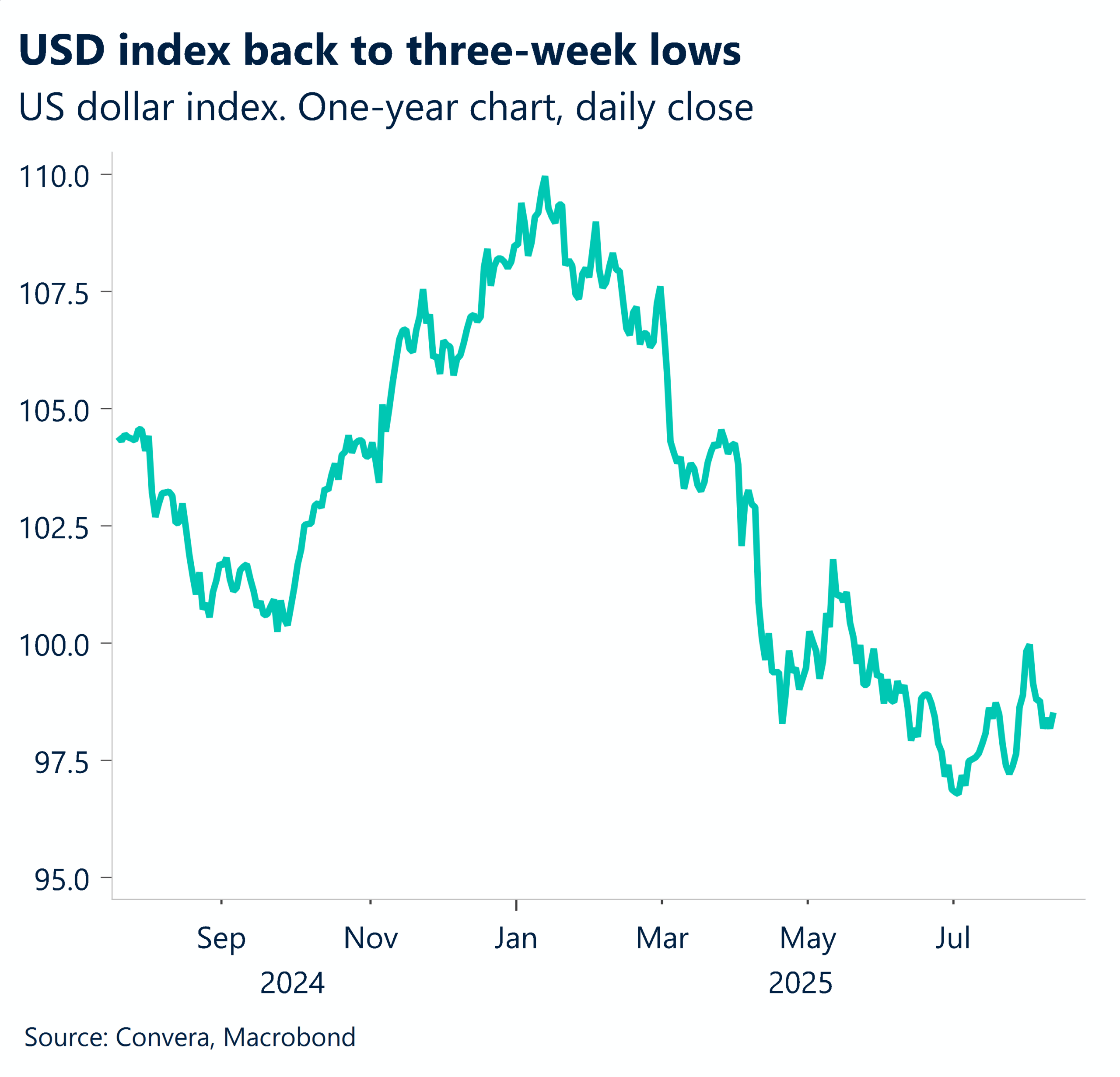

USD lower as Fed cut hopes grow

The US dollar was weaker overnight despite the increase in inflation in the July CPI report.

Core inflation climbed from 2.9% in June to 3.1% in July but the headline number defied expectations for a rise and stayed steady at 2.9%.

