- AI scare trade. Stocks stayed under pressure as worries around AI companies sparked a broader tech selloff. The Nasdaq is over 5% off its recent peak. The MSCI global equity index is on track for its first back‑to‑back weekly decline of the year.

- Payroll pop. US jobs smashed expectations, with January payrolls rising by 130k – the most in over a year – and unemployment unexpectedly falling to 4.3%. However, job gains are unusually concentrated in health care and social assistance.

- Another soft CPI print. US headline inflation came in at 2.4%, a tick below forecasts and offering risk assets a bit of respite amid renewed Fed easing hopes.

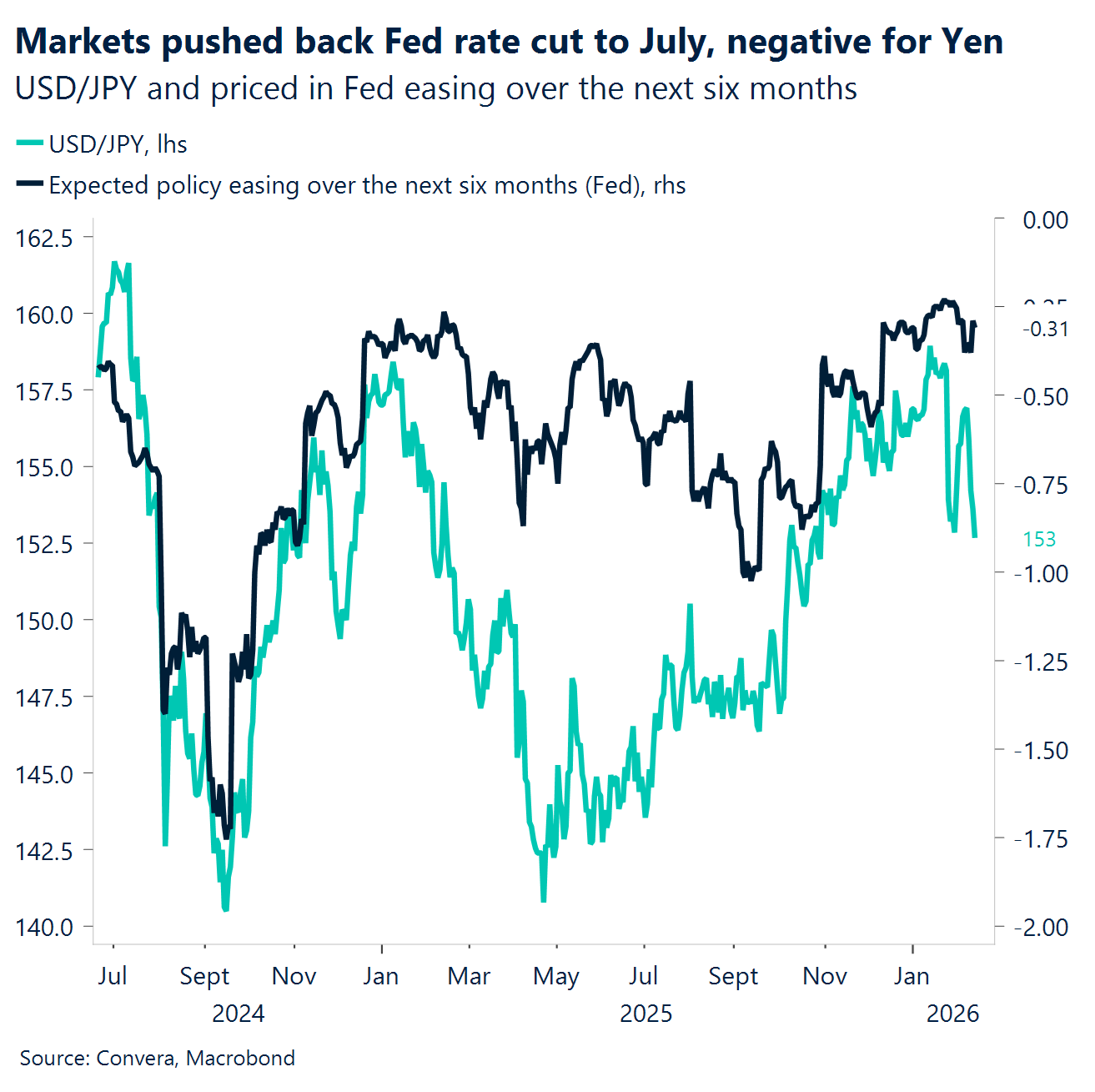

- Fed-upgrades. Market implied Fed rates have chopped and changed all week with traders wavering between June and July being the first cut of 2026. The implied end‑2026 rate ended the week back at 3% after 13bps were added post NFPs.

