The Daily Market Update will take a break over the holiday period. Our final edition will be published on 19 December 2025, and the report will return on 5 January 2026. Our offices will remain open as usual but will observe local public holidays. Contact your account representative for more information.

US inflation undershoots all forecasts

November’s inflation miss knocked US yields lower and kept the USD on the back foot yesterday. However the dollar index is proving surprisingly resilient towards week-end despite a raft of dovish US data of late. The dollar index is up on the week, sure, but it is still down 0.8% month‑to‑date and on track for its worst year (-9%) in more than two decades.

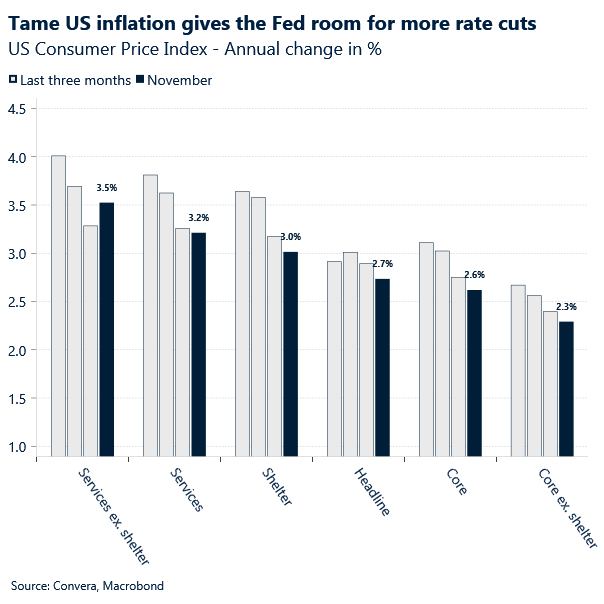

US inflation unexpectedly fell to 2.7% in November, well below the consensus forecast of 3.1%, while core CPI rose just 2.6% — the lowest since 2021. The softer print strengthens the case for Fed doves to push for additional rate cuts if December data weakens further. It also eases stagflation concerns, reviving a “Goldilocks” narrative for equities.

The sharp downside surprise may have been exaggerated by data‑collection disruptions during the federal shutdown, but markets seized on the signal. The S&P 500 snapped a four‑day losing streak with a 1% gain, Bitcoin jumped 3%, and talk of a Santa rally resurfaced.

Meanwhile, Treasury yields dropped across the curve and the US dollar depreciated against all its major peers. The dollar’s losses were capped somewhat by some more data showing labour market resilience; weekly initial claims fell by 13,000 to 224,000 – bringing the 4-week average to 217,000.

Bottom line: The inflation miss is a clear catalyst for more Fed easing, which should in theory keep the dollar under pressure and risk assets buoyant into year‑end.

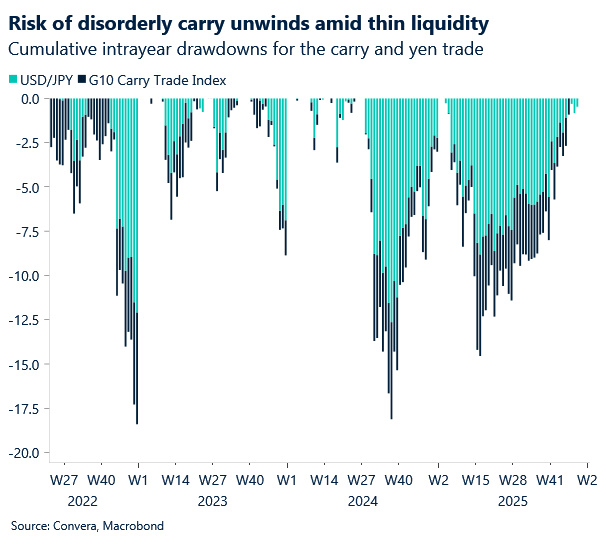

Japanese yen back at lows after BoJ hike

The Japanese yen was mostly lower this morning after the Bank of Japan raised interest rates to their highest level since 1995.

