Structural cracks meet tactical fog

The US dollar index is on track for its seventh monthly decline of 2025, down over 2% against a basket of majors and weaker versus 88% of the global currency basket we’re tracking. While month-end flows are muddying FX signals and the looming August payrolls report is keeping positioning light, the dollar’s appeal is eroding across multiple dimensions.

At the core is a rare convergence of structural shocks. Tariffs are dampening consumer and corporate demand, dragging on GDP. Simultaneously, immigration constraints are tightening labour supply, curbing potential output and stoking wage pressures. These twin shocks slow growth without a clear inflation offset – an environment that typically drives real rates lower.

The yield curve is twist-steepening: short-end yields are falling on rate cut expectations, while long-end yields rise amid fiscal concerns and inflation risk. That’s rarely dollar-supportive, as it signals weaker growth and eroding policy credibility. Political interference is compounding the issue, with Trump’s continued testing of the Fed’s independence undermining investor confidence in the central bank’s autonomy.

Even the latest GDP revision offers little reassurance. Q2 growth was upgraded to 3.3%, but the headline was flattered by a collapse in imports – down over 30% – which mechanically boosts GDP. Strip out trade distortions, and final sales to private domestic purchasers rose just 1.9%, pointing to more modest underlying momentum. Taken together, this trifecta of demand drag, supply constraints, and institutional fragility forms a compelling bearish thesis for the dollar – one that’s structural, not just cyclical.

The next test for the US dollar arrives today with the release of the PCE report – the Fed’s preferred inflation gauge and a key input ahead of the September FOMC meeting. If the PCE print confirms sticky inflation, markets may pare back Fed easing bets, offering the dollar a reprieve from its recent slide – at least temporarily.

Strong UK data and shifting rate expectations

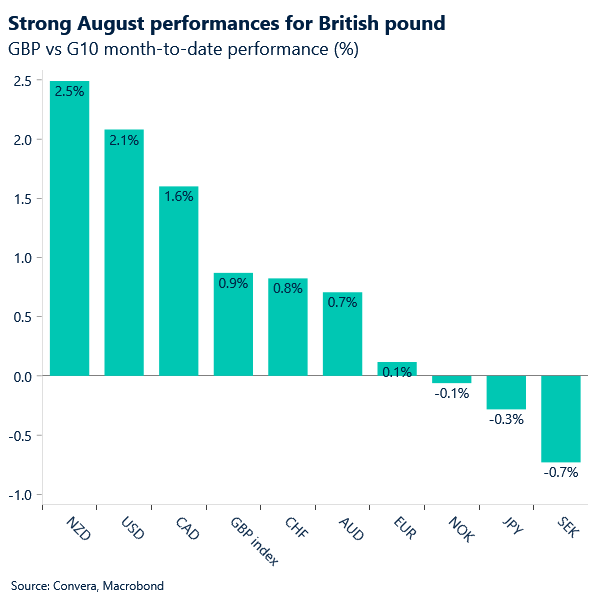

The pound has mounted a modest recovery, buoyed by a string of upbeat UK economic indicators and growing expectations of a more hawkish stance from the Bank of England (BoE). After tumbling nearly 4% in July, GBP/USD regained over 2% in August, stabilising between $1.34 and $1.36 throughout the month.

This rebound marks a partial reversal of the deep economic pessimism that had weighed on sterling, though it’s premature to call it a full-fledged turnaround. GBP/USD remains the most direct way to reflect short-term optimism, especially as the US dollar softens. Meanwhile, GBP/EUR could also see upward momentum, driven by rising political uncertainty across the eurozone.

Despite the improved tone, sterling isn’t out of the woods. Fiscal concerns tied to the upcoming autumn budget continue to cast a shadow, suggesting that the pound’s path forward may remain uneven.

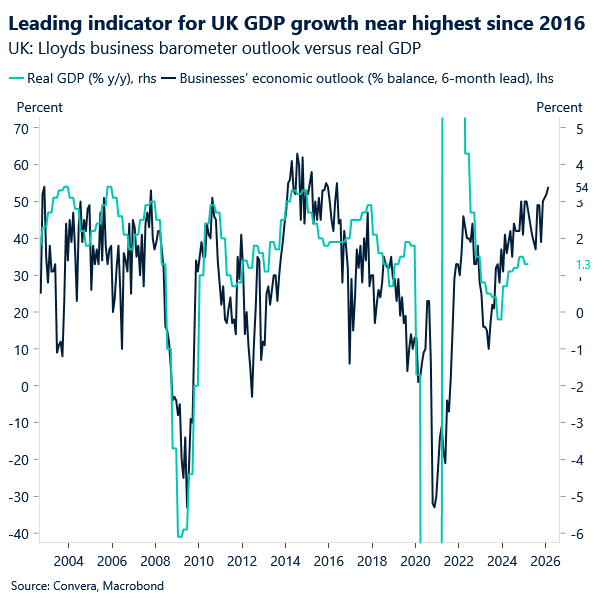

That being said, business confidence in the UK has climbed to its highest level in nearly a decade, with Lloyds’ latest survey showing a growing majority of firms planning to hire over the next year. Despite a £26-billion payroll tax hike and a near 7% rise in the minimum wage, more than 80% of businesses say the impact on staffing plans will be limited.

