Written by Steven Dooley, Head of Market Insights

Global overview

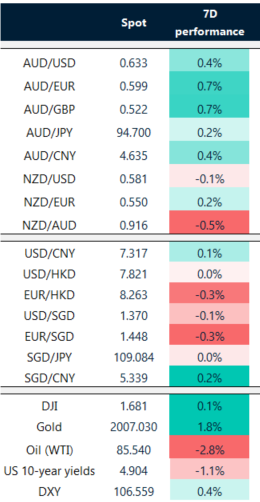

The US dollar was broadly steady on Friday as global sharemarkets continued to be pressured. The Aussie and kiwi both saw small gains on Friday after touching new lows last week. The Bank of Japan and US Federal Reserve decision are in focus this week.

Global markets pressured

Global sharemarkets extended losses on Friday with high interest rates and geopolitical tensions weighing on sentiment.

The benchmark S&P 500 fell 0.5% on Friday to end the week down 2.5%.

Marketwide fears have seen the safe haven appeal of the US remain compelling with the USD index up 0.5% last week and near 11-month highs,

This week, apart from elevated bond yields, concerns in the Middle East and further news on US corporate earnings, markets will also be looking to major decisions from the Bank of Japan on Tuesday and the US Federal Reserve on Thursday.

BoJ move could drive USD/JPY lower

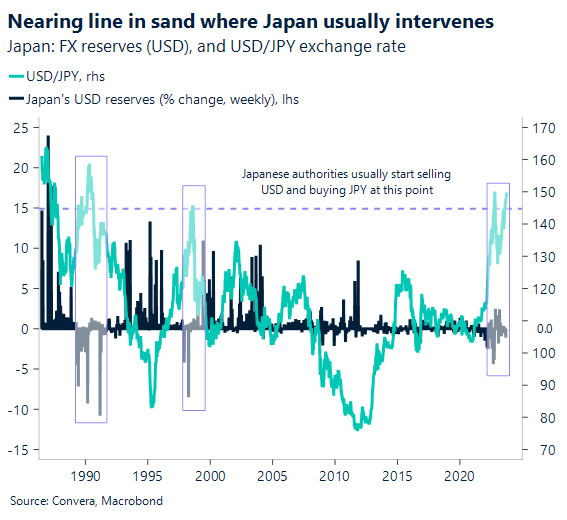

The Bank of Japan might look to tweak policy this week and this could have a big impact on the USD/JPY.

The BoJ’s quarterly outlook report, which includes the board members’ estimates of real GDP growth and CPI through FY2025, will be released together with the monetary policy meeting scheduled for October 30-31. We expect that the BoJ will increase the effective cap of the yield (or the rate for fixed-rate bond purchase operations) from 1.0% to 1.5% and its long-term policy rate, or the 10yr JGB yield target, from around 0% to about 0.5%.

The board members are not yet certain that they can meet the 2% inflation objective in a sustainable and consistent way, together with wage rises, and the BoJ is essentially dovish in the current regime. However, the recent rise of geopolitical risks may make the BoJ hesitant for any policy change. A smaller 25bp hike or more muted Yield Curve Control (YCC) adjustment, such as just raising the cap, cannot be ruled out.

The USDJPY has breached key psychological 150 level and the key risk now is for intervention from the Ministry of Finance (MOF). However, we think that in an effort to stop the yen’s sell-off, we expect that the MoF will step in somewhere between 150 and 155 levels. Next week, all eyes will be on BoJ Interest Rate Decision, JibunBK Mfg PMI Final SA, Monetary Base YY and Unemployment Rate.

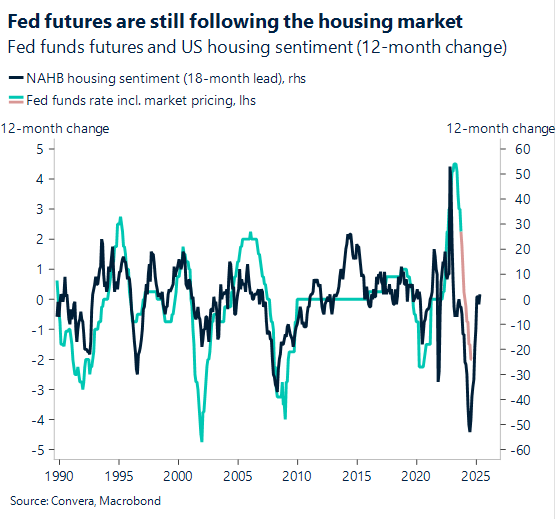

US housing suggests Fed nearly done

In US housing, sales of brand-new single-family homes increased 12.3% in September to 759,000 seasonally adjusted annual rate (saar). The sales decline for August was more than offset by this most recent rise, and the September sales figures exceeded forecasts by a wide margin.

If we limit our analysis to new house sales data, we can see that activity has been trending upward recently. Sales are up around 41% saar over the last six months and nearly 53% saar over the last three months. However, this series is not seen to be a highly reliable housing indicator since the new house sales statistics are erratic and sometimes susceptible to changes that may be significant.

Moreover, a number of other housing indicators have recently declined; these indications are more in line with the theory that the recent rise in mortgage rates should be having a negative impact on the number of people purchasing homes.

The chart below, however, shows US housing sentiment may have bottomed – and housing sentiment tends to lead Fed Funds Rate by 18 months.

Aussie, kiwi lift from lows

Table: seven-day rolling currency trends and trading ranges (apologies, full table not available today)

Key global risk events

Calendar: 3 October – 4 November

All times AEDT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.