USD: Next Fed decision is a coin toss

The end of the longest US government shutdown on record has yet to jolt FX markets, but the return of economic data could soon change that. With investors still wary of data quality and consistency, any renewed signs of labour market weakness may reignite dollar depreciation – especially if they reinforce concerns about underlying growth momentum.

The dollar’s recent behaviour suggests a shift in market dynamics. Despite a sharp repricing in December rate-cut odds from nearly 70% to around 50% the US dollar index has softened. This decoupling from front-end rates marks a notable break from the tight correlation that has defined much of the year.

The divergence reflects deeper unease. Swaps now imply a terminal Fed rate above 3%, yet the dollar’s failure to rally alongside that shift points to skepticism about the US growth outlook. Private-sector indicators, including rising layoffs flagged by Challenger and job losses tracked by Revelio, continue to paint a picture of labour fragility.

In effect, the dollar is trading as if the easing cycle remains intact—even as near-term cut expectations fade. That disconnect may stem from the policy fog left by the shutdown, but it also underscores a broader erosion of confidence in the Fed’s higher-for-longer narrative.

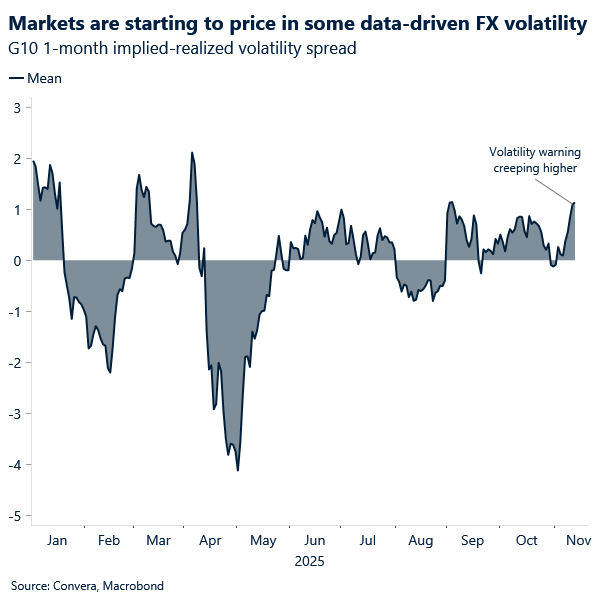

FX volatility, meanwhile, may be nearing a turning point. G10 1-month implied volatility now trades 1.1 vols above realised – the widest spread since early April. While this reflects unusually low realised vol, it also suggests markets are positioning for volatility as fresh data returns to focus. If incoming prints disappoint, the dollar could find itself sliding into year-end.

CAD: Sustained weakness

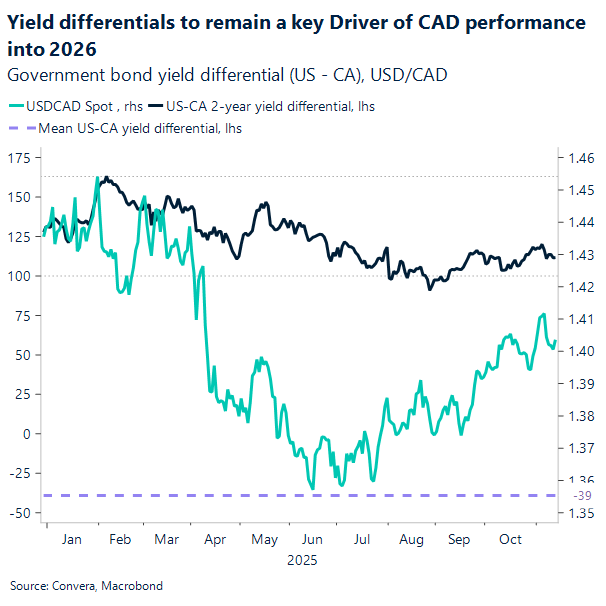

Hovering around 1.40 the Loonie was largely unchanged after the Bank of Canada released the Summary of Governing Council deliberations from its October meeting. The summary revealed an internal debate where officials considered delaying the cut to await more details on the federal budget and US trade policy. However, the governing council ultimately concluded that the arguments for an immediate cut were “more salient,” citing expectations for a weak economy and inflation remaining near the 2% target. The Bank now views this new, lower rate as being “on the stimulative side” of the neutral range.

