- Four-year floor. The US dollar sell-off was the main story at the start of the week. It slid to four‑year lows as a mix of policy unpredictability and growing market chatter that Washington is comfortable with a weaker USD – weighed on sentiment.

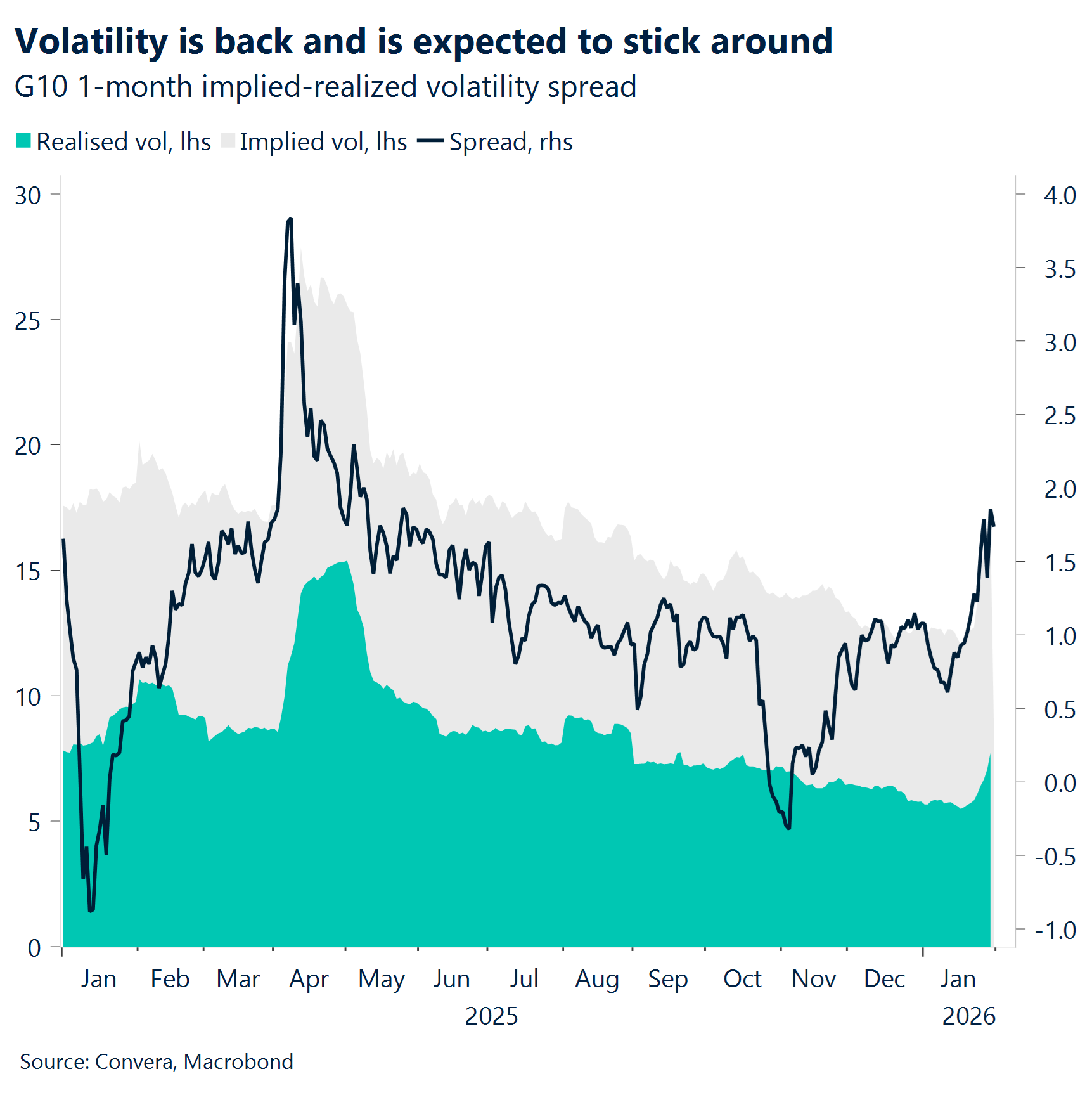

- Fear factor reloaded. Then, global markets were hit by another wave of volatility. The VIX fear index spiked back to 20 briefly on rising geopolitical tensions, and renewed fears that parts of the AI trade have run ahead of fundamentals.

