Written by Convera’s Market Insights team

China continues to disappoint

Boris Kovacevic – Global Macro Strategist

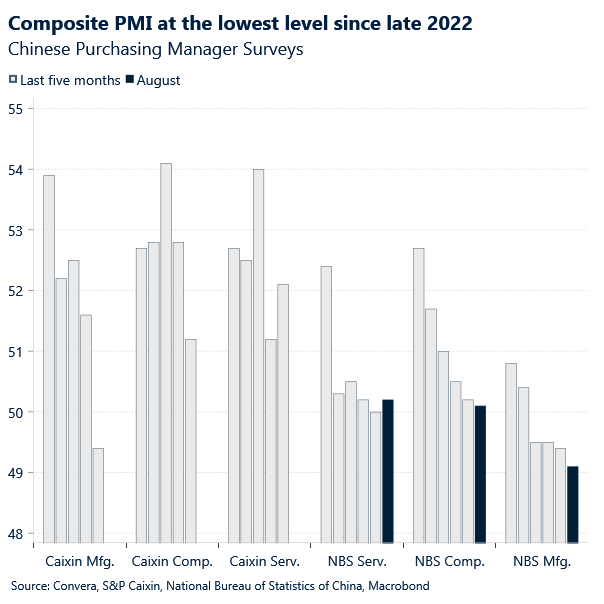

The cyclical part of the Chinese economy continues to suffer from fiscal constraints, weak domestic demand, and expectations of higher tariffs. Loan growth has fallen to the lowest level on record in July, matching the unprecedented descent of Chinese bond yields across the curve. August did not start any better. The official composite PMI fell to its lowest level since December 2022 as the manufacturing barometer remained in contraction for a fourth consecutive month. All sub-components of the manufacturing PMI have fallen below the 50-mark last month. This has only happened 12 times since 2005 with all occasions taking place after the pandemic. The first data print of the week came from China. Attention will now shift to the US PMI for the manufacturing sector, which will set the tone for FX markets.

Seasonals could weigh on sterling

George Vessey – Lead FX Strategist

Sterling kickstarted September on the front foot, helped by the final UK manufacturing PMI print for August confirming UK factory activity grew at the fastest pace in over two years. It was the fourth consecutive month of expansion and bodes well for a continuation of the UK’s economic recovery in Q3.

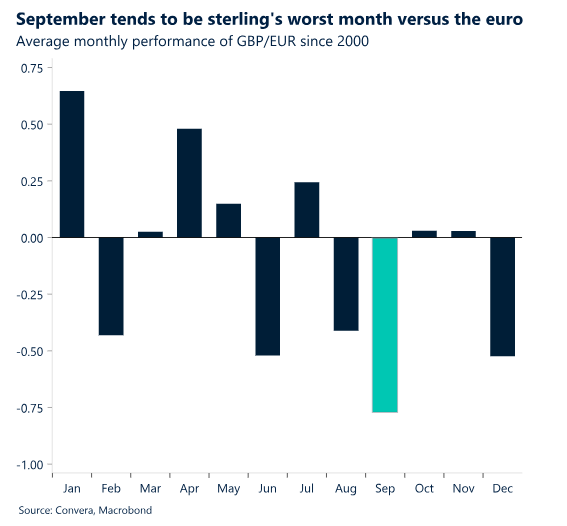

The result contrasted sharply with the declining activity in manufacturing seen across Europe. The manufacturing PMI for the Eurozone confirmed the sector remained in contraction in August, weighed down by Germany and France. The better-than-expected economic data for the UK, coupled with cautious remarks from Bank of England (BoE) Governor Bailey on further rate cuts have dampened expectations for UK rate cuts. Markets are pricing just 40 basis points of rate cuts from the BoE by year-end versus 60bps from the ECB. Hence, the EUR/GBP 2-year swap rate gap has shifted to the widest since February, further in sterling’s favour. As a result, GBP/EUR remains firm just under €1.19 and over three cents above its 5-year average. After three weekly rises in a row, GBP/EUR may lose steam though, and seasonals are negative for sterling as September has, on average, been the worst month of the year for the pair since 2000. A meaningful slide would require a significant rebuilding in BoE easing expectations, hence next week’s UK labour market data and inflation the week after could be critical.

Political risk flares again in Europe

George Vessey – Lead FX Strategist

After rising to a 1-year high above $1.12 last week, EUR/USD lost momentum and the pair has settled back into $1.10 territory. Fed-drive dollar weakness seems largely priced in and the yield-driven bull case looks to have run out of steam as ECB rate-cut talk returns following last week’s Eurozone inflation print came in at a 3-year low. But rising political risk in Europe is also seen as a hurdle to the common currency. While the search for a premier continues to prove elusive in France, over the weekend, populist parties on the extreme right and left stole the show in German regional elections. Germany’s euro-skeptic party, Alternative for Germany (AfD), is celebrating a big victory in the eastern state of Thuringia – its first win in a state parliament election since World War Two. AfD also came a close second in the more populous neighbouring state of Saxony. With federal elections only a year away, the AfD is second in national opinion polls, which might prompt calls for elections to be called early. Given the turmoil in France earlier this year, investors may turn wary about what that might mean for European assets, including the euro. Indeed, EUR/USD one-month risk reversals have fallen back into negative territory. This shows that the premium to protect against a decline in the common currency is starting to rise again.

