The SLR debate that could reshape markets

The Supplementary Leverage Ratio (SLR) emerged in the aftermath of the 2008 Global Financial Crisis (GFC), when regulators worldwide realized that risk-based capital requirements alone weren’t enough to safeguard the financial system. In the lead-up to the crisis, many banks appeared well-capitalized on paper because their internal models assigned low risk weights to assets that later turned toxic, particularly mortgage-backed securities. The SLR was designed as a blunt, but effective backstop: a minimum capital threshold that doesn’t rely on banks’ own risk assessments. By requiring large banks to hold a fixed percentage of Tier 1 capital against their total exposures, regardless of asset type, the SLR aimed to ensure that no institution could become dangerously overleveraged again without a transparent capital cushion.

However, this rigidity has drawn criticism, particularly when it penalizes banks for holding low-risk assets like U.S. Treasuries or central bank reserves. That’s precisely the concern Treasury Secretary Scott Bessent is tackling with a proposed recalibration of the SLR. Under the new framework announced in June 2025, the enhanced SLR (eSLR) buffer would become dynamic, tied to a bank’s global systemic risk profile rather than held at a flat 2%. The intent is to make capital rules more tailored, efficient, and compatible with current market realities. During his June testimony before Congress, the Fed Chair signaled possible changes to the Board’s supplementary leverage ratio standards.

This proposed change is just one component of a larger deregulatory effort spearheaded by Bessent and the Trump administration. At its core is the belief that post-2008 regulations have become overly rigid and counterproductive. Bessent’s agenda reaches far beyond the SLR, it also includes a review of the Basel III capital rules, a restructuring (or near-dismantling) of the Consumer Financial Protection Bureau, and an ambitious plan to privatize Fannie Mae and Freddie Mac. Taken together, it amounts to a dramatic rethinking of the U.S. financial regulatory landscape, with an emphasis on reviving market dynamism over strict oversight.

From a market standpoint, the implications are substantial. Easing the SLR and loosening capital constraints could free up bank balance sheets, making it easier to absorb Treasuries and other safe assets. That’s likely to be supportive for liquidity in the U.S. Treasury market, potentially pushing yields lower and dampening volatility. Banks may also re-engage more forcefully in repo financing and other short-term funding operations, boosting overall market functioning and credit flow. Michelle Bowman, Fed’s vice-chair for supervision also mentioned that the “change will enable these institutions to promote Treasury market functioning and engage in other low-risk activities during periods of financial stress.”

For the U.S. dollar, the picture is more nuanced. On one hand, a more dynamic banking system could attract capital flows, especially if higher equity valuations follow from expanded credit creation. On the other hand, if markets interpret deregulation as eroding the financial system’s safety net, there could be long-run concerns around fiscal discipline and reserve currency strength. Much will depend on execution, both in terms of how reforms are implemented and how international investors perceive them.

In short, the SLR debate isn’t just about a ratio, it’s about the balance between prudence and growth. Scott Bessent’s deregulatory push is meant to unlock liquidity and remove what he sees as artificial barriers to economic potential. Supporters see it as a pragmatic, pro-market reset; critics worry it’s a return to the pre-crisis playbook.

Threats lose their grip as euro seeks fresh catalyst

No concrete steps forward in trade talks between the U.S. and EU have been announced yet, causing the euro to end yesterday’s session slightly lower (-0.05%). However, it perked up this morning during the Asia trading session, spurred by renewed trade tensions following Trump’s announcement of a 50% tariff on Brazil, effective August 1st.

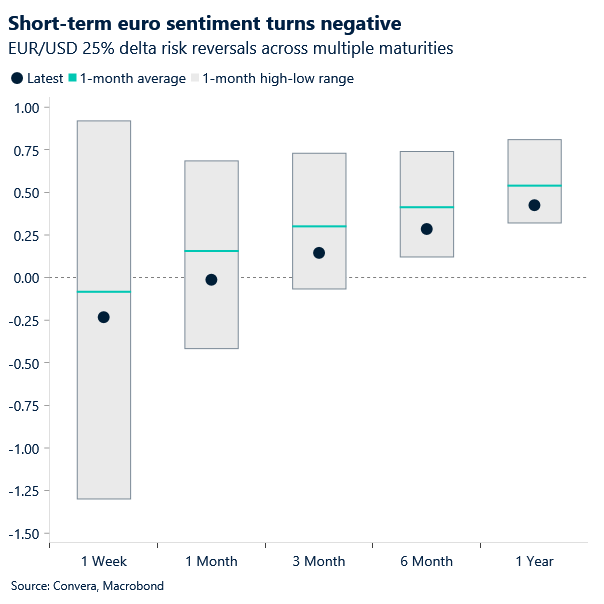

That said, threats alone appear to have lost their magic in triggering significant flows into the euro at the expense of the dollar. The common currency increasingly lacks fresh catalysts needed to push higher, with markets now requiring more bad U.S. news to justify further euro upside.

Also, with expectations for both the ECB and the Fed largely priced in, and both central banks in wait-and-see mode, we expect the euro to continue its tepid decline—hovering around the $1.17 support level until new catalysts emerge.

Yesterday, we heard from ECB speakers, Lane, Guindos and Nagel. Their comments point to a central bank in no rush to ease further, emphasizing a data-dependent, meeting-by-meeting approach—particularly in the face of global trade uncertainty. On the other side of the Atlantic, a cautious tone emerged, too, from the Fed’s Minutes, reflecting concerns that tariffs could lift inflation.