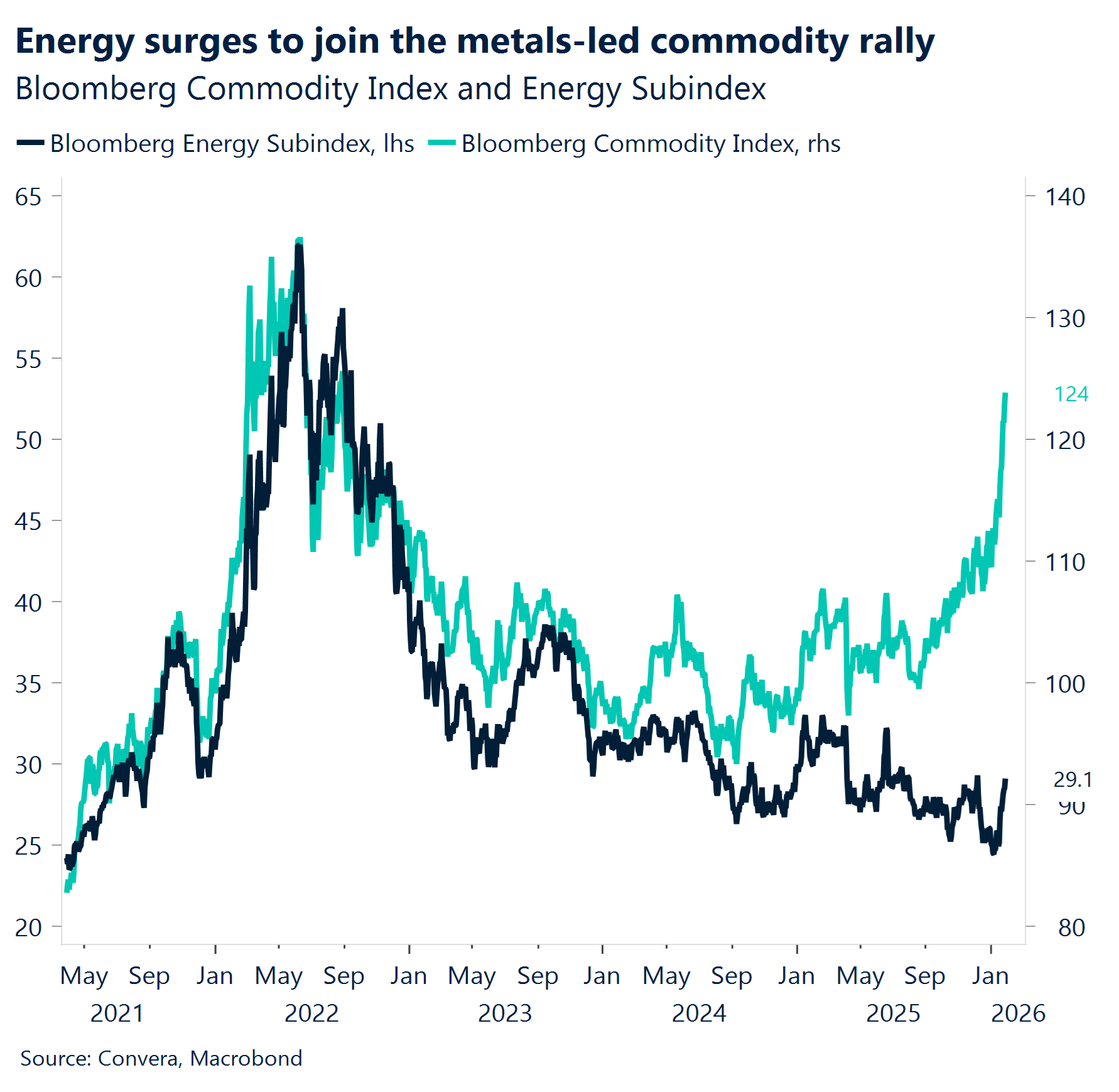

- Crude awakening. Brent crude jumped 5% after President Trump warned Iran to accept a nuclear deal or face potential military action – adding a fresh risk premium to energy markets.

- Byte-sized panic. Tech then amplified the turbulence: Microsoft’s earnings triggered doubts over the near‑term payoff from heavy AI spending, sending the stock down nearly 12% and dragging the Nasdaq lower.

- Taking precious profit. Precious metals – gold and silver – usually beneficiaries in a risk off environment, were sold as traders raised cash on the record highs witnessed earlier in the week.

