Written by Convera’s Market Insights team

US inflation test for Fed

George Vessey – Lead FX Strategist

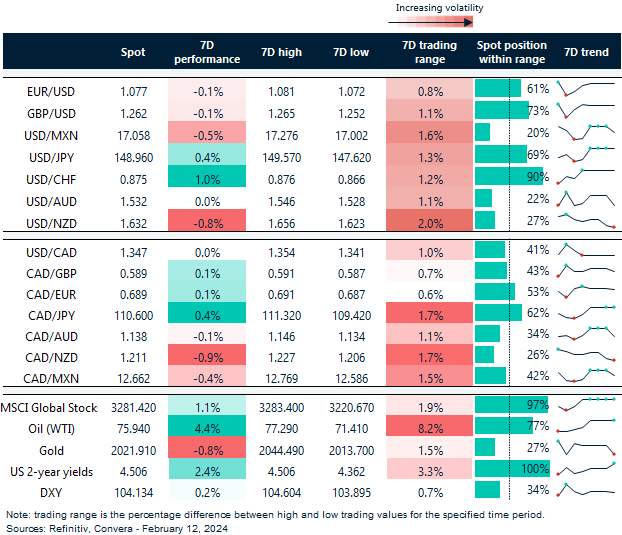

A quiet week in FX markets last week has spilled into Monday as many market participants celebrate the Lunar New Year. Last week saw the US dollar surrender about 40% of its post-US jobs report gains, but the dollar remains the top-performing major currency year-to-date. The lukewarm risk-on climate has somewhat dented dollar demand lately, but we see upside risks in US yields and a spike in fixed income volatility, which could support the dollar further. A catalyst for such a move would be an upside surprise in the US inflation report due this Tuesday.

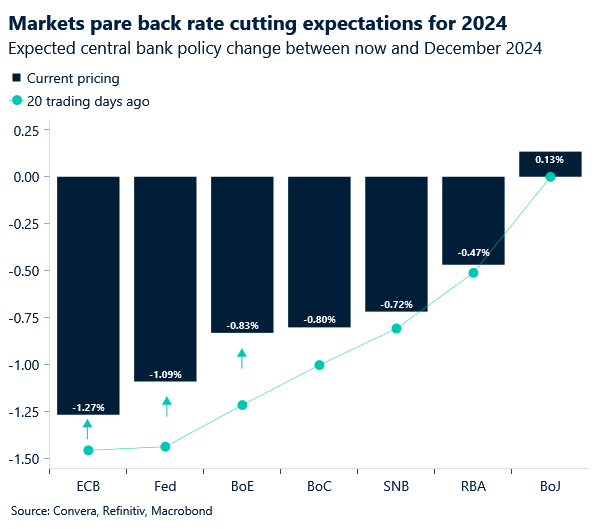

Risk sentiment remained upbeat towards the end of last week as US inflation revisions turned out to be a damp squib. US equities surged to fresh record highs with the S&P500 hitting the key 5000 level. Yields slipped slightly across the curve but although the dollar softened, it recorded its sixth successive weekly gain against a basket of major peers. Despite current low levels of volatility, we’re bracing for what could be an eventful week. A whole host of important data points drop in, which could further complicate central banks’ policy outlooks. Markets have started paring back rate cutting expectations thanks to hawkish signals from policymakers and strong economic data, so it will be interesting to see the reaction following this week’s data dump. US inflation will be key, especially since yields haven’t moved much higher in the face of strong growth data. Headline consumer price inflation has oscillated between 3.0% 4.0% for the last six months and explains why markets are convinced the Federal Reserve (Fed) has the ability to cut interest rates sooner rather than later. A sub 3% print will support this narrative and likely boost risk appetite, but if we see an upside surprise, further hawkish repricing and higher US yields across the curve could see the dollar advance higher.

We also have US retail sales and industrial production to bear in mind. The resilience of the consumer has supported the strength of the US economy, especially the services sector, but we expect a softer retail sales print. Industrial production could lift slightly higher but is likely to remain subdued given the ongoing contraction signalled by the ISM report. All in all, we expect these top-tier data points to shift market implied probabilities of rate cuts this year, which is a key driving force behind FX volatility.

Services inflation and wage growth key for BoE

George Vessey – Lead FX Strategist

The pound continues to benefit from the hawkish repricing of Bank of England (BoE) policy. Markets are now pricing just 80 basis points of easing this year, with the June meeting expected to deliver the first cut. Although yield differentials have supported sterling, economic data has been poor in the UK of late and this week’s GDP and retail sales prints could spark fears of recession once again and thus limit any sterling appreciation.

The pound ended last week on a high in the end, buoyed by improving global risk sentiment and falling US yields. GBP/USD found support at its 200-day moving average but downside risks still linger in the short-term due to growth differentials favouring the buck. On a more positive note, although the pound has lost around 1% in value against the dollar so far this year, it is still the best-performer among the rest of the G10 universe of major currencies. In fact, the pound, staged its seventh straight week of gains versus the euro as investors grow more convinced by the BoE’s determination to keep interest rates where they are for now. This week could be a critical week for sterling’s direction though as the UK jobs report, inflation and retail sales data are published – all of which will influence BoE policy and thus market implied rate expectations.

