USD: No jobs report, no conviction

Markets are sending mixed signals. U.S. and European equities continue to climb, but beneath the surface, investor positioning suggests caution is building. The outperformance of traditional safe havens – Gold, Treasuries, and the Japanese yen – reflects persistent concern over political gridlock and its potential spillover effects. Meanwhile, amidst the US data blackout and the confusing signals on the labour market, the US dollar might find a floor.

With the official September jobs report delayed by the government shutdown, investors have turned to alternative data sources to gauge labour market health. Revelio Labs reported a rise in employment, offering a more comprehensive snapshot by including both public and private sectors. This contrasted with ADP’s weaker print, which was partly skewed by a methodological recalibration.

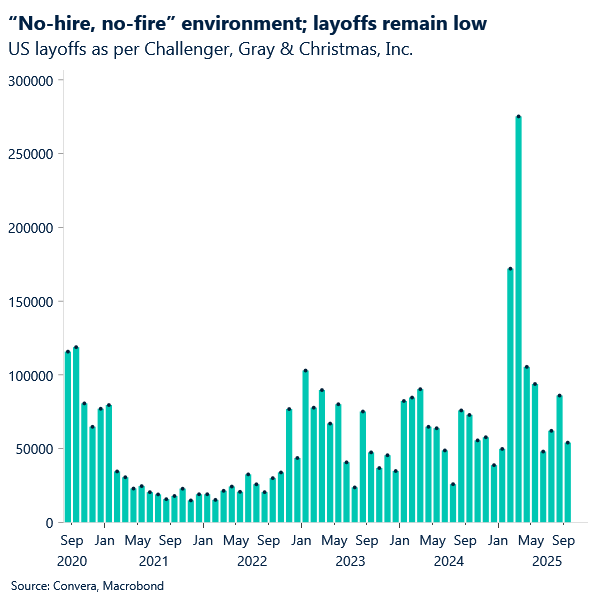

Labour market signals remain murky. Unemployment is edging higher, wage growth is steady, and hiring momentum appears to be stalling. Challenger data showed a sharp drop in job cut announcements -suggesting employers aren’t rushing to downsize – but hiring plans also softened, reinforcing the view of a “no-hire, no-fire” environment.

Overall, the labour market looks fragile but not yet broken. The key risk is that prolonged political dysfunction could trigger broader layoffs, especially if fiscal uncertainty deepens. For now, however, the lack of clear deterioration in employment data may limit expectations for aggressive Fed easing. That dynamic could help the U.S. dollar find a near-term floor, even as broader sentiment remains cautious.

That being said, history offers little comfort – during the last three shutdowns (2013, early 2018, and late 2018–2019), the dollar drifted lower through the impasse.

EUR: Euro’s sugar high fades

This week challenged the divergent ECB–Fed policy paths, with contrasting signals from both sides. ECB President Christine Lagarde sounded more dovish than expected, while Dallas Federal Reserve President Lorie Logan cautioned that although the Fed’s recent rate cut helped mitigate labour market risks, further easing could be premature.

Adding to the mix, the privately-owned Challenger report showed an improvement in layoff intentions for September compared to August. Amid shutdown silence, and with little else concrete to trade on, these factors combined to trigger an outsized market reaction, with EUR/USD tumbling over 0.3% at some point during the session.