Besides this, the deliberations were largely in line with what Governor Macklem had reiterated during the press conference a few weeks ago. The primary driver for the rate cut was the significant economic weakness stemming from US trade policies, which have “severely hit” key Canadian sectors like autos, steel, and lumber. This trade uncertainty has contributed to a “soft” labor market, with the unemployment rate rising to 7.1%. While headline inflation ticked up to 2.4% (blamed on gas) and core measures remained “stuck around 3%,” the Bank believes underlying inflation is stable and will stay near its target. Looking ahead, the BoC signaled this support may be its final step, stating that monetary policy is “likely close to the limits of what it could do” and that the new 2.25% rate is “at about the right level” for the current situation.

In FX, despite Thursday’s decline in the U.S. Dollar, the Canadian Dollar remained mostly muted, trading slightly higher closer to its weekly high of 1.405, as fiscal concerns kept FX markets cautious ahead of upcoming voting in Ottawa. On the trade front, progress remains limited.

Looking ahead, next week’s federal budget decision, and CPI release will be pivotal in shaping expectations for the Bank of Canada’s final meeting of the year.

GBP: Downside drivers accumulate

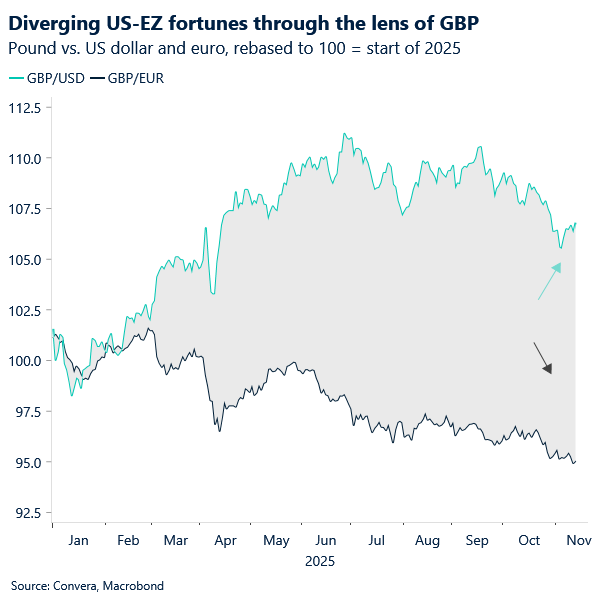

Investor behaviour suggests GBP/EUR is becoming the preferred vehicle for expressing bearish sterling views. The cross has dropped to its lowest level since April 2023, breaking below the €1.13 threshold, while GBP/USD remains above $1.31 after briefly testing $1.32 yesterday.

This divergence underscores how broader USD dynamics are shaping GBP/USD, even as domestic fundamentals and political risks weigh more heavily in cross terms. In effect, the pound’s resilience against the dollar reflects external factors rather than domestic strength.

Across the G10, sterling is on the back foot this morning, though. Reports indicate Chancellor Reeves is considering abandoning plans to raise headline income tax rates and other levies in the upcoming Budget. That raises immediate questions over how the government will plug the revenue shortfall, with gilt markets likely to reflect the uncertainty at the open. Selling pressure is expected to be most acute at the long end of the curve — a familiar pattern whenever the UK’s fiscal trajectory comes under scrutiny.

Political uncertainty just keeps growing louder in the UK. Labour has been rocked this week by internal fighting over Keir Starmer’s leadership, with rumours of plots, anonymous briefings, and talk of a possible challenge. Along with the Budget U-turn, each of those factors on its own would be enough to unsettle investors, but together they amplify the sense of instability.

