Written by Convera’s Market Insights team

Dollar keeps calm and carries on

George Vessey – Lead FX Strategist

As the highest yielding major currency, the low FX volatility environment we’re currently in, conducive to carry trades, favours the US dollar which is also the most liquid currency. It’s also a safe haven asset, meaning those taking more risk by investing in carry trades are also hedged against the chance of any unexpected rise in risk aversion.

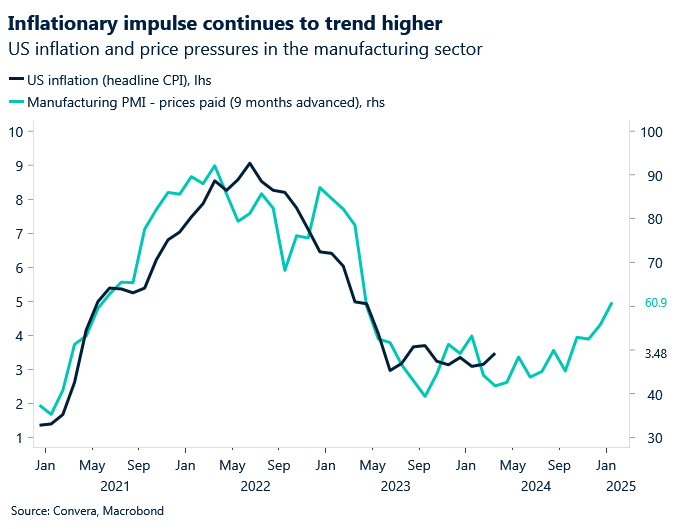

The dollar gained more ground on Wednesday as investors continued to bet on the US economy outperforming peers and that the Federal Reserve (Fed) will keep interest rates higher for longer than its peers. After it fell more than 3% last week, its biggest weekly percentage drop since early December 2022, the US dollar has been advancing most against the Japanese yen, which remains one of the most attractive funding currencies for carry trades. Meanwhile, we recently proposed two macro theses that are starting to unfold, and which might complicate the picture for the Fed going into the second half of the year. First, the global inflationary impulse and the goods side of inflation have bottomed and are on the rise again. Second, the US labour market and economic growth are more likely to surprise to the downside. This poses a conundrum for the Fed, that is complicated by the upcoming presidential election in November.

Q2 inflation misses and further moderation in job and wage growth might sway policy makers to cut rates in July. However, an early pivot and pipeline price pressures might anchor headline inflation above the 2% target in 2025. The incoming data will be crucial to gauge how much of the goods inflation uptick will be combated with by falling wage growth.

BoE edging closer to rate cuts

George Vessey – Lead FX Strategist

We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% today, which is in line with consensus and current market pricing. It’s currently a coin toss whether the BoE cuts in June or August though, so any dovish signals raising the odds of a June cut risk hurting the pound.

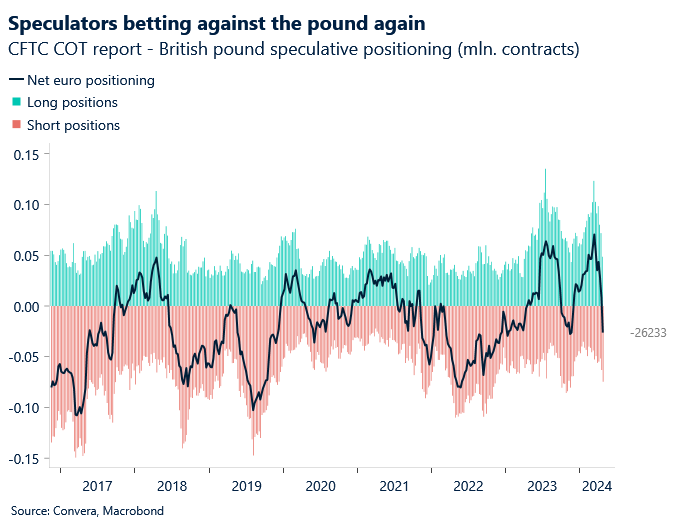

GBP/USD continues to hover below the $1.25 handle whilst GBP/EUR remains suspended above €1.16 as traders await the so called “Super Thursday” meeting, which includes the BoE Monetary Policy Report of updated economic projections. We think the BoE will downgrade its medium-term inflation outlook given the disinflationary trend is more akin to that of Europe as opposed to the US and the MPC vote split could lean more dovish, with another policymaker, potentially Ramsden, joining Dhingra in voting for a cut. Such a scenario would see the odds of a June cut increase, meaning relative rates are a negative for the pound’s value. Speculative traders have been preparing for a weaker pound with GBP short positions recently rising to their largest since January 2023.