As markets remain laser-focused on macroeconomic data and show less sensitivity to tariff headlines, today’s U.S. jobless claims and, more importantly, next week’s U.S. June CPI likely stand as the most immediate catalysts for EUR/USD movement. Weaker-than-expected prints may revive the Fed’s dovish tone, which had faded earlier this month following stronger-than-expected non-farm payrolls, ultimately injecting some much-needed fuel into a rally showing signs of fatigue.

Momentum melts: sterling’s technical chill

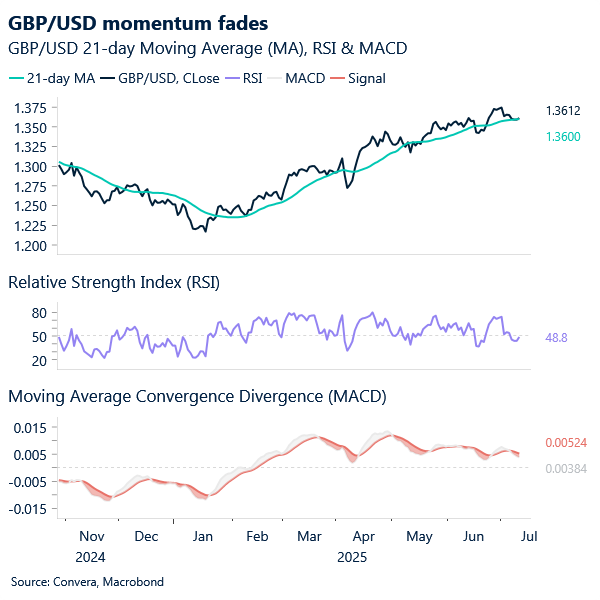

In similar fashion to EUR/USD, GBP/USD has pulled back over the past few days, retreating from last week’s high of $1.3789. Yesterday, it tested support at the 21-day moving average, hinting at trend exhaustion.

While technical signals suggest waning bullish momentum, it’s too soon to call a decisive bearish correction. The Relative Strength Index (RSI)—which tracks the speed and magnitude of price shifts over a 14-day period—now hovers near the neutral 50 mark, down from a late-June peak of 70. This drop implies that bullish drivers have softened, though not fully reversed.

Complementing this, the MACD indicator, which compares short- and long-term moving averages, has its line crossing below the signal line—yet still above zero. This configuration points to fading momentum and a potential phase of consolidation, rather than, once more, a sharp reversal.

Sterling’s inability to build traction—even in a week when the UK should have stood out as one of the few countries to seal a deal with the U.S.—highlights that markets are increasingly shifting from feeding on sentiment to craving hardline data. A not too dissimilar technical setup is unfolding for EUR/USD.

Eyes now turn to upcoming UK macro releases: GDP, manufacturing, and industrial production data. While month-over-month prints are expected to remain in negative territory for industrial and manufacturing production (-0.1%), they are broadly projected to show improvement. For GDP, economists anticipate modest growth of 0.1% in May, bouncing back from a 0.3% contraction in April.

Oil drifts on volatile currents

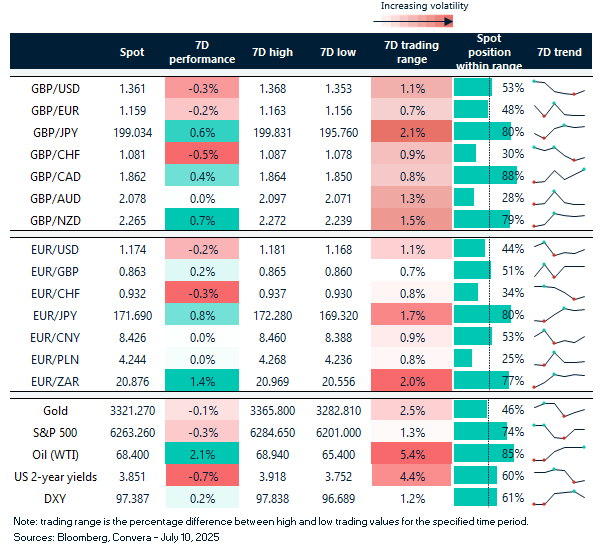

Table: 7-day currency trends and trading ranges

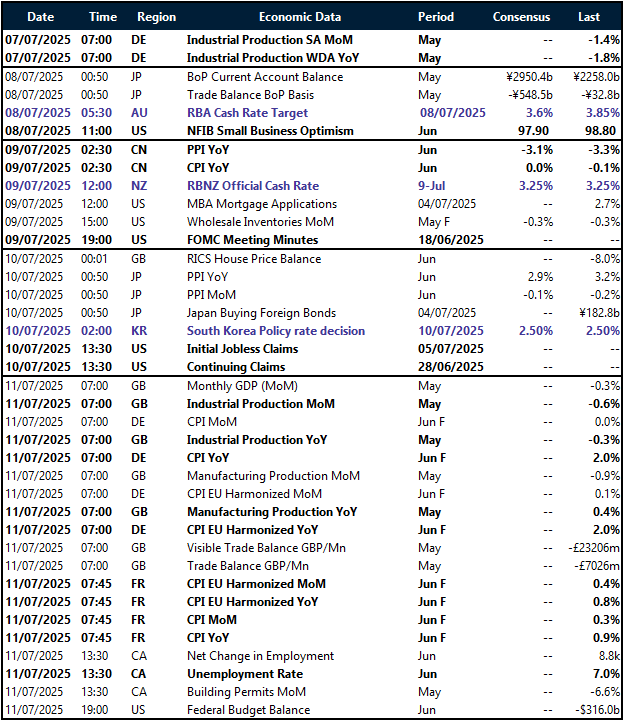

Key global risk events

Calendar: July 7-11

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.