USD: King Dollar’s heavy golden crown

Richmond Fed President Tom Barkin stripped away the pleasantries last week when he noted that “Today’s economy has two engines – AI and the rich.” It is precisely this top-heavy reality that the U.S. administration is scrambling to rebalance as the headlines turn relentless and focus shifts ahead of the midterms. This shift—marked by everything from defense sector buyback changes and credit card rate caps to new restrictions on corporate home ownership—serves as the aggressive tactical front for Treasury Secretary Scott Bessent’s “3-3-3” agenda, mentioned a few days ago on an interview. By targeting 3% growth, a 3% deficit, and 3 million new barrels of oil daily, the administration is attempting to broaden the current rally into an industrial renaissance. Bessent is betting that running the economy “hot” and deregulating aggressively can spark enough organic growth to outpace the nation’s $38 trillion debt burden. It is a calculated attempt to pivot from a government-led economy to a private-sector one, but it forces the U.S. into a delicate experiment: trying to inflate the engines of growth without blowing the gaskets of fiscal stability. If the administration succeeds, that narrow “AI and the rich” rally broadens into a full-blown industrial revival, leaving the deficit hawks screeching into the void while the U.S. GDP prints numbers Europe hasn’t seen since the 90s.

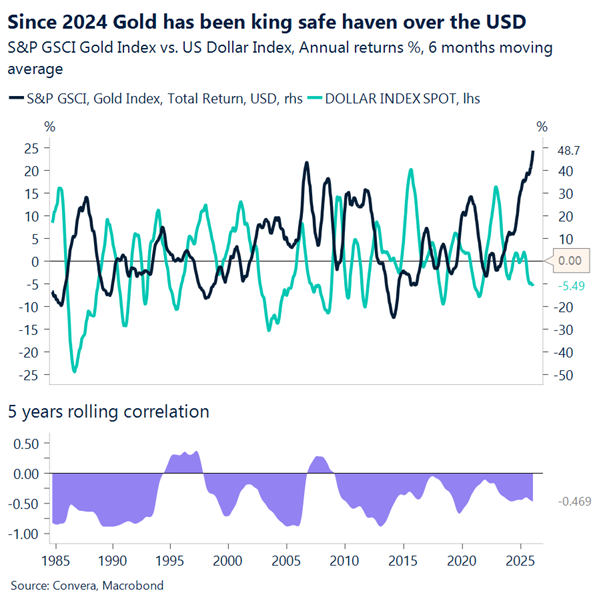

However, the assumption that markets are simply swallowing this pill without side effects is naive. While the dollar remains preferred in the basket of global fiat currencies, a deeper fracture is appearing elsewhere. Gold and safe-haven metals are pushing all-time highs, signaling a profound shift in how capital perceives safety. This isn’t just about inflation hedging; it is a vote of no confidence in institutional credibility. The diplomatic feuds over Greenland and the overt threats to Federal Reserve independence—echoed in the “Shadow Fed” proposals—have investors seeking assets that cannot be debased by a tweet or a policy shift. Capital is bypassing the fiat system entirely for hard assets, creating a bifurcated reality where the dollar reigns supreme over the Euro and Yen, but loses ground to Gold.

However, there’s a key nuisance. While the headlines scream about “institutional erosion” and “debt spirals,” bond and equity markets are quietly pricing in a different reality: American Exceptionalism 2.0. When the Fed Governor’s Lisa Cook removal was announced, the bond market didn’t panic with a spike in yields as many feared; instead, long-end breakevens fell. This suggests the bond market believes it remains the “final arbiter”—a disciplinarian that will force yields up and choke off the economy if the administration gets too reckless. Investors know that no administration, regardless of its rhetoric, can afford to let mortgage rates spiral and crush the housing market. The bond market is effectively acting as the guardrail that politics cannot dismantle, providing a floor of sanity that keeps the dollar viable even as the political noise gets louder.

