Liberation Day-like fallout fades

The dollar’s H1 slide came down to market doubts about the perceived seriousness of, predominantly, the U.S.’s recent trade policy agenda. From the widely criticized formula used to calculate reciprocal tariffs, to their frequent use as bargaining chips—or worse, blackmail tools—confidence in U.S. economic policy has taken a hit. In addition, the U.S. administration’s framing of the trade deficit as a fundamental problem—arguing that it has been a gift to other countries for too many years—is viewed by many as an oversimplification.

The underlying fear, therefore, is simple: if such sweeping economic policy is handled carelessly, the economic fallout could be severe.

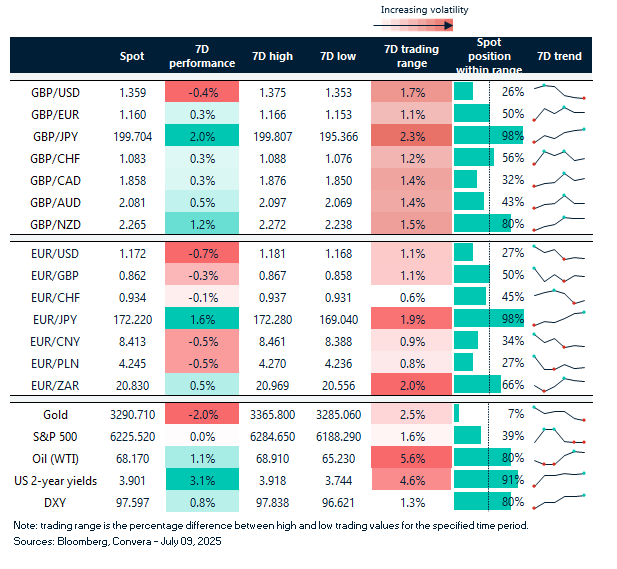

This fear explains the drop of the dollar in early April after reciprocal tariffs were announced on April 2nd. Fast forward a few months to this week, however, the economy has shown surprising resilience, helping to temper, firstly, that fear, and, secondly, an equally severe dollar decline after this week’s fresh batch of tariffs threats. The dollar is up ~0.4% week-to-date.

While this is not to say that concerns about the U.S. economic outlook have vanished, a U.S. economy still standing, coupled with what is now a more familiar trade policy approach by the U.S. administration, has kept the dollar more supported amid the noise.

