USD: Dollar back in command

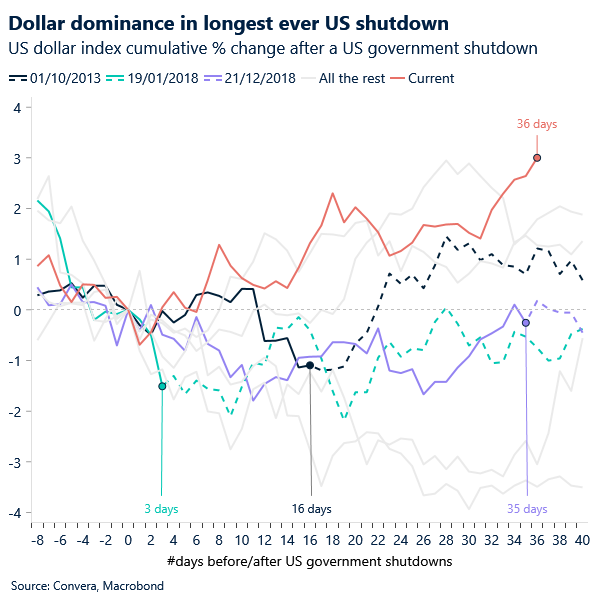

Markets have opened the week under a cloud of uncertainty as the US government shutdown stretches into its 36th day — now the longest in history, surpassing the 35-day standoff of 2018–19 in President’s Trump’s first term. Risk assets are under the pump, whilst the US dollar has reasserted itself as the dominant safe haven in the FX space.

As the government shutdown extends, the absence of fresh US economic data has left the Fed’s rate path murky, amplifying volatility across asset classes. Risk sentiment is softening: Bitcoin has entered a bear market, down over 20% from recent highs, while global equities show signs of fatigue after a record-breaking rally from April lows pushed valuations to exuberant extremes. Investors remain wary as policy paralysis and stretched pricing collide with fragile macro signals.

The US dollar is trading at its highest level since May, marking a sharp turnaround from April’s selloff. Up over 1% against every G10 peer this quarter, the greenback’s rebound reflects a normalization — not speculation. Rate differentials are back in focus, with 1y1y swaps tracking USD strength. Fed officials’ data-dependent tone adds nuance, but risk-off flows and repriced expectations have reestablished the dollar as the anchor of global macro. With the euro lagging growth, sterling pressured ahead of the UK budget, and Japan facing tightening tensions, the dollar basket looks increasingly constructive.

This rebound isn’t just tactical — it’s a return to form for the world’s reserve currency.

