USD: A jobless expansion?

Volatility is picking up this morning. Worries about the Fed’s independence is heating up again, especially with Powell calling out the administration’s recent attempts to influence policy. The US Dollar is weaker as markets assess the renewed tension between the administration and the Federal Reserve.

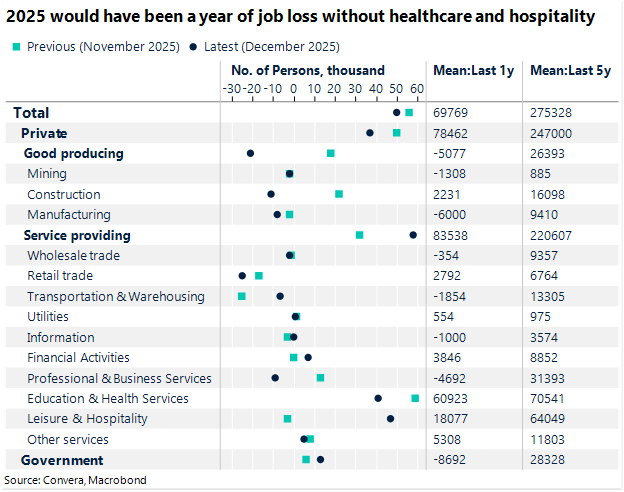

On the macro front, the US economy is currently navigating a jobless expansion, where top-line growth remains resilient even as the labor market hits a functional wall. The December payroll report confirmed this divergence with a meager addition of only 50,000 jobs, cementing 2025 as the weakest year for job creation since 2003, excluding the pandemic era. For the full year, payrolls grew by a mere 584,000, a drastic cooling compared to the robust expansion of the previous decade. When factoring in cumulative downward revisions of 76,000, the three-month moving average has slipped into a contraction of 22,000, signaling that while there is no “cliff-edge” collapse, the momentum of the American workforce is at a virtual standstill.

This selective freeze is characterized by a stark divergence between industries, creating a bifurcated labor market that favors defensive sectors. Hiring is now almost entirely concentrated in healthcare and hospitality, while cyclical industries like manufacturing, construction, and retail are actively shedding positions. In December, healthcare remained the primary engine of growth by adding 21,000 roles, but even this reliable sector has seen its pace decelerate compared to previous years. With job openings falling to a more than one-year low of 7.15 million, we have entered a “low-hire, low-fire” environment where companies are increasingly hesitant to expand headcounts despite a resilient 4.4% unemployment rate.

The Federal Reserve’s path remains complicated by sticky wage growth, which rose 3.8% annually in December and continues to preserve worker purchasing power. While officials have not formally ended the easing cycle, the Fed’s latest projections signal only a single quarter-point rate cut for the entirety of 2026. Markets have adjusted by pricing in a prolonged hold, with no further easing expected until mid-year. This creates a delicate balancing act for the economy as it attempts to sustain momentum while the traditional engines of job creation remain stalled and the Fed waits for more definitive evidence of economic deterioration before acting.

Parallel to this labor shift, the US Dollar has entered 2026 with remarkable strength, largely due to the recent US military intervention in Venezuela. This move has fundamentally altered energy market expectations, with the US signaling a multi-billion dollar commitment to rehabilitate Venezuelan oil infrastructure.

The USD DXY Index remains firmly entrenched in the trading channel it initiated in May of last year. The geopolitical pivot, reinforced by expectations of fiscal expansion and tax stimulus, has injected a surge of liquidity that provides a formidable floor for the currency, effectively allowing the greenback to defy the typical downward gravity of a Fed easing cycle.