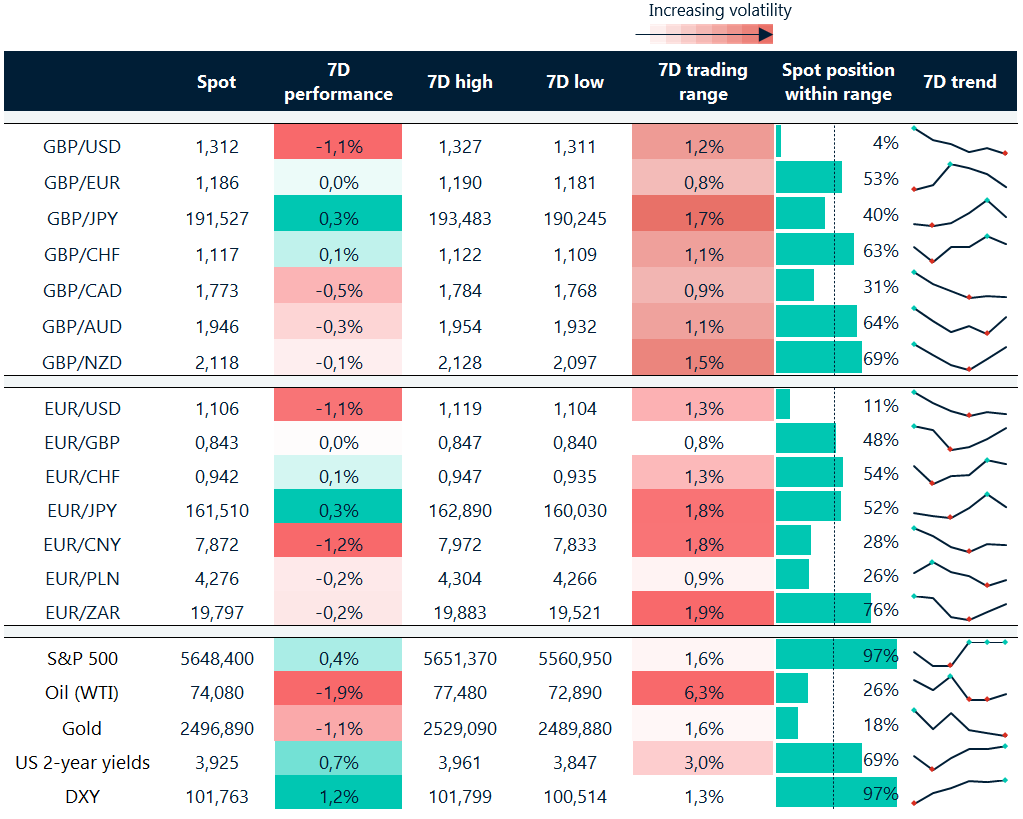

Dollar at its upper 7-day range

Table: 7-day currency trends and trading ranges

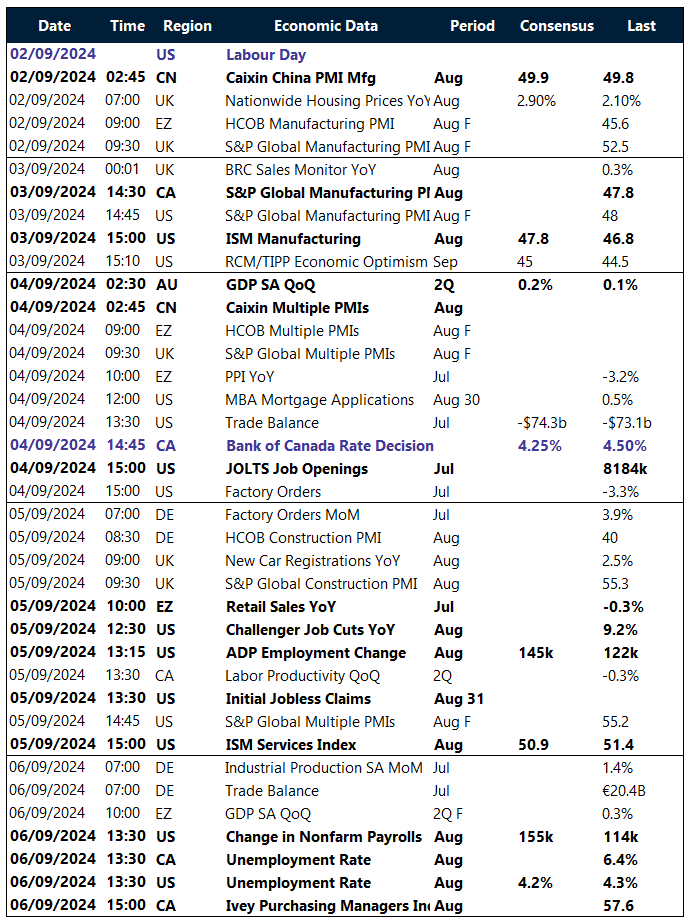

Key global risk events

Calendar: September 2-6

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.