Yet the simultaneous flight to gold reveals that the current administration’s trust premium is thin. We are walking a tightrope where the “3-3-3 gamble” must deliver perfect execution: if the growth materializes, the debt becomes manageable and the dollar holds; if the institutional erosion continues without the economic payoff, the bond vigilantes will eventually revolt, and the safety valve of gold will become the main event. The dollar is winning the currency war but fighting a harder battle for long‑term institutional trust.

EUR: Best day in more than a month

The euro logged its strongest daily gain against the US dollar in more than a month on Monday. The move was only about 0.5%, but a 1‑day Z‑score of +2.4 versus the 20‑day average underlines just how unusually quiet the world’s most‑traded currency pair has been. Even small moves now look outsized simply because volatility has been so muted.

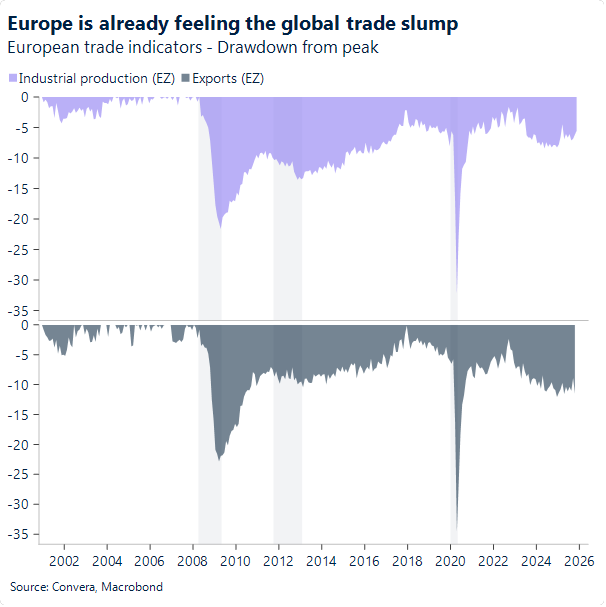

The euro’s move higher comes just as trade tensions flare up again. Trump’s latest tariff threats on European allies — and the EU’s response — echo a pattern we saw repeatedly in 2025: whenever the US rolled out a new tariff plan, the dollar weakened and the euro strengthened. The first half of 2025 made it clear that the euro was the main beneficiary of the “sell America” theme in FX markets. That dynamic still holds today, even though Europe is now the one facing the new round of tariff threats.

But Europe’s previously threatened retaliatory tariffs only covered a small slice of US imports, and the EU is far more dependent on selling goods to the US than the reverse. This asymmetry means that if Europe slapped tariffs on all US products, the economic damage would still fall more heavily on Europe, given its greater reliance on trade. Plus, as we mentioned in yesterday’s report, Europe’s key weakness in today’s transactional geopolitics is clear: without energy self‑sufficiency, it lacks real leverage.