GBP: Pressure is mounting on sterling

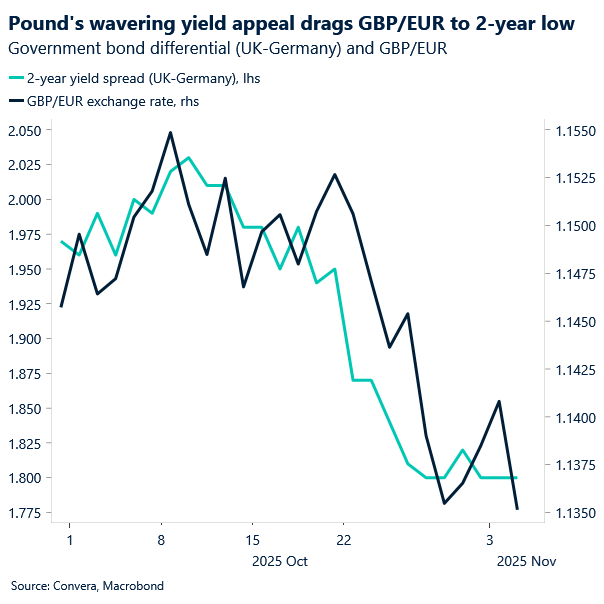

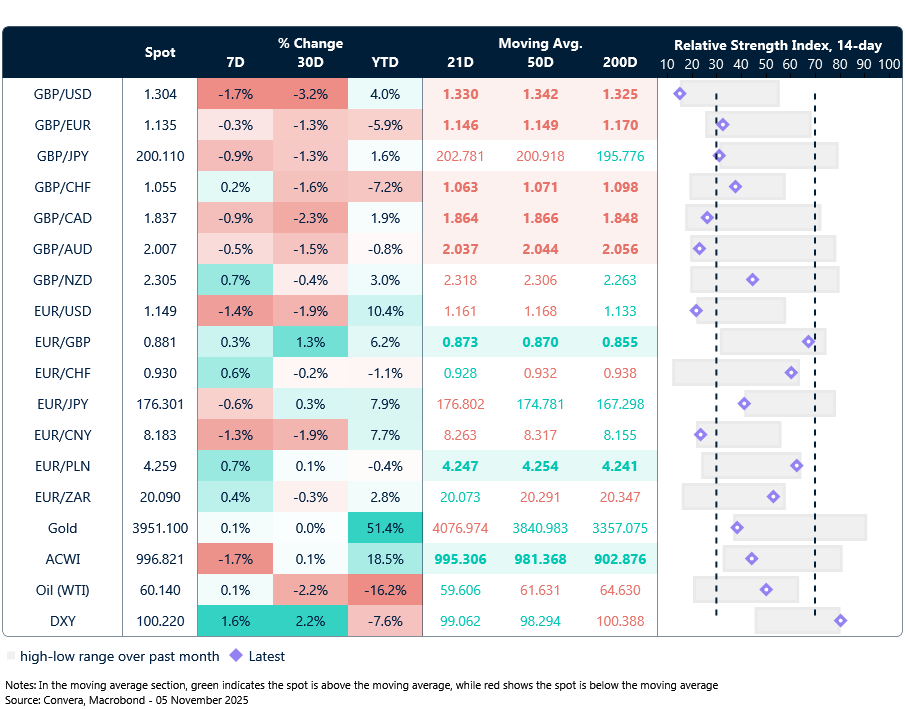

Selling pressure on sterling is intensifying, with GBP/USD sliding to its lowest since April and a test of the psychologically important $1.30 handle now in sight. But we note the pair is now in heavily oversold territory according to the daily relative strength index. GBP/EUR has also hit a fresh two-year low, as the pound’s yield advantage erodes amid rising bets on Bank of England (BoE) rate cuts.

Fueling those expectations is the prospect of tighter fiscal policy at this month’s Budget. Chancellor Reeves’s remarks yesterday suggest a more aggressive stance than markets had anticipated. We note three key takeaways:

- Productivity downgrade: Reeves all but confirmed the OBR will revise down trend productivity growth, widening the fiscal gap and reinforcing the need for corrective measures.

- Greater fiscal headroom: She called for a larger buffer than the £9.9bn left in spring, implying a more cautious and front-loaded tightening path.

- Tax pledges shelved: Reeves declined to repeat Labour’s manifesto promises not to raise income tax, national insurance, or VAT — opening the door to broader revenue-raising options.

Bond traders have welcomed the shift, with UK gilt yields falling across the curve. But for currency traders, the concern is whether fiscal tightening will deepen the consumption slowdown already underway, hence the pound’s depreciation.

Sterling is likely to remain on the back foot ahead of the Budget, with further downside risk this week if the BoE delivers a rate cut — still only partially priced by money markets. If tax hikes dampen growth and fail to deliver expected revenues, the Chancellor could face a vicious cycle of tightening measures and economic underperformance — a fiscal treadmill with rising headwinds.

That’s why any revenue-raising steps must be carefully balanced with bold, growth-oriented reforms to avoid compounding the slowdown already underway.

EUR: Shutdown mutes euro’s bull case

Markets turned risk-off yesterday, with safe-haven demand lifting JPY, CHF, and USD as global equities stalled on renewed concerns over stretched valuations.

