USD: When doves turn hawkish

Antonio Ruggiero

The dollar regained strength yesterday, with its index – the DXY – rising nearly 0.7%. It may have been Austan Goolsbee, a well-known dove, who sealed the cautious tone echoed by several Fed speakers this week, notably Chair Powell. When a dove speaks hawkishly, markets pay close attention. In an interview reported by the Financial Times, Goolsbee remarked that the labour market remains solid despite recent cooling, while inflation continues to tick higher. He ultimately expressed discomfort with cutting rates now, especially if the assumption is that inflation is merely a transitory by-product of tariffs.

As this week’s remarks sink in, investors are increasingly recognising that the Fed’s path remains highly data-dependent – and that the dollar may emerge as a medium-term winner: if the cautious Fed tone is validated by an uptick in the labour market and lingering price pressures – considered the Achilles’ heel of the U.S. economy – it could further support the dollar. After all, August’s and September’s weak NFP prints (covering July and August respectively) seemed more a product of uncertainty than a direct result of tariffs, many of which hadn’t yet taken effect. As these trade measures settle into the economic landscape and businesses begin to adjust, a rebound in labour market conditions remains plausible.

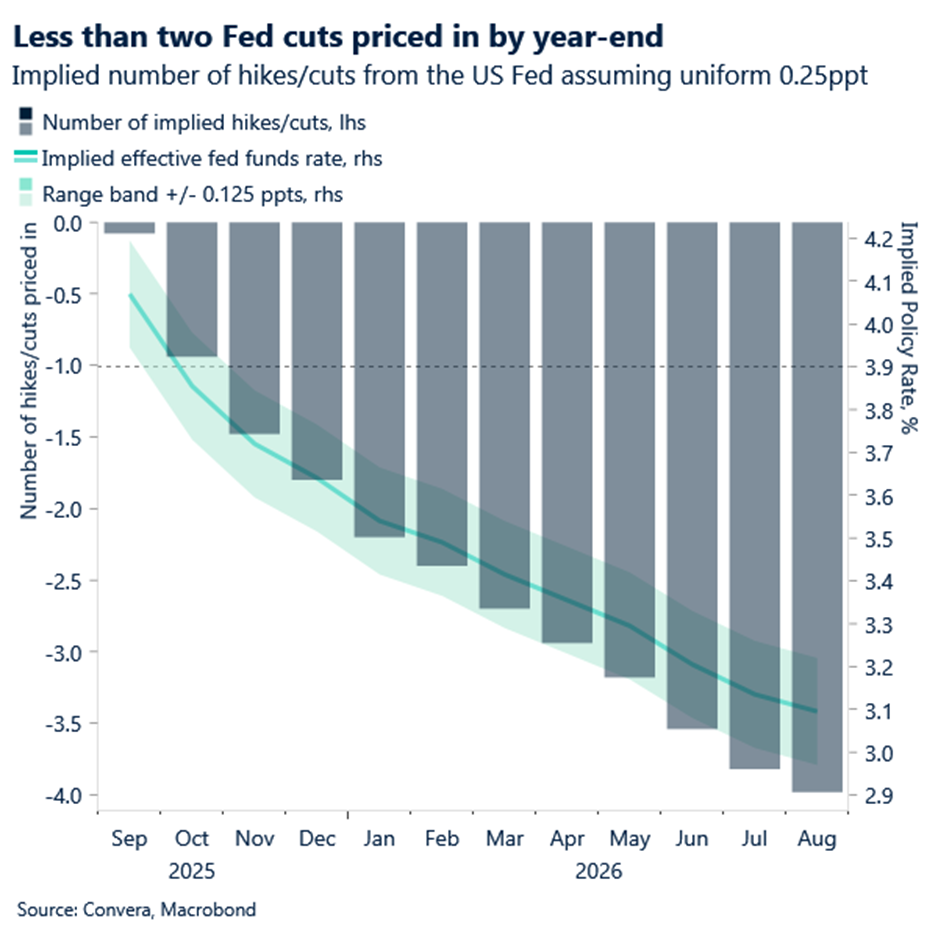

Markets are currently pricing in a ~43 basis-point cut by year-end – just shy of two full quarter-point reductions. In our view, the probability of two cuts is overpriced. With only two meetings remaining, a clearly data-dependent Fed, and an economy that isn’t exactly flashing recession warnings, we expect further easing expectations to be priced out.

Let’s keep an eye on weekly jobless claims today and the PCE report tomorrow as we try to pinpoint the pace at which the Fed may proceed with cuts.

