for the core number. While the 4.1% rise in the gasoline index in September was a significant driver of the monthly increase, the softer overall readings have led to a predictable market reaction: the Dollar Spot has slightly dropped, Treasuries are rallying, and both the S&P 500 and Nasdaq 100 futures are jumping. This data also gives the Trump administration a boost, supporting their argument that inflation is under control and that tariffs aren’t causing a surge in the cost of living. In the foreign exchange market, the reaction was notably subdued, failing to deliver the volatile move many had anticipated, a pattern consistent with the overall low volatility that has characterized the market this week.

The Consumer Price Index (CPI) rose 0.3 percent in September, a decrease from the 0.4 percent rise in August, bringing the unadjusted 12-month increase to 3.0 percent. This monthly rise was mainly fueled by a 1.5 percent increase in the energy index, which saw gasoline jump 4.1 percent, although electricity and natural gas declined. The core CPI (all items less food and energy) slowed its pace, rising 0.2 percent after two months of 0.3 percent growth; while shelter, airline fares, and apparel increased, motor vehicle insurance and used cars and trucks decreased. Over the past year, both the All Items CPI and the Core CPI rose 3.0 percent, with food inflation at 3.1 percent and energy inflation at 2.8 percent, which was heavily influenced by a sharp 11.7 percent rise in natural gas prices, despite a slight decline in gasoline.

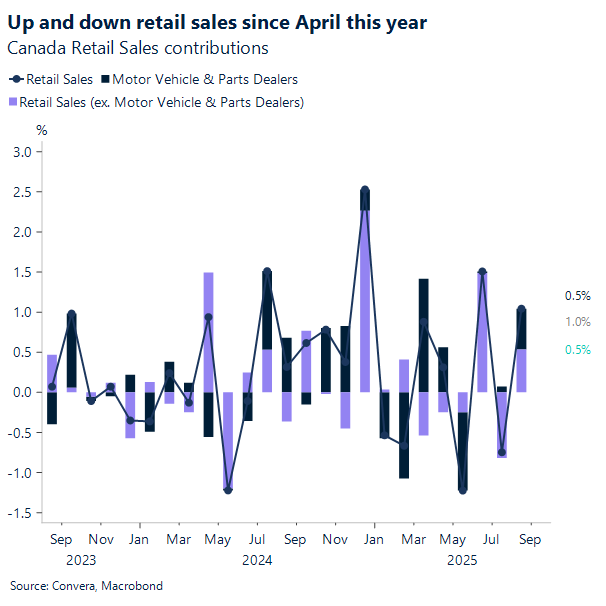

CAD: Up and down

The Canadian Dollar’s recovery below the significant 1.40 level proved fleeting. However, a slightly softer-than-expected US CPI release offered a brief reprieve, nudging the USD/CAD pair back to 1.401. The pair is now poised to continue challenging the 1.40s range in anticipation of next week’s crucial Bank of Canada meeting.

In the macro front, according to Statistics Canada, the latest retail trade data for August 2025 showed a strong rebound, with overall retail sales increasing by 1.0% to reach $70.4 billion. Notably, since April, the monthly retail sales figures have been choppy, with alternating increases and decreases, making it difficult to establish a clear trend. The upcoming reading for September is poised to continue this uneven pattern, as the advance estimate suggests a subsequent decrease of -0.7%. This August growth was broad-based, with sales up in six of nine subsectors, and was primarily driven by a significant +1.8% rise at motor vehicle and parts dealers, the largest increase recorded. Additionally, core retail sales (excluding motor vehicles and gasoline) also showed strength, increasing by +1.1%, boosted by higher receipts at general merchandise retailers and clothing stores, while sales at gasoline stations fell by -2.0%. Geographically, the increase was concentrated in five provinces, with Ontario (+1.2%) and Quebec (+1.8%) recording the largest dollar-term gains, while Nova Scotia saw the largest decrease.

MXN: Retail sales hold steady

According to the National Institute of Statistics, Geography, and Informatics (INEGI), Mexico’s retail sales in August 2025 maintained a steady pace of growth, increasing 2.4% year-on-year. This growth rate matched the performance seen in July and, despite coming in slightly below the estimated +2.6%, contributed to the uneven trend of retail performance this year, following a contraction in April (-1.5%) and strong gains in March and June. The rise in sales was spearheaded by double-digit growth in online and catalog sales (+17.3%) and solid increases in categories like household appliances (+7.2%) and department stores (+4.8%). Even the motor vehicles and fuels sector saw a gain of +2.5%. However, this overall increase was tempered by declines in essential goods and home improvement categories, most notably in groceries and beverages (-2.7%) and hardware, paint supplies, and glass products (-2.2%). On the labor front, the sector showed positive momentum as retail employment rose 0.7% and wages increased 4.5%. Month-on-month, after seasonal adjustments, the value of sales grew by 0.6%, up from a marginal 0.1% increase in July.