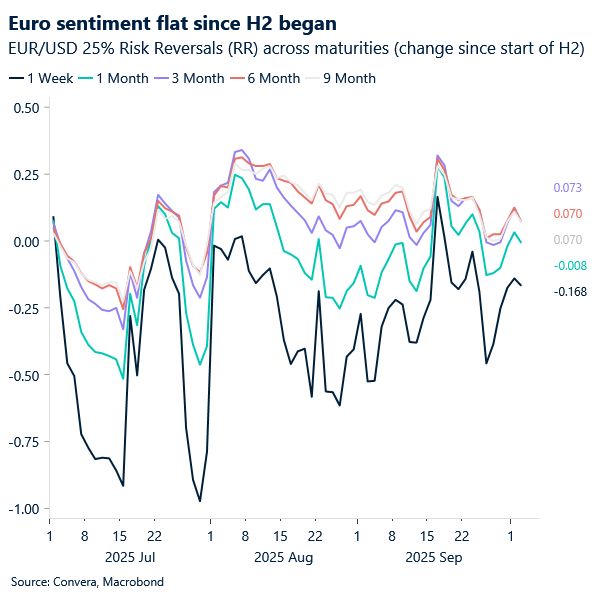

Technically, the pair remains supported around the $1.17 level, which looks more realistic than $1.18 for now, given the ever-cautious Fed. EUR/USD is still in the green week-to-date, having steadily risen until yesterday’s drop. Yet the weekly performance has highlighted signs of upside exhaustion, with daily price action showing longer upper wicks this week compared to previous sessions. After multiple failed attempts to break resistance at $1.1750, it took the often-overlooked Challenger report to trigger a pullback.

Overall, this week’s price action began with an artificial euro rally, driven by shutdown risks that weighed on the dollar. But organically, there was little to support the euro, and after repeated resistance tests, the pullback was inevitable.

GBP: Held Up by rates, held back by growth

Sterling has started October on a firmer footing against most G10 currencies, with the exception of the yen, but the rally lacks conviction. GBP/USD once again failed to hold above the psychologically important $1.35 level – its 10-year average – while GBP/EUR retreated from €1.15, underscoring the currency’s vulnerability to shifting macro sentiment.

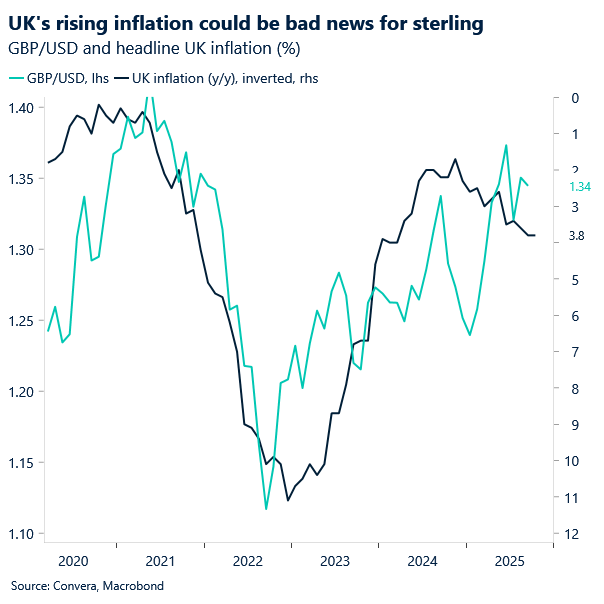

The pound’s performance is being shaped by a complex mix of sticky inflation and weakening growth – conditions that have repeatedly proven challenging for sterling this year. Higher inflation expectations can offer near-term support for GBP by reducing the likelihood of further Bank of England (BoE) rate cuts. However, in a stagflationary environment, that support is often short-lived, as deteriorating growth erodes investor confidence.

This week’s data adds to the tension. UK businesses now expect consumer prices to rise at the fastest pace since 2023, with BoE surveys showing inflation expectations climbing for a second straight month. Firms in the BoE’s Decision Maker Panel also plan to raise prices by 3.7%, up from 3.5% in August. These figures suggest inflation pressures remain embedded, particularly in food and wage costs.

For sterling, this presents a double-edged sword. On one hand, persistent inflation may keep the BoE on hold, offering rate support. On the other, the backdrop of a softening labour market and fragile fiscal credibility limits upside for GBP. Policymakers like Catherine Mann and Megan Greene have warned that disinflation may be largely behind us, reinforcing the case for caution.

In short, while inflation-linked rate expectations may offer a floor for sterling, the broader macro mix – marked by stagnation risks and policy uncertainty – continues to cap its upside.