The BoJ lifted rates by 25 bps to 0.75% in a unanimous decision. USD/JPY gained 0.3%, reaching a two-week high.

The yen eased even as the Bank of Japan signalled further hikes are likely, with the central bank stating: “It’s highly likely that the mechanism in which both wages and prices rise moderately will be maintained.” However, markets expect any additional moves will take time – the first full 25 bps hike isn’t priced in until September 2026.

In other markets, GBP/JPY returned to near 17-year highs, while EUR/JPY climbed back to all-time highs. CAD/JPY approached an 18-month high.

Pound’s short-lived relief rally after BoE cut

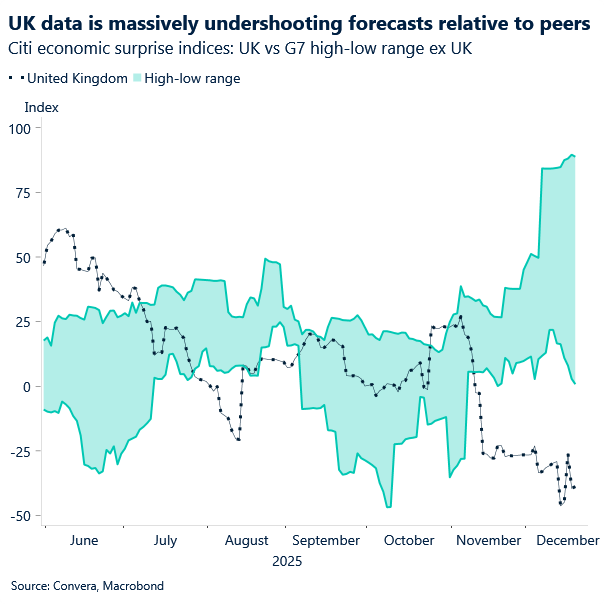

Sterling strengthened across the board yesterday after the Bank of England (BoE) cut rates as expected. GBP/USD spiked back above $1.34 and GBP/EUR above €1.14. The former stretching higher after the US CPI surprise, but reversing course by the session’s close and ending the day flat. Rate differentials between US and UK argue for a weaker pound than current levels, hence it’s no surprise to see sterling’s bounce short‑lived.

The BoE cut its benchmark interest rate by 25bps to 3.75% as expected, with the vote split at 5–4. We had cautioned that the greater risk lay not in the cut itself, but in a narrow split that would disappoint doves and leave scope for sterling to strengthen. With pessimism already embedded in GBP, stretched short positioning and sterling’s still‑attractive carry profile, the setup was primed for a contrarian move — and the immediate post‑decision rally in the pound reflected that dynamic.

Still, recent data have eased inflation concerns across the MPC. Markets pared back expectations for 2026 following the BoE’s cautious tone, but the economic backdrop offers little room to hold steady. Inflation is fading more quickly than the BoE expected, private sector wage growth is now below 4% for the first time since 2020, and unemployment is a near five-year high. If growth remains sluggish and inflation drifts closer to target in early 2026, pressure will build for further cuts, leaving GBP vulnerable.

Indeed, UK retail sales for November came in lower than expected this morning. Sales excluding fuel rose 1.2% year-on-year, less than the forecast 1.5%.