Whilst GBP/USD overnight implied volatility hasn’t budged too much, EUR/GBP overnight implied volatility jumped to 8.6%, the highest level in three months, with option skews favouring topside, meaning sterling could be a greater risk of falling more against the common currency on a dovish BoE tilt today.

Euro drifts lower to $1.075

Ruta Prieskienyte – FX Strategist

The euro edged lower against the US dollar during the mid-week trading session amid a cautious mood in global markets. In the absence of top-tier economic data release from both sides of the Atlantic, comments from the central bank officials took the centre stage.

The latest report showed that German industrial production declined by 0.4% m/m in March 2024, admittedly less than the market consensus of 0.6% m/m drop, marking the first contraction so far this year. The less volatile 3m/3m comparison showed that production was 0.1% higher from January to March 2024 than in the previous three months. On an annual basis, industrial output fell 3.3% y/y in March, softer than the prior 5.3% y/y slump. Elsewhere, Sweden’s central bank cut interest rates for the first time in eight years, becoming only the second G10 central bank to begin its easing cycle following the post-pandemic surge in inflation. The ECB is also among one of the monetary policymakers willing to diverge from the Fed even if it comes at the expense of its currency. Speaking in Frankfurt on Wednesday, ECB’s Wunsch noted that ECB’s divergence from the Fed risks significant euro effects. The common currency has thus far shed 2.5% value against the US dollar in 2024.

Elsewhere, EUR/GBP briefly surged to a fresh 2-week high of £0.86179, touching the 200-day SMA, as bullish bets accumulate ahead of the BoE rate decision later today. Options flows are already reflecting the potential for a more dovish BOE stance. With overnight EUR/GBP ATM implied volatility up to 8.6%, the highest level since February 2nd, and the 1-week EUR/GBP risk reversal skew, an indicator of sentiment and positioning, widening to 0.25% in favor of euro calls, the most bullish since beginning of October. A close above its 200-day moving average would be a bullish signal and could see EUR/GBP test 2024 highs around £0.8650.

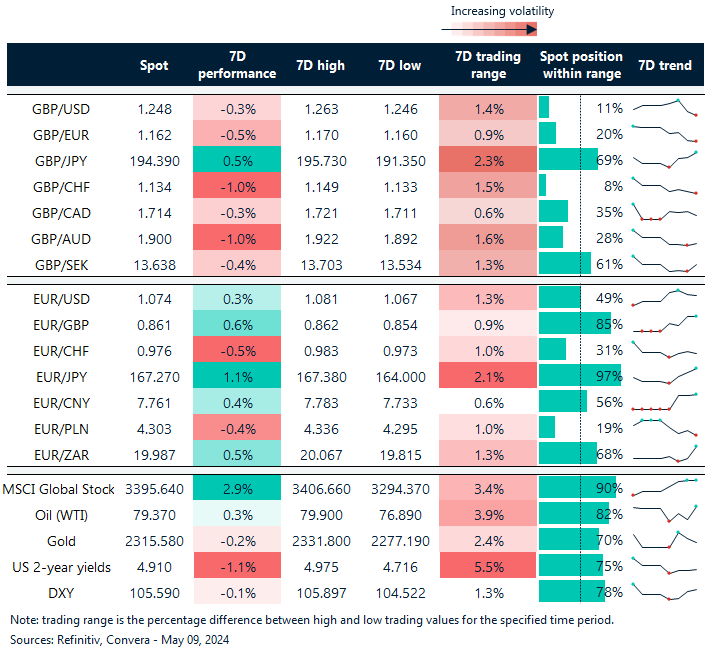

Global stocks up almost 3% in a week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 6-10

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.