USD: Fed on track for June after January CPI cools

Markets breathed a visible sigh of relief following the release, with two-year Treasury yields falling and the dollar hitting session lows as fears of a “hot” January print evaporated. This cooler-than-feared data has immediately reshuffled expectations for the Federal Reserve: June is now firmly back in play as the likely timing for the first interest rate cut in 2026, with markets pricing in an over 80% probability of easing by then. There is even a modest 30% chance of a cut arriving as early as April. The “bull steepening” in the bond market suggests investors are increasingly confident that the Fed’s 2% target is within reach and the path toward policy normalization is becoming much clearer.

The headline numbers themselves were encouragingly soft. Headline CPI rose just 0.2% for the month, coming in under the 0.3% forecast, while the core reading was bang in line with expectations at 0.3%. Notably, the headline year-on-year rate cooled to 2.4%, marking the smallest annual increase since last May. While shelter costs remain the primary driver of inflation, their 0.2% monthly rise is seen as benign; for context, not a single month in 2024 saw a print that low. Overall, the data indicates that the broad disinflationary trend is holding up well.

Under the surface, however, there were a few quirks worth noting. “Supercore” services inflation shot up to nearly 0.6% on the month, its highest reading in a year, though this is widely viewed as a result of messy beginning-of-year seasonal adjustments rather than a resurgence in price pressure. Crucially, the year-on-year change for this metric actually declined to roughly 2.7%, its lowest level since March 2021. Elsewhere, apparel prices nudged up 0.3%, hinting at potential tariff passthrough, but with the Fed signaling that the worst of the tariff-related shocks are likely behind us, the overall narrative remains one of stability.

GBP: Sterling buckles under risk aversion

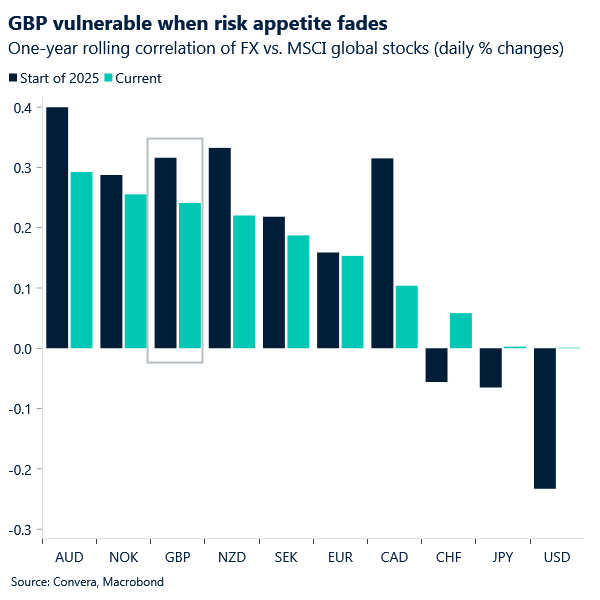

Sterling is one of the higher‑beta currencies in the G10, so yesterday’s equity sell‑off naturally weighed on the pound. When risk sentiment deteriorates, GBP tends to underperform alongside other pro‑cyclical currencies, while the likes of CHF and JPY attract inflows. The move wasn’t dramatic, but it was consistent with the broader risk‑off tone.

GBP/USD is grappling to stay above the $1.36 handle this morning, and a close below that level would take out the 21‑day moving‑average support — a break that would hint the recent uptrend is losing steam. The options market also shows signs of caution with negative risk‑reversals the further out the time horizon, reinforcing the market’s preference for GBP downside protection over longer tenors.

GBP/EUR is also lacking directional impetus, with the 100‑day moving average remaining the key support level in focus. The cross has spent the past few sessions drifting sideways, reflecting a broader lack of conviction on both sides: eurozone data hasn’t been strong enough to fuel a sustained EUR rebound, while sterling’s own high‑beta tendencies have been dampened by softer risk sentiment.

The domestic backdrop is also bleak for sterling. The UK economy grew by just 1.3% in 2025, leaving the UK on course for its weakest decade of growth since the 1920s — effectively the most dismal ten‑year performance in a century. The backward‑looking nature of the figures limited their immediate market impact, but they reinforce the sense that next week’s jobs and inflation data will matter far more for near‑term pricing.

Against this backdrop, further Bank of England rate cuts are likely needed simply to keep the economy on an even keel, especially with demand still fragile and productivity trends uninspiring. In a market environment where relative rate expectations are the dominant driver of currency moves, that dynamic leaves sterling vulnerable, in the short term at least.

MXN: Consolidation zone

The Mexican Peso’s resilience in early 2026 is anchored by Banco de México’s (Banxico) strategic “hawkish pause.” By holding the benchmark rate at 7.00% during the February 5 meeting, the board signaled a decisive pivot from its previous easing cycle to combat stubborn price pressures. Core inflation, which hit a nearly two-year high of 4.52% in January, remains the primary agitator, driven by persistent cost pass-throughs from fiscal measures and a $13 minimum wage hike. This firm stance has preserved a 325-basis-point interest rate differential over the US Federal Reserve, keeping the MXN a darling for carry trades and attracting significant diversification inflows from global asset managers looking to rotate into emerging market local assets.

However, the “Super Peso” narrative hit a notable speed bump this week following reports that President Trump is privately weighing a withdrawal from the USMCA trade pact. While the currency has been a top performer in emerging markets, lagging only the South African rand, the prospect of the US exiting its most critical trade agreement triggered immediate volatility, stalling a rally that had pushed the peso to its highest level in almost two years. President Claudia Sheinbaum has proactively downplayed these concerns, the looming summer renegotiations will become the dominant driver of peso volatility, potentially capping the currency’s upside as markets price in the risk of a “renegotiation” rather than a simple “review.”

Market snapshot

Table: Currency trends, trading ranges & technical indicators

Key global risk events

Calendar: February 9 – 13

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.