Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Aussie at six-month highs

The AUD/USD jumped to six-month highs overnight after US inflation came in below expectations and caused markets to speculate about the potential for US rate cuts.

Headline annual inflation fell from 3.3% in May to 3.0% in June with the core number down from 3.4% to 3.3% — both numbers were below market forecasts.

The US dollar dropped on the news with the USD index falling to three-month lows before later recovering.

The Aussie climbed to six-month highs with the AUD/USD up 0.7% before easing later in the session to close 0.2% higher. The NZD/USD gained 0.3%.

In Asia, the Japanese yen surged, with a significant drop in the USD/JPY seen as possible evidence the Japanese Ministry of Finance ordered further invention. The USD/JPY fell 1.7%. Other JPY crosses, like AUD/JPY, also fell sharply.

US sentiment dips but USD can recover

The USD will remain in focus. We anticipate that the University of Michigan’s preliminary reading of its consumer sentiment index decreased slightly, from 68.2 to 64.0.

During the survey interview period, there was a rise in fuel costs and volatility in stock prices. Observe that the daily news sentiment index of the San Francisco Fed dropped to its lowest level since November 2023, indicating a dip in sentiment.

Over the medium run, the US’s relatively higher interest rates can sustain the US dollar.

Singapore dollar strengthens on robust GDP growth

The USD/SGD was down 0.5% in line with other USD losses.

Looking forward, a robust rebound in manufacturing output, driven by rising external demand for electronics exports amid the global tech turnaround, is expected to drive sequential GDP growth to 0.5% q-o-q sa in Q2 according to the official advance estimate.

This should also help boost the trade-related services clusters and offset some moderation in tourist-facing clusters. This would suggest that GDP growth in Q2 remained constant at 2.7% year over year from Q1.

S$NEER – the Monetary Authority of Singapore’s trading basket – is now trading close to the top of its range meaning the SGD could decline as it reverts back towards the midpoint.

AUD/USD hits six-month highs

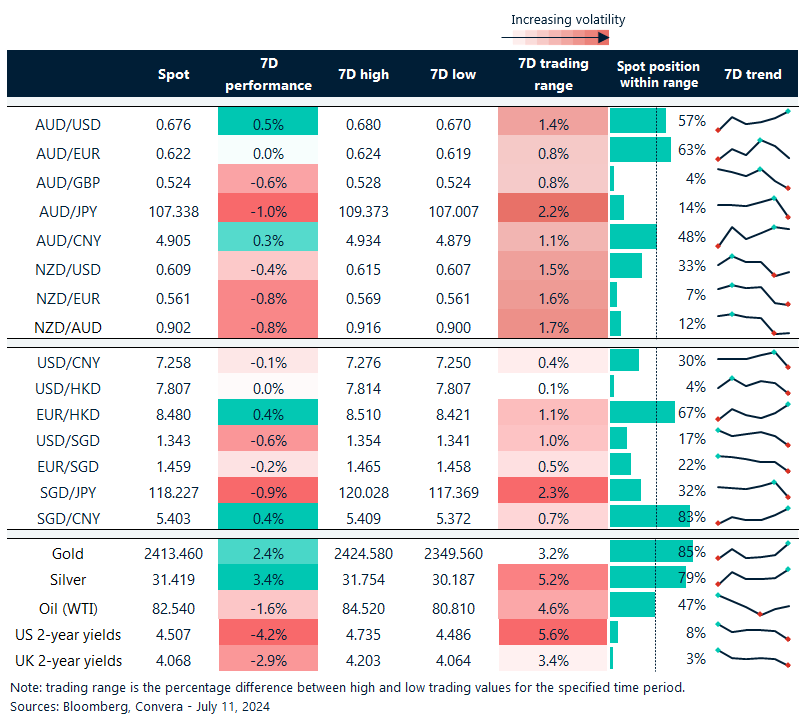

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 8 – 13 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]