GBP: Labour weakens, sterling waits

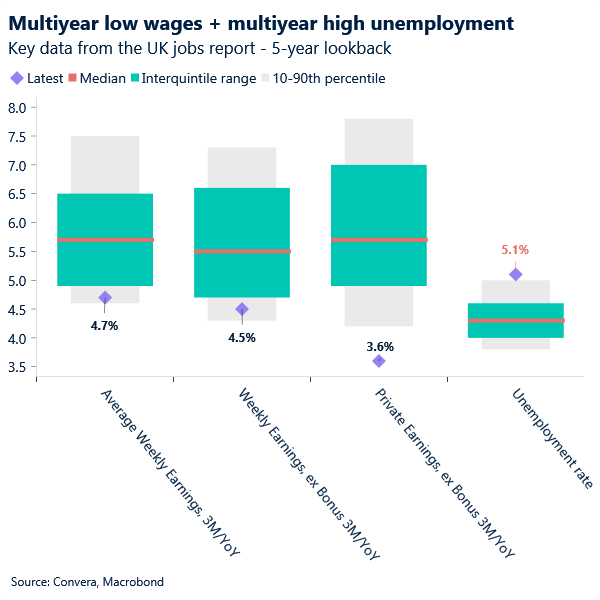

The UK jobs report was released this morning. Weekly earnings excluding bonuses matched expectations at 4.5% in the three months to November ( down from 4.6% in the three months to October). Private-sector earnings excluding bonuses missed forecasts at 3.6% (est. 3.7%), the weakest pace since 2020. The unemployment rate held at 5.1%, a multi‑year high, while the payrolled employees measure continued to show job losses, with a decline of 43k in December compared with expectations for a 20k drop. Overall, the report underscores the ongoing softening in the UK labour market.

As expected however, sterling’s immediate reaction was muted, consistent with the dynamics highlighted in yesterday’s daily report. The pair remains driven by geopolitically coloured US developments, while a paralysed MPC removes much of the influence that UK data would normally exert.

Investors are instead waiting for a clearer shift in communication from the more hawkish rate setters, since even one official changing their stance could materially alter the expected policy path. Meanwhile, the UK’s softening labour‑market trend is well understood and already embedded in the cautious pricing of BoE easing into 2026, leaving market reactions far more subdued.

Attention now turns to tomorrow’s inflation report. The outlook continues to soften, with headline inflation expected to fall from 3.2% in November to around 2% from April onwards. Given inflation’s role in keeping rate setters from turning more dovish, a more material miss could influence GBP more meaningfully than this morning.

For today we nonetheless expect GBP to stay offered, due, as explained, not so much by today’s jobs report but by the heated tariff tensions with the US that position the UK as a key target. GBP typically struggles in broad risk‑off moves, and the current backdrop offers little support.

