Written by Convera’s Market Insights team

Powell heads to Capitol Hill

George Vessey – Lead FX Strategist

The US dollar’s safe haven appeal didn’t last long in the wake of the surprise left-wing alliance in the French second-round legislative elections. Instead, the focus pivots to the macro and monetary policy outlook amid signs of a cooling US economy and more room for Federal Reserve (Fed) rate cuts. The US dollar index is slumped near 3-week lows with US yields near 2-month lows as Fed Chair Jerome Powell will likely face conflicting pressures from lawmakers in his semiannual testimony to Congress.

US Treasuries remained suppressed at the start of the week and the dollar on the back foot after Friday’s June employment report showed a cooling labour market and we expect this trend to continue as the year goes on, underlying hopes for two Fed rate cuts this year. The ECB and BoE are also expected to cut rates by 50 basis points this year, making monetary policy a net-neutral factor on the surface for both EUR/USD and GBP/USD. Although inflation is more likely to be sticky in the US, the Fed also has more room to cut interest rates, particularly relative to the ECB. Therefore, the real divergence could come next year as expectations for 2024 policy rates have converged.

As well as the important US inflation report due later this week, Fed Chair Jerome Powell’s testimony to Congress (Tuesday-Wednesday) will be a key event to watch. with Democrats pressuring him to cut policy rates and Republicans questioning the Fed’s ability to control inflation. We think any surprise communication could lean more towards the dovish side given the latest economic developments, thus keeping dollar demand soft.

Canadian dollar in wait-and-watch mode ahead of Powell

Ruta Prieskienyte – Lead FX Strategist

The Canadian dollar is struggling to find direction following an uneventful start to the week having erased all of Friday’s post-employment report gains. The CA-US 2- and 10-year bond yield spreads both widened by a negligible amount compared to the previous session.

The US and Canadian economic calendars are both empty today, with the Fed Chair Powell testimony to Congress serving as the main attraction. The options markets are not showing much concern though, with the overnight implied vols for USD/CAD trading within their normal bounds. If there is any deviation from the recent narrative, it should be on the dovish side, as Powell might see the June Dot Plot revisions as too hawkish and want to fine-tune communication on the back of recent data. Such an outcome would be CAD positive and is likely to be concentrated around the release of opening remarks. Having said that, investors are likely to prefer to wait until the US CPI report due on Thursday before reacting.

In FX, AUD/CAD climbed to fresh a 16-month high on the back last Friday’s cooling Canadian labour market report which saw the money markets revise up their near-term rate cut expectations for the BoC. The implied probability of a July rate cut rose to 64%, up from 48% the day prior to the release. In terms of market sentiment, the 1-week USD/CAD risk reversal is currently at 0.105 vol in favour of calls, the most bearish position for the Greenback in over 3-months. In fact, since the last Friday’s disappointing NFPs report, we have seen a sizable USD bearish repricing against the Canadian dollar, especially on the 3-month tenor, which envelopes the September Fed decision. For now, technical analysis shows USD/CAD is currently trading just above its 100-day SMA at 1.3638. As the relative momentum indicator RSI is currently at 44, this indicates a non-trending market.

Euro shrugs off French election snafu

Ruta Prieskienyte – Lead FX Strategist

EUR/USD remained steady at $1.084 after dipping as low as $1.08 as investors moved past the initial shock of the France’s election results, where a leftist alliance unexpectedly took the lead, resulting in a hung parliament. Despite displaying early signs of resilience, the French CAC 40 ended the day in red, largely in line with the global equities’ performance, as France now faces a period of tough negotiations and uncertainty while trying to form a government. The OAT-Bund 10-year spreads further narrowed to 62bps, a fresh 3-week low, as ultimately this outcome is seen as more favorable compared to the potential of a right-wing government.

On the data front, German trade surplus in May rose to €24.9 billion, a 4-month high, despite falling demand for both imports and exports. Exports shrank 3.6% m/m to a five-month low while imports declined by 6.6% m/m, also to a five-month low. Elsewhere, the ECB’s Knot became yet another GC member to endorse the current market expectations for rates in 2024 (40-42bps). As the ECB rate cut expectations are likely to remain stable throughout coming weeks, with a potential for an additional easing priced in for Sep24, this suggests that the Fed’s actions will be a major driver for EUR/USD going forward. Consequentially, the attention now shifts to the US CPI report due on Thursday.