Probably the most important data points for the rate outlook will be services inflation and private-sector wage growth, with the former expected to tick higher and the latter to drop. Any major deviations from the consensus could induce sharp reactions in rates and currency markets and given GBP/USD’s narrow trading range of late, perhaps we’ll see a convincing breakout.

Euro stuck in a bearish trend

Ruta Prieskienyte – FX Strategist

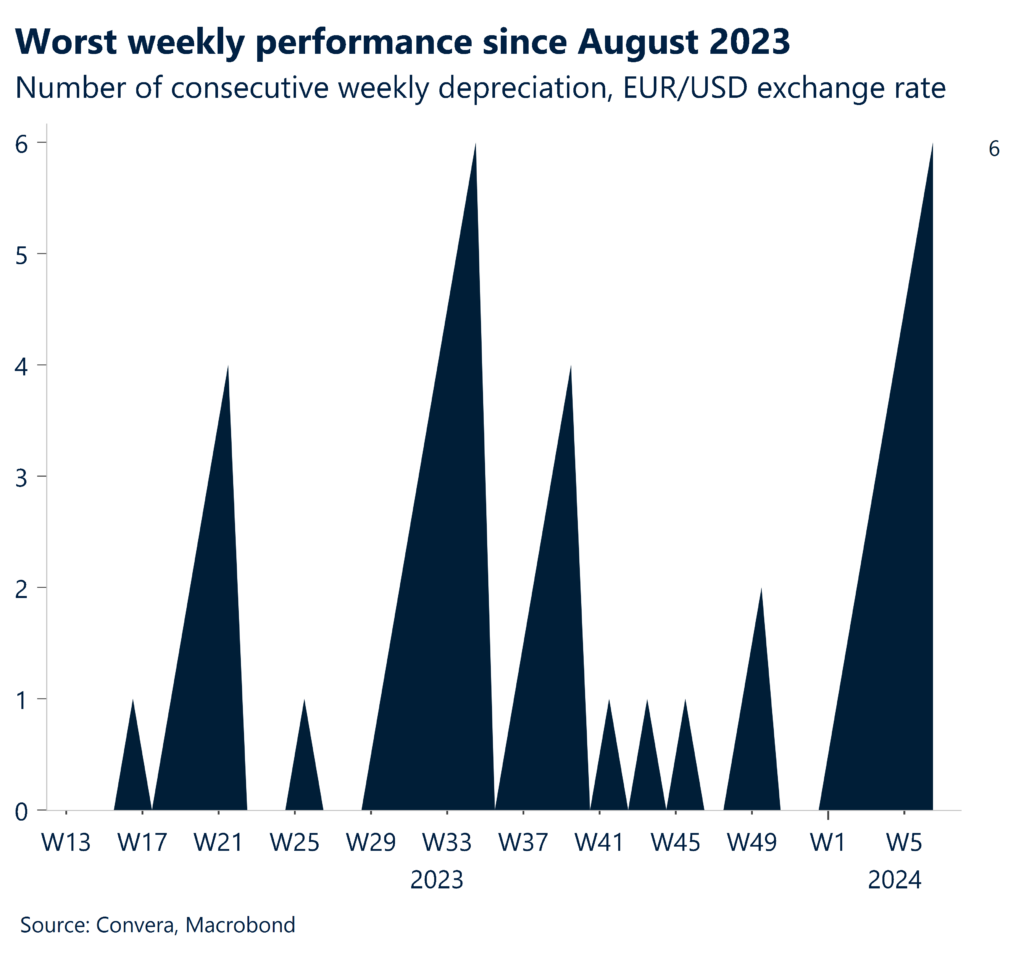

European markets kick off the week on the back of an atypically calm spell. STOXX 50 reached a fresh 23-year high and German 10-year bond yields advanced to a 3-month high above 2.38%. Meanwhile, EUR/USD volatility fell close to a 5 ½ year low as the pair depreciated for the sixth consecutive week – the longest bearish streak since end of August 2023.

Last week’s Eurozone data was largely mixed. The Sentix index improved for the fourth straight month, consumer inflation expectations fell to a 2-year low and German factory orders surged by the most in over three years in December. However, optimism was dampened by December retail sales falling the most in a year across the Eurozone bloc, as persistently high inflation and elevated borrowing costs continued to weigh on demand. The construction sector is also in the deepest downturn since the aftermath of the pandemic. On the monetary policy front, the chorus of ECB policymakers grew more cautious throughout the week. ECB’s Wunsch expressed a strong preference to wait for more data — particularly on workers’ pay — before deciding to start cutting interest rates. Meanwhile, his Austrian counterpart Holzmann reiterated that the Governing Council might not cut rates at all in 2024, or only once the year is almost over. Markets did pull back on rate cut expectations, albeit in tandem with the general trend for all central banks. The market implied probability of an ECB April rate cut dropped to 51%. Cumulative rate cuts bets fell to 115bps worth of easing by year-end, down from 140bps from the beginning of last week.

EUR/USD has not been able to sustainably break above the 100-day SMA last week and, without fresh stimulus, that remains the ceiling in the immediate future. EUR/GBP depreciated for the seventh consecutive week – the worst consecutive weekly performance in close to 19 years. The key event to watch this week from Eurozone is the German ZEW survey due on Tuesday, while the event posing the most downside risk will be the US CPI print.

Yen and Swissy still licking wounds

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 12-16

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.