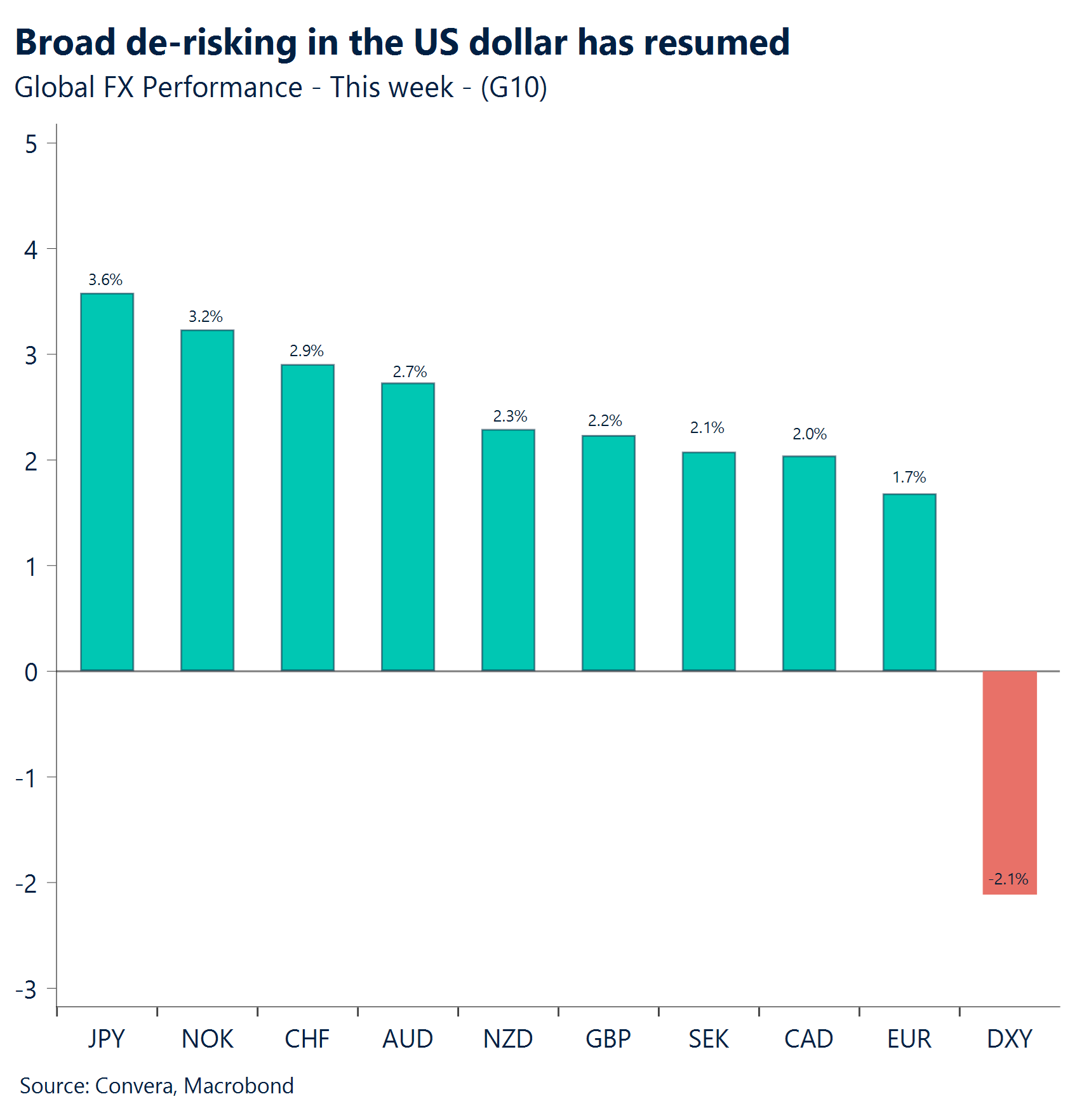

- Haven when it has tobe. In FX, recent risk‑off episodes haven’t consistently supported the USD, but this week demand snapped back as de‑risking hit EM currencies, equities, crypto and metals alike.