The Euro index, which tracks the performance of EUR versus a basket of 9 leading global currencies, ended the day marginally lower due to a prudent market mood. EUR/GBP declined for the second consecutive day, as the political stress continued to weigh on the common currency. Despite the ongoing French induced turmoil, further advances may soon be capped as the pair is sitting just below its 200-month SMA at €1.1870, a key moving average that it has been unable to break through since Brexit.

GBP/USD up 1% since last week

Table: 7-day currency trends and trading ranges

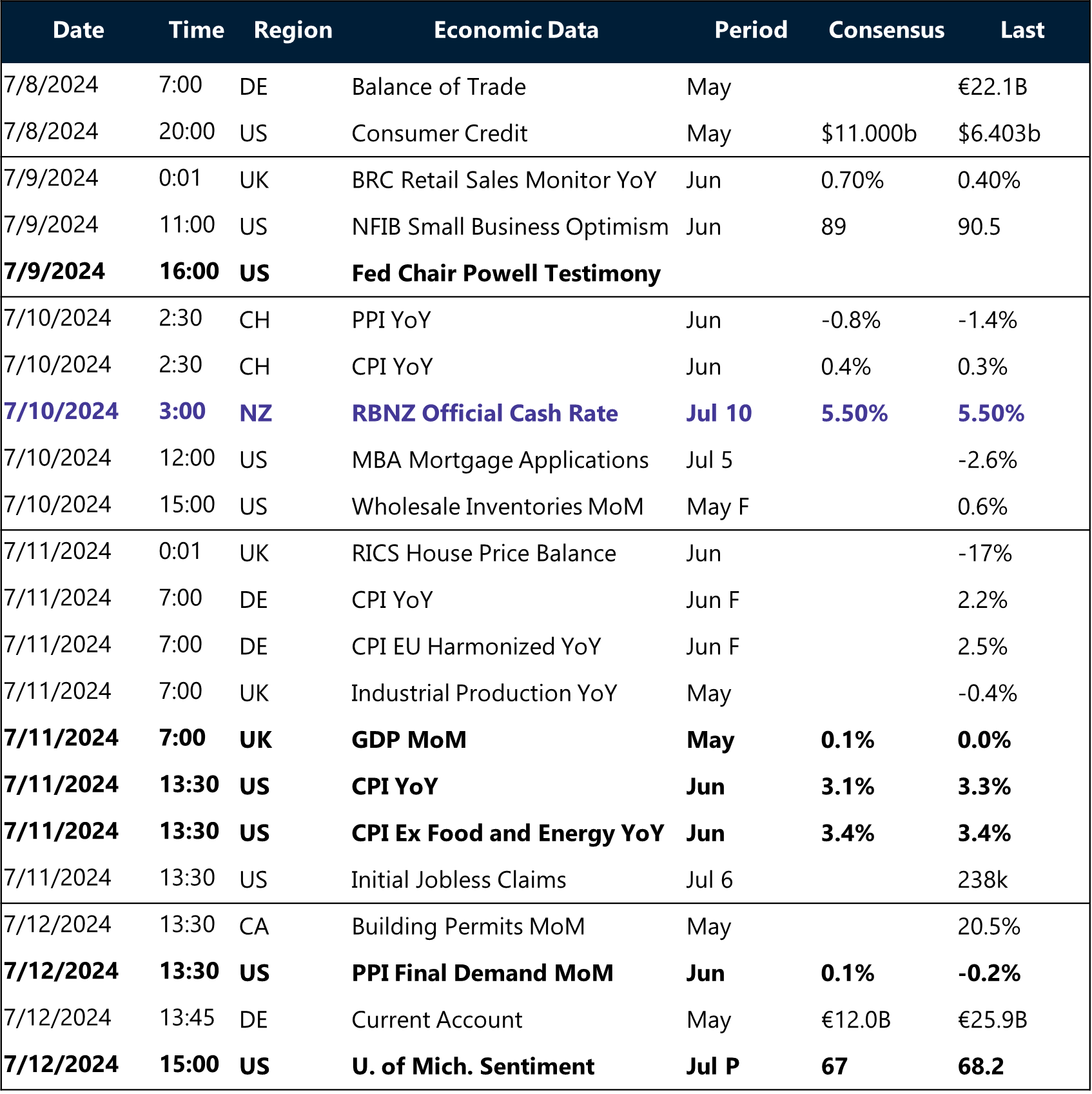

Key global risk events

Calendar: July 08-12

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.