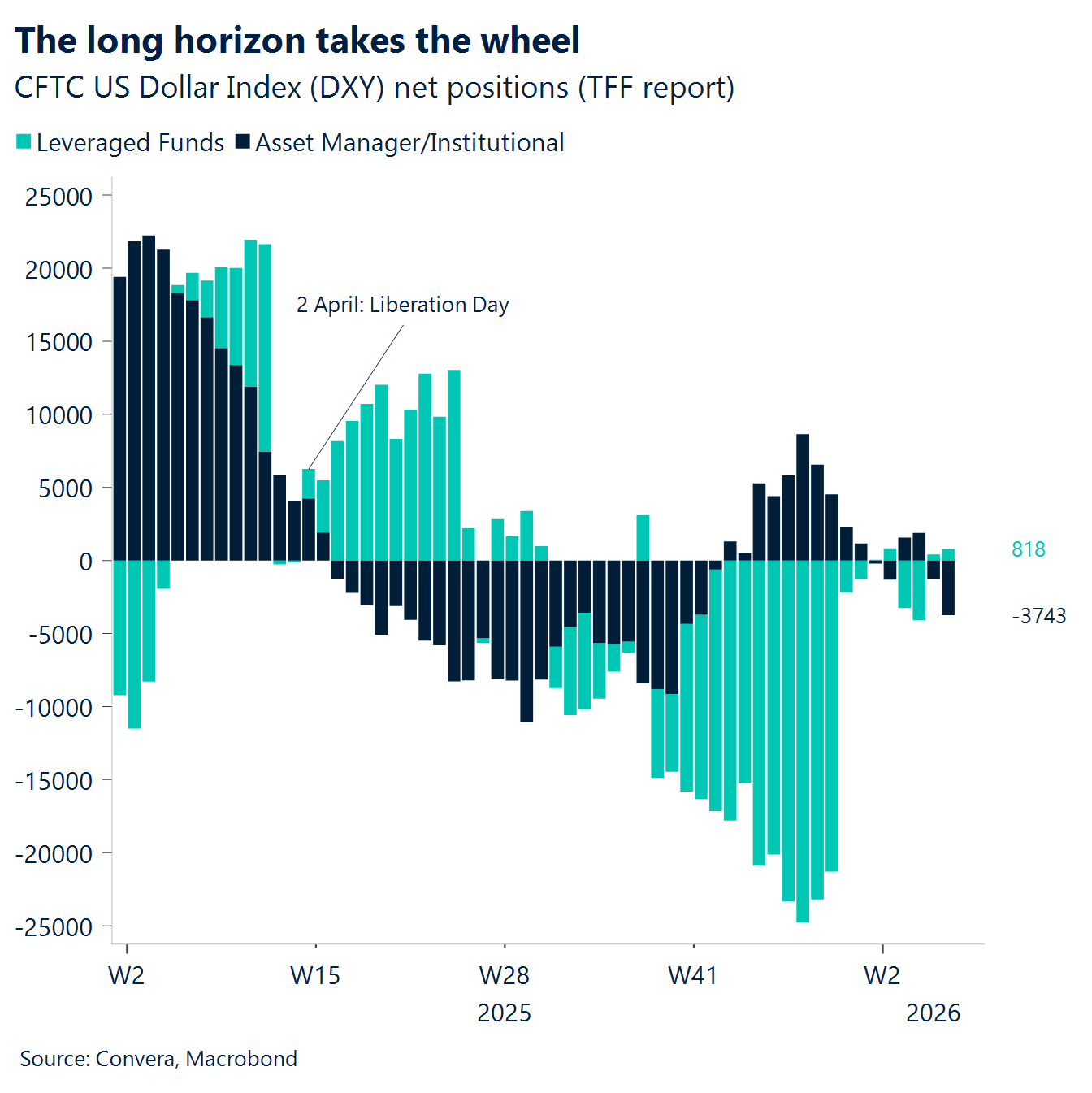

- De-dollar drama. Supportive fundamentals should help USD stabilise, but elevated US policy uncertainty is offsetting the boost, amid renewed “de‑dollarization” chatter and reports that Chinese regulators have urged banks to limit Treasury exposure.

- Yen-sensational, for now. Investors are loving the yen again, framing Takaichi’s win as a pro‑growth, buy‑Japan moment. JPY is up over 2% this week, but Japan’s slow growth, huge debt, and negative real yields keep the long‑term bearish case intact.

