Written by Convera’s Market Insights team

Sterling extends slide after Bailey’s warning

George Vessey – Lead FX Strategist

The pound has held the status of the best-performing G10 currency year-to-date for most of 2024. However, it’s high beta to risk, meaning it tends to depreciate in line with global risk aversion, saw sterling weaken against safe haven and commodity-linked FX peers amid geopolitical risks this week. But as we’ve warned recently, the biggest risk to sterling was a dovish recalibration of Bank of England (BoE) rate expectations. Therefore, Governor Bailey’s comments suggesting the BoE could become more aggressive in its rate-cutting cycle, has piled selling pressure on sterling.

Against the US dollar, the pound has sharply pulled back from 31-month highs, above $1.34, reached last week, to trade below $1.32. This is still nearly four cents above its 5-year average rate of $1.28 though, and the pair holds firmly in the top quarter of its 3-year trading range. Rate differentials have been elevated in favour of GBP/USD sticking around the $1.34 mark, but this dovish tilt by the BoE will reduce the pound’s attractiveness. Plus, if Fed easing bets are trimmed further, sending US yields higher, the downside bias will increase. In a sign of increasing stress in financial markets, one-week implied volatility in GBP/USD has this week risen to its highest level of 2024. FX options traders have also turned sharply bearish on GBP versus the USD on weekly and monthly tenors, having been the most bullish in four years just last week.

Against the euro, sterling has lost its grip on the key €1.20 handle, but remains 3.7% up year-to-date. The euro continues to be plagued by economic and political uncertainty, which is why the downside risk for this currency pair might not be as excessive as GBP/USD.

Dollar’s safe haven support

George Vessey – Lead FX Strategist

Geopolitical risk remains a big worry for investors, but after the turbulence which sparked a flight to safety and sent oil prices rocketing over 5%, markets have calmed somewhat. Although it’s wise to look through the noise of geopolitical upheaval on markets, second-order effects, like the potential impact on monetary policy is worth considering.

For now, monetary policy by the Federal Reserve (Fed) largely hinges on the direction of the labour market. Hence, after the rosier job openings figures on Tuesday, followed by yesterday’s ADP beat, markets have scale back slightly Fed easing expectations by year-end. Less than 65 basis points of cuts are priced in compared to 80bps last week. Supporting this shift is arguably the dockers strike in the US too, the first such strike since 1977, which has shut down around half of America’s ocean shipping. The longer this persists, the more disruptive it will be, presenting an inflationary risk. Meanwhile, the conflict in the Middle East, causing energy prices to rally, might also prove inflationary if the situation escalates further. Thus, the current skepticism over aggressive Fed rate cuts seems warranted right now, and this is one reason why the US dollar’s rebound could extend in the short term.

The dollar is also a safe haven play, so it’s no surprise to see it appreciate against most peers so far this week. Investors will remain ultra-sensitive to geopolitical events at this stage, but also any data that doesn’t support the soft-landing narrative or the amount of policy easing currently priced in. October is already living up to its reputation for volatility, and with the knife edge US election just weeks away too, volatility is likely to remain elevated along with safe haven demand.

Euro retreats amid cautious mood

Ruta Prieskienyte – Lead FX Strategist

The euro retreated to find support at the 50-day SMA at $1.1040, its lowest since 12th September, as geopolitical tensions continued to impact FX markets, though less intensely than the previous day. European equities remained subdued, with the Stoxx50 marginally higher, while the French CAC and German DAX underperformed. European bonds were offered as Tuesday’s risk-off sentiment eased, and the German bond yield curve shifted higher, with the back end paring the most. However, the 2-year DE-US spread remained steady around 160bps, its widest in six weeks, pressuring the euro. The common currency weakened against most G10 currencies except CHF and JPY, gaining 1.6% against the latter after Japan’s PM ruled out near-term rate hikes.

While not market-moving, the Eurozone unemployment rate remained steady at 6.4% in August, matching market expectations. Given the light macro calendar, attention shifted to geopolitical and political developments. Prime Minister Michel Barnier announced plans for €60 billion in spending cuts and tax hikes next year to reduce the budget deficit from 6.1% to 5%. President Macron endorsed a temporary tax on large companies, marking a shift in his pro-business stance. The market reaction was limited, with the 10-year OAT-Bund spread narrowing slightly but remaining near end-June highs.

With the next ECB rate decision two weeks away and limited macro data until then, investors are focusing on ECB speakers. A growing faction within the Governing Council recognises rising downside risks to growth, and with inflation below the ECB’s 2% target, a 25bps rate cut at the upcoming meeting is likely. The OIS curve now prices in a 96% chance of a cut, up from 40% a week ago.

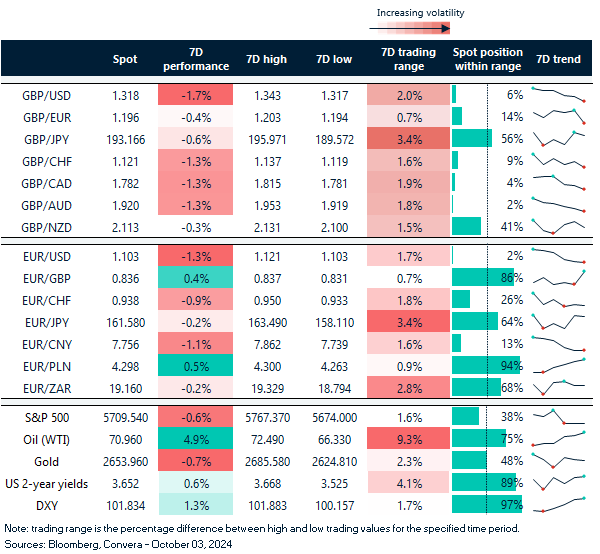

GBP/USD down almost 2% in a week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: September 30-October 04

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.