Written by Convera’s Market Insights team

Treasury yields push higher

George Vessey – Lead FX Strategist

Speculative FX traders have made their biggest move in three years ahead of the US election. Hedge funds and asset managers reduced their bets against the US dollar (short positions) in the second week of October by around $8 billion. This is the biggest shift in sentiment since 2021. The US dollar index has, meanwhile, risen for four consecutive weeks by almost 4% to over 2-month highs as US yields march to fresh 3-month highs.

US economic exceptionalism, reduced Federal Reserve (Fed) easing expectations and improved polling for Donald Trump to win the US election are all bullish factors driving demand for the US dollar. Moreover, considering a Trump win is seen as the more impactful event for markets, we could see additional safe haven flows into the buck too, especially if more de-risking leads to a significant reduction in liquidity. Meanwhile, there’s trouble in bond markets, which are reeling from the risk that the Fed won’t cut interest rate as much as anticipated. A gauge of expected fixed-income volatility, the MOVE index, is now around its highest level of the year. This has also dampened risk appetite – another catalyst weakening risk sensitive currencies whilst supporting the haven dollar.

Today, all eyes are on the Fed’s Beige Book of economic conditions. Last time this was released, it showed stagnant and declining activity across most regions in the US. This was arguably one of the reasons the Fed opted for a jumbo cut last month. Could another soft report halt the dollar’s positive run? Given the US economic surprise index is at 5-month highs, it’s unlikely.

Pound falls to 2-month low

George Vessey – Lead FX Strategist

The British pound fell to the weakest level against the US dollar since mid-August, wrestling with its 100-day moving average support level at $1.2865. A convincing break below opens the door to its 200-day moving average located down at $1.28, though the 200-week moving average ahead of that at $1.2850 should offer decent support.

Relative growth differentials and safe haven demand are a drag on the currency pair, but as is the dovish recalibration of Bank of England (BoE) rate expectations. Markets are pricing a 70% chance of the BoE delivering a second 25bps cut in December after one in November following the downside surprises in UK inflation numbers last week. Meanwhile, volatility in bond markets is spooking investors, which also weighs on the risk-sensitive pound, despite the fact UK yields are marching higher this week too. Against the euro, sterling remains atop the €1.20 handle, buoyed by the uplift in short-term rate differentials, with the 2-year spread close to 10-month highs. GBP/EUR is now around 12% higher than its 2022 low, 4% higher year-to-date, and five cents above its 5-year average.

Economic data is sparse today, but the flash purchasing managers’ indices are due tomorrow and could trigger some currency volatility if we see any widening divergence in economic activity between the major economies.

High volatility puts $1.08 in danger

Boris Kovacevic – Global Macro Strategist

The euro set a new 2-month low in yesterday’s session following the continued rise of US Treasury yields and the prospects of a Trump 2.0 presidency. Euro sellers have put pressure on the currency and have led EUR/USD below the $1.08 level this morning as the plethora of ECB speakers was not enough to induce bullish momentum.

President Christine Lagarde said in an interview yesterday that she remains confidence that the inflation target will be hit sustainably in the course of 2025 as the recent numbers were reassuring. She is just the latest speaker in a row of Governing Council members coming out with dovish words recently. This has led markets to reprice their expectations of the ECB policy rate lower with the probability of a 50 basis point cut in December at around 20%. Policymaker Mario Centeno called for a gradual and steady reduction in interest rate, displaying the bias for a smaller 25 basis point cut at the last meeting of the year.

Risks to the economic growth outlook are clearly tilted to the downside. However, it seems that a lot of the recent pessimism surround the negative news flow seems to be priced in. This could be a favorable for the euro. Still, the upcoming US election will likely keep buyers away for now. US investors turned net-long the equity volatility index for the first time this year and fixed income volatility has risen to the highest level in 2024. These developments don’t bode well for EUR/USD, especially now the $1.08 threshold has broken.