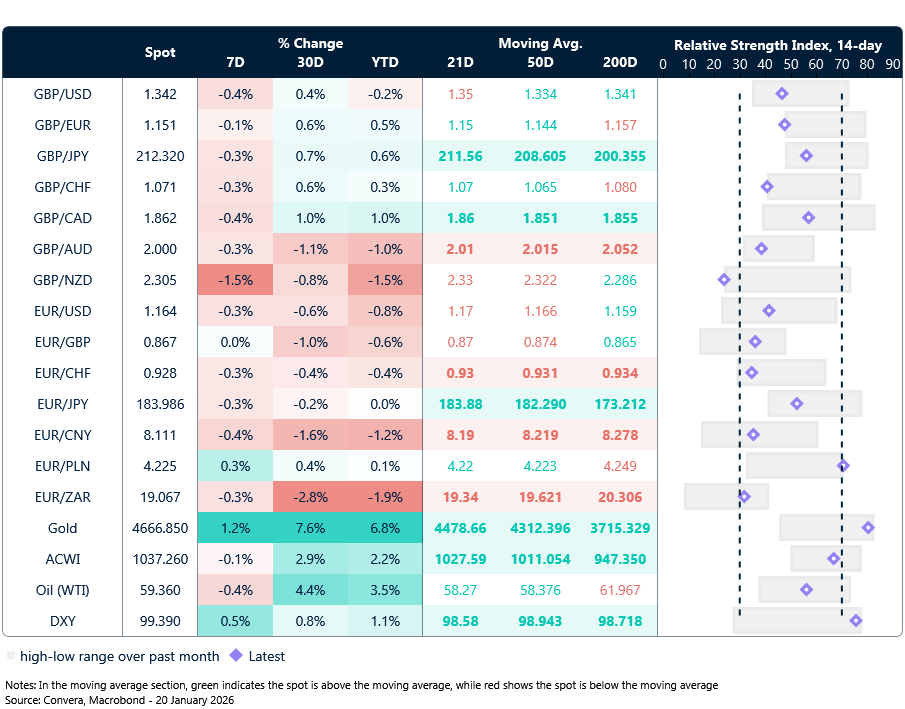

Market snapshot

Table: Currency trends, trading ranges & technical indicators

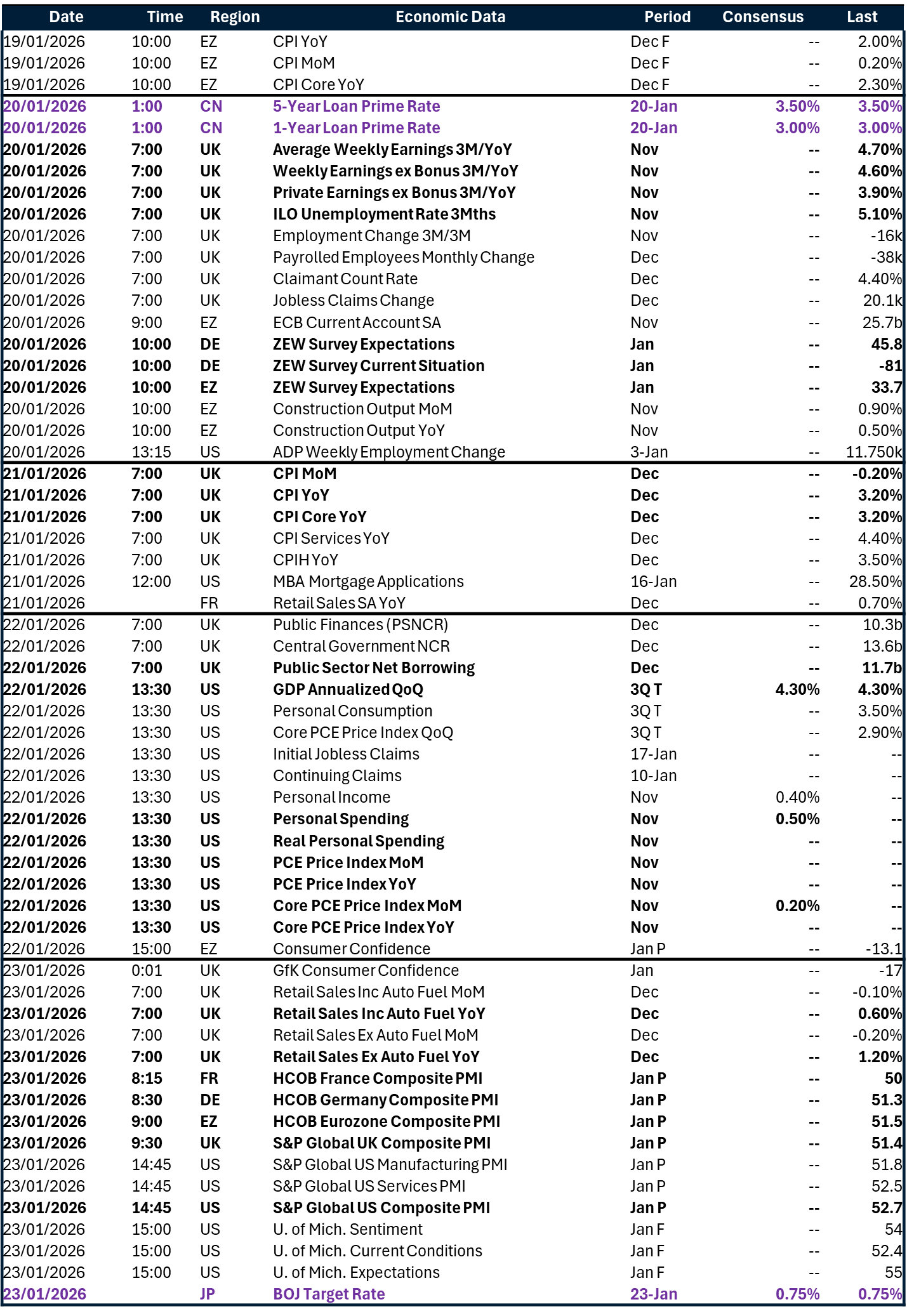

Key global risk events

Calendar: January 19-23

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.