FX relatively calm after a softer US CPI reading

Table: Currency trends, trading ranges and technical indicators

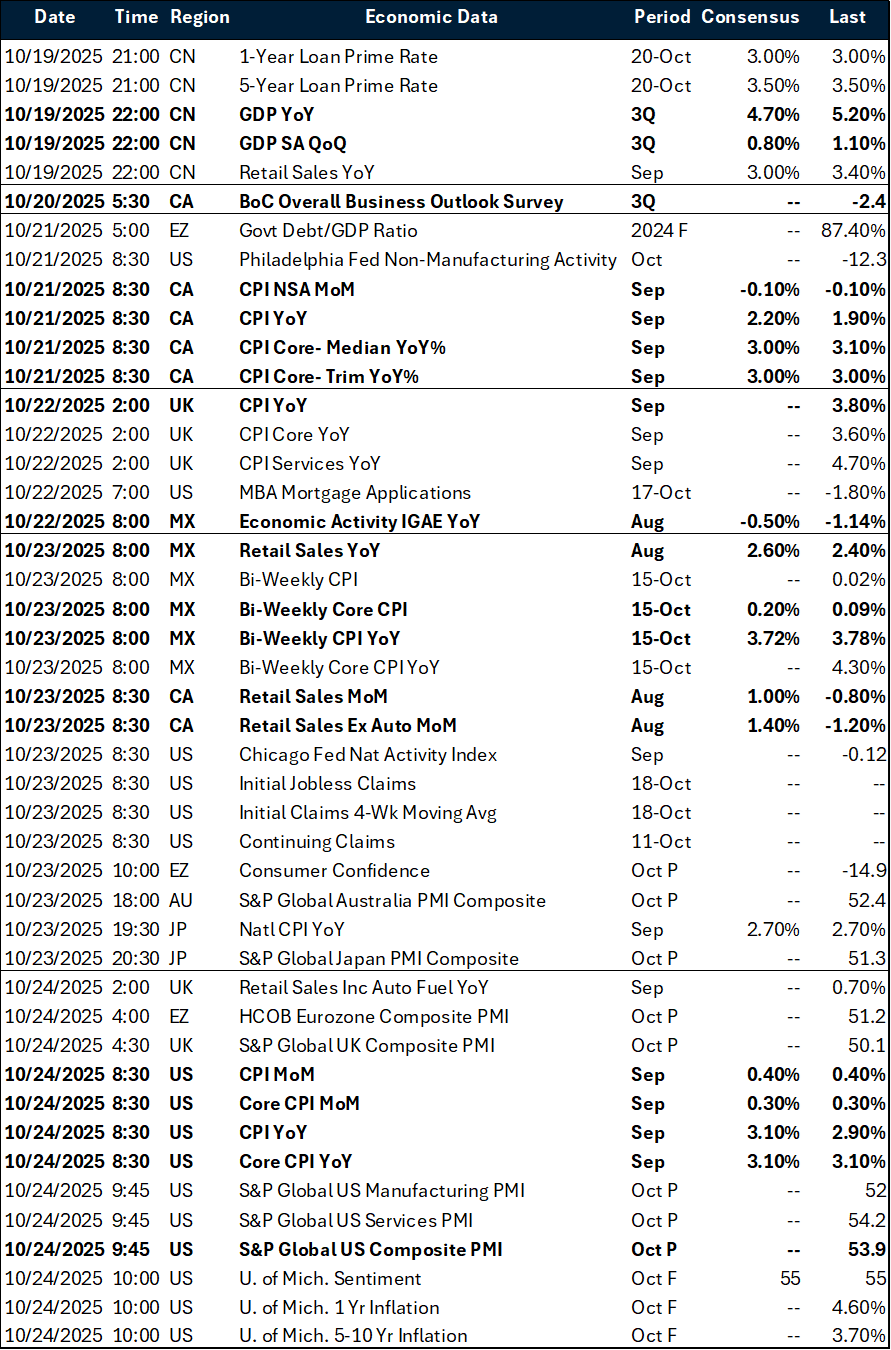

Key global risk events

Calendar: October 20-24

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.