ECB sticks to script

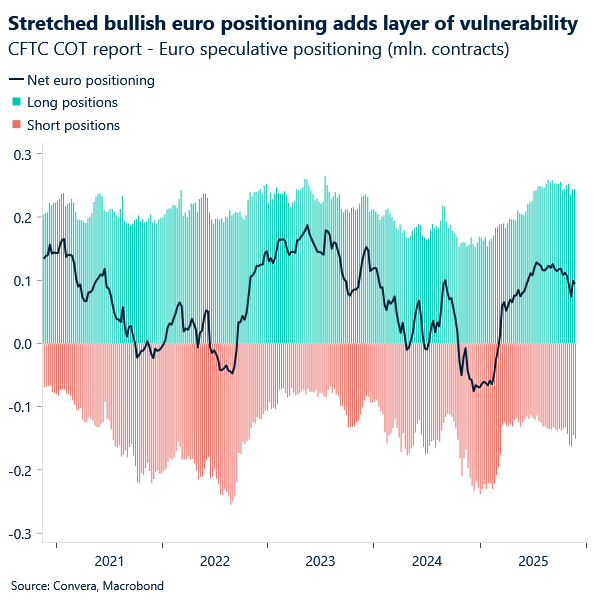

The European Central Bank left its benchmark rate unchanged at 2% for the fourth consecutive meeting, reiterating its “data‑dependent, meeting‑by‑meeting” guidance. The euro erased earlier losses against the dollar, helped by softer US inflation figures.

Staff projections were the main takeaway: Eurozone GDP growth for 2025 was revised up to 1.4% (from 1.2%), while the 2026 forecast rose to 1.2% (from 0.9%). Inflation is now expected at 1.9% (from 1.7%) in 2026, edging closer to the ECB’s 2% target. With inflation broadly at or below target and growth near potential, the central bank has little reason to shift policy in either direction for now.

German yields moved higher on the back of the upgrades, supporting the euro via the rates channel. A grind above $1.18 before year‑end looks increasingly plausible. But we note that net long positioning in EUR remains sticky since “liberation day” in April, leaving the currency vulnerable to a sharp sell-off if sentiment does turn sour towards the common currency.

