Written by the Market Insights Team

Truce extended, now for inflation

As expected, the U.S.–China trade truce has been extended for another 90 days, keeping tariffs steady through November. Markets welcomed the news, with Asian equities surging and European and U.S. futures pointing higher. Risk sentiment remains buoyant, but the real test comes today: U.S. CPI.

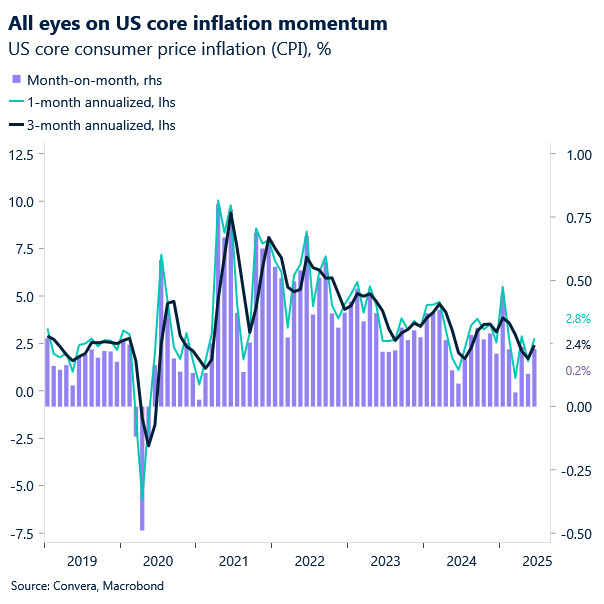

Markets are bracing for signs of renewed inflationary pressure, with economists warning that tariff-related costs could increasingly filter through to consumers and businesses over the coming months. The June PCE index — the Fed’s preferred inflation gauge — already showed a sharp uptick, and today’s core CPI is expected to rise 0.3%, marking the largest monthly increase since January. If realized, this would lift annual core inflation to 3.1%, further above the Fed’s 2% target.

This presents a policy dilemma for the Fed. While rising inflation typically argues against rate cuts, recent labour market data has shown a marked slowdown in hiring, raising concerns about economic momentum. The Fed has held rates steady this year, awaiting clarity on the inflation trajectory and the impact of tariffs. However, weakening employment trends may tilt the balance toward easing.

Today’s CPI release also carries political overtones, being the first since President Trump dismissed Erika McEntarfer, head of the Bureau of Labor Statistics, following a disappointing jobs report. The move has sparked concerns about the integrity of U.S. economic data.

As for the dollar, the bounce is fading. The dollar index is struggling to hold gains, marking another failed attempt to recover from early July lows. With speculative shorts cleared and fiscal headwinds building, the dollar’s path looks lower for longer.

Pound steady after UK jobs data

Sterling edged slightly higher against the U.S. dollar this morning following the UK labour market release, though FX markets responded with little urgency as the data broadly matched expectations. Wage growth slowed more than forecast, with weekly earnings rising 4.6% versus 4.7% expected and down from 5% previously. Unemployment held steady at 4.7%, while headline wage growth excluding bonuses remained elevated at 5%, offering a clearer view of underlying pay pressures. Private sector earnings eased to 4.8%, and payrolled employee numbers declined for a sixth consecutive month – the worst stretch since the pandemic.

Additional signs of labour market softening came from a continued drop in job vacancies, now falling for the 37th straight period. The vacancy-to-unemployment ratio also declined, suggesting a less tight labour market as more workers are available to fill open roles. While these indicators point to easing conditions, wage growth remains above levels consistent with the Bank of England’s (BoE) inflation target.

Taken together, the data supports the BoE’s hawkish hold last week, reinforcing the view that rate cuts may remain off the table for now. With elevated pay growth sustaining inflation concerns, the yield channel continues to offer support for the pound – though its durability will depend on how quickly wage pressures ease in the months ahead.