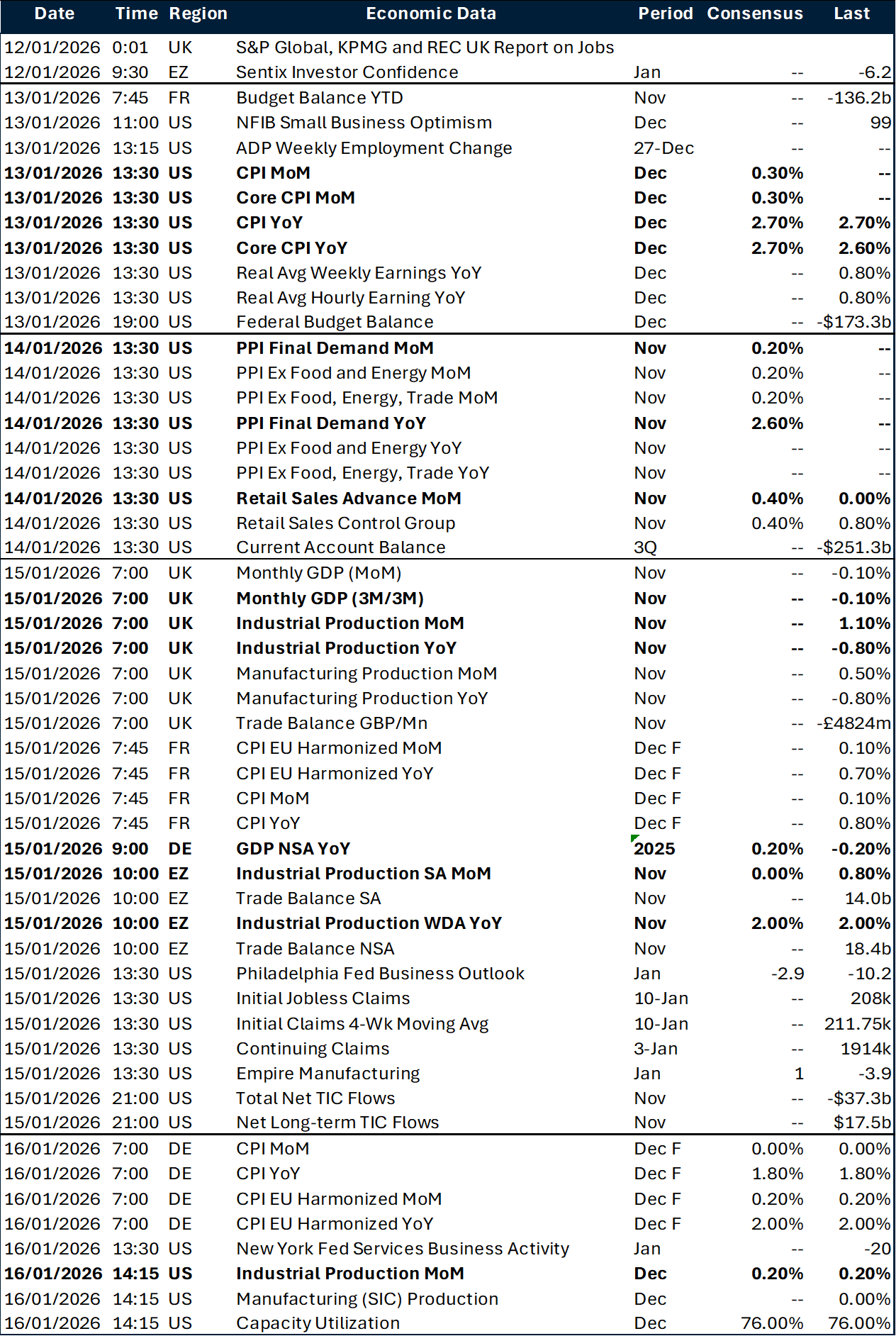

The trajectory for 2026 will likely be defined by whether this currency channel breaks or leads to a full-scale dollar recovery as the conversation regarding the “neutral rate” shifts upward toward 3%. A critical turning point arrives in May, when Jerome Powell’s term expires, raising immediate questions about the Fed’s independence and the policy lean of his successor. As the market weighs these leadership changes against the shifting fundamentals of a higher-for-longer interest rate environment, all eyes turn to next week’s key data releases. On the macro front, focus remains squarely on Tuesday’s CPI report, where the 2025 yearly reading is expected to hit 2.7%, providing a final look at the inflationary backdrop that will guide the Fed’s first major decisions of the year. On the trade front, the Supreme Court is set to decide the fate of the IEEPA tariffs; however, the administration has already signaled it is prepared to pivot to alternative executive tools, including Section 232 and Section 301 authorities, to ensure its trade policy remains intact regardless of the judicial outcome.

EUR: Oversold setup gets breathing space

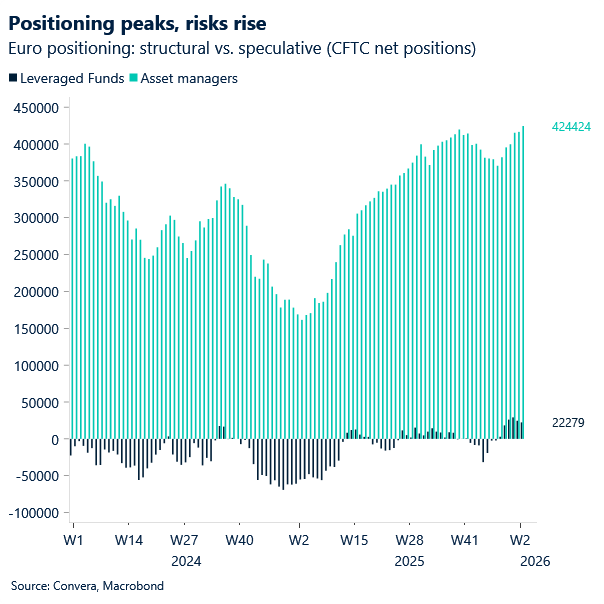

EUR/USD entered 2026 with peak long positioning from both speculative and structural investors. This setup widened the window for downside surprises because crowded longs tend to be more vulnerable to profit taking. The trigger came from mixed US data last week that failed to convey any urgency that a Fed cut is imminent, putting the euro’s start to the year on the back foot.

