Euro eyes 1.18, pending key signals

EUR/USD closed last week about 0.8% higher before hitting resistance at $1.1760. Dovish leanings from the Fed fueled the move, though the dollar steadied on Friday as the Fed’s nonetheless highly cautious stance, with its “we need more data” mantra ever present, could not justify further upside from there.

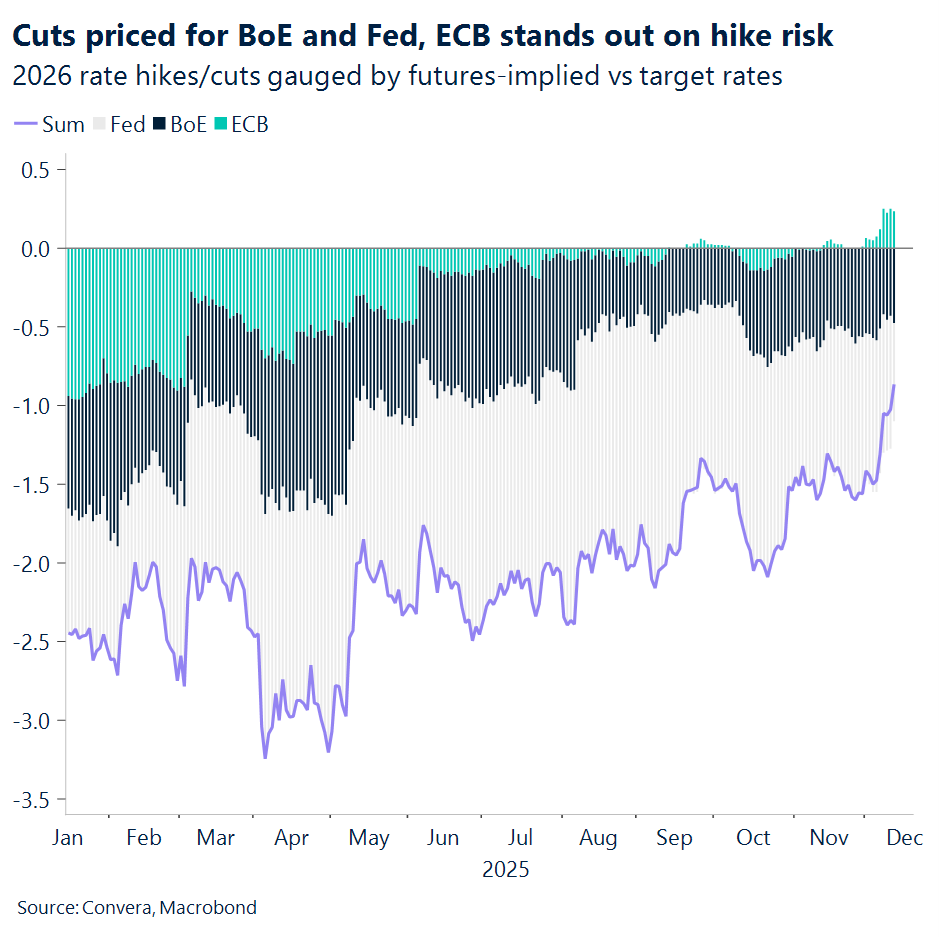

Against last week’s global hawkish recalibration, the euro leg may have a chance to shine in driving the EUR/USD rate spread higher, thereby supporting the euro. We see risks that Lagarde’s messaging at Thursday’s policy meeting may substantiate the recent hawkish switch, crystallizing rate differentials in favour of the common currency.

