USD: Flirting with resistance, dollar awaits Fed firepower

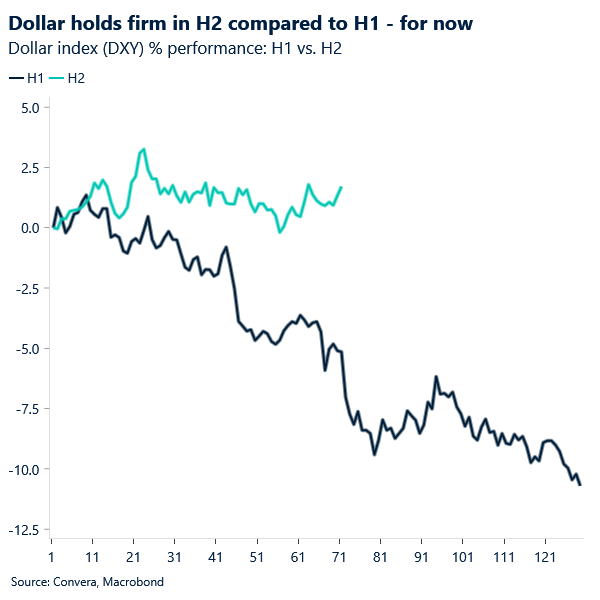

The US dollar index (DXY) has performed well so far this month – up ~0.7% – despite the ongoing U.S. government shutdown. Its largest constituents – the euro (57.6%) and the yen (13.6%) – have each faced political upheavals that sent both currencies lower, boosting the greenback. In Europe, persistent turmoil within the French government has weighed on the common currency, while in Japan, the election of pro-stimulus conservative Sanae Takaichi has raised concerns that the Bank of Japan may delay its recent shift away from ultra-loose monetary policy. Meanwhile, long-term bonds have sold off across the board in response to these developments – echoing the late-summer episode – further supporting the dollar through safe-haven flows.

Regarding the Fed’s rate expectations, we continue to believe that the two rate cuts priced in by markets for year-end represent an outsized move, suggesting that any hawkish repricing would likely support the dollar. More clarity on this may emerge later today from the Fed meeting minutes, unaffected by the shutdown.

DXY has tested resistance at 98.500. For this level to be sustainably broken, however, the dollar will need a consolidation of the Fed’s cautious stance – enough to start pricing out cuts for the October meeting. Meanwhile, investors appear to be brushing off shutdown-related risks for now. Reports suggest President Trump may be open to negotiating with Democrats on healthcare subsidies to resolve the funding stalemate, signaling mounting pressure within the White House as the shutdown enters its eighth day.

CAD: Trade talks and trade deficit

Kevin Ford

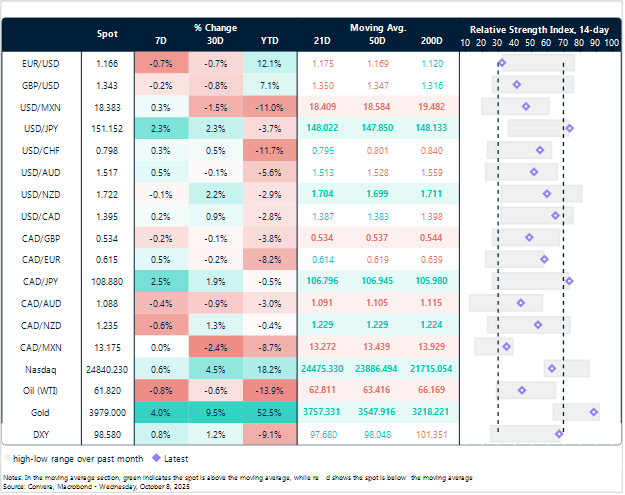

The Canadian Dollar has held steady at 1.395 despite gains in the U.S. Dollar this week. While the Yen and Euro have weakened, the Loonie remains steady, below 1.40, and near its highest level in five months. The anticipated meeting between President Trump and Canadian Prime Minister Mark Carney offered few details on a potential trade deal. Trump said he believes the U.S. and Canada can eventually reach an agreement but was vague about the timeline and terms. He described the two countries as being in “natural conflict,” competing for the same business, but noted they’ve “come a long way” in negotiations. Prime Minister Carney emphasized that Canada is the largest foreign investor in the U.S. and suggested investment could accelerate if a deal is reached.