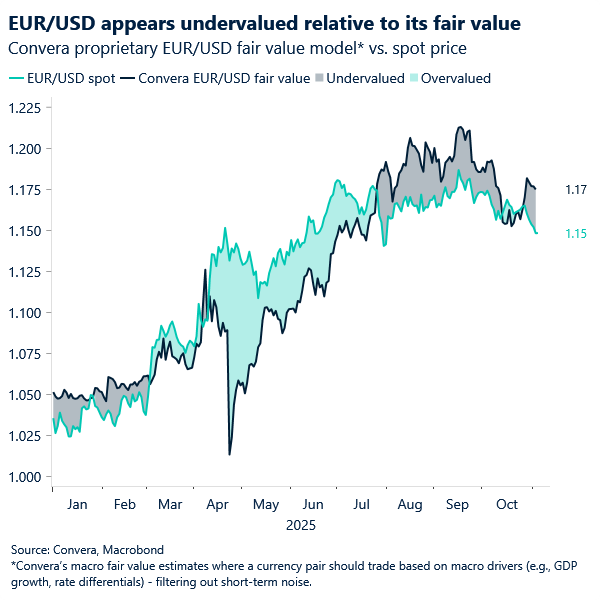

EUR/USD broke below 1.15, a level that last touched on August 1, deepening its disconnect from fair value. Our models suggest a “should-be” level closer to 1.17, highlighting the euro’s growing undervaluation.

With macro data frozen by the shutdown, the euro is left without its clearest bullish catalyst: weak US data. In the absence of fresh downside surprises for the dollar, EUR/USD remains exposed to selling pressure, with little to offset the valuation gap. Dislodged from its 100-day moving average, EUR/USD looks increasingly vulnerable, and sellers appear emboldened to test lower levels.

Yesterday’s price action reaffirmed USD’s safe-haven appeal, as Treasury yields fell on strong demand. These dynamics continue to underscore the dollar’s resilience in risk-off environments, with appetite for USD-denominated assets – equities and bonds alike – still intact.

The ongoing data freeze may be prompting investors to reassess the weight they place on soft indicators once they begin to reappear – killing that momentum of persistently negative US headlines and data. Had those signals been available from the outset – and pointed to weakness – we believe selling pressure on USD assets would have been more aggressive, with the “sell America” narrative more vivid in investors’ minds. In their absence, it will now take significantly weaker data for sellers to feel confident enough to step in.

EUR/USD remains under pressure, with 1.14 as the next key support. Today’s ADP release could offer a temporary reprieve – or trigger a test lower – depending on the outcome.

Pound is heavily oversold versus US dollar

Table: Currency trends, trading ranges and technical indicators

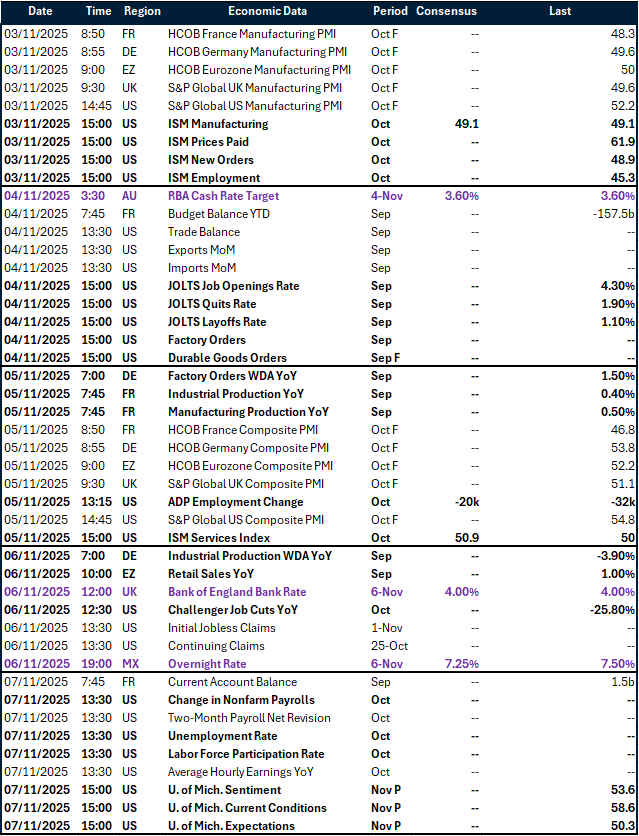

Key global risk events

Calendar: November 3-7

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.