USD: Reconciling GDP growth with labor weakness

The most notable move to start the week has certainly been the sharp drop in the Japanese Yen. It weakened 1.6% against the dollar on Monday following Takaichi’s victory. Her unexpected win boosted expectations for continued fiscal stimulus and immediately curtailed bets on an imminent rate hike by the Bank of Japan (BoJ). This uncertainty sent both Gold and Bitcoin soaring to record levels when priced in JPY. While Takaichi’s post-win comments about revisiting the BoJ accord and “owning… monetary policy” caught attention, she’s actually toned down her anti-rate hike rhetoric recently, moving away from calling hikes “stupid” last year. This signals that the full throttle “Abenomics” era is unlikely to make a comeback, especially since the LDP is now operating as a minority government.

Meanwhile, the US economy remains a challenge to read due to the ongoing government shutdown, which has severely diminished visibility. However, the shutdown is a material headwind: S&P Global Ratings estimates it could trim GDP growth by 0.1−0.2 percentage point for every week the government remains closed. The limited data we do have, like the JOLTS report and September estimates from ADP and Revello Labs, still suggests the US is firmly a “no-hire, no-fire” economy, characterized by very slow turnover and low, but positive, job gains.

So, what’s the Federal Reserve (Fed) to do? Despite the government shutdown, and no new official data to rely on, the Fed is forced to take its signals from private-sector indicators and its broad network of business contacts. As of now, markets are pricing in another 25 basis points rate cut by the end of the month.

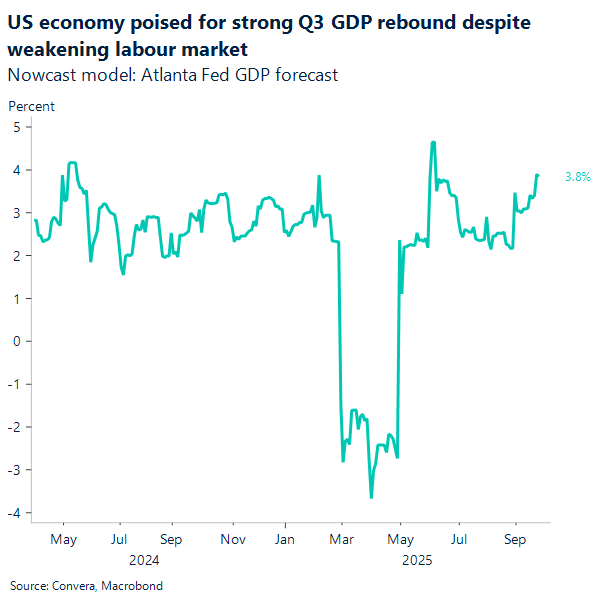

This brings us to a crucial paradox: How can we reconcile the apparent weakness in the labor market (the slow job growth/no-hire environment) with the decent economic growth forecasted by models like the Atlanta Fed’s 3.9% Q3 GDP nowcast?

This puzzle seems to be solved primarily by a surge in labor productivity. Remember, GDP measures total output. If businesses are suddenly producing significantly more goods and services without hiring more workers, GDP will rise even if employment doesn’t. This dynamic is fueled by heavy Capital Expenditure (Capex) in technology, particularly Artificial Intelligence (AI) and automation. Companies are deploying capital to make their existing workforce more efficient, which boosts output per hour and, consequently, GDP, while keeping their headcount flat. The net result is a temporary but powerful “decoupling” where corporate profits and overall production accelerate faster than job creation.

On the labor market side, its “weakness” isn’t solely a collapse in demand; it’s also a function of diminished supply. Structural constraints, such as reduced immigration and demographic trends (like retiring Baby Boomers, as noted by the St. Louis Fed), have lowered the “break-even” job growth rate needed just to keep unemployment stable. This means sluggish payroll gains don’t necessarily signal an impending recession, but rather a structurally tight labor supply. Separately, short-term GDP figures can be easily skewed by volatile components, such as a sharp decline in imports, providing an inflated growth reading that doesn’t immediately translate to new jobs. Ultimately, this coexistence highlights an economy that’s growing more efficiently by relying heavily on capital-intensive technology and a constrained workforce.