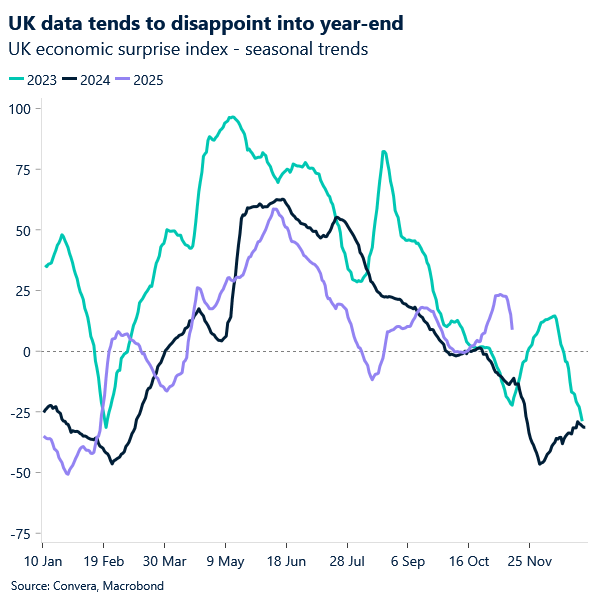

Meanwhile, a string of soft UK data has reinforced concerns about stagnation. Third‑quarter GDP undershot both market and BoE forecasts, following weak labour‑market figures earlier in the week that showed unemployment rising to pandemic‑era levels. Traders responded by pricing in over an 80% chance of a December rate cut via overnight indexed swaps.

The combination of soft data, dovish BoE repricing, and political noise presents a challenging backdrop for sterling. The near‑term bias remains tilted toward weakness, but GBP/EUR looks the cleaner way to express it. For GBP/USD, a decisive break below $1.30 will likely require renewed dollar strength.

EUR: Breaks higher, but soft data holds the key

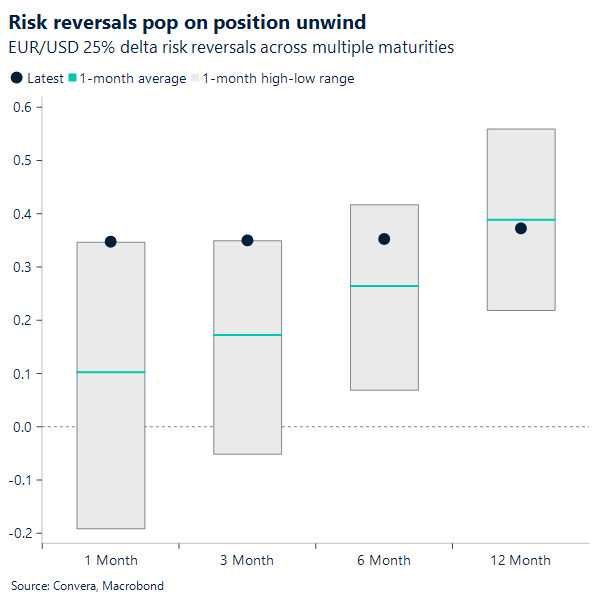

Amid broad dollar weakness yesterday, the euro gained ground, breaking above the 21‑day moving average – a key resistance level untested since early October. Almost ironic, given that when (soft) US data – the euro’s clearest bullish catalyst – was not being released due to the shutdown, the single currency underperformed against the dollar (down ~1.4%). That said, with the shutdown now ended, the move in EUR/USD looks more like a positioning adjustment than fresh conviction – driven by euro short‑covering and dollar long trimming, rather than aggressive new euro buying. While risks are mounting that EUR/USD could push higher on softer US macro, traders remain uncertain about the true state of the US economy.

Markets continue to price a 50‑50 chance of a December cut, reinforcing the view that yesterday’s euro rally was driven more by positioning than by fundamental justification. More meaningful upside looks unlikely for now, with the 50‑ and 100‑day moving averages converging near 1.1660 as the next clear resistance.

The release of US government data – expected to resume next week – is likely to imprint the next significant directional move in the euro. This will be fundamentally justified but also layered with sentiment, as glimpses of softness in alternative data throughout October have left markets speculating about the state of the US economy, now eager to step in more aggressively on validation or rejection.