GBP/JPY up 1.6% this week as bond yields surge

Table: 7-day currency trends and trading ranges

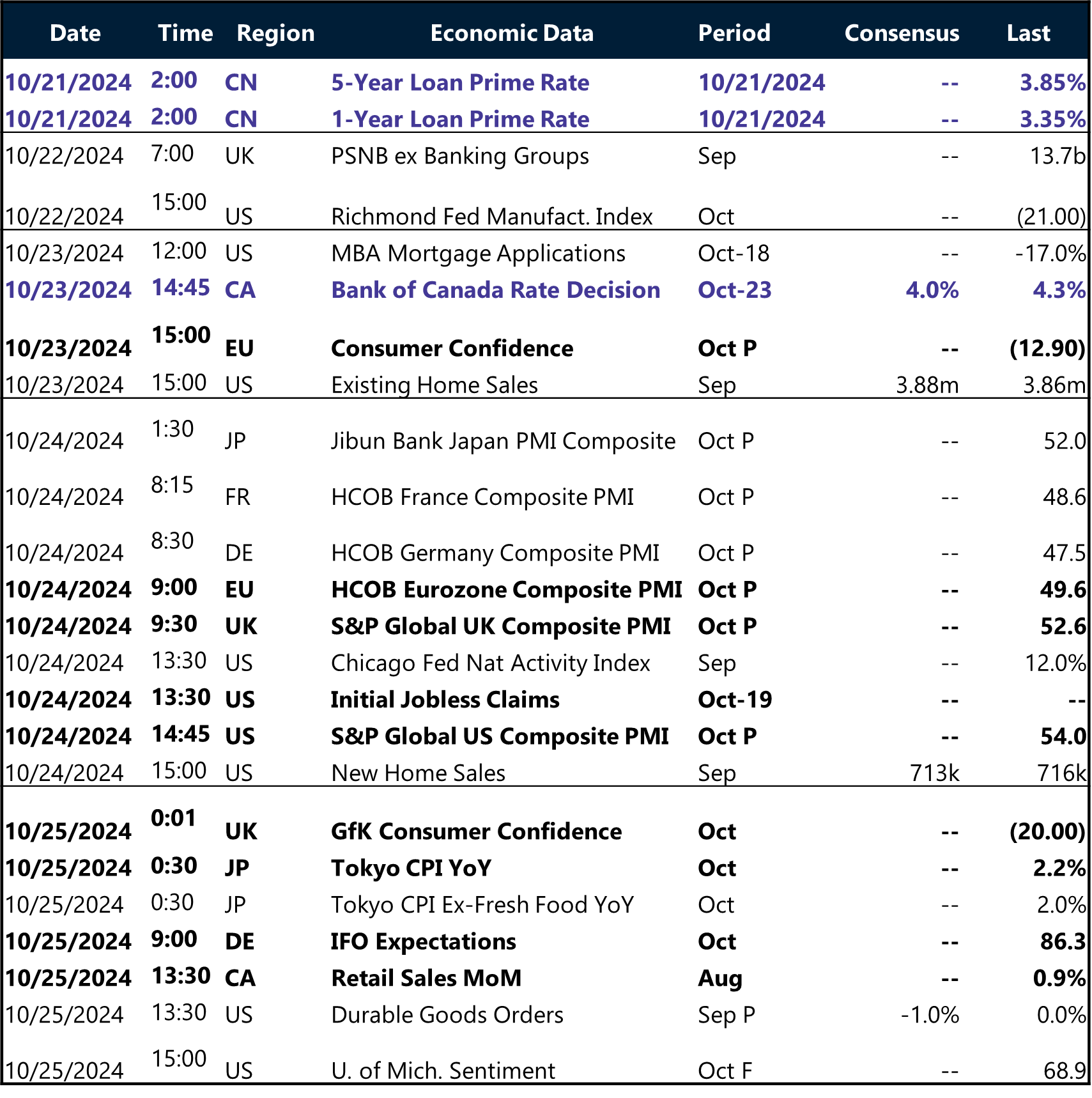

Key global risk events

Calendar: October 21-25

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.