USD gains for first time in five sessions

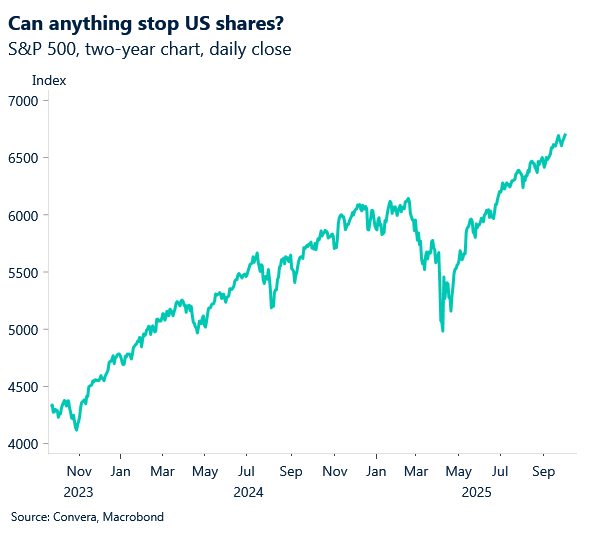

Financial markets continue to be mainly unfazed by the US government shutdown with US equities higher again as the Dow Jones, S&P 500 and tech-focused Nasdaq all closed at new record highs.

In FX markets, the USD was higher for the first time in five sessions as it rebounded from one-week lows.

FX markets are caught in the middle of the shutdown with the monthly US jobs report, due tonight, not released while the US government is closed.

Most key markets were lower versus the US dollar with the EUR/USD down 0.2% and GBP/USD down 0.3%. USD/JPY gained 0.1%.

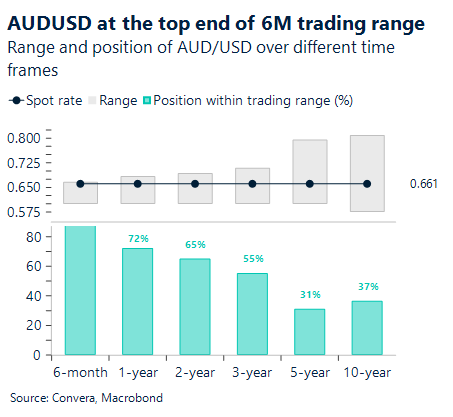

The AUD/USD fell 0.3% while NZD/USD was steady.

In Asia, the USD/SGD and USD/CNH both fell 0.1%.

AUD/USD eases as RBA warns of global risks

Australia’s central bank is sounding the alarm on rising global financial risks, warning that a major shock abroad could spill over and heighten domestic vulnerabilities.

Still, the local financial system remains resilient, with regulators keeping a close eye on lending standards and ready to act if needed.

Strong employment and rising household incomes are helping keep loan arrears in check, adding a layer of stability despite the global uncertainty.

While lower overnight, the AUD/USD continues to show upward momentum, with the market still above key moving averages. Resistance sits near 0.6700, while support levels are marked at 50-day EMA of 0.6559 and 100-day EMA of 0.6520.

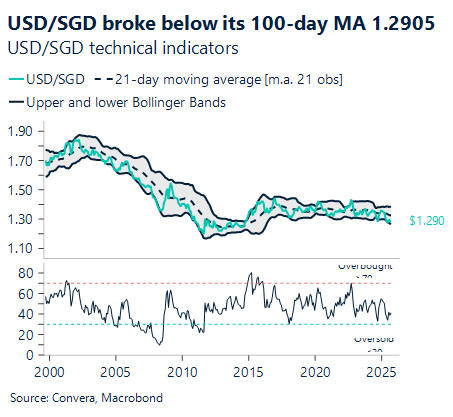

USD/SGD dips as shutdown hits jobs

The US government shutdown that began October 1 is escalating risks, with permanent job cuts under consideration for furloughed workers, potentially affecting tens of thousands. This could trigger deeper economic fallout than previous shutdowns.

If the shutdown continues, the release of the September employment report may be delayed.