However, markets were surprised the gains in core inflation were driven by services rather than tariff-related goods inflation and as a result hopes for a Federal Reserve rate cut increased. Financial market pricing sees a 90% chance of a cut next month according to Bloomberg.

The US dollar fell with the USD index dropping to three-week lows.

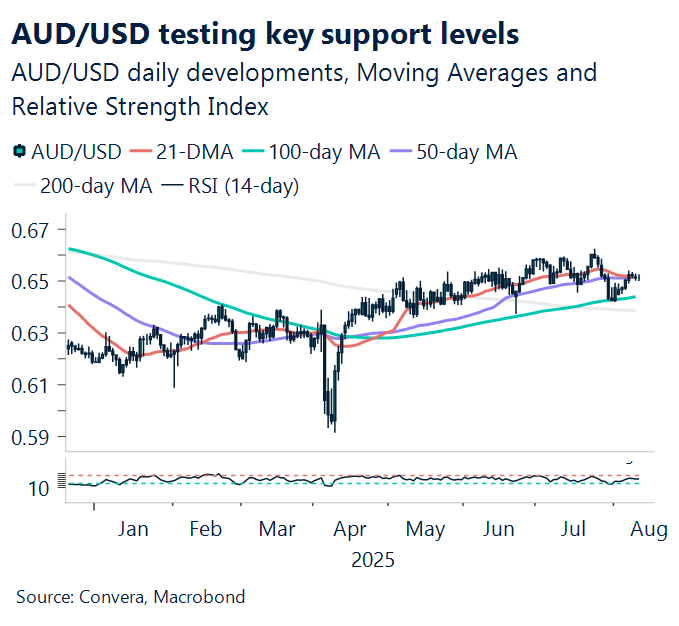

The AUD/USD ended the session higher, up 0.2% even after the Reserve Bank of Australia cut rates, while the NZD/USD gained 0.3%.

Aussie dips as rate cut lands; later gains

As noted, the RBA cut rates by 25 basis points in a unanimous decision yesterday, with all nine board members backing the move.

The central bank flagged rising uncertainty, warning that households and businesses may hold off on spending. While wages have climbed, the RBA noted that job market conditions remain slightly tight.

AUD/USD is trading just above its 21-day EMA as of writing. The next solid support sits at the 100-day EMA of 0.6467.

On the upside, the next key resistance is the psychological barrier at 0.6600.

USD lower in Asia as Fed considers cuts

US core inflation picked up in July, rising to 0.3% month-on-month from 0.2% in June.

Looking forward to the next key release, on 29 August, we expect core PCE inflation to climb to 0.33% in July, up from 0.26% in June and 0.21% in May.

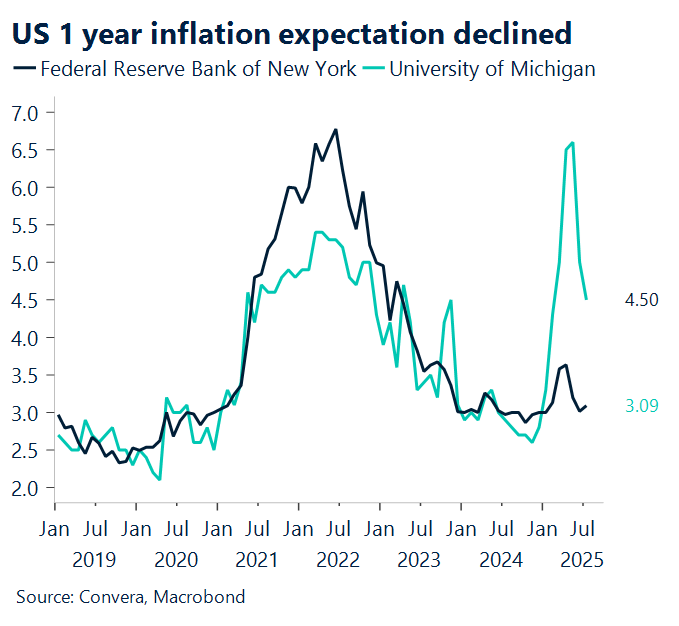

Markets now expect two rate cuts by the end of 2025. Interestingly, one-year inflation expectations in the US have eased in recent months, as shown in the chart, allowing the Fed to cut if it desires.