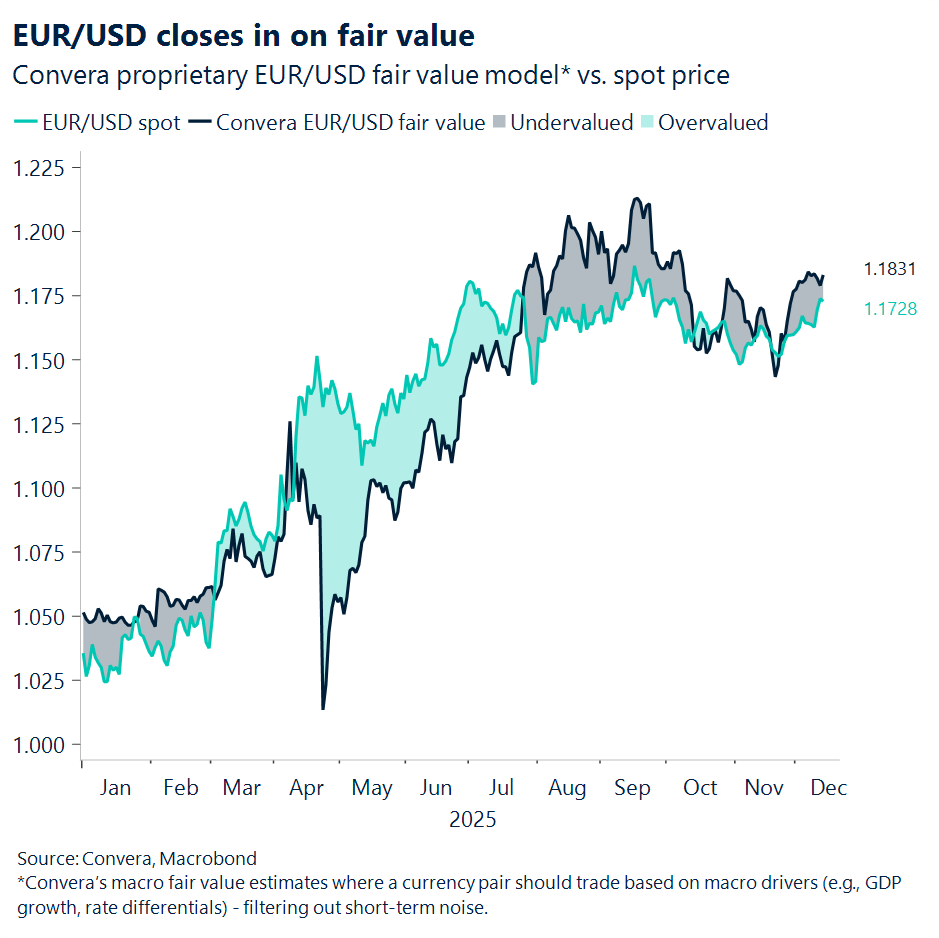

Also, while our EUR/USD fair value suggests spot looks more balanced today compared with a few weeks ago, it still points toward $1.18 lows, suggesting further upside appears fundamentally warranted. To see year‑end levels comfortably in the $1.18 zone, or even testing year‑to‑date highs at $1.1919, two conditions would be needed: a material NFP miss tomorrow and hints of hikes from the ECB.

However, the potential re‑emergence of a French fiscal premium cannot be ignored, with the main budget vote scheduled by year‑end. Last week, Prime Minister Lecornu narrowly survived a crucial test as parliament backed the 2026 social security bill. Prospects now look stronger for passing the main state budget, though risks remain and could weigh on the euro should the vote fail.

On this quiet day before the storm, expect range‑bound behaviour in EUR/USD between $1.17 and $1.1760.

Sterling’s fate tied to data and Bailey

The contraction in UK GDP monthly growth for October last Friday pushed GBP/EUR away from resistance at €1.1460, which was repeatedly tested in December, leaving the pair near the top of the €1.13 zone waiting for the next catalyst.

With the BoE and ECB holding their final policy meetings of the year on Thursday, alongside a slew of macro indicators, attention will be firmly on tomorrow’s UK labour market report, Wednesday’s inflation release, and Thursday’s BoE decision. On the eurozone side, beyond the ECB meeting, we will also scrutinise Wednesday’s inflation print. In line with our EUR/USD analysis above, we see upside risks for the euro should Lagarde corroborate her preference for a hike more strongly than markets currently anticipate. Meanwhile, the BoE is expected to cut, and the extent to which Bailey conveys dovishness will weigh on sterling to varying degrees. A lower‑than‑expected inflation print would be a crucial condition for louder dovish voices to emerge. Should the UK macro backdrop undershoot further, following last Friday’s weak GDP result, we see scope for renewed sterling declines, with €1.1350 and €1.13 as key support levels to monitor for GBP/EUR.

For GBP/USD the balance of risks may be more neutral this week, with tomorrow’s NFP likely to be as forceful, if not more so, in swaying cable than Bailey’s messaging. The latter may turn out to be a bit of a flop in moving FX if the MPC Chair gives no hints of a more pronounced inclination toward further easing. On the upside we see a test of $1.35 as likely, while the downside points to a return to the $1.32 zone.

