USD: Dollar stumbles as trade risks multiply

Despite somewhat appeasing words from President Trump yesterday – “we will probably be able to work something out” – that may certainly help contain further important losses in the dollar today, we remain at peak trade tensions. This time, markets are facing a far more confrontational Europe, adopting something closer to a China‑style approach, and the shift is rattling sentiment. Equities retreated while high‑beta currencies took the brunt of the move. We are hearing mind‑boggling threats of a 200% tariff on France’s champagne imports – something markets might have taken in stride had it not been paired with immediate retaliatory action from Europe. The VIX briefly pushed above 20 for the first time since November, suggesting markets may no longer be willing to shrug off geopolitics as much as they were earlier this month.

Add to this an imminent Supreme Court ruling that may deem Trump’s tariffs illegal, the nomination of the next Fed chair – almost certainly a dove – and the still‑fresh escalation of intervention in Fed affairs via the DoJ’s legal route, and the dollar is trembling on reignited “sell‑America” fears, having fractured a bullish setup that saw the dollar index riding above all key moving averages, now piercing back through the 98 zone. In other words, while the bar was high for further dollar weakness on this front, when you get a confluence of de‑dollarisation themes coupled with Europe’s retaliatory stance, market calmness begins to crack.

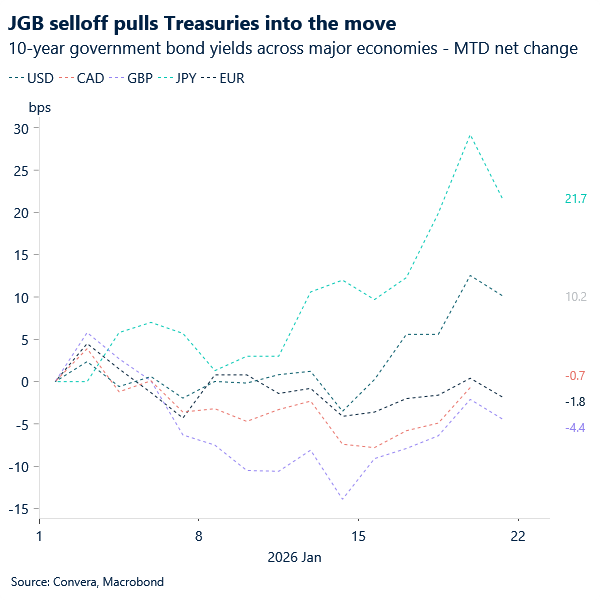

Coincidentally, bonds sold off in Japan, where Prime Minister Takaichi official called for an early snap election on February 8 aimed at shoring up her ruling party’s narrow coalition majority. The announcement heightened concern that it may pave the way for looser government spending that exacerbates the nation’s already fragile finances while adding fuel to still‑elevated inflation. JGB long‑end yields jumped to their highest levels in decades. Treasuries followed, a typical cross‑market contagion move that was nonetheless justified by domestically driven factors, compounding dollar bearishness.

However, overnight, we saw JGBs rebound, and Treasuries followed, stripping away a bearish catalyst from what is likely to be a calmer day for the dollar as markets await further developments before committing to a more defined view of sharp USD selling.

One thing to note here is that while sell‑America fears inevitably made a comeback, sending the dollar 0.8% lower week-to-date, these are unlikely to resemble the 2025 post‑Liberation Day episode. Investors are now far better USD‑hedged compared with the highly unhedged 2025 environment that warranted heavy dollar selling. Also, there is still an inclination to look through these geopolitical flare‑ups and lean on the resilient US macro story to justify a more orderly dollar profile at the start of 2026, yet markets are waiting for further updates before challenging, or re-embracing, that narrative with greater conviction.