In Asia FX, USD/SGD has broken back lower, falling to three-week lows.

In USD/CNH, the market dropped back to near two-week lows.

USD lower after CPI

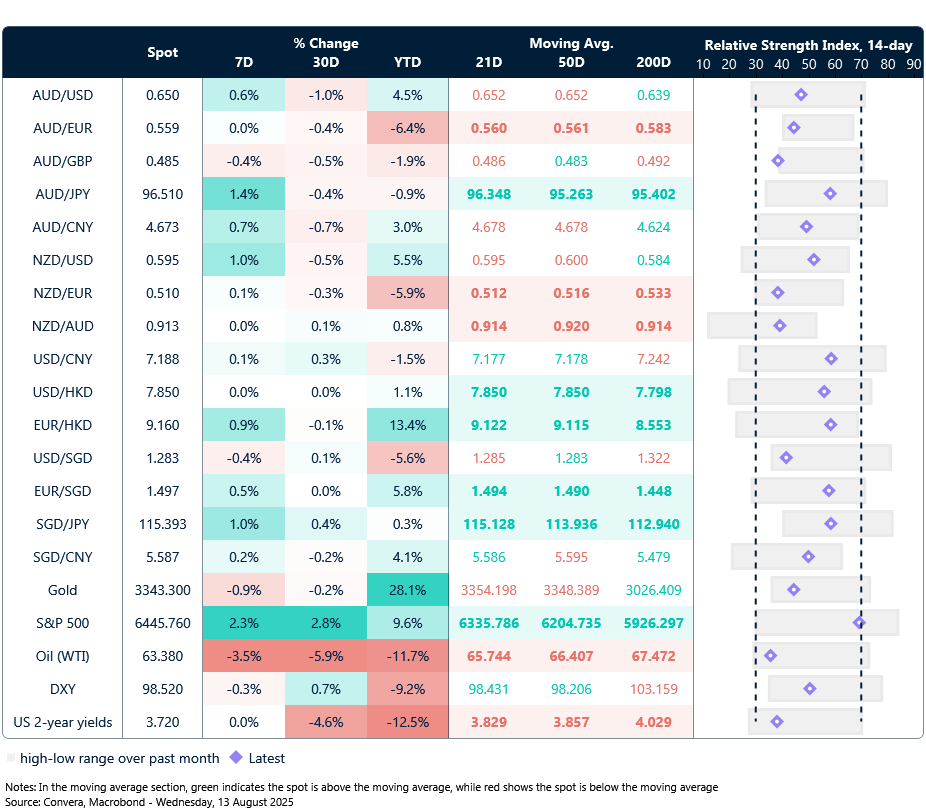

Table: seven-day rolling currency trends and trading ranges

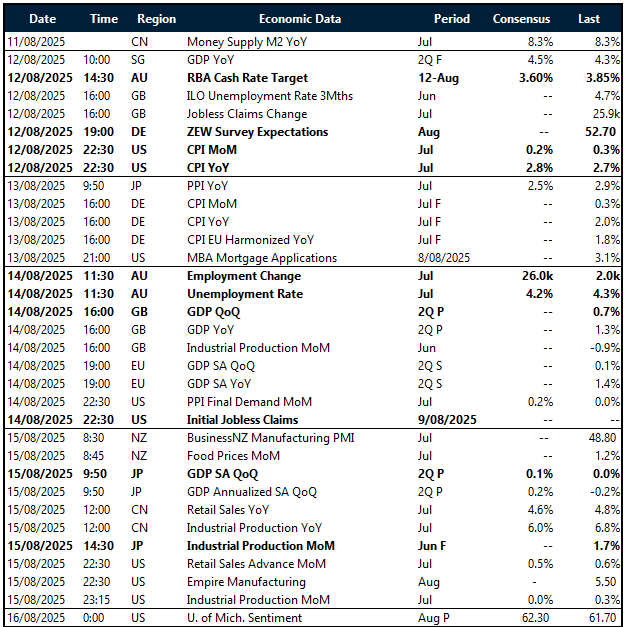

Key global risk events

Calendar: 11 – 16 August

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.