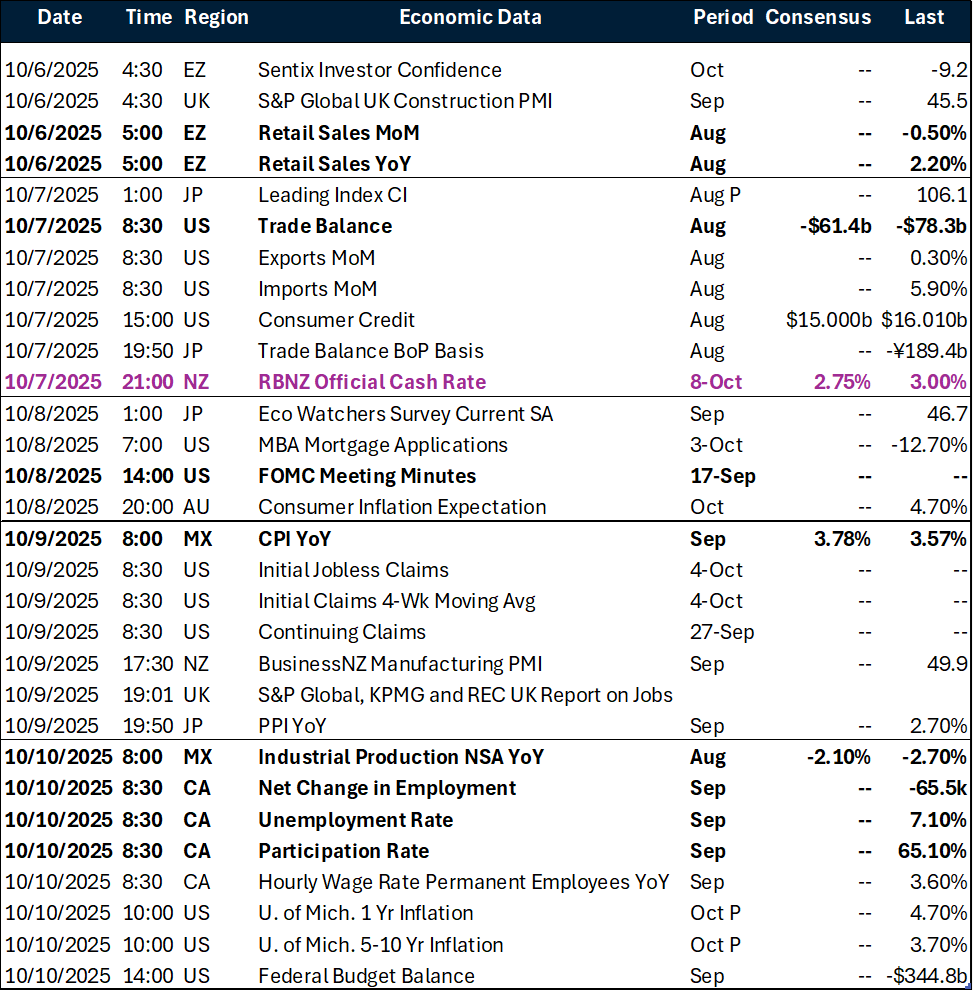

The central bank calendar remains busy this week. We anticipate the release of the FOMC Minutes on Wednesday, followed by Fed Chair Powell on Thursday. Elsewhere, the Reserve Bank of New Zealand (RBNZ) takes the spotlight on Wednesday, where a 25 basis-point cut is widely expected. We’ll also hear from the Norges Bank today and the Reserve Bank of Australia (RBA) on Friday.