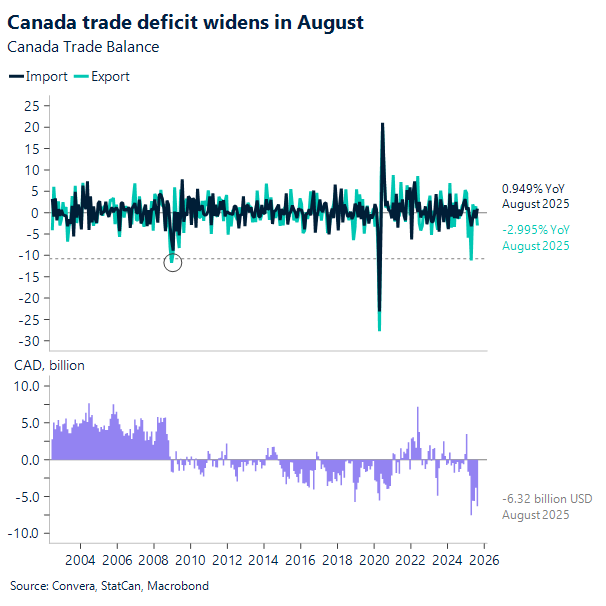

In the macro front, Canada’s goods trade deficit widened back to the second largest shortfall on record in August. According to Statistics Canada, the central theme of Canadian international merchandise trade in August 2025 was a widening trade deficit, which grew sharply from $3.8 billion in July to $6.3 billion in August. This deterioration was driven by a 3.0% drop in merchandise exports alongside a 0.9% rise in imports. Both movements were characterized by the extreme volatility of unwrought gold transactions, which significantly influenced the figures for metal and non-metallic mineral products. Exports saw broad-based declines across eight of eleven sectors, with the most notable drops coming from gold, a 9.5% fall in industrial machinery, and a significant 10.1% decrease in forestry products like lumber, the latter reaching a multi-year low following new U.S. anti-dumping and countervailing duties. Trade with the United States saw the Canadian surplus narrow, while the trade deficit with non-U.S. countries hit a record high as imports from these partners surged.

The rise in total imports was almost entirely attributable to the large influx of unwrought gold; excluding this product, overall imports would have fallen 1.0% in the month. Further impacting the trade figures were the U.S. sectoral tariffs on Canadian aluminum, which continued to depress aluminum exports, causing them to average more than 24% less post-tariff (April–August) compared to the 2024 monthly average. This tariff pressure has led to a notable diversion of Canadian aluminum exports to other global markets like the Netherlands and Poland. Overall, when combining both goods and services, Canada’s total trade deficit with the world also expanded significantly to $6.0 billion in August. Exports to the United States decreased by 3.4%, which caused Canada’s longstanding trade surplus with the US to narrow.

EUR: Shutdown silence, euro slides

EUR/USD has re-approached the $1.1650 support level, as France’s political instability continues to weigh on the euro. Since hitting its year-to-date high of $1.1919 on 19 September, the pair has revisited this support three times, recently entering a shutdown-specific range between $1.1650 and $1.1750. The range appears however fragile, and vulnerable to a downside break – particularly if today’s Fed minutes reinforce a cautious tone, prompting a hawkish repricing ahead of the October policy meeting.

In the options market, negative momentum continues to build for the euro. Short-term sentiment has tipped lower, with 1-week risk reversals turning negative – suggesting investors are more inclined to hedge against euro weakness than strength in the near term.

