Written by Convera’s Market Insights team

US retail sales could be next market mover

George Vessey – Lead FX Strategist

US stocks rebounded yesterday after falling more than 1% in the previous session as a higher-than-expected US inflation print lowered bets the Federal Reserve (Fed) will cut interest rates soon. The US dollar eased slightly from 3-month highs but remains over 3.5% stronger against a basket of currencies so far this year and has appreciated against 75% of the world’s currencies over the last three months.

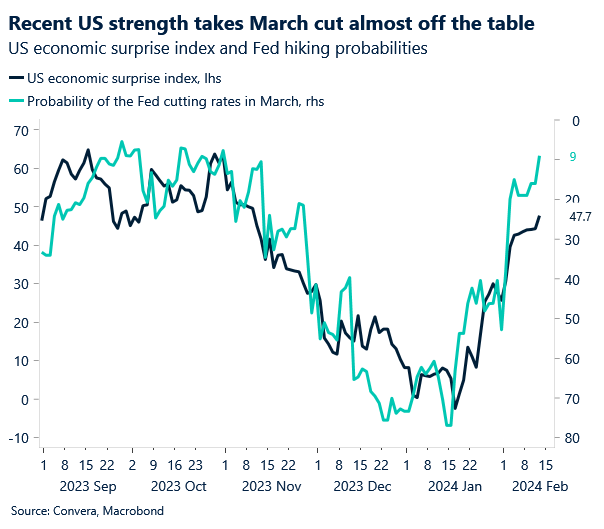

The big shift in Fed expectations – first after a blowout US jobs report and then from Tuesday’s upside surprise on inflation – has seen market pricing for 2024 rate cuts fall from about 160 basis points at the end of last year to just under 90 basis points currently. After the US CPI report, money markets have priced out a Fed cut in March and see a 53% chance of a cut in June. In line with this hawkish repricing of rates, we’ve seen US yields surge to their highest in two months, thus supporting the US dollar’s appreciation. Although both the jobs and inflation reports were a surprise, we were expecting a USD rise this month given positive seasonal trends – the dollar index has climbed in February for seven years in a row.

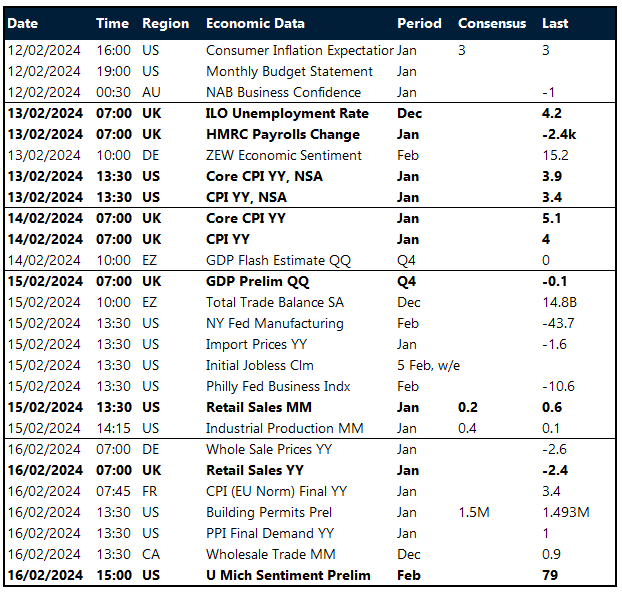

The key focus points today are US retail sales and industrial production. We expect a softer retail sales print and although industrial production could lift higher, it is likely to remain subdued given the ongoing contraction signalled by the ISM report. Any more positive surprises though will likely see a continued paring of Fed rate cut bets and thus keep the dollar well supported.

UK falls into technical recession

George Vessey – Lead FX Strategist

GDP data this morning revealed the UK fell into a technical recession last year. The fourth quarter number came in at minus 0.3%, worse than forecast. GBP/USD is trading back in the mid-$1.25 region and is grappling with its 200-day moving average. Should this key support give way, we’re eying the 100-day moving average, located at $1.25, as the next downside target in the short-term. GBP/EUR has slipped under €1.17 for the first time in over a week and needs to hold above €1.16 to retain its uptrend.