- Euro calls the shots. Risk‑reversal pricing shows a large premium for EUR upside across maturities, signalling the market doesn’t see euro strength as a short‑term trade and is positioning for a more lasting shift toward the euro over the dollar.

Global Macro

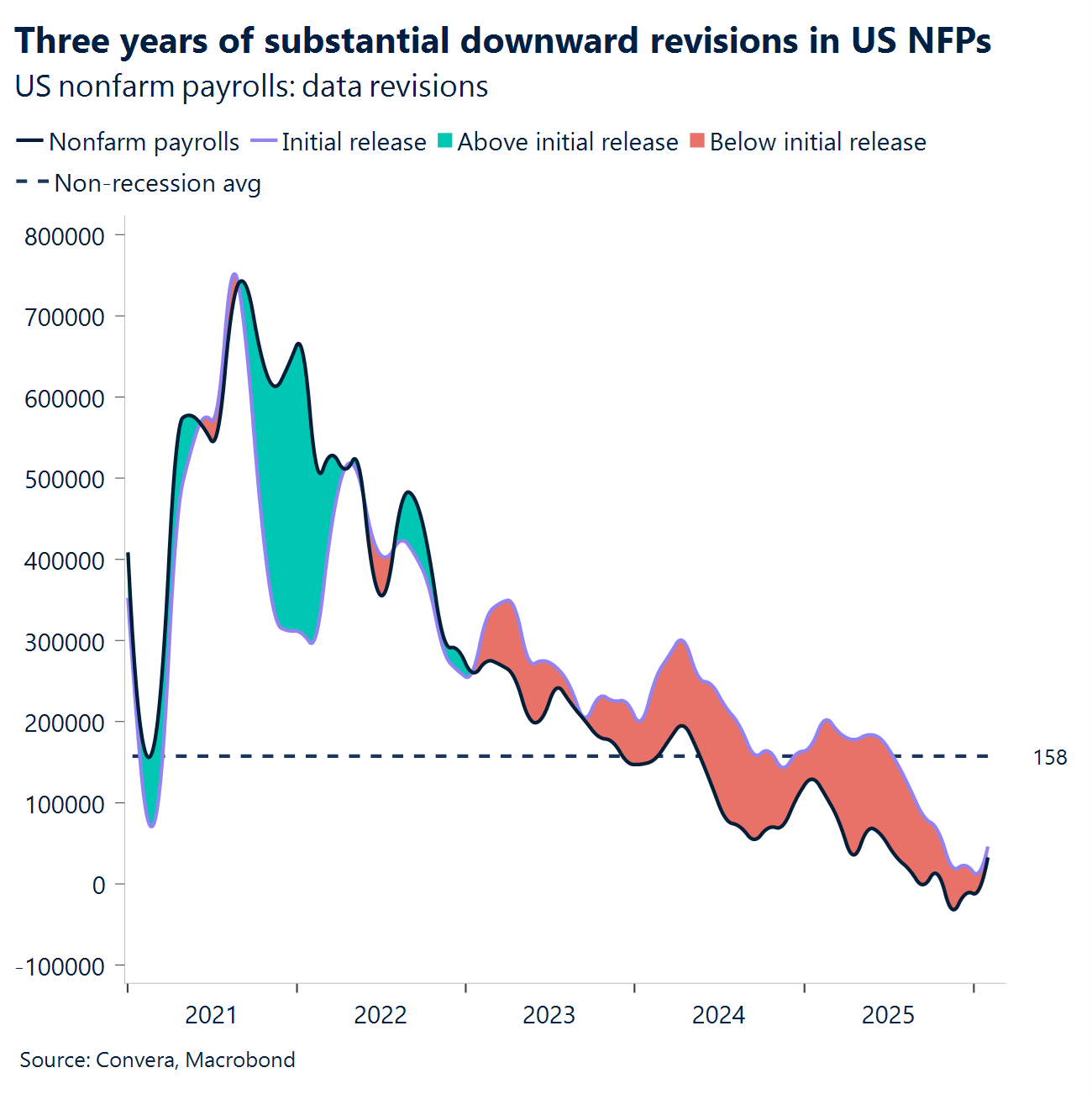

A jobless expansion

Stalled US labor market. While January payrolls rose by 130,000 and the unemployment rate slipped to 4.3%, both better than expected, the BLS revised March 2025 total nonfarm employment down by 898,000 on a seasonally adjusted basis (–0.6%), recasting 2025 as a year that added just 181,000 jobs in total, about 15,000 per month. It was the weakest hiring year since 2020, and the weakest outside recession since 2003. Meanwhile, the US economy grew at a 4.4% annualized rate in Q3 2025, and Q4 is pointing to 3.8%. A jobless expansion keeps defying all recession calls.

