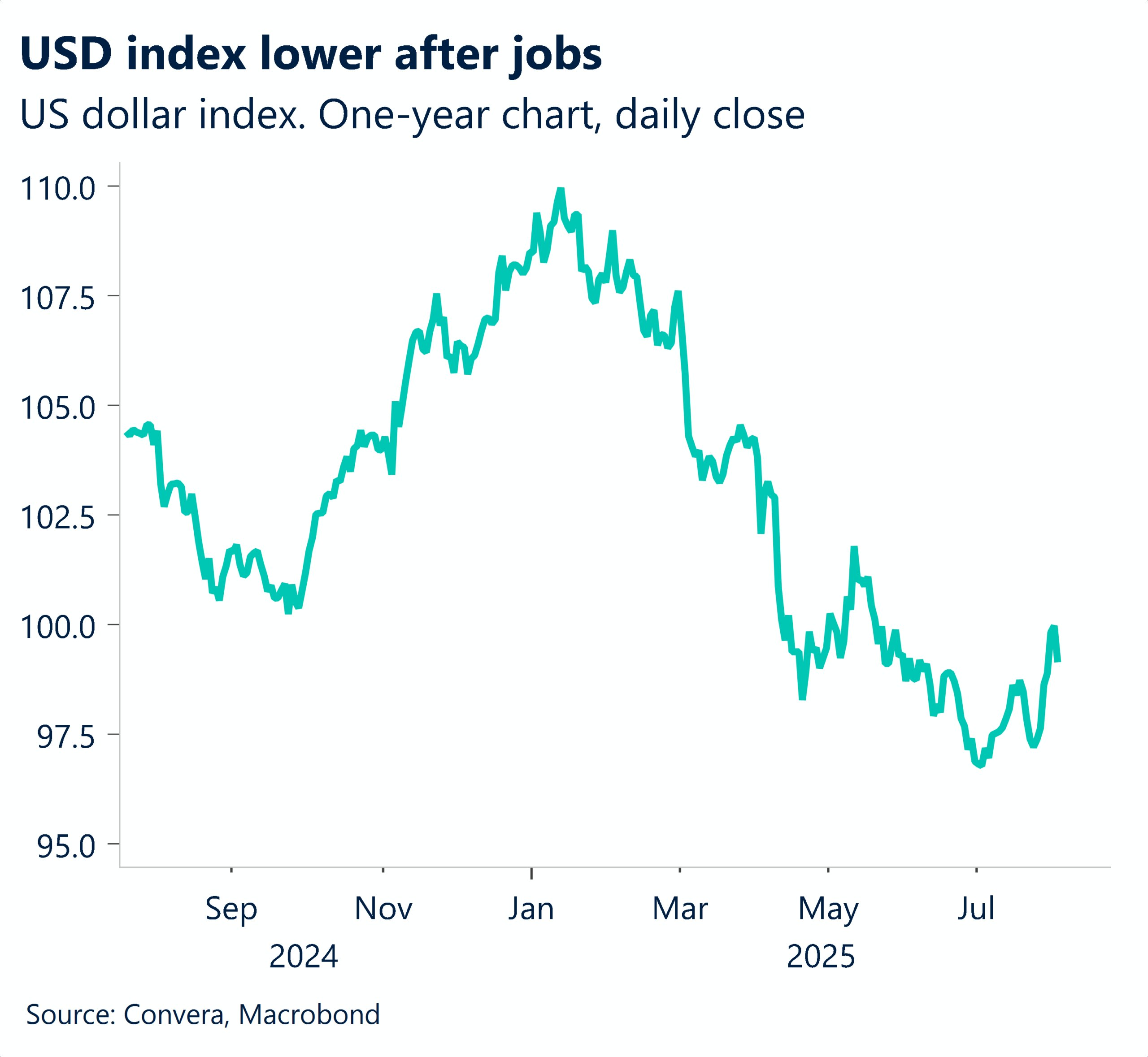

Greenback hit by jobs miss

The US dollar was sharply lower on Friday after a shock miss from the July non-farm payrolls report with previous results also revised lower.