Chinese yuan extends gains despite weaker data

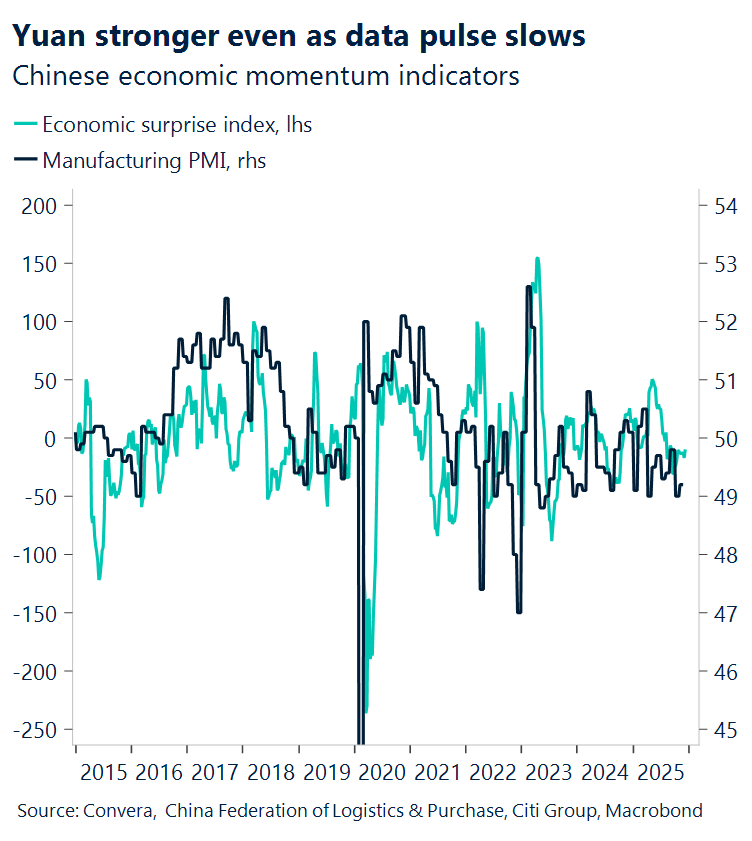

The Chinese yuan strengthened further on Monday despite softer results from key monthly indicators, including industrial production, retail sales, and fixed asset investment.

Annual retail sales growth slowed sharply to 1.3% in November, down from 2.9% in October, while industrial production eased from 4.9% to 4.8% over the same period.

The yuan has recently been firmer, with USD/CNH at an 18-month low. The move has been partly driven by USD weakness, with the yuan’s gains less pronounced against the euro and British pound.

The currency’s strength has impacted local companies, with state-owned financial newspaper The Securities Times reporting last week that Chinese corporates have seen a sudden surge in hedging activity.

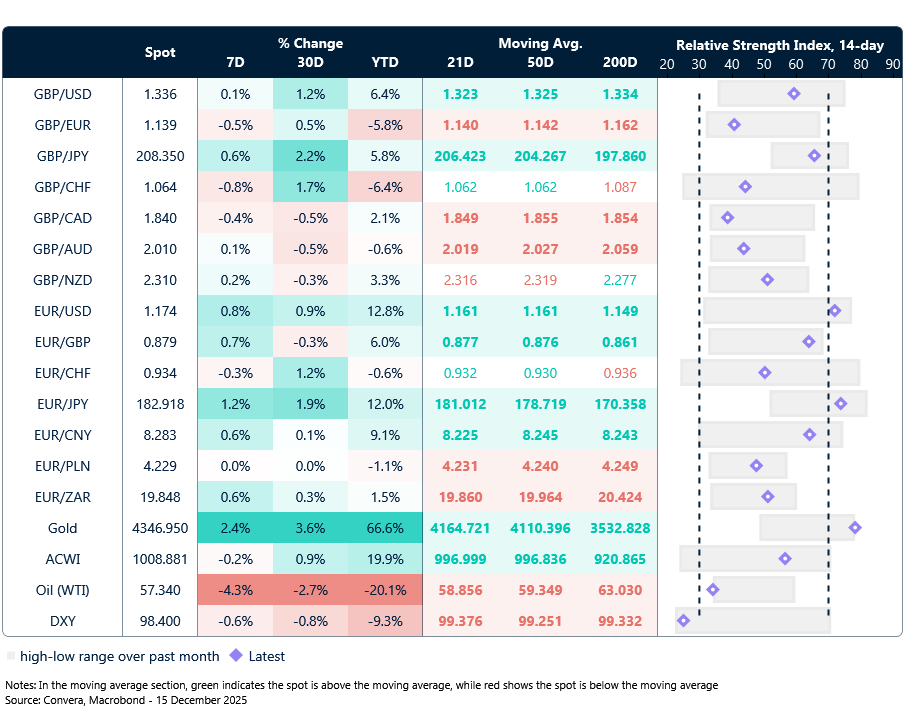

Market snapshot

Table: Currency trends, trading ranges and technical indicators

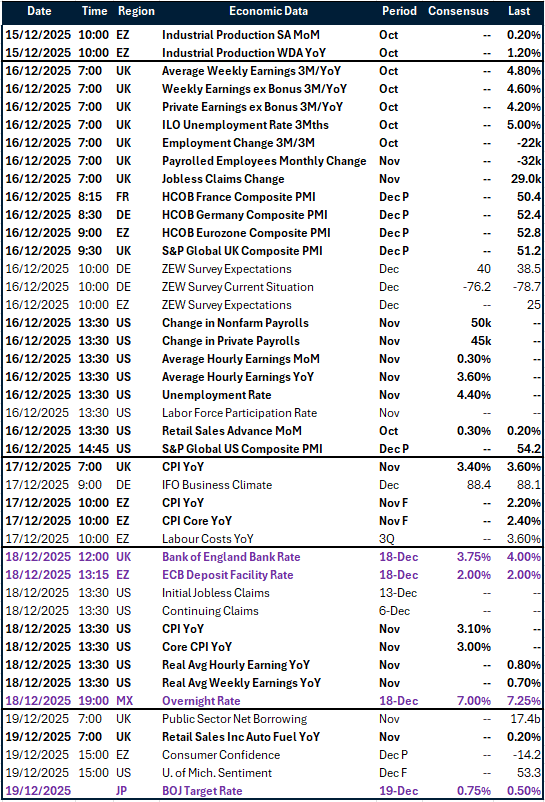

Key global risk events

Calendar: December 15-19

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.