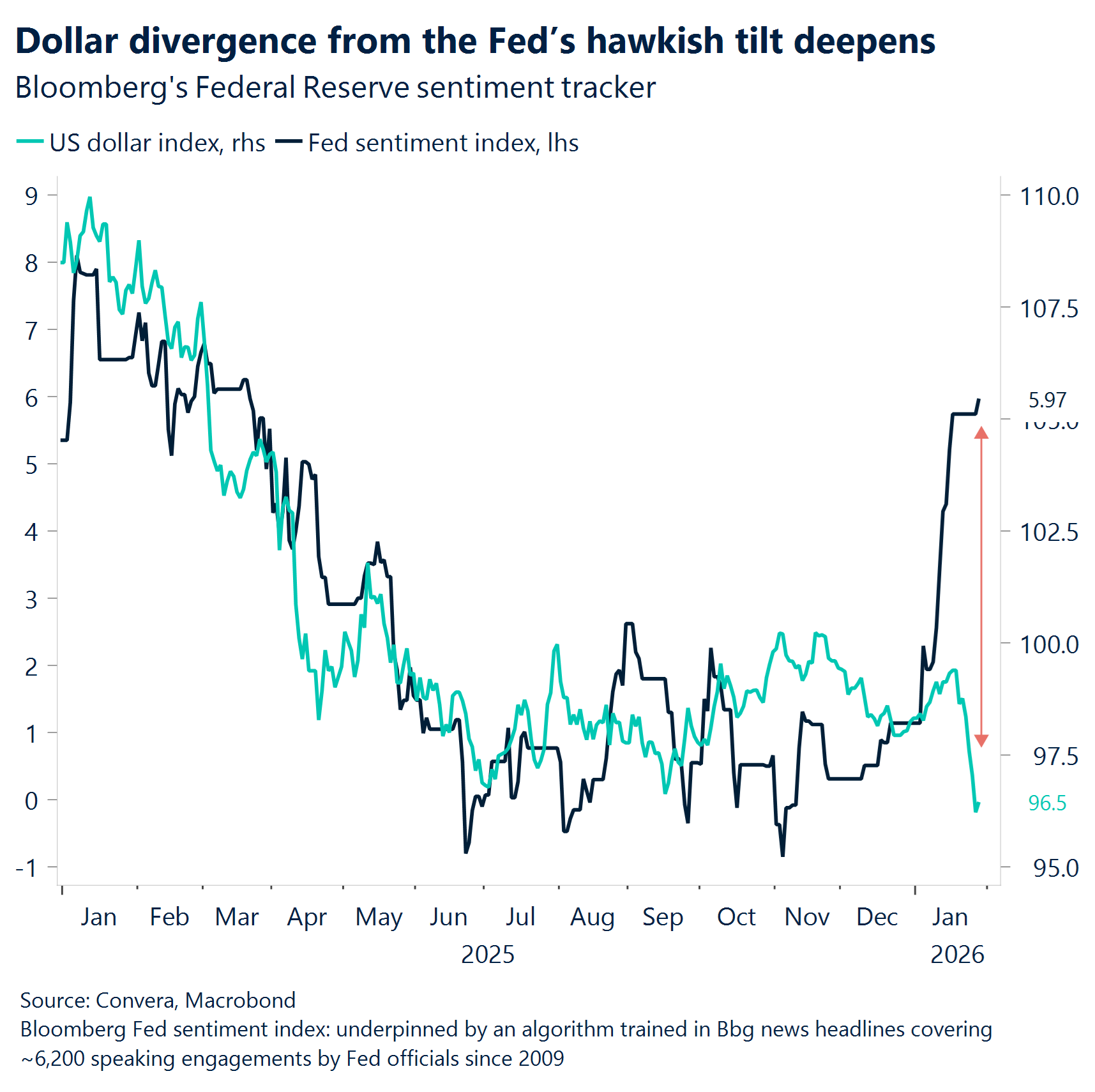

- Warsh and the wash up. The dollar strengthened further following reports that President Trump is preparing to nominate Kevin Warsh as Fed chair.

Global Macro

Commodities run continues

Rally accelerates then cools. After hitting $5,000 oz, gold continued rallying and hitting a new all-time-high at $5,400 before reversing course towards week-end. Silver scored year-to-date gains of up to 57%, followed by platinum with 27% and palladium at 24%, before all lost over 12% on Friday morning as rumours of Kevin Warsh becoming next Fed Chair fueled a USD rebound. Still, the rally in precious metals has been striking this year. Analysts are racing to pin down the driver: is it the weight of central bank accumulation, the acceleration of the so called ‘de-basement trade’, or a preemptive strike against resurgent inflation? Perhaps it is a reaction to fiscal deficits and their looming pressure on long-end yields, or a geopolitical scramble to secure critical minerals for industrial survival. Whether it’s inflation hedging or industrial scarcity, or a powerful convergence of them all, the energy subsector wants to join the party, as US-Iran tensions push oil 6% up for the week.

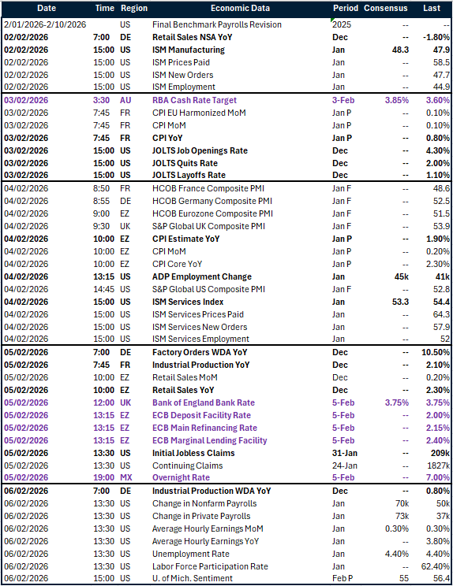

Boring Fed? During this week’s press conference, Powell sidestepped questions regarding his pushback against the DoJ subpoena. By avoiding the “juicy” topics, he left the session feeling uncharacteristically dull. Powell instead doubled down on the importance of central bank independence. With only two meetings remaining before his term ends, it is clear that the Fed’s next move will be clouded by political noise and a heavy stream of data leading up to the March meeting.

US economic divergence. The US economy is currently a study in contradictions, defined by a jarring disconnect between top-line strength and ground-level sentiment. While Q4 growth numbers are pointing above a staggering 5%, consumer confidence has simultaneously cratered to its lowest point since 2014. This divergence is mirrored in a peculiar labor market where the time required to land a new role has hit its highest level since 2021, even as initial jobless claims refuse to signal a recessionary surge.

Week ahead

Policy signals drive the week

- ECB: No fireworks expected. ECB President C. Lagarde is unlikely to deliver anything exciting as the ECB holds steady. Comments on recent euro strength may draw attention, given market chatter about whether a stronger euro could prompt additional easing. But expectations should stay grounded – we see no hint of cuts for this reason (at least not yet), and no meaningful downside reaction in the euro.

- The split matters more than the decision. The BoE is also expected to hold rates, but markets will be watching for signals on the medium‑term path as further cuts are expected but poorly timed. The MPC remains deeply divided, making the vote split more interesting than the decision itself. Any firm pushback from cut‑leaning officials, despite the Bank holding steady, would signal growing urgency for more easing – a clear contrast to the cautious pace seen so far in the cycle.