Market snapshot

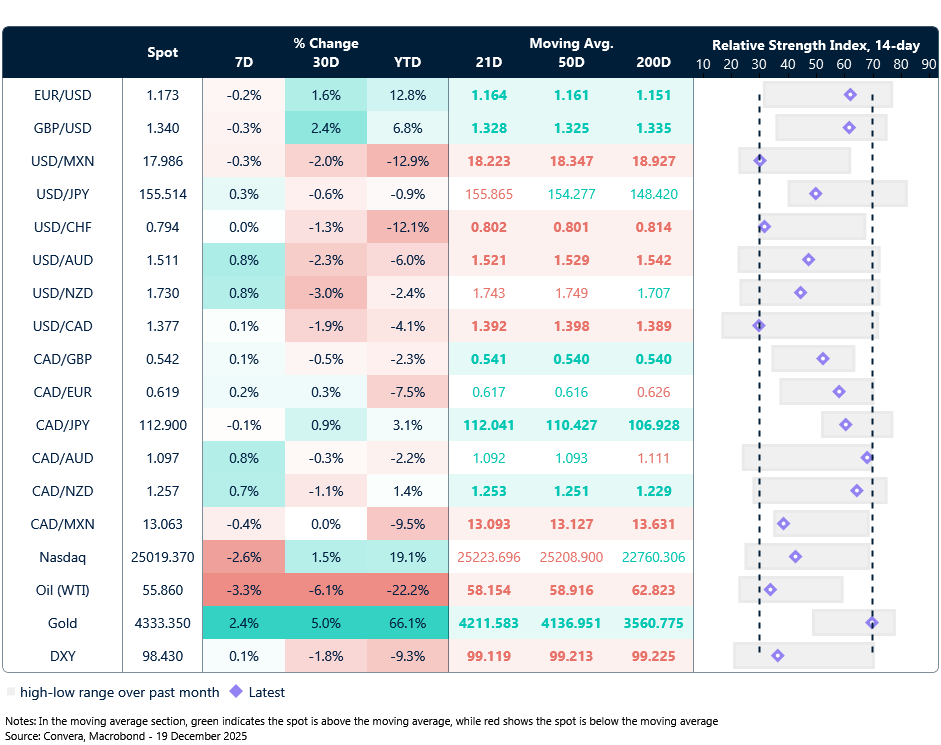

Table: Currency trends, trading ranges and technical indicators

Key global risk events

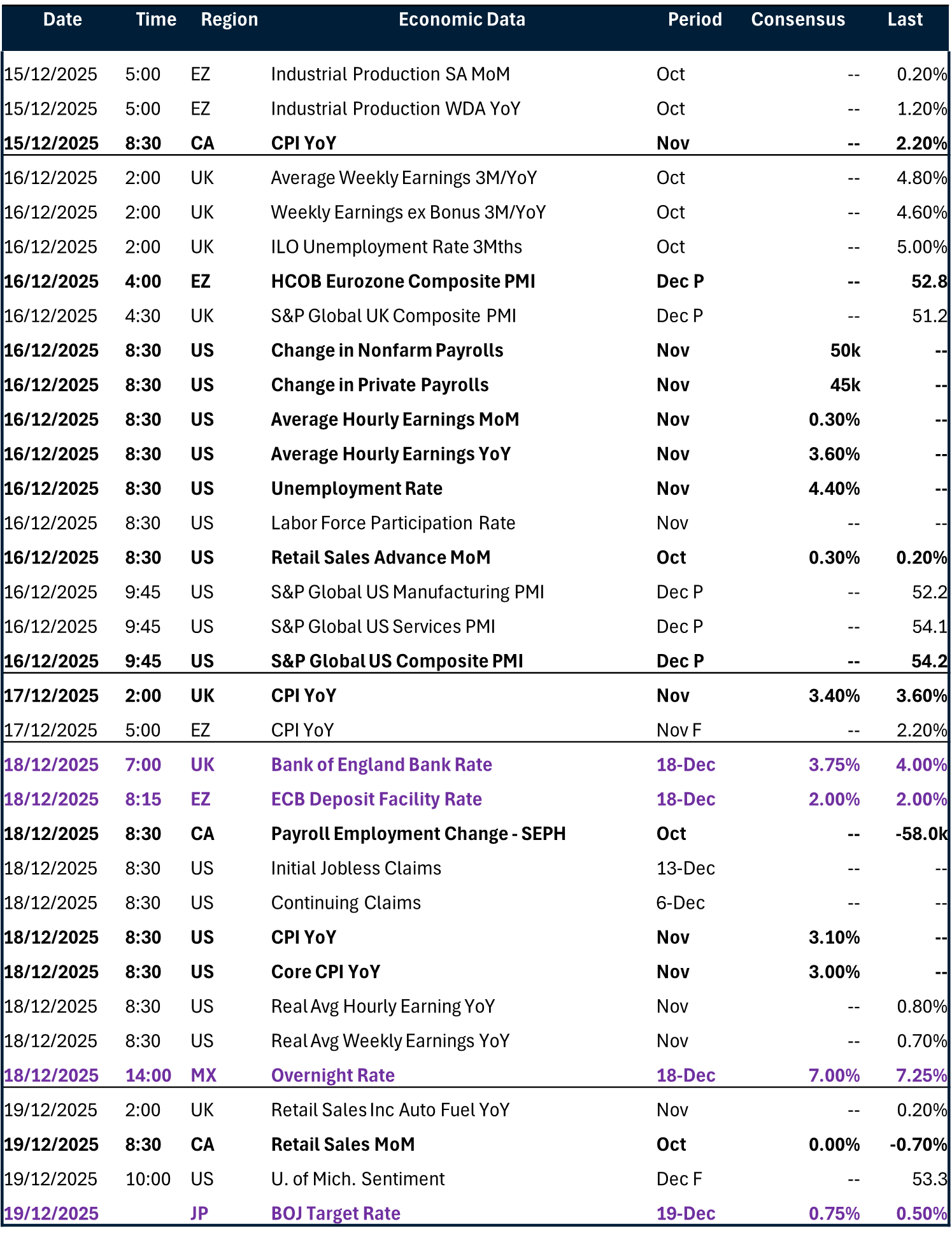

Calendar: December 15-19

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.