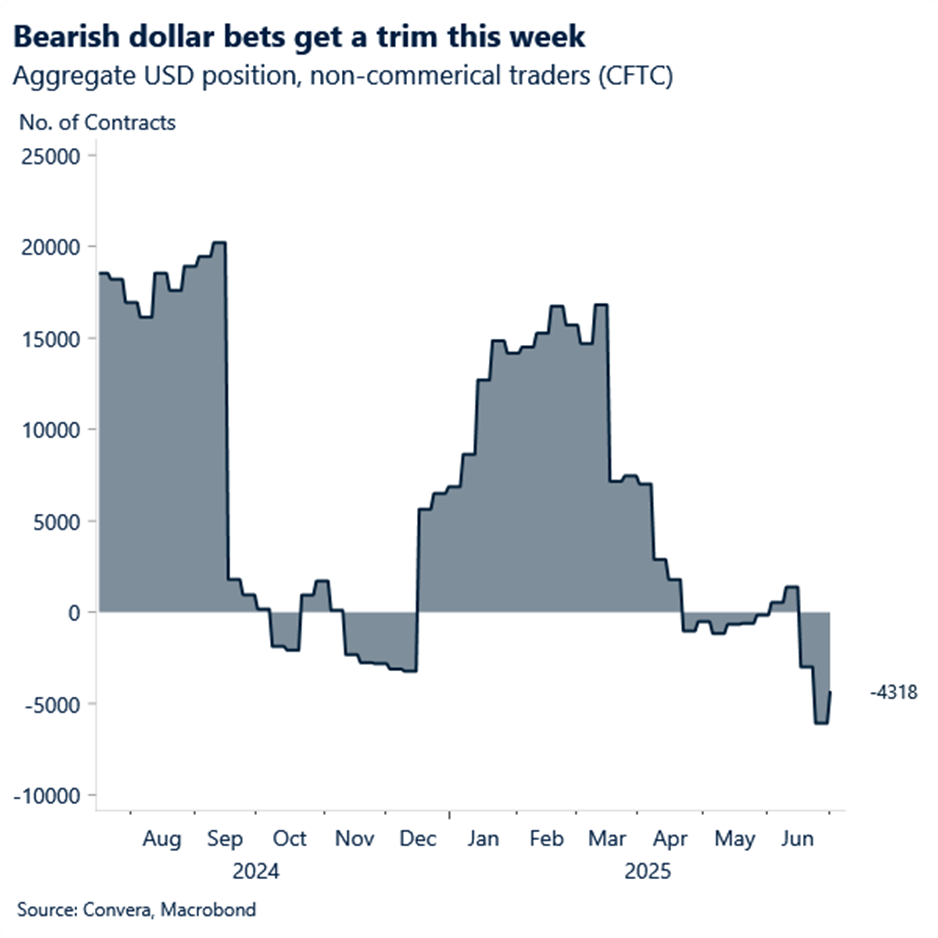

On top of sentiment, technical factors play a role too. The dollar is far more oversold now than it was several months ago—down 10% over the past three months. That alone sets the stage for a possible rebound. Combine that with renewed optimism around tariff-reducing trade deals, and there’s solid reason to expect a near-term correction in the DXY.

No trade deal has been announced so far this week. Meanwhile yesterday Trump stated that there will no more extensions after Aug. 1 (an extension in itself), and threatened 50% tariffs on copper, and 200% in pharmaceutical. Despite a few dents, the S&P proceeded barely scared, while the dollar rose – signs that markets are growing increasingly accustomed to Trump’s modus operandi.

Chill for the euro heatwave

The euro’s rally has faded and is likely to remain under pressure through the remainder of the week. After kicking off the month on a strong note—briefly breaching the $1.18 zone—momentum stalled. EUR/USD now sits just over 0.5% lower month-to-date, though it’s still up an impressive ~13% year-to-date.

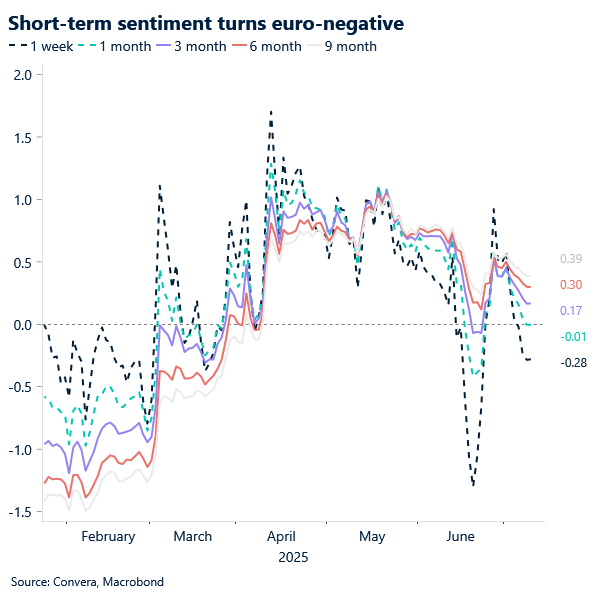

Short-term sentiment has turned cautious. 1-week and 1-month risk reversals show a tilt toward euro puts, with bearish bets overtaking bullish ones—reflecting heightened concern around near-term risks. Meanwhile, longer-tenor risk reversals continue to lean positive, signaling broader investor optimism about the euro’s prospects.

Adding to the cautious tone, EUR/USD’s 14-day Relative Strength Index (RSI) dipped from oversold territory closer to 60 yesterday, pointing to waning momentum. In effect, markets are discounting the euro this week, pricing in potential fallout from the impending U.S. tariff decision.

Regardless of the final tariff level, the perception remains that the EU stands to lose more economically than the U.S., given its greater export dependency and relatively softer fundamentals. That narrative is driving short-term bearishness, even as longer-dated positioning continues to reflect structural dollar vulnerability—helping to support the euro outlook beyond this immediate event risk.

