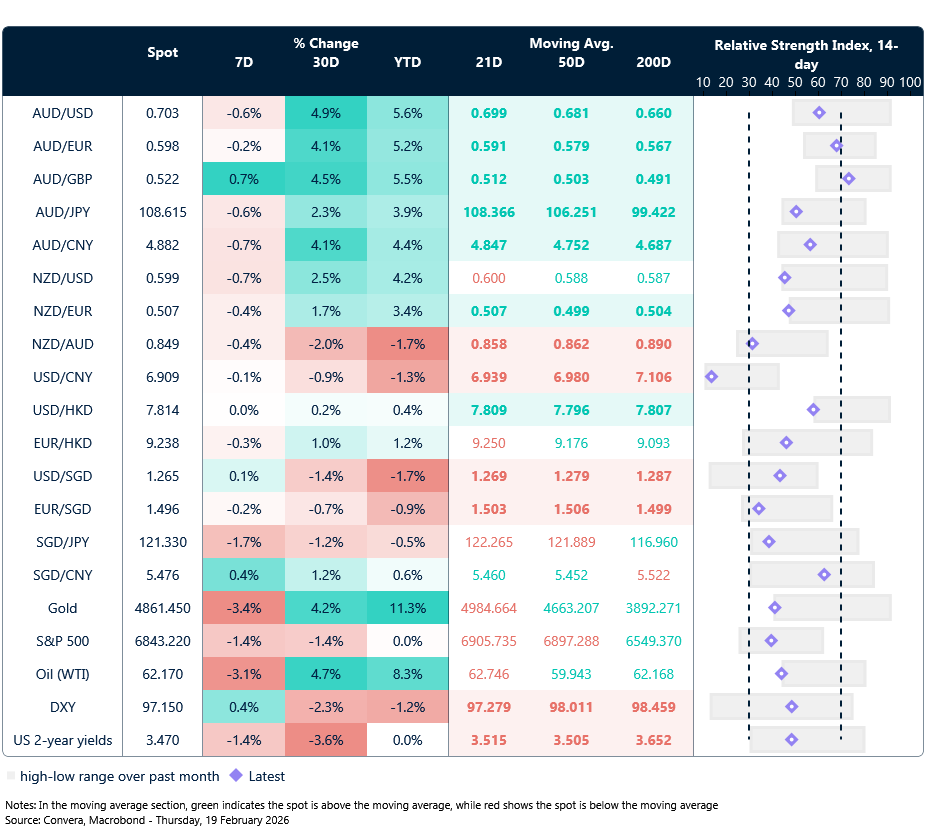

USD stronger after Fed minutes

The US dollar moved sharply higher overnight after this morning’s Federal Reserve minutes indicated that “several” Fed members remain concerned about inflation and are willing to raise rates if needed to contain price pressures.

The USD jumped on the news, with the USD index reaching two‑week highs.

The AUD/USD fell 0.6%, while the NZD/USD tumbled 1.4% following yesterday’s Reserve Bank of New Zealand decision.

In Asia, USD/SGD gained 0.2% and USD/CNH rose 0.1%, with trading subdued due to the Chinese New Year holidays.

The minutes noted: “Several participants cautioned that easing policy further in the context of elevated inflation readings could be misinterpreted as implying diminished policymaker commitment to the 2 percent inflation objective.”

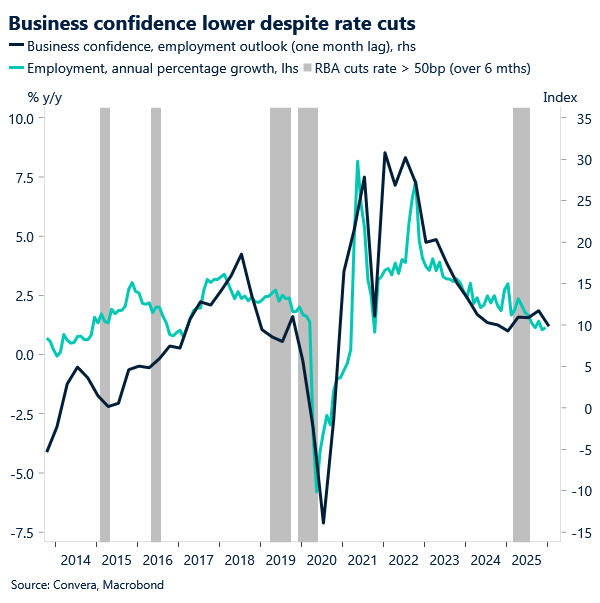

Wage price index eases RBA risk… for now

Australian mortgage holders can breathe a sigh of relief – at least for now.

