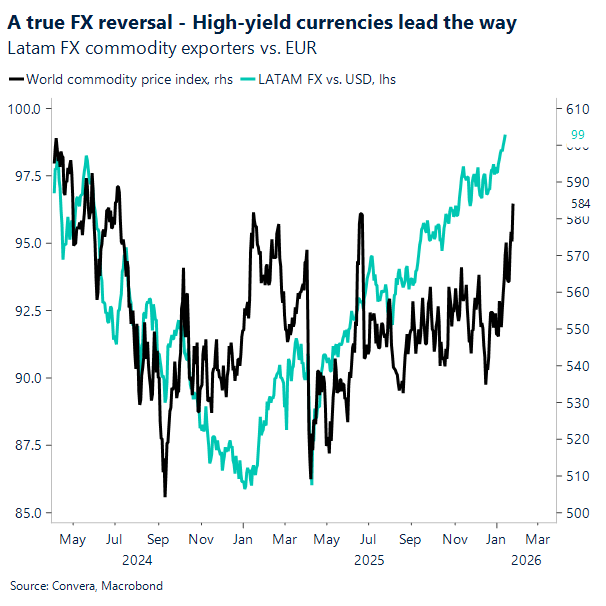

Emerging Markets: LatAm Alpha crushes global benchmarks

The investment playbook for 2025 was strikingly clear: pile into high-yield Latin American FX to capture the potent combination of carry, a soft USD, and commodity-driven valuation mean reversion. This environment of relative calm fundamentally lowered the risk premium required for cross-border investments, encouraging a broad-based migration of capital toward high-yielding assets as the fear of sudden exchange rate swings began to dissipate after ‘Liberation-day’. As risk premia compressed, global flows aggressively chased the best available mix of yield and growth, positioning LatAm as the definitive standout of early 2026 as these regional assets consistently outpaced global benchmarks.

The current rally draws striking parallels to the post-2009 liquidity bounce and the “commodity-off-the-floor” surge of 2016, yet the sustainability of this 2026 script hinges on a fragile set of conditions. For the trend to hold, DM real yields must remain low enough to support the carry, LatAm central banks must manage a gradual easing process that preserves critical rate differentials while metals/commodities momentum is sustained. However, the path ahead is littered with potential derailment factors, ranging from a sudden USD snapback or a global growth scare to a heavy election calendar (Brazil, Colombia, Peru, and Costa Rica) that could trigger a policy-credibility shock just as the carry cushion begins to erode.

Transitioning from these macro tailwinds to the specifics of the market’s most crowded trade, the “Super Peso” has become the ultimate poster child for this movement, though technicals suggest it may be approaching terminal velocity. As seen in the USD/MXN daily chart, the pair has plummeted to the 17.25 handle, driven by an unrelenting downtrend that has left every major moving average in the rearview mirror. With the 14-day RSI now buried deep in oversold territory, the sheer extension of this move is impossible to ignore. While the fundamental carry remains enticing, this level of parabolic momentum often invites a sharp mean-reversion, begging the question of whether the Peso trade is finally reaching a breaking point as it drifts dangerously far from its 200-day baseline.

CAD: Capitalizing on broad USD weakness

Current market dynamics are defined by a striking decoupling of the US Dollar from macro fundamentals. While the Japanese Yen has staged a relief rally following reported “rate checks”—a clear warning of potential coordinated intervention—its recovery remains fragile due to deep fiscal uncertainty ahead of the February 8th snap election. Meanwhile, the Greenback is faltering despite robust US data, weighed down by a “policy risk premium” linked to the Greenland shock; as investors aggressively hedge against US-specific instability, the Dollar is failing to capitalize on its traditional safe-haven status.

The Canadian Dollar has capitalized on this broad USD weakness, forcing USD/CAD down from 1.41 highs toward the 1.37 level as the extreme speculative short positioning of 2025 finally unwinds. This technical breakout is robust—slicing through the 20, 40, and 60-day moving averages—yet it masks a distinct lack of idiosyncratic demand. While commodity-linked peers like the Australian and New Zealand Dollars have surged roughly 3.5% to lead the G10 pack, the Loonie remains virtually flat year-to-date. Ultimately, while the normalization of bearish bets provides a floor, a lingering tariff risk premium caps the currency’s upside, leaving it largely a passive beneficiary of the Greenback’s decline rather than a leader in its own right. As US Dollar sell dominates ahead of the Fed meeting, the CAD is poised to consolidate closer to 1.36.

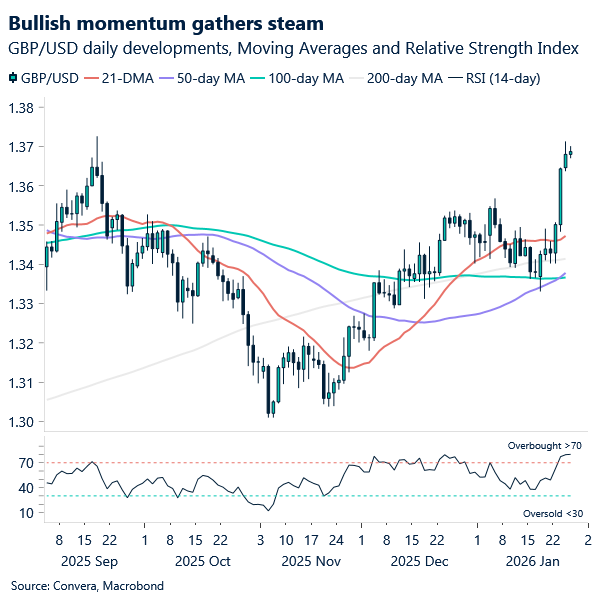

GBP: Trading near 4-month high

GBP/USD is trading around the $1.37 handle, its strongest level since mid‑September, with broad‑based dollar weakness doing most of the heavy lifting. A range of currencies are marking multi‑week and even multi‑year highs against the dollar to start the week. Heightened US policy uncertainty under the Trump administration — spanning foreign policy, trade tensions, and questions around the Fed’s independence — has already been weighing on the dollar, and last week’s rate check only adds another layer to that pressure.