In Asia, USD/SGD broke below its 100-day moving average of 1.2905.

The next support level is 50-day EMA of 1.2857, where dollar buyers may look to take advantage.

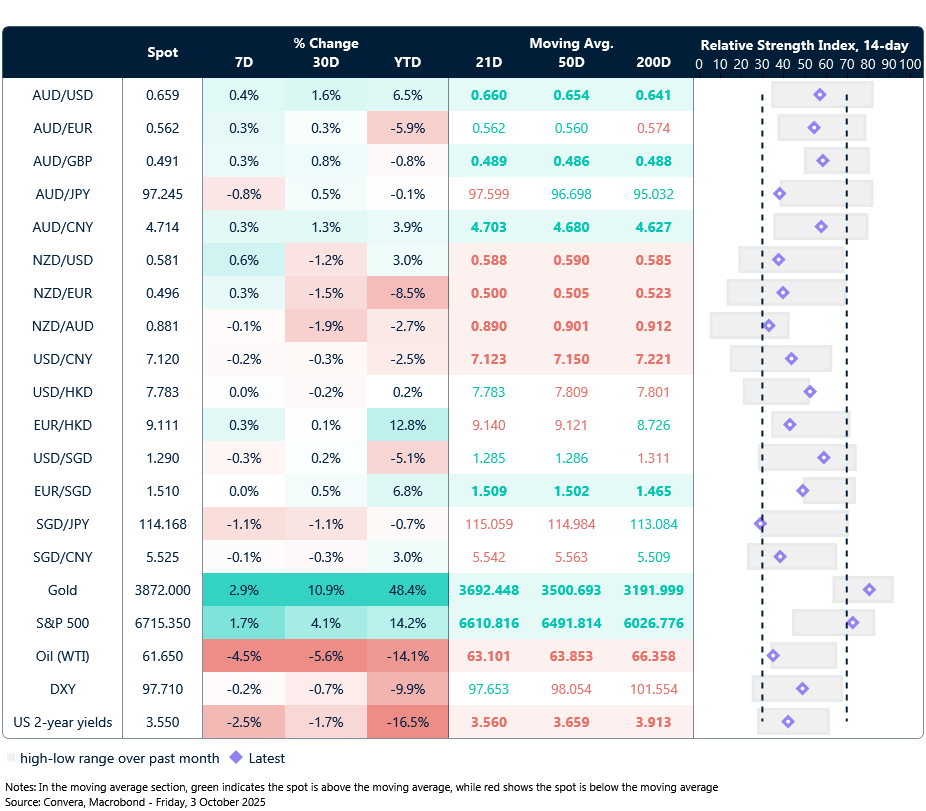

USD higher overnight

Table: seven-day rolling currency trends and trading ranges

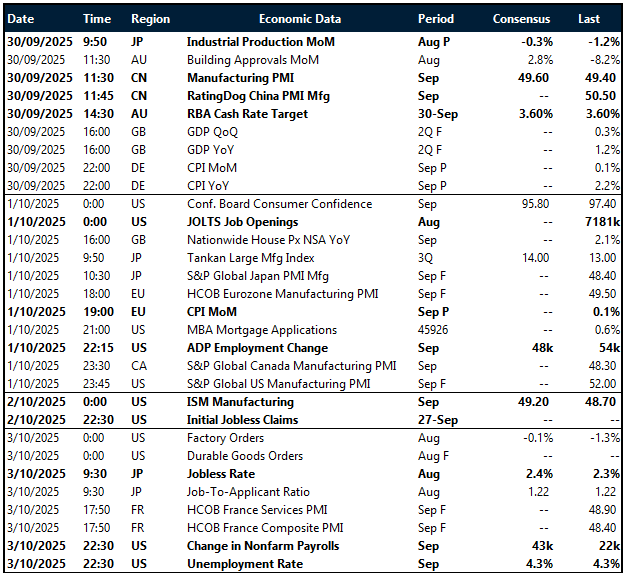

Key global risk events

Calendar: 29 September – 3 October

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer