Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Fed looks to “higher-for-longer” rates

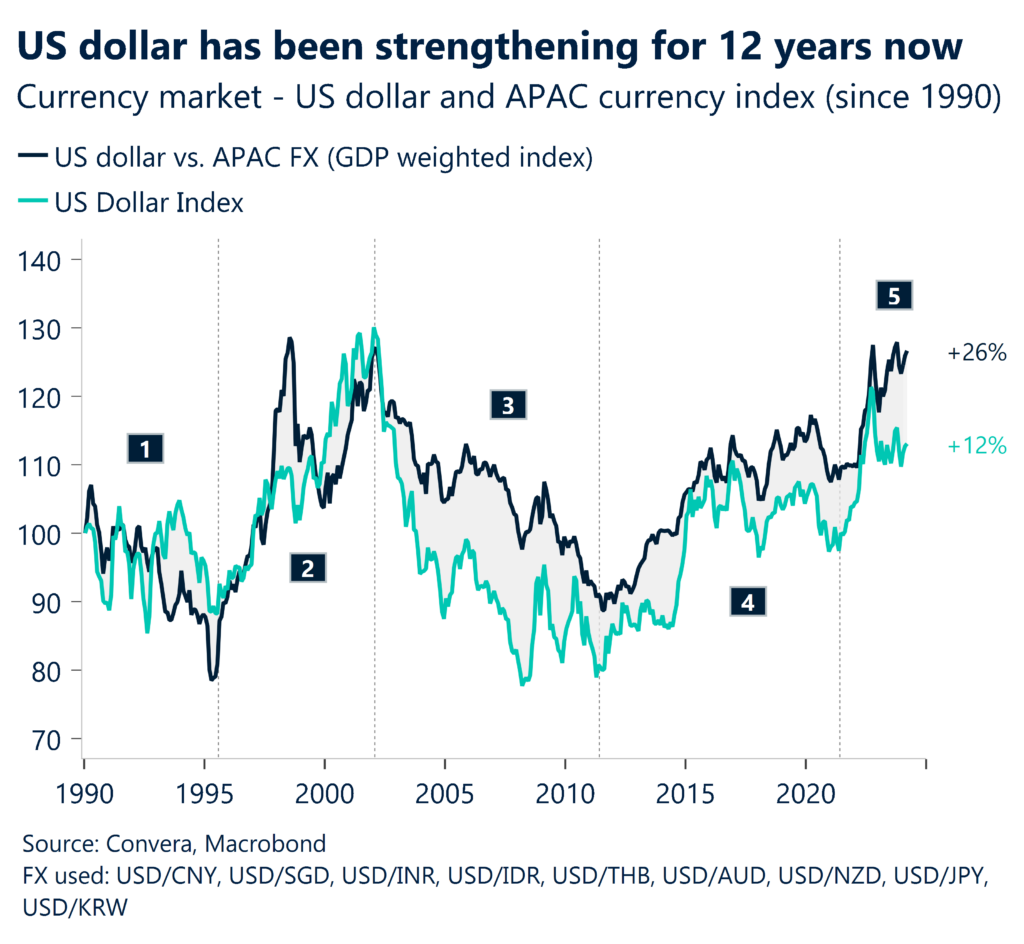

The US dollar was stronger across markets overnight after a keenly-anticipated speech from Federal Reserve chair Jerome Powell indicated the US central bank might need to keep interest rates higher for longer.

After three higher-than-expected US CPI readings, Powell said: “The recent data have clearly not given us greater confidence [on inflation….] it’s likely to take longer than expected to achieve that confidence.”

The commentary continued to drive market sentiment in line with the reaction after last week’s CPI number – US shares fell, bond yields climbed and the US dollar extended gains.

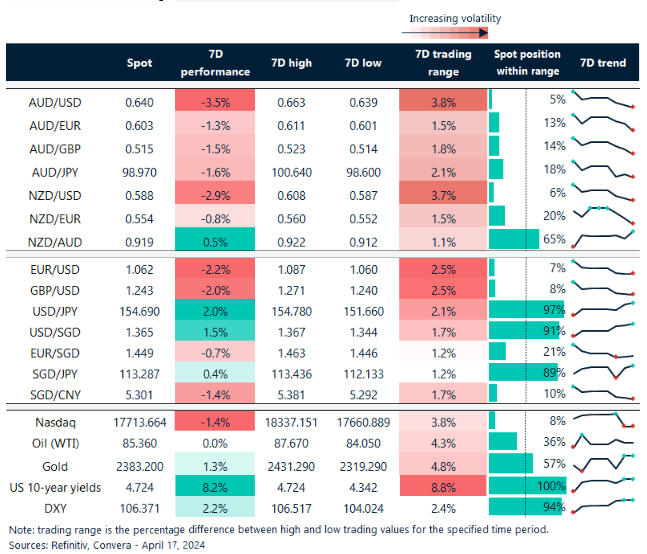

The AUD/USD fell 0.6% while NZD/USD lost 0.3% – both falling to the lowest levels of the year so far.