- The Fed needs confirmation. US labour data is due, from JOLTS to ADP to the all‑important NFP. At its first meeting of the year, the Fed noted that the labour market appears to have stabilised, with layoffs contained and unemployment back at 4.4% after November’s jump. Next week’s data will be crucial to confirm that shift, likely delaying any easing adjustments further.

- Strong sentiment, softer reality. A raft of hard data is due across the eurozone, including retail sales, industrial production, and factory orders. The bloc started 2026 on a strong note, but momentum has so far been driven more by sentiment indicators rather than macro data. Tracking next week’s releases will be key to seeing whether hard data begins to catch up with the soft‑data optimism.

FX Views

Sentiment sets the tone

USD Dollar slide turns sentiment‑driven. The dollar index fell over 1% into week’s end, weighed by softer sentiment toward the greenback amid Trump’s unpredictable policy moves. The selloff eased as reports surfaced that Warsh – viewed as more hawkish – is Trump’s pick for Fed chair. A broader risk‑off tone and Bessent’s remarks that the Fed is not planning a joint FX intervention with the BoJ also helped steady the move. Nonetheless, the dollar remains dislocated from macro‑warranted fair value. The muted reaction to this week’s hawkish FOMC tilt in fact underscored how weak sentiment continues to drive the divergence. The 96 level has held as key long‑term support, defining a new 2025/26 DXY range of 96–100, down from the 100–107 band of 2023/24. We expect this range to hold for now on solid fundamentals, though longer‑term risks are building. Relative macro performance in the eurozone and Japan – both buoyed by heavy spending commitments and major contributors to the index – may challenge the US growth premium. A bearish breakout would be justified as the dollar begins to lose fundamental support as well, with the Fed likely turning more dovish later in the year on easing inflation pressure.

EUR Euro lift, no fundamentals. The dollar has made it easy for the euro this year, with broad‑based USD softness boosting demand for the common currency, the second‑most liquid alternative. EUR/USD heads into the week’s close about 1% higher on the week and nearly 2% higher year‑to‑date. The move looks overdone, fuelled largely by sentiment‑driven USD pessimism. Fundamentally, the rally lacks support: EUR:USD rate differentials have widened the most since early November 2025 in favour of the greenback. What may help the euro are technicals, with the pair’s long‑term downtrend being challenged after briefly breaking above 1.20 this week. That said, a sustained break above that zone, plus an invalidation of the lower‑high pattern (testing 2021 highs at 1.2260), would be needed to truly embolden buyers and trigger a bullish breakout. But without fundamental backing, only a sharp deterioration in the dollar would provide the sentiment catalyst required to challenge the pair’s long‑term bearish setup. We see this as a tailwind risk and still expect a move back below 1.18 in the medium term.

