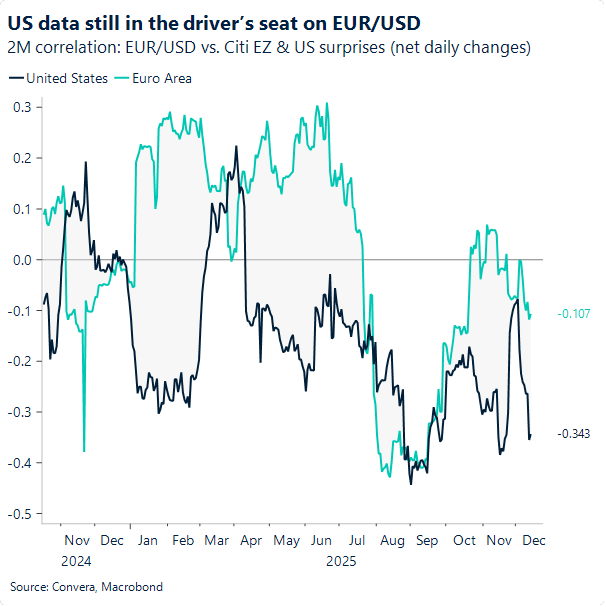

US jobs report in focus

Markets face a pivotal week as US jobs and inflation data take centre stage. November payrolls are expected to show just +50k jobs, as government cuts drag the three‑month average down — underscoring labour market fragility. Softer prints could accelerate bets on a March Fed cut, currently priced at only 33%, and weaken the dollar while stronger data would bolster the buck.

As a reminder, the Fed’s decision to lower rates by 25 bps to 3.5–3.75% exposed divisions, with dissenters split between no move and a larger cut. The dot plot signals just one cut in 2026, but risks skew toward more if jobs weaken. Internal disagreements highlight uncertainty in the policy path, increasing market sensitivity to each data release. Plus, Powell has made clear the easing cycle is now driven by labour market weakness rather than inflation.

The bottom line is that expectations of Fed dovishness underpin a bearish dollar bias right now, but this hinges on validation from labour market data.

USD/CAD losses pause after inflation

USD/CAD paused at three-month lows yesterday after a weaker-than-expected inflation reading raised questions about the Bank of Canada’s hawkish stance.

Headline annual inflation in November was steady at 2.2% — versus forecasts for a rise to 2.3% — while the trimmed core reading fell more than expected, from 3.0% to 2.8%.

Market pricing shifted from last week’s 30bps of hikes over the next ten months to only 19bps by the end of Monday’s trade.

USD/CAD ended the day flat, with the technical pattern forming a “doji” indecision day that can sometimes mark the beginning of a reversal higher. Momentum indicators like the relative strength index (RSI) also point to an overstretched market that could see a rebound.

Of course, the short-term outlook for USD/CAD will be mostly driven by today’s US non-farm employment report – due at 8:30am EST.

Euphoric euro meets downbeat dollar

The US dollar has started the new week still on the defensive, but the euro’s rally is running hot. The macro and policy backdrop remains complex as a heavy calendar of risk events kicks off. Yesterday saw October’s Eurozone industrial production rose 0.8%, lifting annual growth to 2.0% and supporting the common currency versus the beleaguered US dollar. The $1.18 mark is eyed to the upside this week.

After years of pressure from high energy costs, trade frictions, a stronger euro and rising Chinese competition, lower oil and gas prices and leaner inventories are finally supporting a cyclical Eurozone recovery. Structural headwinds remain, but the ECB is likely to frame this rebound as evidence that no further rate cuts are needed – a euro positive story.

Today’s PMI data will be pivotal. In the eurozone, the services PMI is expected at 53.3, while manufacturing is seen edging up to 49.9 — just shy of growth territory. Stronger‑than‑expected prints would reinforce the view that the ECB’s next move could be a hike, adding fuel to the euro’s advance. But the speed of the rally has already pushed EUR/USD close to technically stretched territory, with the RSI hovering just below 70. That raises the risk of consolidation or a short‑lived pullback, even if fundamentals remain supportive.

Still, the direction of EUR/USD will ultimately hinge on dollar dynamics. November payrolls, delayed by the government shutdown, are also due today with forecasts for a 50K gain and unemployment edging up to 4.5%. Disappointing figures would ramp up expectations for Fed cuts in 2026, weighing on yields and the dollar; a beat would pare those bets, lift the dollar, and cap the euro’s rally. Alongside payrolls, US retail sales and a slate of Fed speakers will provide further tests of demand and policy direction.