UK sluggish growth. Quarter‑on‑quarter growth came in at 0.1% versus the 0.2% expected, with services flat, production a touch firmer and construction weak. On an annual basis, output rose 1.0%, below the 1.2% forecast. December’s monthly GDP met expectations at 0.1%. The data is a further blow to PM Starmer, who has come under intense pressure to resign. Polymarket continues to show a 70% probability of him stepping down by June 30, and concerns about a less‑centrist Labour successor introduce a meaningful layer of political risk for GBP, given the potential fiscal implications.

US CPI. Markets breathed a visible sigh of relief following the release, with two-year Treasury yields falling and the dollar hitting session lows as fears of a “hot” January print evaporated. Headline CPI rose just 0.2% for the month, coming in under the 0.3% forecast, while the core reading was bang in line with expectations at 0.3%. Notably, the headline year-on-year rate cooled to 2.4%, marking the smallest annual increase since last May. While shelter costs remain the primary driver of inflation, their 0.2% monthly rise is seen as benign; for context, not a single month in 2024 saw a print that low. Overall, the data indicates that the broad disinflationary trend is holding up well. A June cut is now firmly back in play.

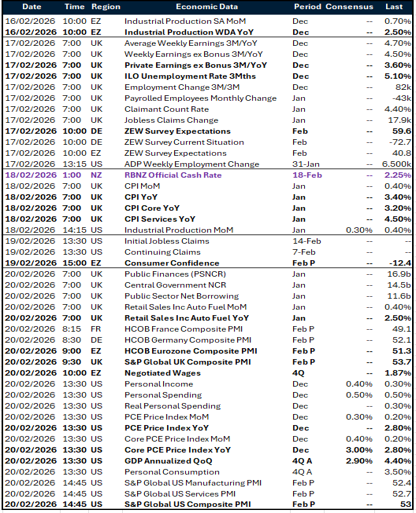

Week ahead

UK inflation leads the macro parade

- Inflation showdown. UK labour market data and inflation will be closely watched. We do not expect significant downward pressure on sterling, as both labour‑market softness and the ongoing disinflation trend are largely priced in. The inflation print remains critical, since the BoE’s dovish tilt depends heavily on it. Consensus looks for a drop from 3.4% to 3%. A meaningful upside surprise would likely lift sterling.

- The real-spending reality check. Personal consumption expenditure data, both real and nominal, are due next week. The subdued nominal retail sales print earlier this week already hinted at softer goods spending, but the weaker figure likely reflects heavy holiday discounting, which mechanically lowers nominal sales. Tracking real PCE, which includes services and feeds directly into GDP, should offer a clearer and fuller read on underlying consumer momentum.

- The Fed’s favourite deflator. The PCE price index follows, used to deflate the consumption component of GDP, also due next week for Q4. It remains the Fed’s preferred inflation gauge, given its broader coverage relative to CPI, and it feeds directly into the GDP framework through the PCE channel.

- PMI pulse check. Preliminary PMIs for the eurozone, UK, and US are also due. These February readings offer an early gauge of whether recent political developments, such as UK leadership uncertainty or erratic US politics, have spilled over into broader business sentiment.

FX views

NFP can’t save the dollar

USD. Dollar loses its NFP glow. The week ends with the dollar on the back foot, despite what should have been supportive macro news. Wednesday’s upbeat NFP initially triggered bearish flattening in Treasuries, but much of that move has since been retraced. The shift reflects growing skepticism about the underlying labour‑market trajectory that fails to imprint a more sustainable hawkish tilt. Beneath the surface, annual benchmark revisions cut the average 2025 monthly job gain to just 15k, reinforcing the sense of a “low hire, low fire” equilibrium rather than a re‑acceleration story. Meanwhile, inflation appears to be easing in line with the Fed’s expectations (January y/y% at 2.4 from 2.7). The macro‑warranted bullish bias has, so far, failed to materialize, while sentiment toward the currency remains soft. As a result, traders seem to be treating any USD strength as an opportunity to sell at better levels, guided more by longer-term bearish considerations than short-term dynamics.

EUR. Euro rides the dollar’s drift. EUR/USD remains a near‑perfect mirror of the dollar’s swings. With USD sentiment still soft and the US macro story failing to inspire investors, the euro is well positioned to stay bid. Technically, the setup remains constructive. EUR/USD is trading above all key moving averages, most notably the 21‑day, whose upward slope and position relative to spot offer the clearest read on short‑term momentum. The bulls remain firmly in control. The pair screens overvalued relative to macro‑warranted fair value, this may prove more durable than initially assumed. If the US macro narrative continues to disappoint and nudges the Fed toward a more dovish stance, the market’s current preference for the 1.18–1.19 zones could become fundamentally justified, reinforcing the pair’s comfort at higher levels.