That said, longer-term euro-positive sentiment, as reflected in the options market, remains largely a function of structural U.S. weakness. As we’ve argued previously, unless global investors continue finding compelling reasons to diversify away from U.S. assets, flows into Europe could stall—echoing patterns last seen in 2017. That would point to a far more choppy path for sustained euro appreciation.

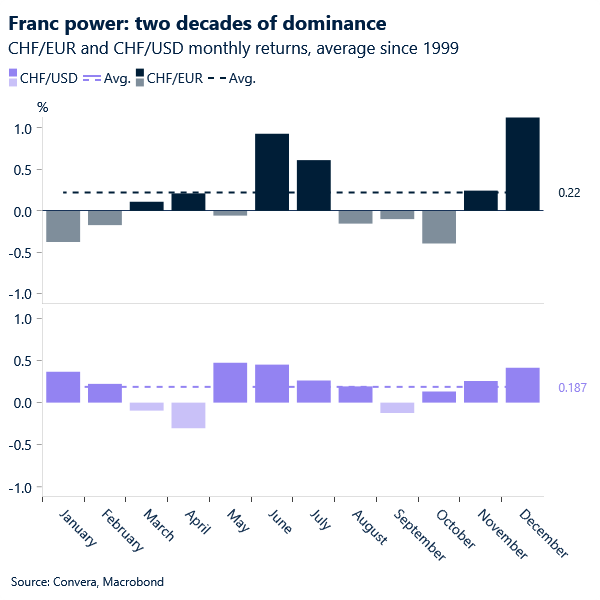

CHF strength is the only certainty

While the euro and the dollar continue to battle for who is the strongest, the Swiss franc seems weary—if not quietly alarmed—by its own strength. Despite zero interest rates, the franc has steadily appreciated. Against the dollar, it reached a decade-plus high in early July, while EUR/CHF hovers around 0.9350, having dropped to near 0.9200 back in April—levels not seen since 2015.

This persistent uptrend suggests the Swiss franc is evolving beyond its traditional safe-haven role. In a world where politics increasingly stress economic frameworks—ranging from bold, sometimes reckless trade moves to ballooning fiscal deficits and overly ambitious fiscal targets—Switzerland’s political neutrality shines through, fueling additional demand for the currency.

This leaves the Swiss National Bank (SNB) in a delicate position: possibly leaning more heavily on FX intervention rather than rate adjustments. But that path risks reigniting old accusations of currency manipulation—a narrative the SNB would surely prefer to avoid.

Euro rally wanes

Table: 7-day currency trends and trading ranges

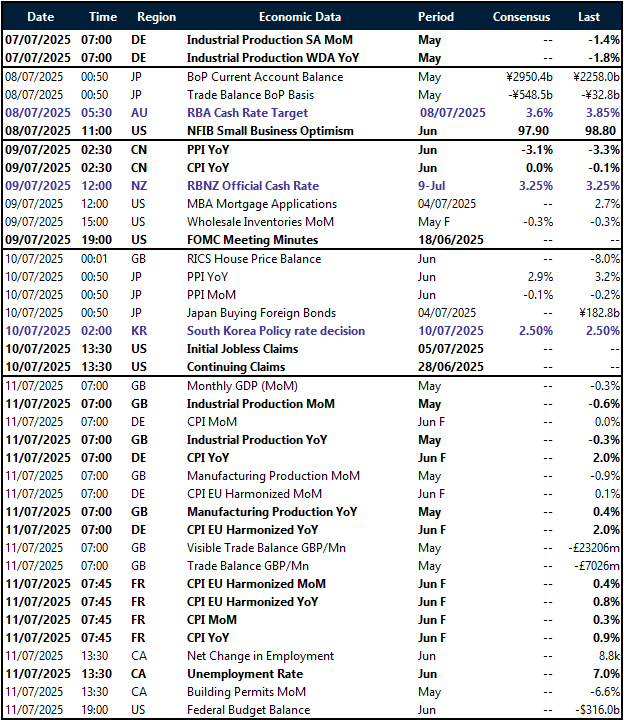

Key global risk events

Calendar: July 7-11

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.