CAD: A widening gap in productivity

Section written by: Kevin Ford

The Canadian Dollar extended its upward momentum, reaching a fresh monthly peak of 1.3907 against the U.S. Dollar. Over the past two months, 1.3925 has stood as the highest level, marking that as a key resistance point. The ‘Fedspeak‘ this week has brought a more cautious tone and reaffirmed the data-dependent approach to gradual monetary policy normalization. The U.S. Dollar has rebounded, gaining against all major currencies and leaving the Loonie among the week’s worst performers.

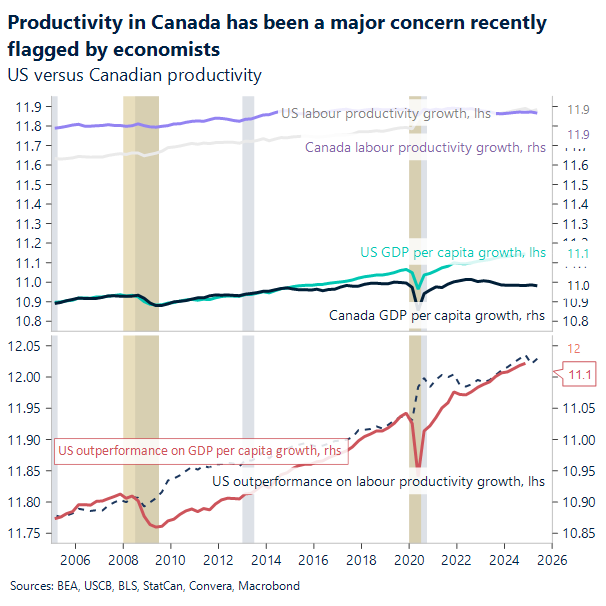

On the macro front, Canadian productivity has been consistently lagging behind that of the United States, a trend that has grown more concerning over the last five years. While the U.S. has seen its business productivity increase, Canada’s has stagnated and even declined. This widening gap is a significant problem, as a country’s long-term prosperity is directly tied to its ability to produce more with the same amount of effort. Unfortunately, key Canadian sectors have seen significant productivity declines, which has meant that, as a whole, our economy has required more workers to generate less output.

Currency performance also plays a role in this dynamic, as a weaker Canadian dollar can make imported machinery and technology, which are essential for boosting productivity, more expensive for businesses to acquire. This challenge has been made even more complex by recent trade shifts. The regional trade war with the U.S. has hit Canadian industries hard, particularly those in non-durable manufacturing and wholesale trade. These sectors are feeling the direct effects of new U.S. tariffs, which have created a palpable sense of uncertainty and disruption. This isn’t just a matter of a fluctuating dollar; it’s a new reality where trade barriers are directly disrupting production and supply chains, causing a tangible drag on the efficiency and output of Canada’s most trade-dependent sectors. As a result, businesses have been forced to pull back on production, reduce hiring, and delay crucial investments, all of which contribute to the broader decline in national productivity.

EUR: Euro’s balancing act

Antonio Ruggiero

1.1725 appears to be the new short-term support level for EUR/USD, emerging from a shift in policy expectations from the Fed – one that markets took time to digest. Initially, there was aggressive pricing of easing, which later transitioned to a more moderate and conservative outlook. In response, the euro rallied, reaching new year-to-date highs, before paring back gains as hawkish repricing took hold.

Yesterday, the euro fell approximately 0.65% against the dollar, catching up with re-priced expectations. We expect the support level to hold as we await macroeconomic data from the U.S. that could further clarify the Fed’s policy trajectory – tomorrow’s PCE report being a clear case in point. Markets are currently pricing in a 43 basis-point cut by year-end, which we believe may be overly optimistic (see USD section).