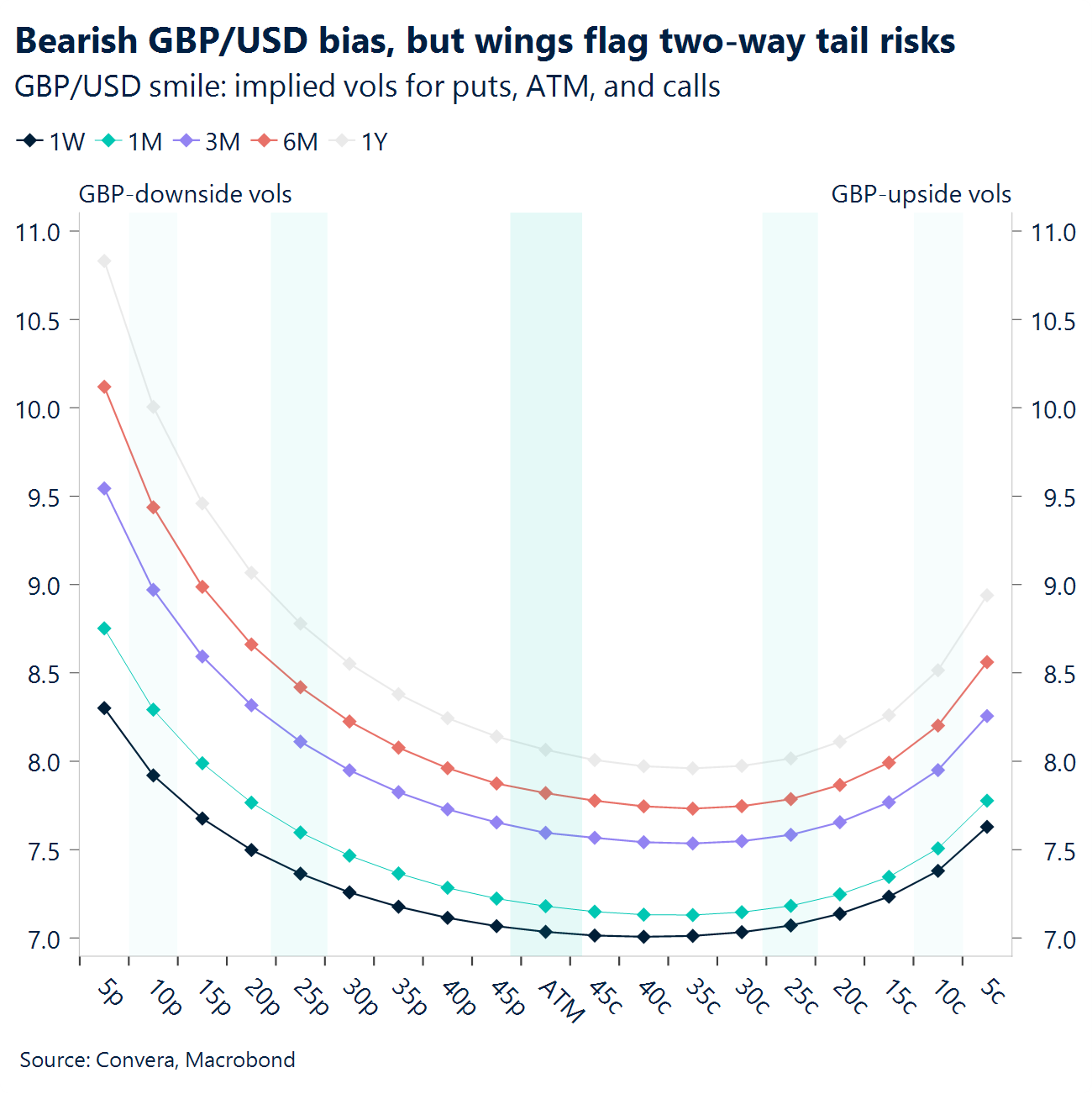

GBP. Triple-jab trouble. A three‑pronged setback is now shaping the GBP narrative. Political uncertainty and a dovish shift in Bank of England expectations have weighed on sentiment and as one of the higher‑beta G10 currencies, this week’s equity sell‑off also dragged on the pound. GBP/USD is struggling to hold $1.36, and a close below that level would break 21‑day moving‑average support, hinting the recent uptrend is fading. The options market is also cautious, with negative risk‑reversals further out showing a clear preference for longer‑dated GBP downside protection — although wing kinks suggest two‑way risk remains on the extremes. GBP/EUR remains directionless, with the 100‑day moving average still the key support level. The cross has drifted sideways in recent sessions, reflecting a broader lack of conviction on both sides, but if global risk sentiment improves a drifty back above €1.15 seems plausible in the near term. Macro data is key though. UK GDP data disappointed this week, but its backward‑looking nature limited the market reaction. Next week’s jobs and inflation releases will matter far more for the near‑term GBP outlook.