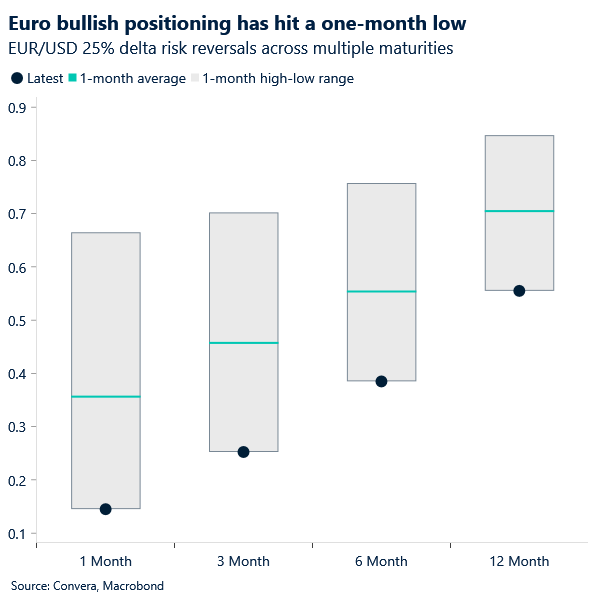

EUR: Euro sentiment back on trial

EUR/USD fell as low as ~0.70% at one point during London trading hours yesterday. An already fragile political backdrop in France worsened following Prime Minister Sébastien Lecornu’s surprise resignation – less than a month from his appointment, and just days after President Emmanuel Macron unveiled a new cabinet aimed at restoring stability. Lecornu’s departure mirrors the fate of his two predecessors, each undone by the same challenge: passing a budget through a fractured parliament, one that includes unpopular spending cuts and tax increases aimed at reining in the euro area’s largest deficit.

The French-German 10-year spread widened to 86 bps – its highest level since January. Meanwhile, EUR/USD later pared losses, closing at -0.1%, as the surprise nature of the move likely triggered an outsized reaction that was subsequently retraced. Amid limited data-driven substance, the US shutdown may have further amplified the initial move.

Yet this is far from an isolated euro-negative event. Recent months have seen a buildup of structural headwinds weighing on the common currency, compounding the stalled momentum of its earlier H1 rally. Optimism around Germany’s debt brake reform is fading amid concerns over execution, transparency, and long-term credibility. While the EU-US trade deal has been formalized, questions linger over its implementation and strategic balance – especially given the EU’s weaker negotiating position. To cap it off, the macroeconomic backdrop remains consistently disappointing, with this morning’s weak German factory orders a clear case in point (down 0.8% month-on-month).

In this context, while the US government shutdown remains – on paper – a USD-negative event, the resulting silence has created space for investors to reassess euro sentiment, offering no fresh US-driven impetus, i.e., disappointing macro releases, for the euro to push higher.

EUR/USD bounced off support at 1.1650 yesterday, returning to the 1.17 zone. With little fresh input from the US side today, we expect the pair to tread water around current levels.

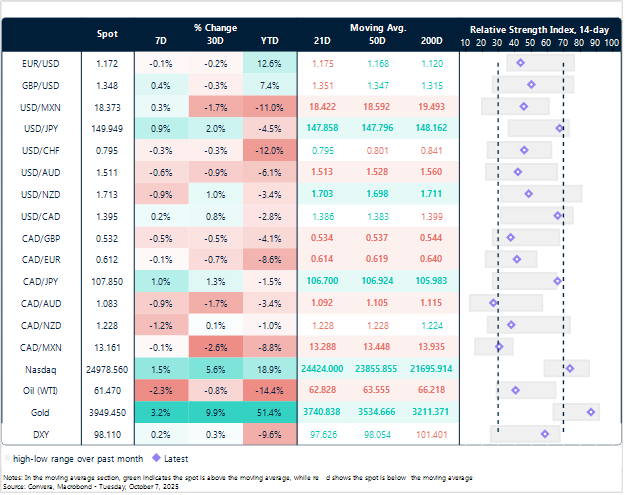

GBP: Sterling breathes, euro buckles

Unfazed by political turmoil in France, sterling rose ~0.4% against the dollar and the euro yesterday. With little on the data calendar this week, GBP remains driven by BoE speakers and evolving eurozone political dynamics. Perhaps good news for the pound, as anything domestic nowadays seems to be sterling-unfriendly.

Yesterday’s political upheaval in France gave GBP/EUR room to breathe, allowing it to distance itself from the well-worn support level at 1.1450 that dominated the second half of September. While spillovers from France’s developments onto euro price action are likely to remain contained, the BoE’s persistently hawkish stance -despite occasional dovish leanings – should keep 1.1450 a medium-term threshold, preventing sterling from revisiting its 2023 lows for now.

That said, with GBP/EUR breaking out of its upward trend that held since late 2022 – a technical armour now breached – a deeper exploration of these levels looks increasingly likely as we head toward the Autumn Budget.

CAD crosses under pressure, Oil extends its decline

Table: Currency trends, trading ranges and technical indicators

Key global risk events

Calendar: October 6-10

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.