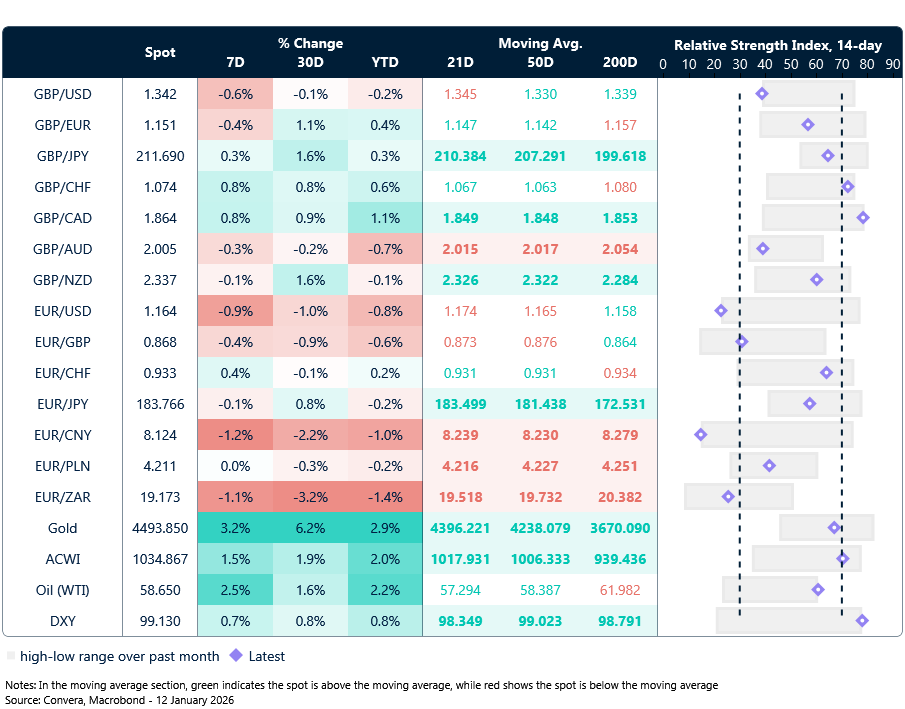

This week’s price action will hinge on the US CPI report. The release is expected to come in hot, reflecting an unwinding of the exaggerated softness in the November print that likely stemmed from shutdown‑related measurement distortions. Even so, with technicals stretched – the relative strength index sits in oversold territory – and with only a 5% chance of a cut at the Fed’s January meeting, the pair may lack the bearish fuel needed to test meaningfully 1.1625/1.16 levels.

Meanwhile, this morning the euro garnered demand against the dollar, bouncing off support at 1.1625. An overstretched bearish setup combined with renewed concerns about Fed independence, triggering a bullish pullback that took the pair to resistance at 1.1680. Fed Chair Powell said the Fed had been served grand jury subpoenas threatening criminal charges related to his testimony on renovations at the central bank headquarters. Naturally, the news revived concerns about the Trump administration’s pressure on Fed affairs, weighing on the dollar.

GBP: Sterling’s external sensitivity has shifted meaningfully

Sterling has opened the week on firmer footing against the US dollar, as the probe into Fed Chair Jerome Powell revives concerns that Trump’s push for much lower interest rates could erode the central bank’s credibility. That backdrop gives the de‑dollarization narrative fresh momentum. GBP/USD has climbed back into the mid‑$1.34s after bouncing cleanly off its 200‑day moving‑average support in the upper echelons of $1.33, reinforcing the idea that the broader uptrend remains intact for now.

Monthly UK GDP data lands on Thursday, giving markets a domestic focal point, but the real test comes the following week with labour‑market, inflation and PMI releases. Together, these will offer the first meaningful read‑across for the Bank of England’s February meeting and help determine whether policymakers feel compelled to deliver another 25-basis point rate cut. Markets are currently pricing fewer than two cuts for 2026, a stance that looks overly cautious given the likely path of disinflation and the UK’s lacklustre growth backdrop. A dovish repricing of BoE expectations would leave sterling vulnerable again via the yield channel.

For the consensus to shift decisively in favour of the pound, investors will need clear evidence of improving UK growth and stickier‑than‑expected inflation — without that combination, sterling’s upside case remains hard to sustain from a purely domestic driving standpoint.

That said, sterling’s external sensitivity has shifted meaningfully: as the chart below shows, GBP has become far more responsive to USD weakness over the past six months — more so than any other G10 currency. A 1% drop in the US dollar index now translates into nearly a 1% rise in GBP/USD, up from 0.55%. That shift shows how heavily the pound is trading off the broader dollar cycle.

Market snapshot

Table: Currency trends, trading ranges & technical indicators

Key global risk events

Calendar: January 12-16

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.