EUR: Greenland standoff lifts the euro

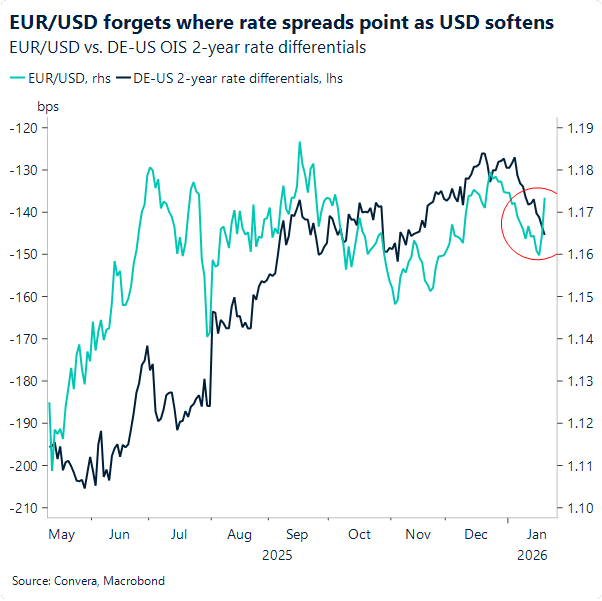

Amid this geopolitical flare‑up over Greenland, we are seeing renewed demand for the euro, one of the clearest beneficiaries of dollar weakness and a move that recalls 2025 dynamics. These are sentiment‑driven, somewhat reactionary demand flows that do not account for the longer‑term economic implications of higher tariff rates for the bloc, which would most certainly hurt the euro through weakened competitiveness.

We believe that what amplified the broad push higher in the common currency was a firmer Europe: a more pronounced retaliatory stance, including plans to apply 93 billion euros worth of tariffs on US goods alongside public and broad‑based condemnation from European leaders of Trump’s coercive move. By contrast, a more subordinate Europe saw the currency free‑fall against the dollar back in July after a trade deal between the two economies that left the US reaping most of the benefits. One could argue that a diplomatic resolution on the Greenland issue that stops short of granting outright ownership of the territory to the US but still expands, questionably, its military presence may turn into yet another euro‑negative story.

Let’s not forget the bearish setup that was brewing in EUR/USD before this geopolitical escalation, with the pair inches away from the 200‑day moving average and hedge fund positioning turning bearish for the first time since November. A poorly negotiated deal over Greenland could easily re‑establish that bearish setup. For now, any move capped at 1.18 appears justified, as the 1.15 to 1.18 range has been the trading map investors have grown accustomed to for months. But for a sustained break above it, without a more dovish turn from the Fed to support the move, sentiment‑driven dollar selling looks insufficient to generate more durable bullish momentum in the pair.

While reaching some sort of compromise over Greenland remains our base case, of course we cannot exclude the possibility that the 1.18 ceiling becomes more vulnerable if we see a significant escalation from here.

GBP: Gains against USD, losses against EUR

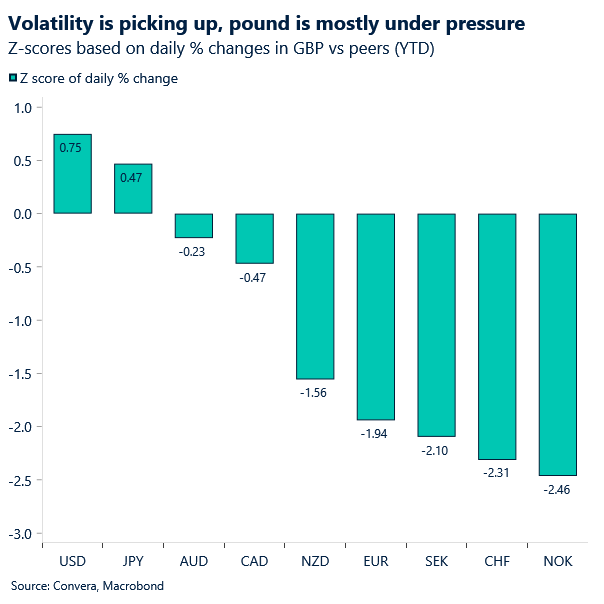

Two key narratives are shaping markets this week: renewed tariff threats tied to Trump’s push over Greenland and rising global bond yields driven by Japan’s difficulty finding buyers for its long‑term debt. This backdrop has lifted realised FX volatility, while implied volatility has climbed to one‑month highs across several tenors.

For sterling, this has meant weakness against the euro but gains against the dollar, as markets price in higher risks around the US–Europe Greenland standoff. The sharpest move is in GBP/EUR, where a 0.5% drop yesterday sits more than two standard deviations below its 20‑day average. In a low‑volatility regime, that kind of move stands out — leaving the cross more vulnerable to either a volatility pickup or a mean‑reversion snapback.