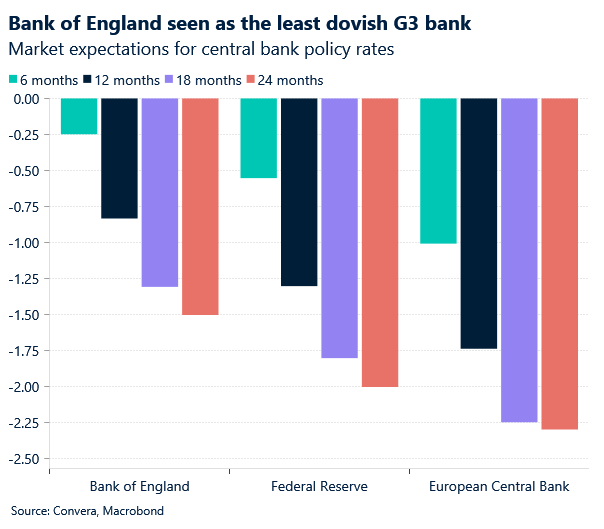

All three major parts of the UK economy contracted in October through December. The services sector, which makes up around three-quarters of the economy, declined by 0.2%. Production, which includes manufacturing, suffered a 1% drop in output, while construction shrank by 1.3%. While the economy has now decreased for two consecutive quarters, across 2023, GDP is estimated to have increased by 0.1% compared with 2022. For the Bank of England (BoE), the result is largely irrelevant to the outlook for interest rates. More importantly, data showed yesterday that UK inflation was less than forecast in January, with downward trends in the cost of food and household goods bolstering expectations that inflation could soon return to the Bank of England’s (BoE) target by the summer. The pound suffered daily declines across the board because traders bet on steeper and earlier interest-rate cuts. The market now sees the BoE delivering just over 70 basis points of cuts this year, compared to 61 basis points at Tuesday’s close after the stronger-than-expected wage growth numbers.

Despite the very short-term outlook for sterling potentially looking weaker, we still think 2024 should see sterling stage a shallow recovery against the US dollar and euro, mainly due to the higher UK interest rate outlook with less rate cuts expected by the BoE compared to the Fed and ECB.

Green shoots for euro

George Vessey – Lead FX Strategist

The euro continues to hold onto the $1.07 handle versus the stronger US dollar, helped by a rebound in risk sentiment with global stocks clawing back some of Tuesday’s losses. There was no change to Eurozone GDP results, which confirmed the bloc’s stagnation in the fourth quarter of last year, but data did show industrial production rebounded 2.6% m/m in December and defying market expectations of a 0.2% decrease.

It was the biggest gain in Eurozone industrial production since August 2022, with the largest monthly growth in Ireland at 23.5%. Exclude Ireland and we see the overall trend for the Eurozone remained down though, with continued German weakness where output fell for the second consecutive month. In addition, we’ve also heard this week that the German government will revise down its forecast for growth this year to 0.2% from a prediction of 1.3% published in October. Germany was the only G10 economy to shrink last year, and continued weakness this year will likely weigh on rest of the bloc, especially the manufacturing sector, which has been in contraction since July 2022. The recovery of the manufacturing sector is taking time, but businesses are getting slightly more upbeat about orders.

China’s economic woes aren’t helping though, especially for its close trading partner – Germany. Plus, as we noted in our annual outlook, historic peaks in EUR/USD since 2010 have only occurred during times of Chinese manufacturing expansions, so to see a sustained recovery in Europe and the euro will likely require conditions to improve in China too.

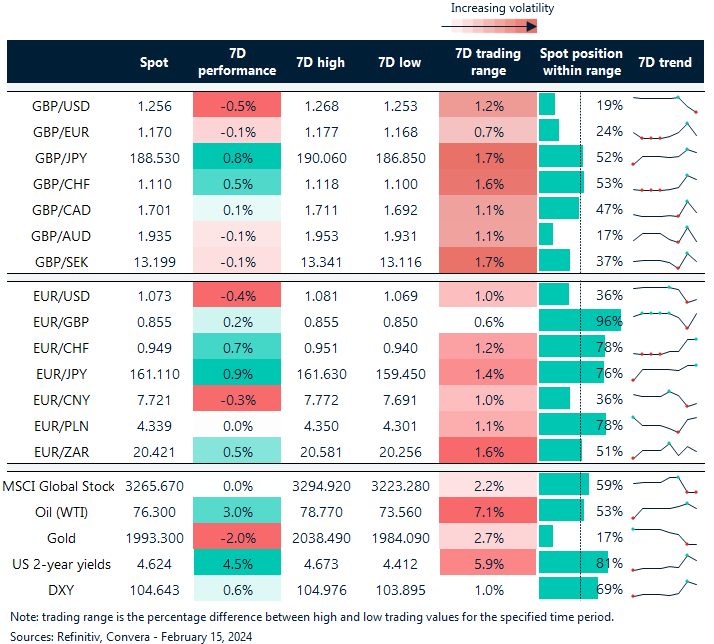

Yen and Swiss franc still biggest losers

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 12-16

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.