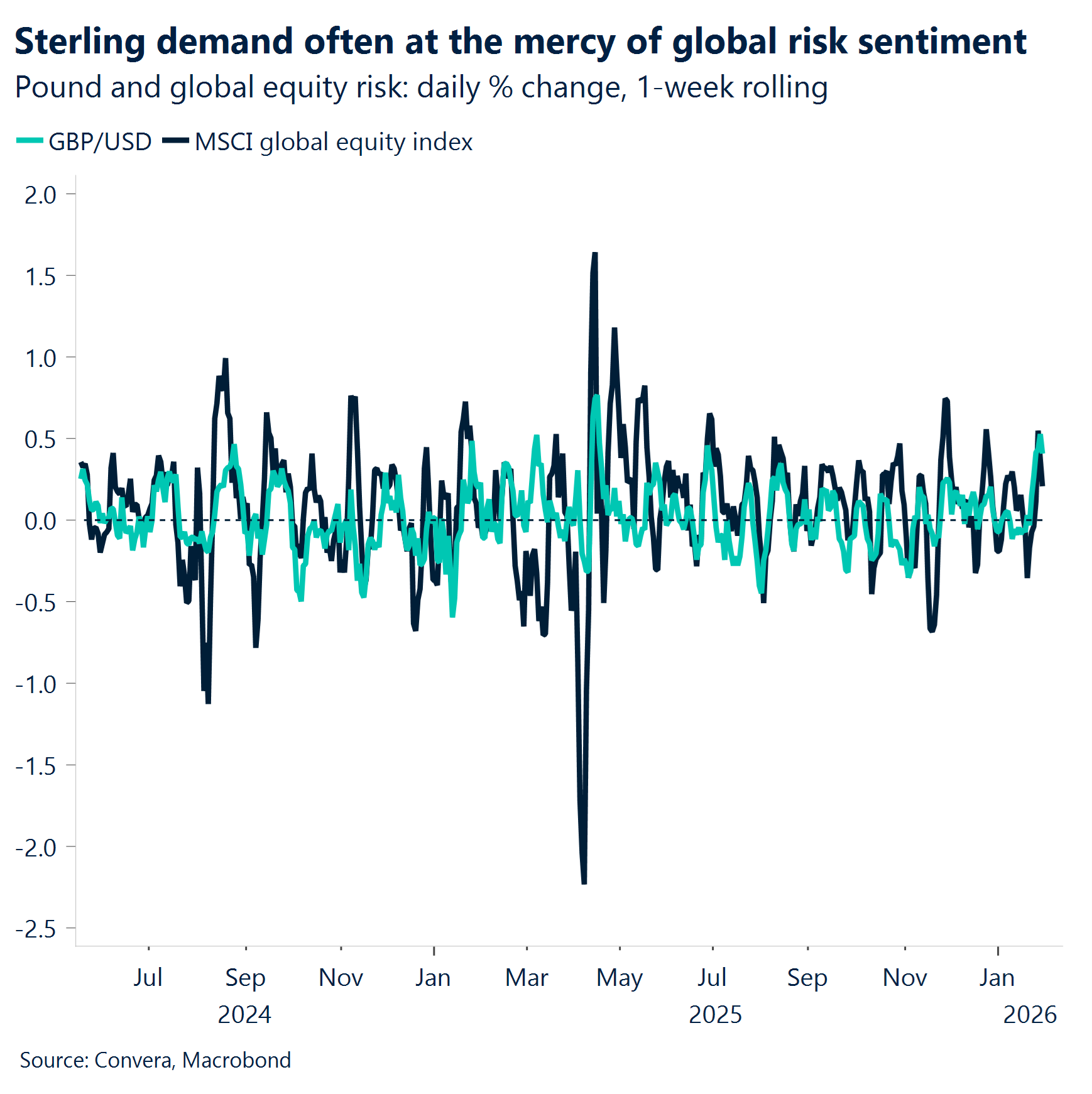

GBP Swinging with global sentiment. Sterling spent the week taking its cues from global sentiment rather than domestic drivers. GBP/USD pushed through 1.38 to fresh four‑year highs as softer US data weighed on the dollar, keeping the path toward 1.40 very much alive despite the lack of a strong UK catalyst. Looking at the FX options market, traders bolstered the expectations of a stronger pound versus the dollar to the most bullish over a 1-week period since 2019. Risk reversals across longer-dated tenors also shot up to the highs witnessed last April after Trump’s tariffs were announced. Meanwhile, GBP/EUR was steadier, reflecting a familiar pattern of late: during bouts of US‑led uncertainty, the cross has traded less decisively in the euro’s favour than it did in the immediate post‑liberation‑day period. Our medium‑term view remains mildly bearish, though we recognise scope for upside surprises if the economic backdrop improves. Focus now turns to the first Bank of England meeting of the year. A hold is widely expected, but the vote split will be the real signal for markets trying to assess the direction of a still‑divided MPC.

CHF Stand out winner. The Swiss franc has emerged as a standout beneficiary of the dollar’s latest slide, climbing to levels that once would have triggered firm pushback from the Swiss National Bank. With USD/CHF now below 0.77—its strongest since the SNB scrapped its currency cap—and similar gains against the euro, geopolitical tension, renewed US trade threats, and Switzerland’s absence from tariff disputes have all boosted demand for the franc as confidence in the dollar softens. What’s notable is the SNB’s tolerance. EUR/CHF is hovering near past intervention zones, yet falling sight deposits suggest policymakers are holding off. This comes even as officials warn that franc strength risks pushing inflation back below zero, while signalling that the threshold for returning to negative rates remains high.Despite the sharp moves, the broader picture is one of continuity: the trade‑weighted franc has been grinding higher for nearly eight years, making this latest appreciation part of a long, orderly trend rather than a sudden shock.

CAD 15-month low. The Canadian dollar has surged this week, moving from 1.3918 to an intraday low of 1.3492—its lowest point since October 2024. This rally stems from broad greenback weakness after President Trump dismissed concerns over the dollar’s decline, fueling a 2% month-to-date drop in the USD Index that overshadowed hawkish Fed rhetoric. After both the Fed and the Bank of Canada holding rates steady—with the BoC maintaining 2.25% amid a cautious growth outlook—USD/CAD has stabilized near the 1.35 support level. Markets are now eyeing a potential move toward 1.3430, contingent on continued dollar selling and next Friday’s critical January unemployment data.

AUD RBA in focus as inflation bites. Headline CPI rose 1.0% month‑on‑month in December, pushing annual inflation up to 3.8%, above the consensus forecast of 3.6%. With inflation proving sticky and underlying annualised inflation still above target, the RBA is likely to maintain a cautious stance. A rate hike at the February meeting appears unlikely unless the data delivers a significant upside surprise; however, if these sticky inflation trends persist, further tightening in the coming quarters cannot be ruled out. Market, however is currently pricing in 70% likelihood of rate hike in February meeting. AUD/USD recently touched a high of 0.7094 on 29 January. Key support levels sit at the 21‑day EMA (0.6831) and the 50‑day EMA (0.6727). Traders should keep a lookout on upcoming RBA rate decision, RBA rate statement and RBA monetary policy statement.