CHF. Persistent strength. The franc is almost 1% stronger against the USD this week and sits less than 0.3% from 10‑year highs versus the euro. Risk aversion continues to support the safe‑haven franc, and the SNB’s reluctance to intervene has added to the move. Swiss inflation held at 0.1% year‑on‑year in January, matching expectations and reinforcing the view that the SNB will keep rates unchanged next month. With the bank willing to tolerate temporarily low or even negative inflation, it also suggests the SNB is comfortable letting EUR/CHF drift lower. More broadly, the franc’s rising sensitivity to USD weakness highlights its growing appeal as a structural alternative to the dollar. Compared with pre‑Liberation Day trends, the CHF is now absorbing a larger share of safe‑haven flows than the USD.

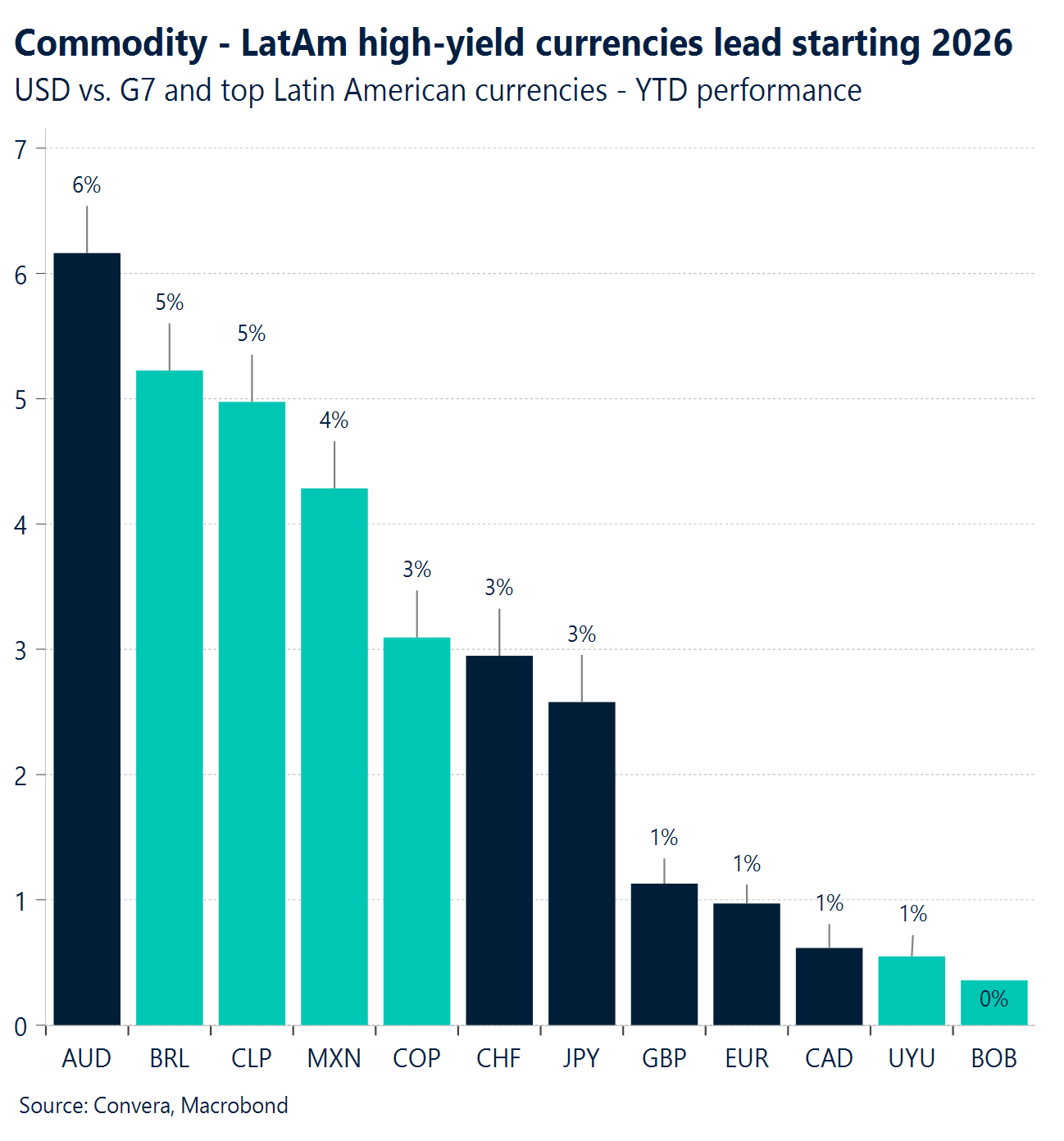

CAD. Continues lagging. The USD/CAD surged toward the 1.36 handle following the surprisingly robust US Nonfarm Payrolls report for January. While market participants were largely positioned to confirm the labor market weakness that defined much of 2025, the unexpected strength in the monthly data caught investors off guard, sparking a rally in both the US Dollar and the Treasury yield curve. Even after its 2% appreciation against the US dollar this year, the Canadian dollar continues to lag other commodity‑linked currencies, restrained by ongoing geopolitical tension with the United States. Economic momentum has cooled from the pace seen in late 2025, and recent data releases have been uneven, as seen by last week’s employment report. Fiscal expansion and accommodative monetary policy should provide some lift in the coming quarters, yet the currency remains vulnerable. The reality is that Canada, as opposed to Mexico, has decided on a rockier path in its conversations ahead of the CUSMA deal review, which leaves the currency vulnerable to geopolitical risks. Next Tuesday, CPI release for the month of January will be of focus, and on Friday, retail sales for December last year will cap a shortened week due to Family day holiday.