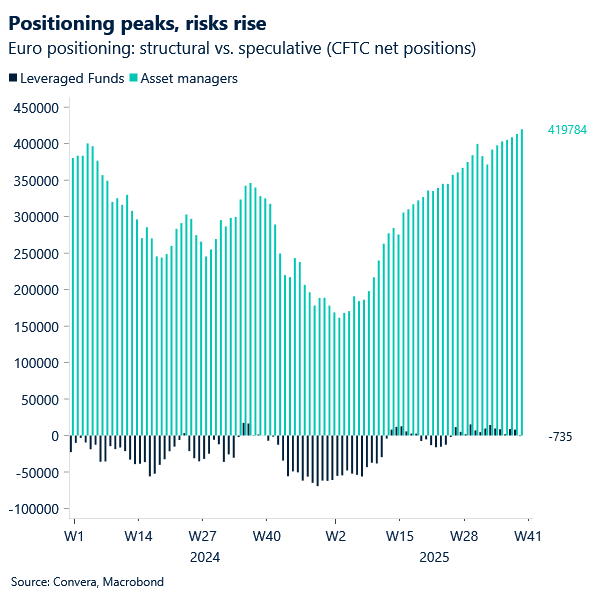

As for the credibility of these declines amid France’s renewed political risk, the silence stemming from the US government shutdown acts as an amplifier. The euro, which has largely depended on US-driven moves this year, is now grasping at alternative catalysts. Also, we still observe strong demand for euro longs – at levels not seen since 2023 – particularly among asset managers, who tend to shape longer-term currency sentiment. This contrasts with leveraged funds, which typically drive short-term speculative flows and currently hold a moderate underweight in the euro. Given how recent developments have dented euro sentiment – while bearish USD positioning appears less acute – these long euro positions may be starting to look overstretched. The resulting short-squeeze dynamic is contributing to the magnitude of the current declines.

CAD holds below 1.40 as USD keeps momentum

Table: Currency trends, trading ranges and technical indicators

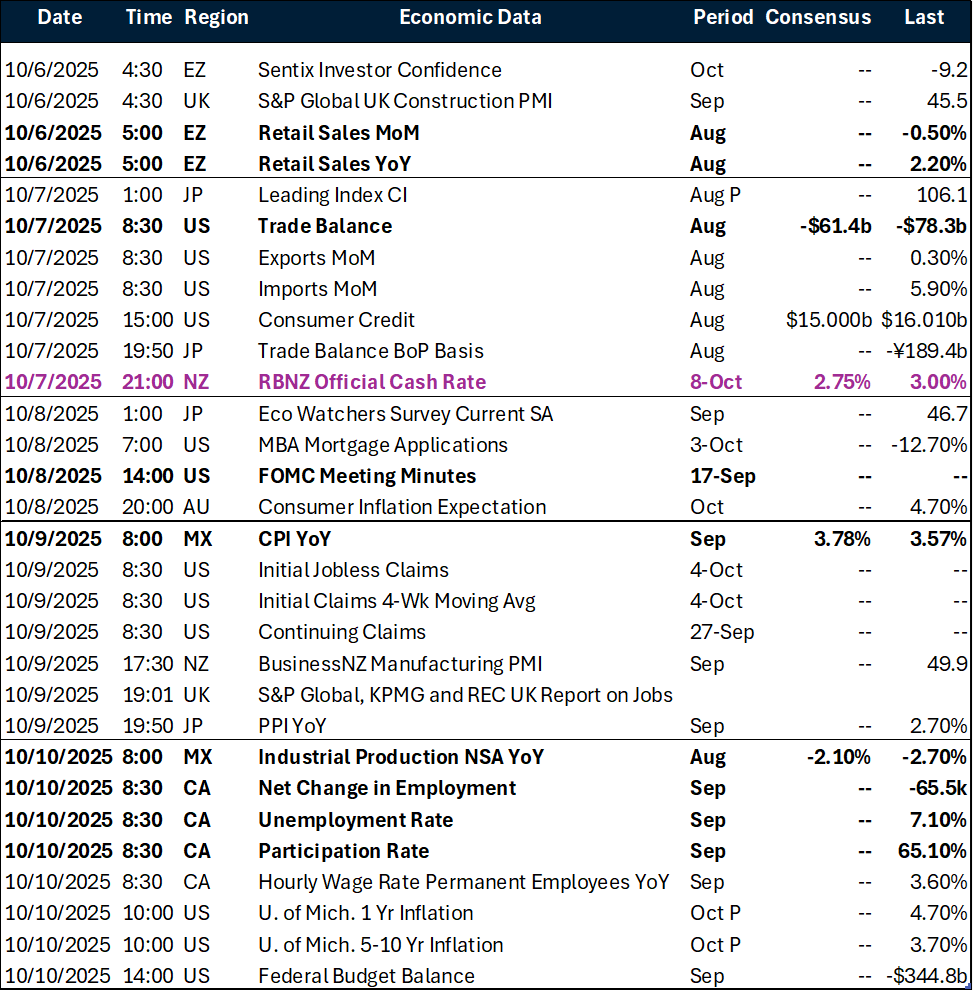

Key global risk events

Calendar: October 6-10

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.