The euro continues to benefit as the main large, liquid non‑USD alternative, even though it is the one facing Trump’s tariff threats. The New Zealand and Australian dollars are also advancing, helped by their geographic distance from the dispute — with NZD now over 1% stronger versus sterling week‑to‑date.

On the rates side, 10‑ and 30‑year gilt yields have jumped to their highest levels in almost a month, hinting at renewed pressure for Chancellor Rachel Reeves. While much of the move reflects developments in Japan, a wave of global bond supply and rising inflation concerns are adding to the upward pressure. Recent data suggest the disinflation process has stalled across many major economies.

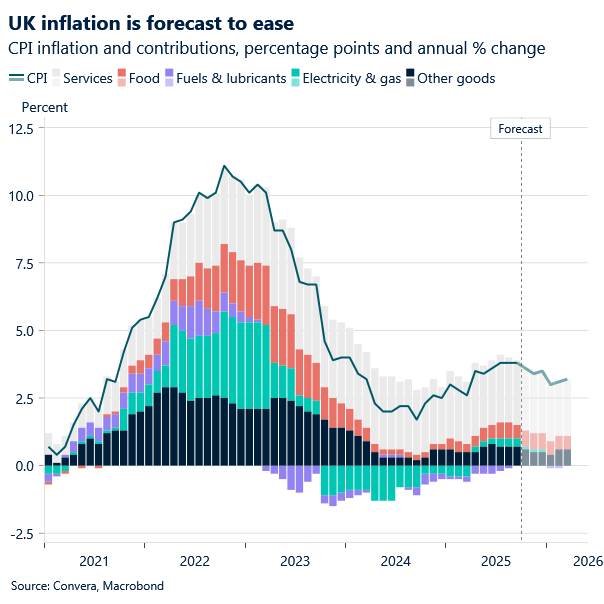

Mixed inflation numbers

This morning’s UK inflation report showed headline CPI at 3.4%, slightly above expectations, while core (3.2%) and services CPI (4.5%) came in marginally softer. With no major surprises, the release hasn’t shifted expectations for Bank of England rate cuts, with markets still pricing just over 45 bps of easing by year‑end.

Sterling’s reaction has been muted, with GBP/USD holding above $1.34 and yesterday’s GBP/EUR sell‑off stabilising around the 100‑day moving average near €1.1460.