GBP/USD is trading comfortably above all the key daily and weekly moving averages, signalling potential for more upside, however a note of caution is an overheated daily Relative Strength Index, which suggests the move may be running a little hot in the very short term.

GBP/EUR has also been performing well, extending a six‑week run of gains and holding near the €1.15 level after trading below €1.13 just a couple of months ago. Technically, the pair has rebuilt momentum, reclaiming its short‑term moving averages — the 9, 21, 50 and 100‑day measures — which reinforces the improving tone.

The challenge remains the 200‑day exponential moving average around €1.1556, a level that has repeatedly capped rallies since early January. A decisive break above this barrier would open the door to a more durable upside extension, while continued failures here risk another spell of consolidation.

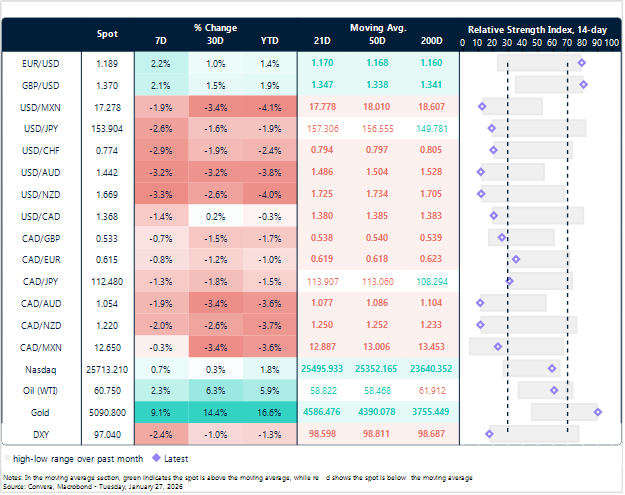

Market snapshot

Table: Currency trends, trading ranges & technical indicators

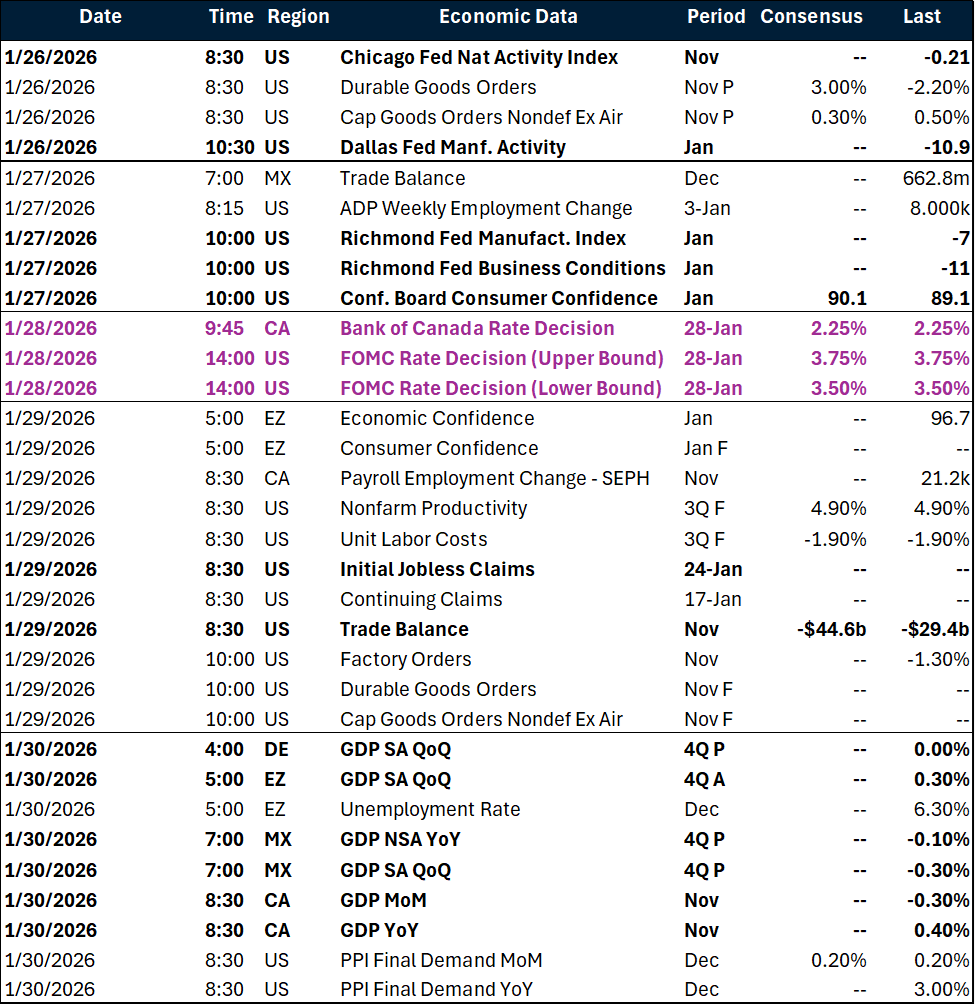

Key global risk events

Calendar: January 26-30

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.