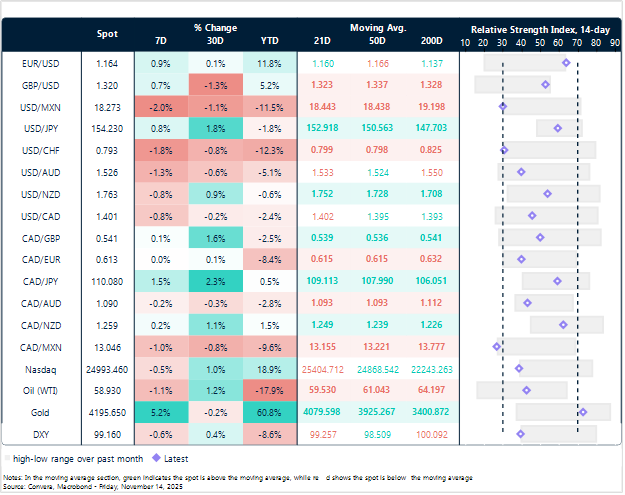

Swiss franc and Mexican Peso dominate

Table: Currency trends, trading ranges and technical indicators

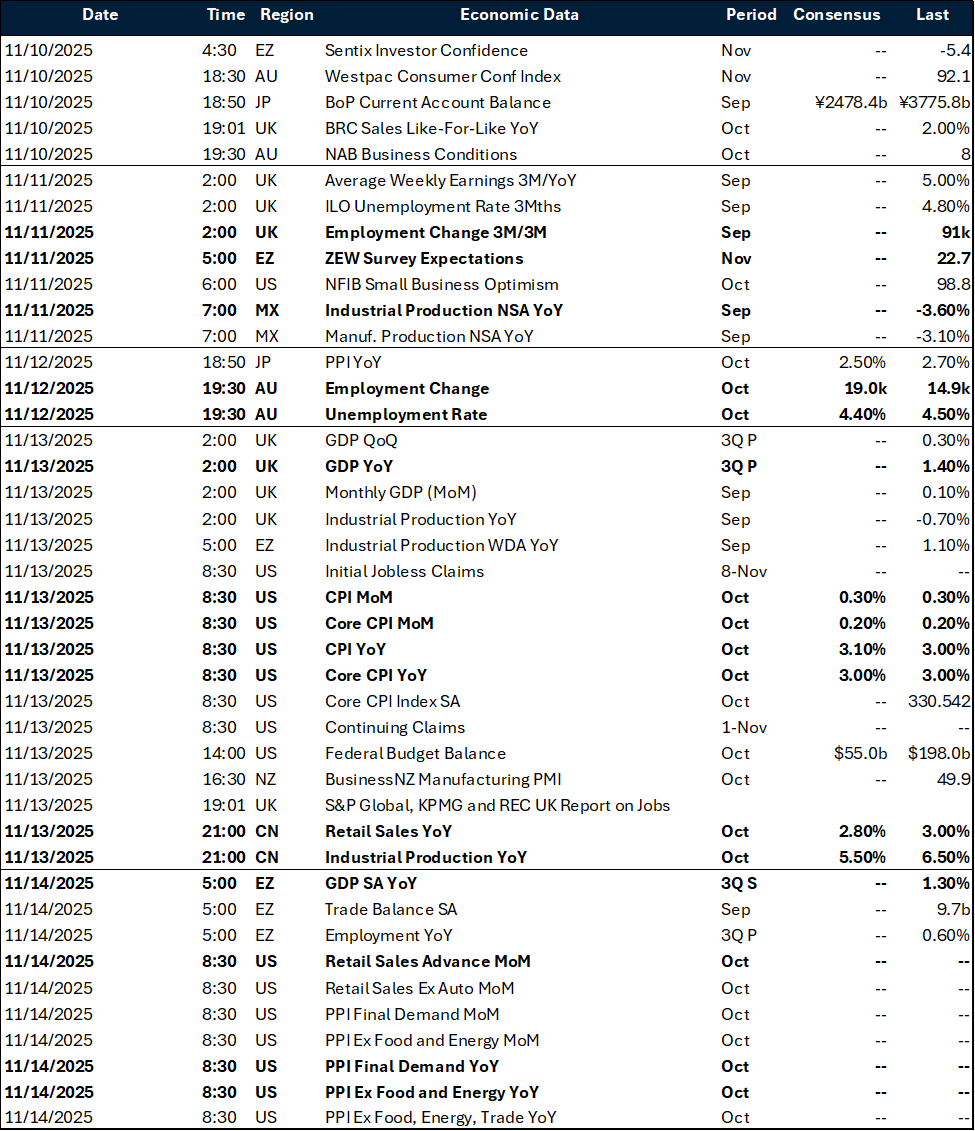

Key global risk events

Calendar: November 10-14

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.