Wednesday’s wage price index came in at 0.8% for the December quarter and 3.4% for the year. The annual reading matches the Reserve Bank of Australia’s forecasts, allowing the RBA to wait for the March‑quarter CPI report in April before making its next move.

Interest rate pricing barely shifted, with the probability of a March hike steady at around 9%. Markets still see the next full hike occurring in August.

The Australian dollar eased slightly on the release – reflecting a mild pullback in hike expectations – and fell further overnight to lose 0.6%.

Despite this, the Aussie remains one of the strongest G10 currencies in 2026. The AUD/USD is up 5.5% YTD, just behind the Norwegian krone’s 5.8% gain.

Looking ahead, Australia’s January employment report is due at 11:30am AEDT. The market expects 20k new jobs following last month’s bumper 65.2k increase. The unemployment rate is forecast to edge up from 4.1% to 4.2%.

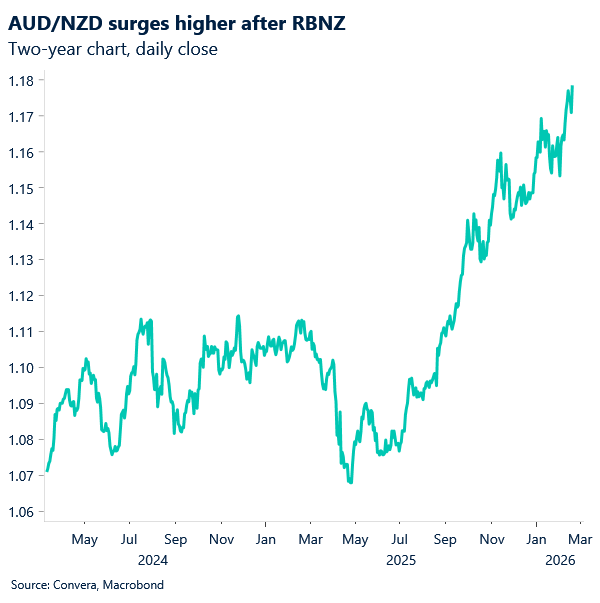

Kiwi hit as RBNZ sees inflation falling

The NZD was hit the hardest over the past 24 hours after the Reserve Bank of New Zealand surprised markets and said it expects inflation to fall back to 2.0% over the next twelve months.

New RBNZ Governor Anna Brennan said local monetary policy “is likely to remain accommodative for some time.”

Markets had expected the RBNZ to begin lifting rates in the second half of this year, but expectations have now been pushed out to 2027.

The NZD was hit hard, with the kiwi falling in most markets. The NZD/USD dropped 1.4%, NZD/EUR fell 0.8%, and NZD/CHF slipped 1.0%.

In NZD/USD, the next support is at 0.5930, with a break below this level opening the door to 0.5855.

USD stages Fed-inspired comeback

Table: seven-day rolling currency trends and trading ranges

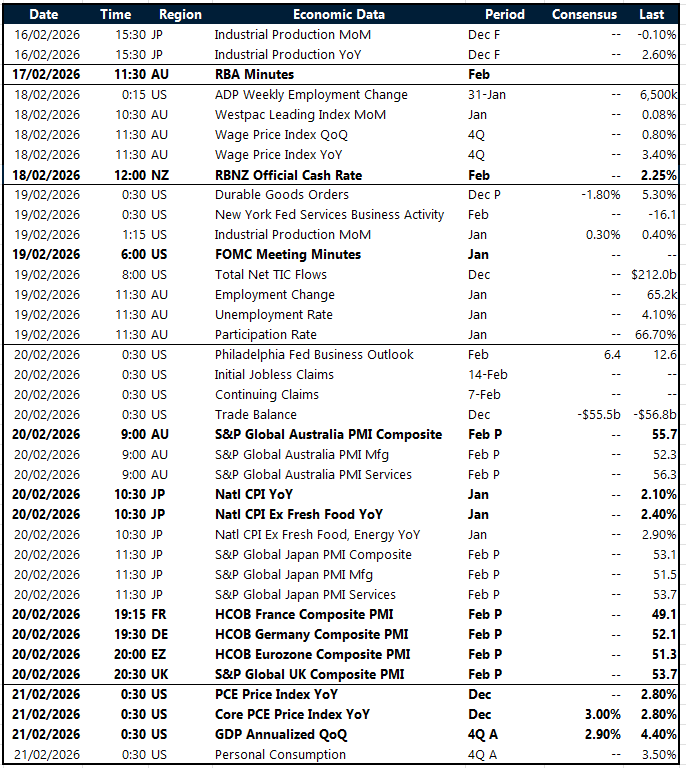

Key global risk events

Calendar: 16 – 21 Feb

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.