Aussie under performs as crude oil tumbles

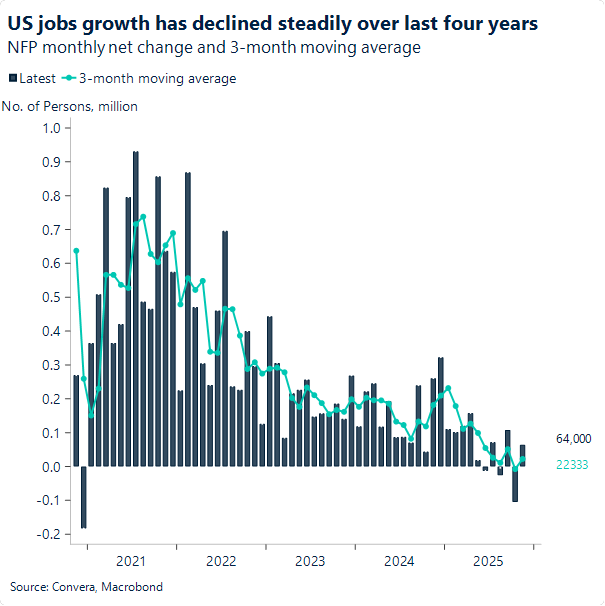

The US dollar was mostly lower overnight after the long-delayed US jobs report showed the US labour market was mostly weakening, albeit with a number of mixed signals.

The news kept market expectations alive for further Federal Reserve rate cuts, with a 25% chance of a cut at the January meeting and a 37% chance for a cut by the March meeting (source: Bloomberg).

The USD saw the biggest losses in Asia, led by the ongoing moves lower in the USD/JPY. The USD/JPY fell 0.4% yesterday. The USD/SGD and USD/CNH both fell 0.1%.

The Aussie underperformed, however. Big losses in the crude oil markets, with WTI crude falling 2.8% to the lowest level since 2021, weighed on the commodity currencies.

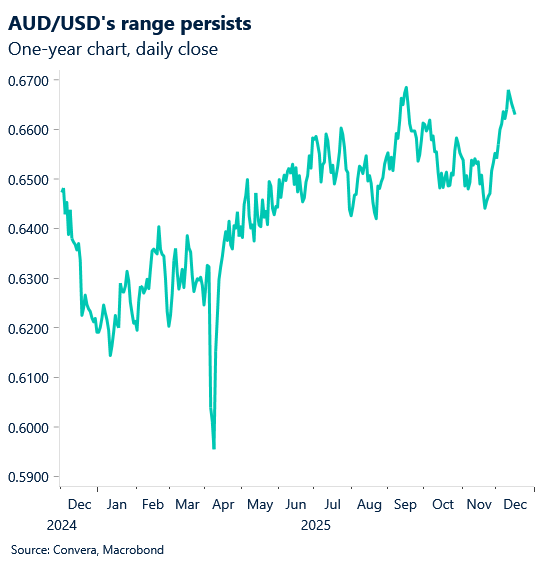

The AUD/USD fell for a fourth consecutive day as it dropped 0.1%.

NZD/USD was higher with a 0.1% gain.

Greenback lower as US jobs slowdown continues

The US dollar index is hovering near its lowest level since early October, dragged down by the slide in front-end Treasury yields following the US jobs data overnight.

US nonfarm payrolls rose 64k in November, modestly above consensus, but October’s sharp downward revision left the three-month average at just 22k.

The unemployment rate climbed unexpectedly to 4.6%, the highest since 2021, underscoring labour market fragility and validating the Fed’s recent rate cut. This backdrop keeps traders positioned for two further cuts in 2026, reinforcing downside risks for the dollar.

Retail sales provided a brighter note, with October’s control group up 0.8%, signalling household demand remains resilient. Yet with jobs data softening and consumption holding up, the next inflation release will be pivotal in shaping Fed expectations, and near-term USD direction.

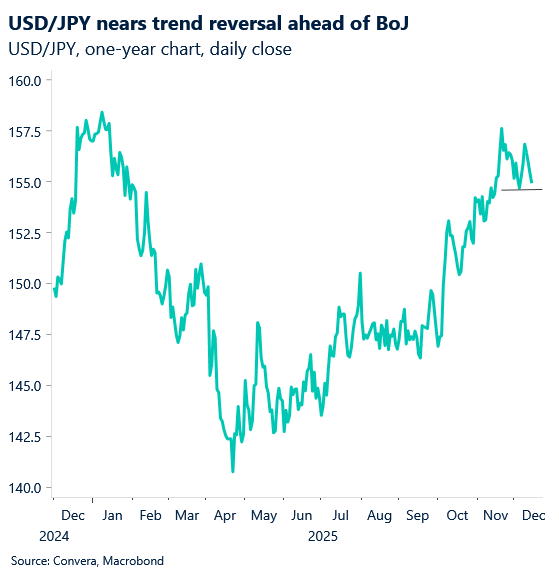

Japanese yen shows strength as BoJ looms

The Japanese yen has been one of the strongest performers in FX markets so far this week ahead of the all-important Bank of Japan decision on Friday.

USD/JPY has fallen 0.7% this week, with a crossing of the key 8- and 21-day moving averages signalling a potential trend change lower.

A break below 154.35 would provide further evidence of a shift into a downtrend.

AUD/JPY dropped 1.0% in the first two days of the week, while NZD/JPY fell as much as 1.4%.

Financial markets see a 94% chance of a rate hike on Friday. However, with only 30bps of further hikes priced in, any more aggressive commentary from Bank of Japan Governor Kazuo Ueda could trigger sharper falls in JPY pairs.

Aussie loses traction as crude tumbles

Table: seven-day rolling currency trends and trading ranges

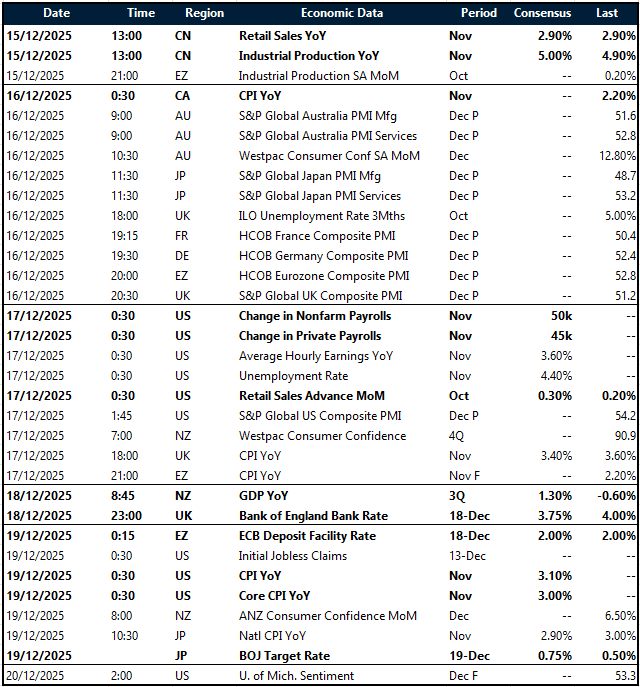

Key global risk events

Calendar: 15 – 20 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.