The July report came in at 73k new jobs – just below the 106k forecast. However, the June report was revised from 147k to 14k while the May report was lowered from 139k to 19k.

Global markets were also unsettled after last week’s confirmation around the next phase of tariffs with US president Donald Trump signing a new executive order that would see changes in a many countries’ “reciprocal” tariff rates.

Notably, Switzerland now faces a 39% tariff rate while Canada was hit with a 35% rate.

Australia will face a 10% tariff while New Zealand sees a 15% rate.

After a strong run higher for most of last week, the US dollar fell on Friday.

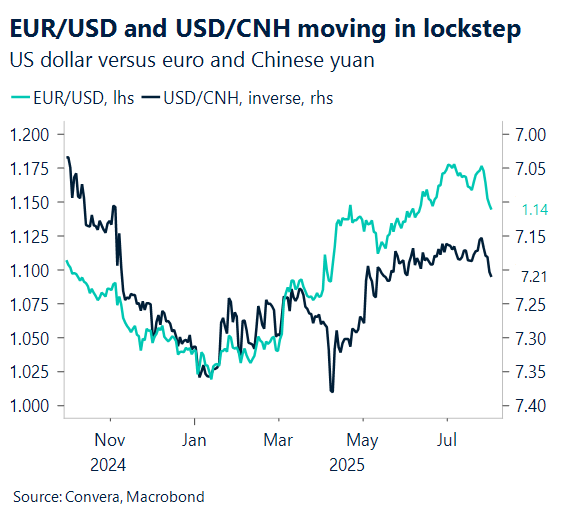

China’s factory slowdown sparks yuan pressure

Away from the US, China’s Caixin manufacturing index slipped to 49.5 in July, signaling a slowdown after June’s 50.4 and missing expectations of 50.2.

The drop matches the official factory reading of 49.3, marking a clear step back as U.S. tariffs bite and local demand stays weak. S&P Global also flagged a fourth straight month of falling export orders, with the pace of decline picking up since June.

Technically, USD/CNH has broken key psychological resistance of 7.2000. The next hurdles lie at 7.2392 and 7.2400. If the tide turns, support sits around the 100-day EMA of 7.2084 and the 50-day EMA at 7.1899.

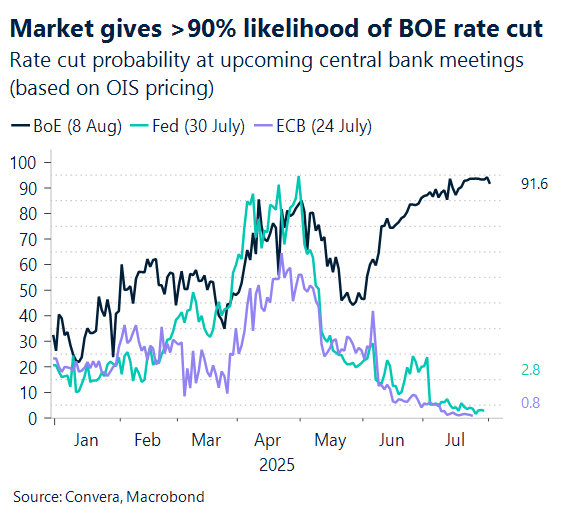

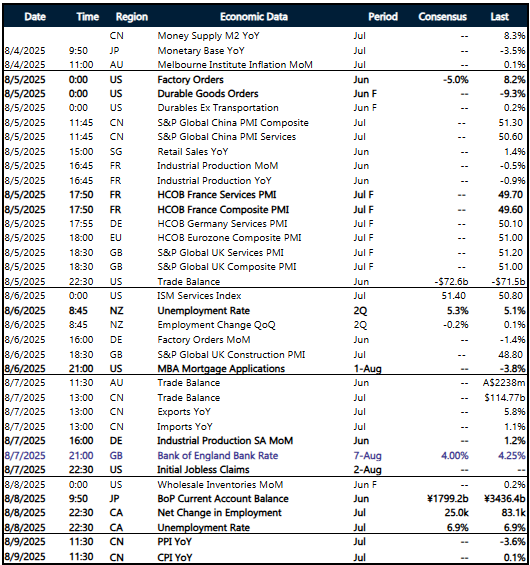

BoE rate cut, global data drive FX volatility this week

The coming week features a packed calendar, headlined by the Bank of England’s policy decision on Thursday. Markets are widely expecting a 25bp rate cut to 4.00%, down from 4.25%. With UK inflation still sticky and growth subdued, the tone of the BoE’s statement will be closely scrutinized for signals on the future path of rates and the pound’s direction.