CNH China’s industrial profits rebound after slump. China’s industrial profits climbed 5.3% year-on-year in December, reversing a 13.1% drop the month before and marking the first gain in three months. For the full year, profits edged up 0.6%, compared with 0.1% in 2024. A statistician at the National Bureau of Statistics cautioned that challenges remain, citing global headwinds and the ongoing push for industrial transformation and upgrading. USDCNH is hovering near the 6.9500 level, at the time of writing, with charts pointing to potential upside. The next resistance sits near the 21-day EMA at 6.9655, followed by the 50-day EMA at 7.0039. Market participants should keep a lookout on upcoming manufacturing PMI, Chinese composite PMI, Non manufacturing PMI, Caixin Manufacturing and services PMI.

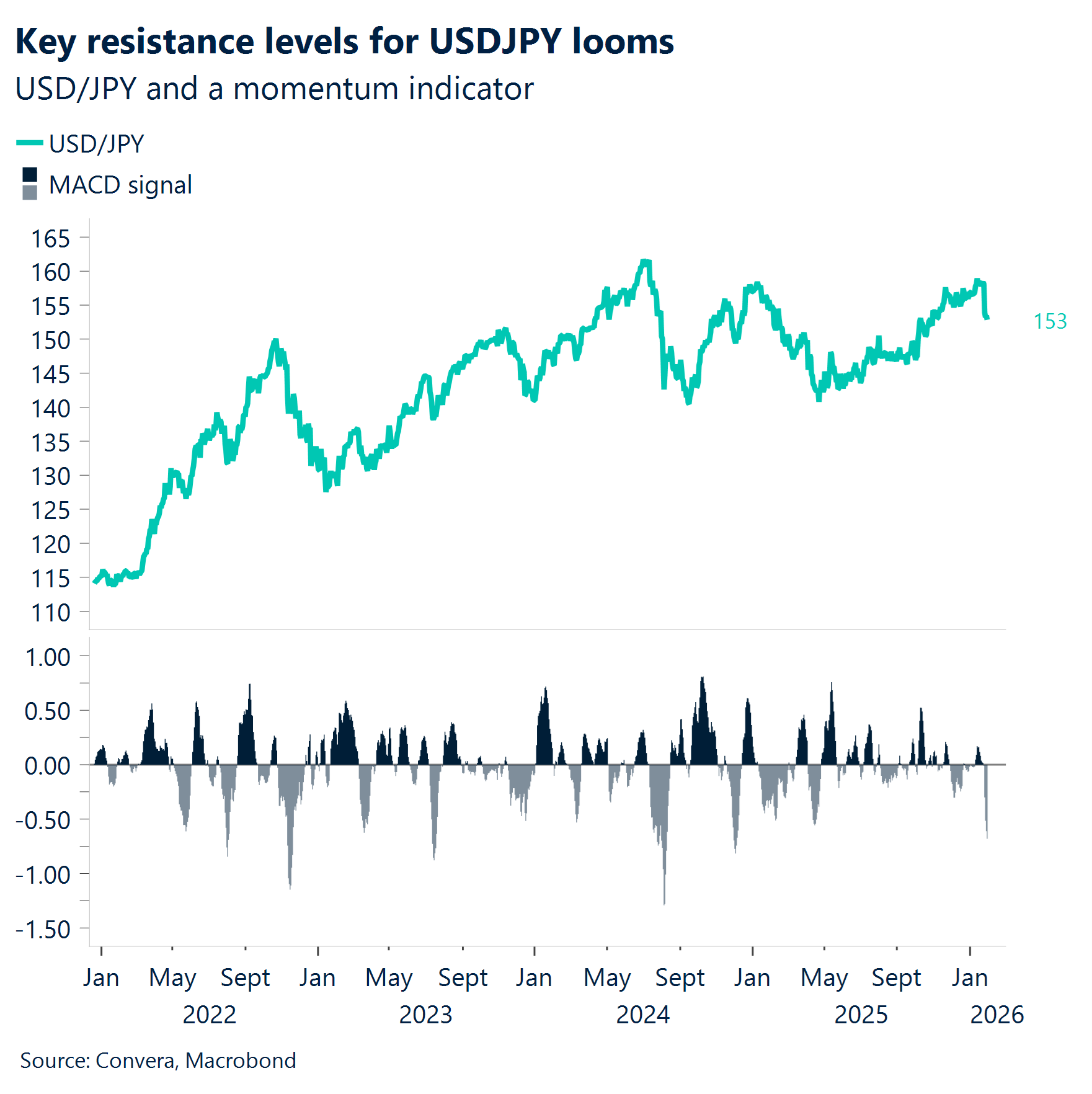

JPY LDP set to tighten grip. Local media and overnight polls indicate that Japan’s Liberal Democratic Party is on track to secure a majority in the snap election, while the new centrist party continues to struggle for traction. This outcome could support sentiment around Japanese equities. The yen has eased, with USD/JPY correcting 4% from its recent peak of 159.45 on January 14. Key levels to watch include the 100‑day EMA at 154.15, followed by the 50‑day EMA at 155.72, which may act as near‑term resistance. Market participants should keep a lookout on upcoming BoJ Summary of Opinions, au Jibun Bank Manufacturing and Services PMIs, monetary base, and household spending.