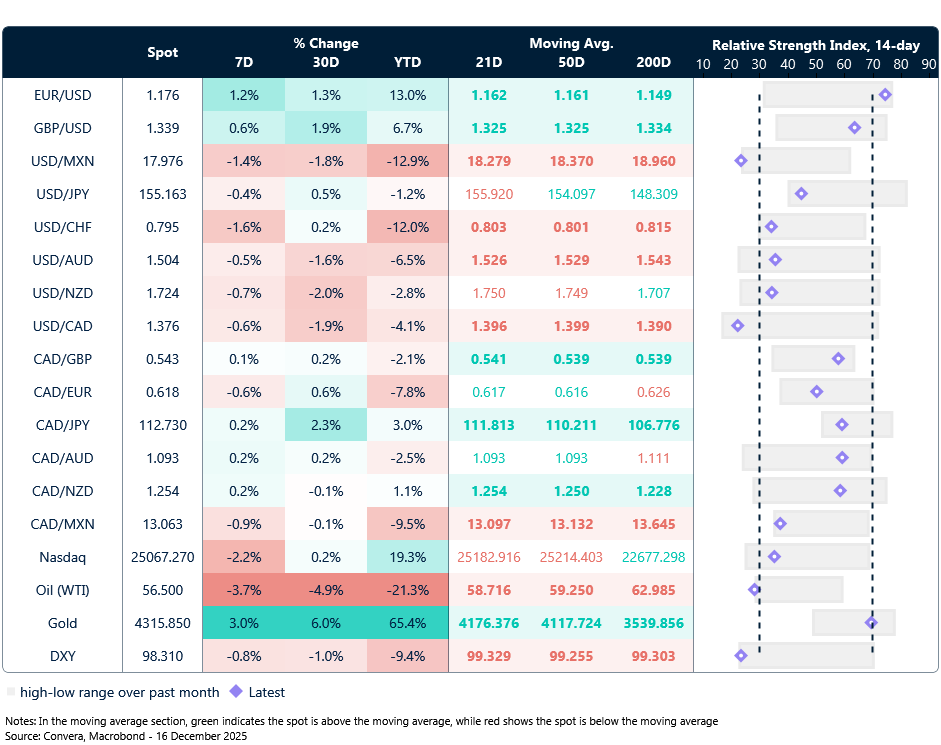

Market snapshot

Table: Currency trends, trading ranges and technical indicators

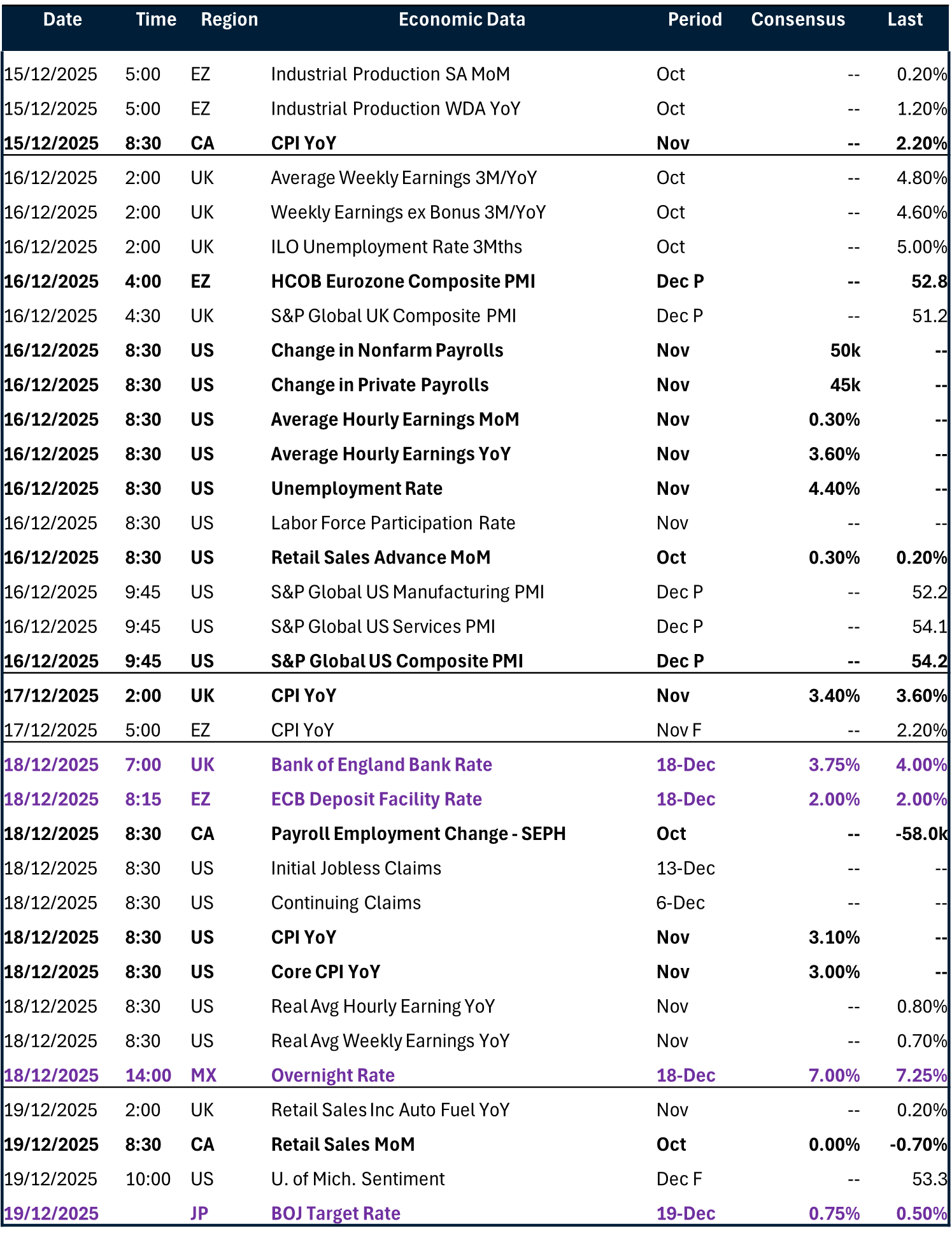

Key global risk events

Calendar: December 15-19

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.