A wave of final July services and composite PMI readings will set the tone early in the week, with releases from China, Japan, the Eurozone, UK, and US.

The US calendar is busy, starting with June factory orders on Tuesday, where consensus points to a mild contraction after last month’s gain. Wednesday brings the ISM Services Index for July, expected to edge up to 51.4 from 50.8, providing a timely read on the largest segment of the US economy. Weekly jobless claims on Thursday will offer the latest snapshot of labor market conditions.

China’s July trade balance is due Thursday, with last month’s surplus at $114.77bn and modest growth in both exports and imports. Over the weekend, July PPI and CPI will be released, with markets watching for signs of persistent deflationary pressures after June’s negative PPI and flat CPI.

Japan’s week includes the July monetary base on Monday, and the June current account on Friday. In Canada, Friday’s July labor force survey is expected to show a sharp slowdown in job gains, with unemployment steady at 6.9%. Both will be key for JPY and CAD direction.

Australia’s June trade balance and July inflation gauge, as well as German and French industrial production and factory orders, round out a week that should keep FX markets active.

USD ends week lower after US jobs miss

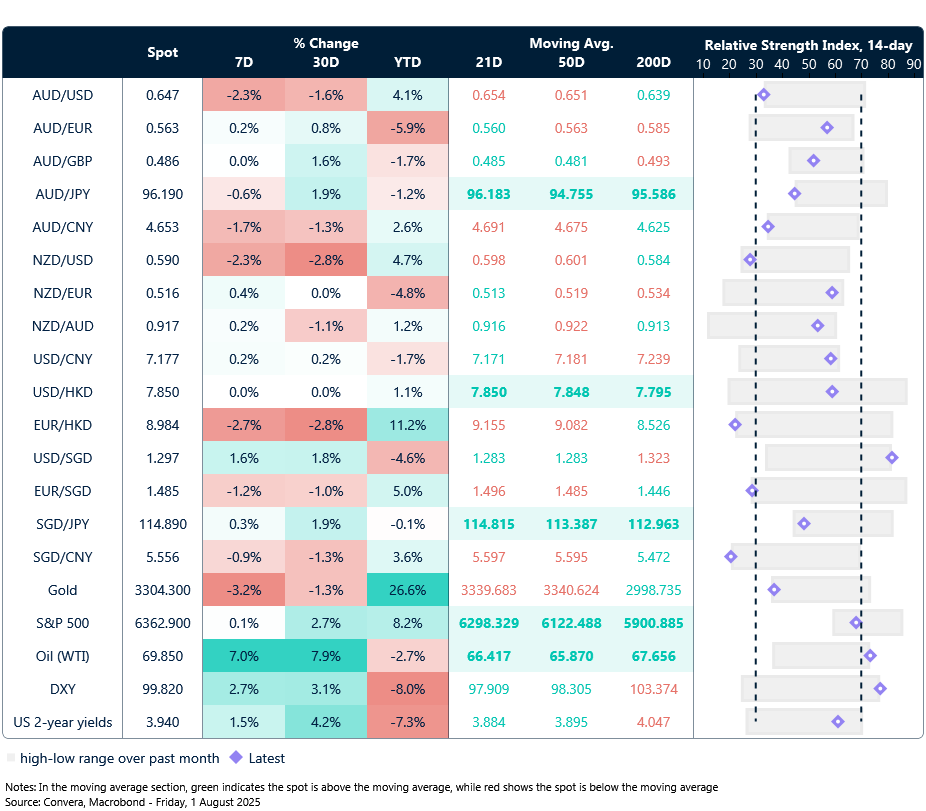

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 4 – 9 August

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.