In Asia, the USD/JPY climbed 0.3%.

The USD/CNH ended flat after a volatile session saw the pair touch 2024 highs after March-quarter GDP beat expectations at an annualized rate of 5.3% but more up-to-date indicators like retail sales and industrial production missed forecasts.

NZD CPI higher than RBNZ forecasts?

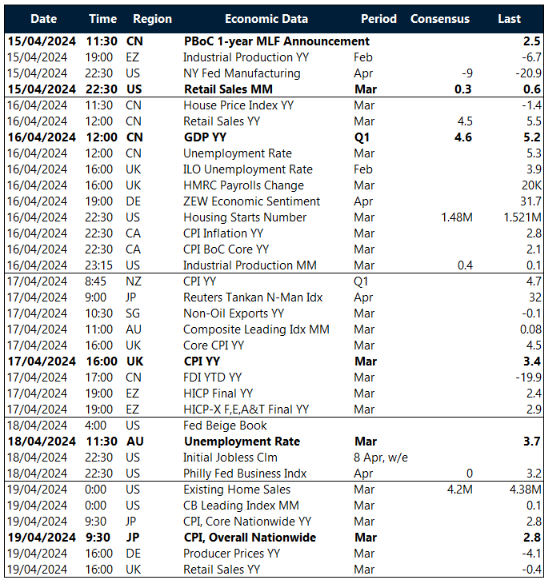

Today’s NZ inflation, due at 10.45am NZST, will be key for the kiwi.

Our Q1 CPI projection is about 0.8% q-o-q, which is much higher than the RBNZ’s previous estimate of 0.4% q-o-q.

As in other places, non-traded and services prices have declined more slowly in New Zealand; thus, this study should pay special attention to them.

According to our 0.8% q-o-q projection for Q1, headline inflation increased by a more notable 1.2% q-o-q in Q1 of 2023, meaning that the annual inflation rate should drop to 4.2% y-o-y from 4.7% y-o-y in Q4.

With the possibility that the RBNZ might need to pivot to support the local economy – and with potentially less global cyclical protection from rate cuts by developed market peers – the NZD could see further losses in the near term.

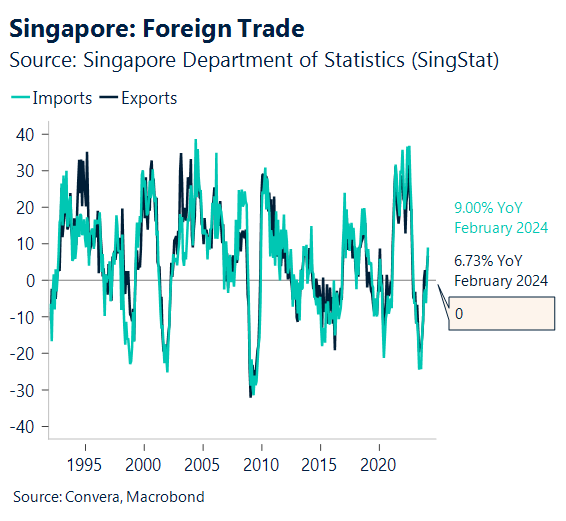

Singapore slows amid tight labor market

From Singapore, non-oil exports are due. Anticipating a decline in growth to -7.5% y-o-y in March from -0.1% in February, we attribute this to high base effects from the previous year’s spike in pharmaceutical exports.

Sequentially speaking, this would indicate that, in the midst of the ongoing global tech turnaround, NODX growth improved to 2.0% m-o-m sa from -4.8%.

The labor market has remained somewhat tight due to resilient growth, which is likely to increase worries that inflation may continue to be more persistent.

The recent sell-off across share markets and stronger US dollar has weighed on the Singapore dollar and the currency could face further potential losses in the short term.

Aussie, kiwi hit new lows ahead of NZ CPI

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 15 – 19 April

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]

Take a deep dive into the trends shaping cross-border payments with our podcast, Converge.