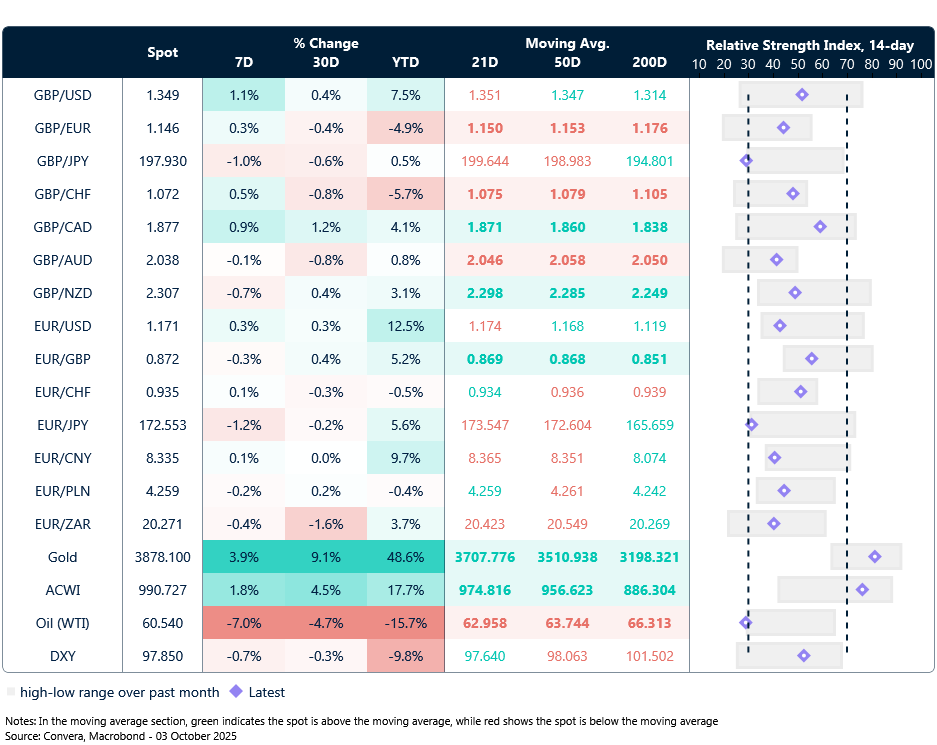

Japanese yen is top performer this week

Table: Currency trends, trading ranges and technical indicators

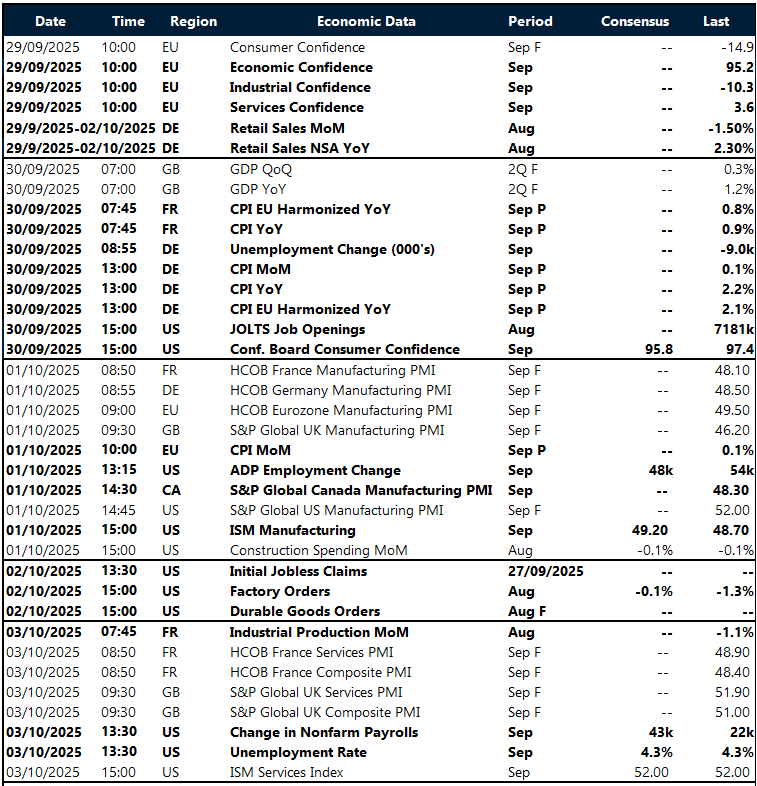

Key global risk events

Calendar: September 29- October 3

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.