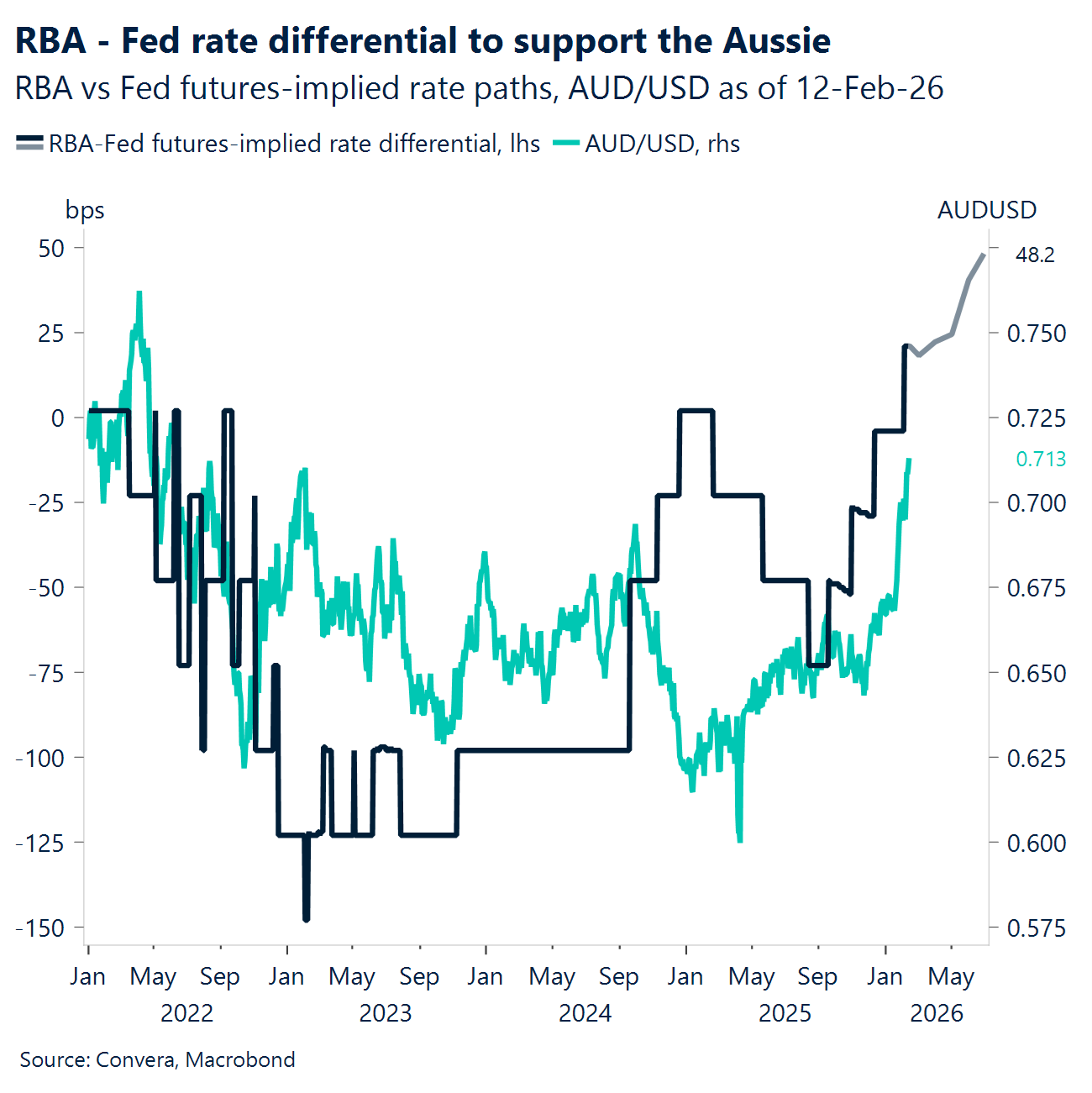

AUD. Aussie jumps on RBA warning. RBA deputy governor Andrew Hauser says inflation remains “too high” and the central bank can’t allow it to persist much longer, according to Bloomberg. He argued that some of the recent rise in prices shows stronger demand running into supply limits. If that’s the case, he warned, inflation could stick around—and the bank “can’t let that happen.” His comments pushed AUDUSD above 0.71. Hauser added that policymakers need to “respect the speed limit,” saying that trying to push the economy beyond its capacity would only fuel inflation, which he called the biggest drag on productivity growth. AUDUSD now trades just 1% below its recent high of 0.7147, last reached on February 12. Key support sits at the 21‑day EMA at 0.6966, followed by the 50‑day EMA at 0.6831. The pair has retreated from overbought conditions on the RSI. Traders will watch the upcoming RBA minutes, wage price index, unemployment rate and full‑time employment change for the next cues.

CNH. China prices dip again. China’s consumer prices rose just 0.2% in January, falling short of the 0.4% forecast and slowing from 0.8% the month before. The statistics bureau said the softer reading reflected the timing of the Lunar New Year and cheaper oil, but those factors were already well understood. The miss underlines how stubborn China’s deflation pressures remain. Factory‑gate prices also stayed negative. Producer prices fell 1.4% from a year earlier—slightly better than expected and the smallest drop since July 2024—helped by firmer commodity prices and efforts to rein in excessive competition. USDCNH is now sitting near a 33‑month low. Key resistance stands at the 21‑day EMA at 6.9366, followed by the 50‑day EMA at 6.9766. Traders will watch upcoming new loan figures and the latest loan prime rate decision for the next signals.