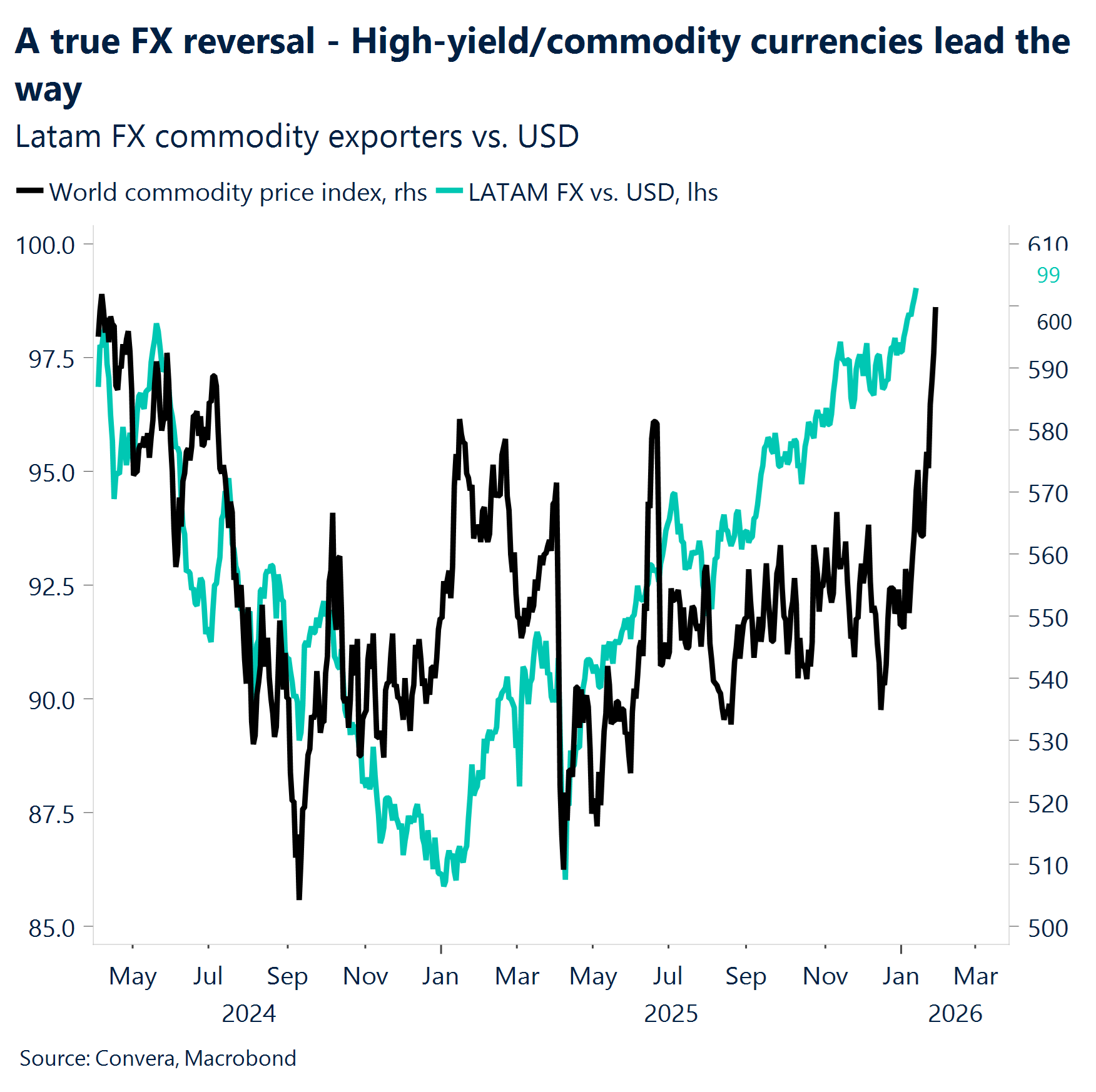

MXN Taking a breather. Early in 2026, we’re seeing the repeat of the investment playbook of 2025: pile into high-yield Latin American FX to capture the potent combination of carry, a soft USD, and commodity-driven valuation mean reversion. This environment of relative calm fundamentally lowered the risk premium required for cross-border investments, encouraging a broad-based migration of capital toward high-yielding assets as the fear of sudden exchange rate swings began to dissipate after ‘Liberation-day’. As risk premia compressed, global flows have been aggressively chasing the best available mix of yield and growth, positioning LatAm as the definitive standout of early 2026 as these regional assets consistently outpaced global benchmarks. Transitioning from these macro tailwinds to the specifics of the market’s most crowded trade, the “Super Peso” has become the ultimate poster child for this movement, though technicals suggest it may be approaching terminal velocity. The pair has plummeted to the 17.1 handle, driven by an unrelenting downtrend that has left every major moving average in the rearview mirror. With the pair in oversold territory, it has taken a breather at the 17.2 level. Next Thursday, Banco de México is expected to hold rates at 7% for the first time since March 2023. Policymakers are likely to maintain this stance as they await further confirmation that core inflation measures are cooling.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.