Hiring intentions rose for a fourth consecutive month, and nearly a quarter of firms are offering inflation-beating pay rises of 4%, suggesting higher labour costs are being passed to customers rather than absorbed by workers. The upbeat tone aligns with S&P Global’s PMI data, which shows private sector activity expanding at its fastest pace in a year.

The figures offer political cover for Chancellor Reeves amid criticism that Labour’s first budget could stifle growth. But they also raise fresh concerns for the BoE, as resilient demand and rising wages may complicate the path toward rate cuts.

Dovish whispers linger in Frankfurt

EUR/USD traded within a broad range this week, oscillating between 1.16 and 1.17 as investors weighed newly emerged eurozone-specific risks – namely political turmoil in France and the Netherlands – against developments in the U.S., including the Cook controversy and trade headlines such as the imposition of 50% tariffs on India. U.S. news continues to be the primary driver of euro movements, with eurozone-specific risks likely to exert only short-lived bearish pressure on the pair.

Yesterday, the euro outperformed the dollar. With minimal negative political euro news, supportive data and the release of ECB minutes helped lift the euro.

Eurozone confidence data suggests a cautiously optimistic outlook for third-quarter growth. Although the headline index ticked down from 95.2 to 94.9, the overall picture appears somewhat improved compared to Q2. Investors may have braced for worse, especially after the poorly negotiated trade deal between the U.S. and EU raised fresh doubts about the bloc’s ability to counter Trump-era tariffs.

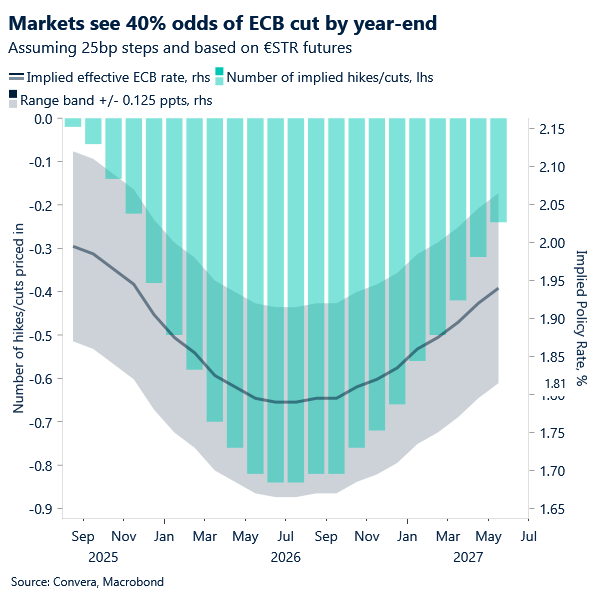

The ECB’s July meeting and President Christine Lagarde’s remarks signaled that the threshold for another rate cut remains high. However, disinflationary risks and growth concerns remain, particularly after acknowledging that the final tariff rate was higher than expected. While the meeting reaffirmed a wait-and-see stance, there was a subtle dovish undertone, leaving one more cut by year-end not completely off the table.

In fact, the short end of the yield curve remains vulnerable to a downward shift. Markets are currently pricing in just 18 basis points of ECB easing by mid-2026 – less than a full rate cut. This could weigh on the euro heading into September, especially if the finalised U.S. trade deal prompts further escalation and accelerates the case for easing.

Today’s lower-than-expected inflation readings across major eurozone economies may reinforce concerns about inflation undershooting, adding pressure to EUR/USD. However, it is the potential for higher-than-expected U.S. PCE data – building on yesterday’s stronger-than-anticipated macro prints, such as upwardly revised quarterly GDP – that could drive the pair to test support at 1.16.

GBP/USD trading above key moving averages

Table: Currency trends, trading ranges and technical indicators

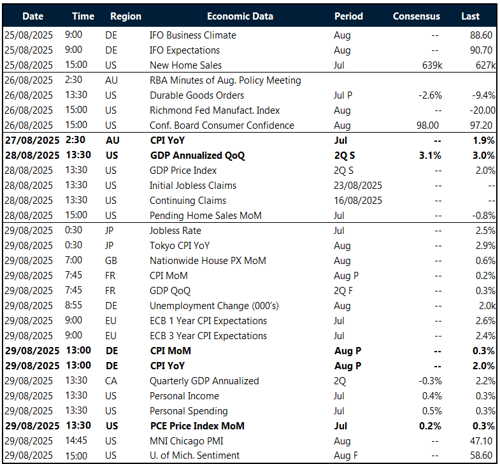

Key global risk events

Calendar: August 25-29

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.