Rangebound with upside risk

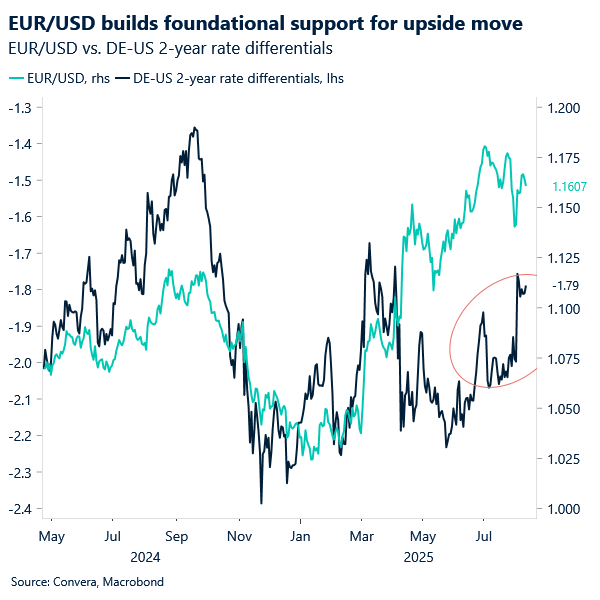

EUR/USD dipped yesterday to test support at $1.1600, delineating the contours of a range it has been stuck in for several days: $1.1600–1.1670. Following the major US labor market fiasco – and the Trump-esque response that saw the head of the BLS removed – the euro found momentum to push higher. It is now up 1.7% month-to-date. However, investor confidence in the eurozone’s ability to secure a trade deal that proportionally benefits the bloc remains damaged.

From a sentiment perspective, therefore, this creates a less-than-rosy outlook for both currencies, reinforcing the need for concrete catalysts to drive the euro higher amid structural dollar weakness. In the absence of such events, quiet trading days tend to leave the pair directionless.

Still, the balance of risks remains tilted to the upside for EUR/USD in the short term. Fundamentally, the pair has support, which bolsters sentiment-driven factors in favor of the euro—especially during periods of recovery. In fact, two-year EUR/USD rate differentials have narrowed to their tightest levels this year, reflecting expectations that the Fed may soon resume rate cuts.

Traditional safe havens under pressure

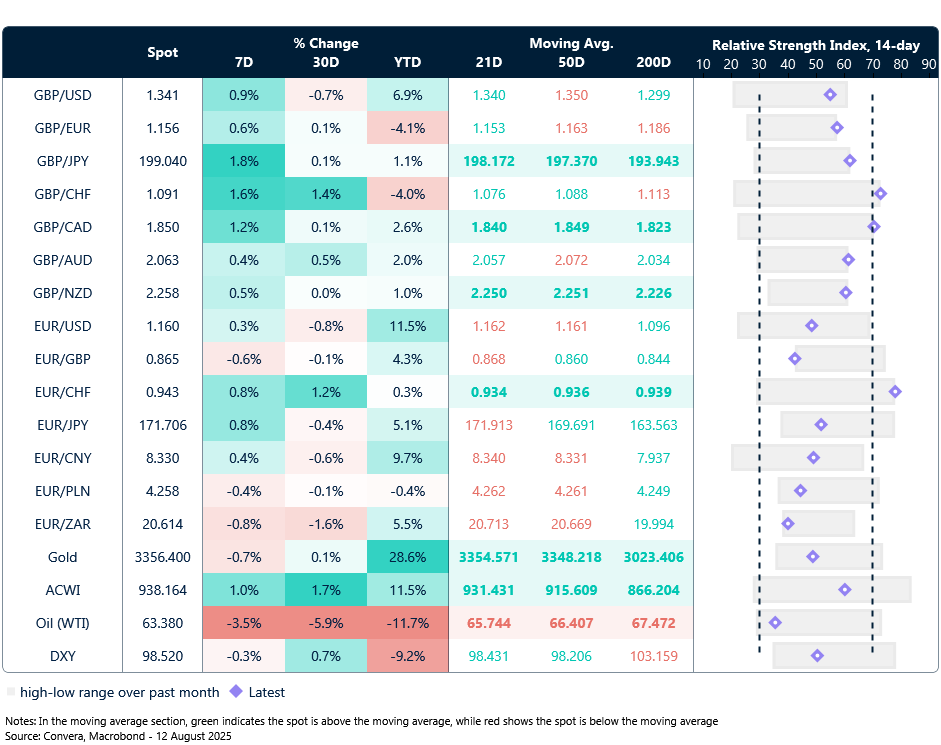

Table: Currency trends, trading ranges and technical indicators

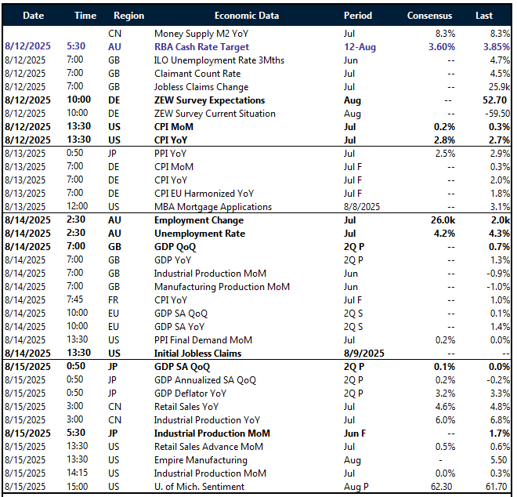

Key global risk events

Calendar: August 11-15

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.