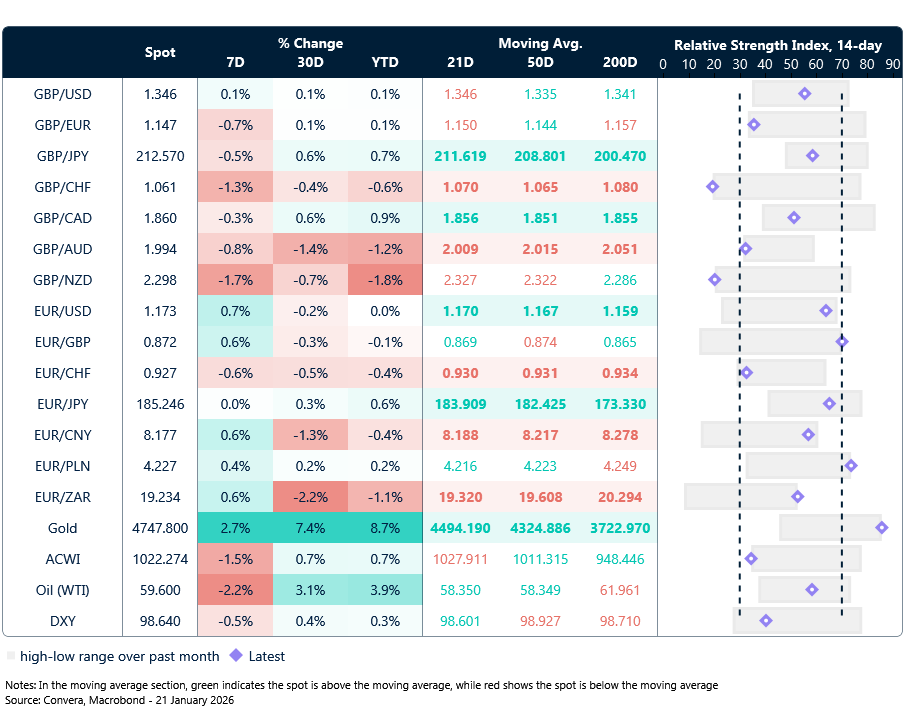

Market snapshot

Table: Currency trends, trading ranges & technical indicators

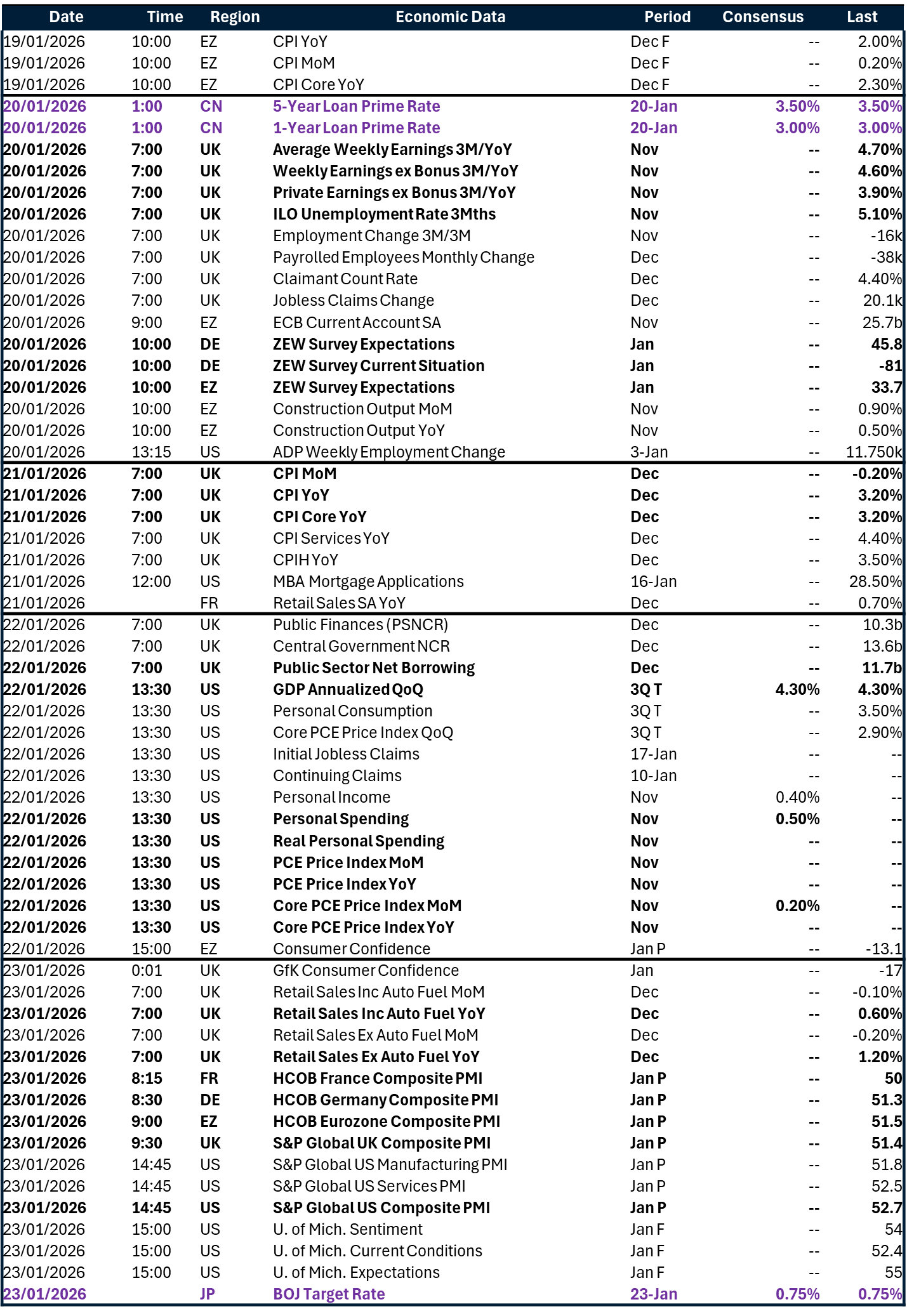

Key global risk events

Calendar: January 19-23

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.