JPY. Japan steps up watch. The Japan’s top currency official, Masato Mimura, said he is watching currency moves closely and with urgency, noting that Tokyo remains in steady contact with US counterparts. The yen has strengthened even after the LDP’s sweeping election win, pushing back against the so‑called “Takaichi trade” narrative. USDJPY has dropped more than 4% from its recent peak of 159.45, last reached on January 14. The next key levels to watch sit near the 100‑day average at 154.33 and the 21‑day average at 155.23. Market participants will keep an eye on upcoming GDP, trade balance, industrial production, national CPIs and S&P Global Services PMI.

MXN. Consolidating. On February 5, Banxico voted unanimously to hold the benchmark interest rate at 7.00%, effectively halting a sequence of 12 consecutive rate cuts. This decision was a direct response to core inflation accelerating to 4.52% y/y in January, its highest level since March 2024, driven by persistent cost pass-throughs from fiscal measures. With Banxico pushing back its 3% inflation target convergence to Q2 2027, the significant interest rate differential over the US Federal Reserve (currently around 325 basis points) continues to make the MXN a favored destination for carry trades. This week, after a strong US jobs report, the Peso has continued consolidating closer to 17.2. Next Friday, retail sales for the month of December will be of focus.

BRL. Yield appeal. The Brazilian Real (BRL) has demonstrated remarkable strength to start the year, appreciating approximately 3.5% against the US Dollar as of early February, trading closer to its lowest level since June 2024. This performance has been anchored by the “carry trade” appeal; the 15% Selic rate provides a massive cushion against volatility, especially as the greenback faces renewed global weakness. Currently trading in the 5.16–5.30 range, the BRL’s outlook for the remainder of Q1 remains positive, bolstered by high carry and a potential shift in investor preference away from US assets. However, the path forward will be tested by upcoming local catalysts, including fresh inflation data and political polls, which may determine if the BCB opts for a more aggressive 50bp cut in March should the currency’s appreciating trend hold firm.

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.