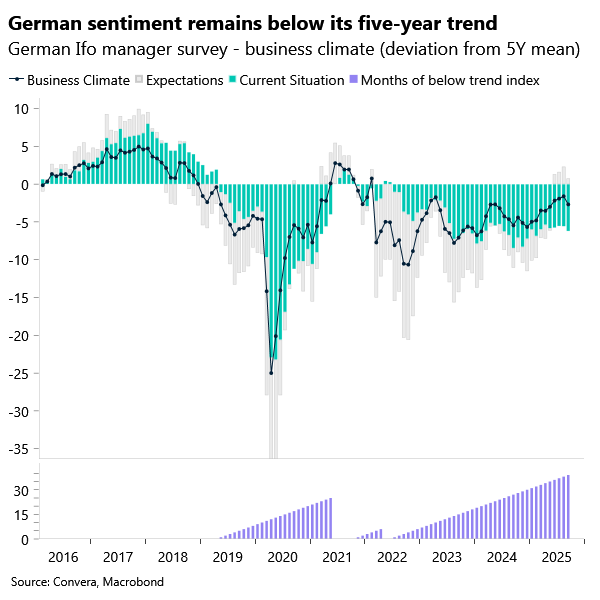

Meanwhile, weaker-than-expected German Ifo data added further pressure on the common currency, with both the current conditions and expectations components falling short of forecasts. This may reflect the long-awaited catch-up between sentiment – still buoyed by early optimism following the debt ceiling relaxation – and a much gloomier macroeconomic backdrop. That backdrop is marred by U.S. tariffs and a stronger euro, which remains a threat to export competitiveness.

MXN: Banxico to cut rates to 7.5%

Section written by: Kevin Ford

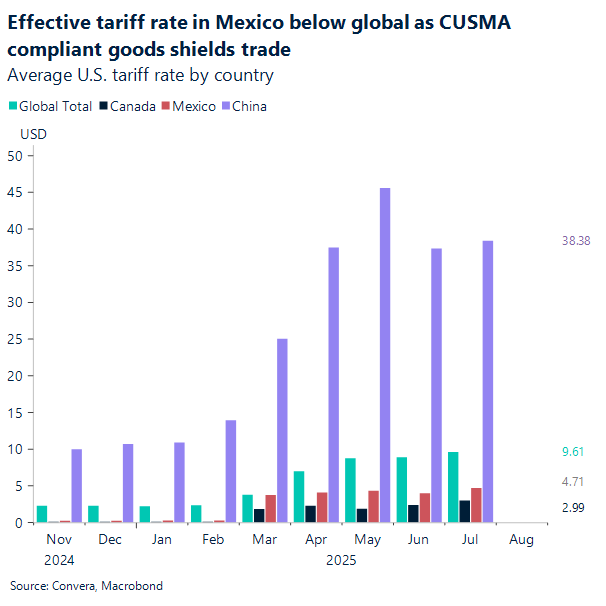

Markets are anticipating another 25 basis-point cut by Mexico’s central bank, delivering its 10th straight rate cut, which would bring the overnight rate to 7.5%, the lowest in three years. In its past meetings, Banxico has acknowledged that economic activity has slowed significantly over the past year, and monetary policy transmission has yet to fully materialize in the economy, while inflation remains within Banxico’s target range. The peso has found support from Banxico’s gradual easing policy. Despite some erosion of carry trade appeal, emerging market and Latin American currencies have performed well, especially since April. This strength is a result of a global environment where the demand for risk and high-yield assets has kept the peso supported.

Mexico’s export sector, in particular, has remained strong, benefiting significantly from its integration with the North American market under the USMCA trade agreement. This framework, along with the exemption of certain products and US content rules, has helped Mexico maintain its competitive edge even as other countries faced trade barriers. The primary vulnerability for the Mexican peso (MXN) is now less about tariffs and trade uncertainty and more about the health of the US economic cycle. The currency’s strength will likely be influenced by the ongoing resilience of the US consumer, as well as risks stemming from a potentially weaker US labor market, which could in turn lead to softer remittances and impact Mexico’s financial stability.

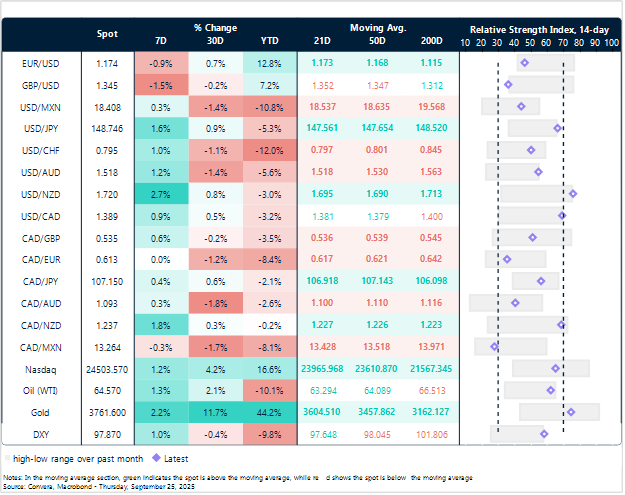

Loonie and Kiwi look overbought as seen by the RSI Index

Table: Currency trends, trading ranges and technical indicators

Key global risk events

Calendar: September 22-26

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.